It is not easy to accurately predict the peak of the cryptocurrency bull market, but mastering the following nine indicators can help you more effectively judge the market direction and avoid risks. If more than five signals appear at the same time, it indicates that the market may be close to the top and needs to be dealt with with caution.

1. NUPL (No net profit/loss): Barometer of market sentiment

NUPL value exceeds 75% enters the fanatic/greed zone, which usually indicates that market sentiment is too optimistic, close to the top.

2. RSI (relative strength index): short-term overbought warning

RSI breaks through 90, and the market is in an extremely overbought state. Historical data shows that the high point usually forms within 4-7 weeks, and a pullback will occur.

3. Altcoin seasonal index: the game between altcoins and Bitcoin

The index exceeds 85, and the overall performance of altcoins is better than Bitcoin, which is often a signal that the market has entered a fanatical stage.

4. MVRV Z-Score (market value vs actual value): overestimate risk warning

MVRV Z-Score exceeds 6, indicating that the market may be seriously overvalued and we need to be wary of potential pullback risks.

5. Pi Cycle Top Indicator: Bitcoin Bull Market Vertex Predictor

This indicator successfully predicted the main price highs of Bitcoin in multiple cycles, indicating that the bull market is about to reach its peak when it sends a warning signal.

6. MACD (Moving Average Convergence and Divergence): Trend Change and Kinetic Energy Signal

The dead cross of MACD means that the market momentum is weakened and the trend may reverse.

7. MFI (Fund Flow Index): Buying and Selling Pressure Monitor

Similar to RSI, but MFI combines trading volume data, and extreme overbought usually indicates a market peak.

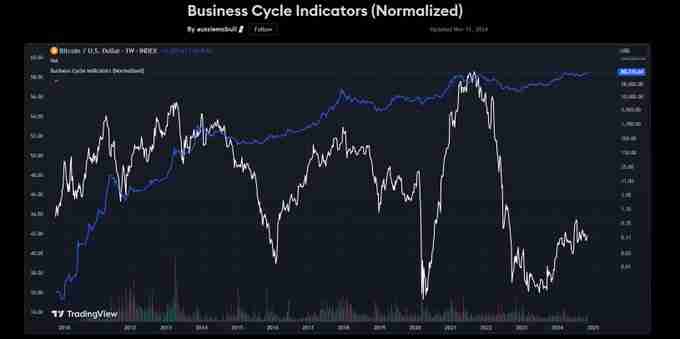

8. Comprehensive Business Cycle Index: Macroeconomic Impact Assessment

The index exceeds 50, indicating that the market may be about to enter its peak stage and macroeconomic factors need to be considered.

9. Mayer Multiple: The ratio of price to 200-day moving average

Historical data shows that when Mayer Multiple reaches 2.4, Bitcoin is usually at the peak of a bull market.

Summary:

Although it is impossible to accurately predict the market peak, comprehensively using the above nine indicators can help you evaluate market risks more scientifically, formulate more reasonable investment strategies, seize opportunities in a bull market, and effectively avoid risks. Remember, a clear exit strategy is crucial!

The above is the detailed content of When will the Bitcoin bull market peak? 9 indicators teach you how to judge the top and avoid taking over at a high level!. For more information, please follow other related articles on the PHP Chinese website!