Leveraging AI for Enhanced Financial Investment Decisions

The integration of AI in finance is revolutionizing investment strategies. This article details the creation of a hierarchical multi-agent AI system using LangGraph Supervisor to analyze financial market trends, conduct sentiment analysis, and generate investment recommendations. This intelligent, automated system mirrors the processes of human financial analysts by incorporating specialized agents for diverse functions.

Key Learning Objectives:

- Understanding hierarchical structures, supervisor roles, and agent coordination.

- Developing domain-specific, sentiment, and quantitative analysis agents.

- Managing inter-agent communication and configuring hierarchical workflows.

- Integrating AI insights for data-driven recommendations.

- Implementing, optimizing, and scaling AI-driven applications.

- Mitigating biases, ensuring transparency, and enhancing reliability.

- This module offers practical experience in building intelligent, AI-driven multi-agent systems using scalable frameworks.

(This article is part of the Data Science Blogathon.)

Table of Contents:

- Multi-Agent AI System: LangChain Supervisor

- The Multi-Agent Architecture

- Hands-on Multi-Agent AI System for Financial Market Analysis

- Setting Up the Environment

- Defining Specialized Agent Functions

- Creating and Deploying Agents

- Running the System

- Future Enhancements

- Key Takeaways

- Frequently Asked Questions

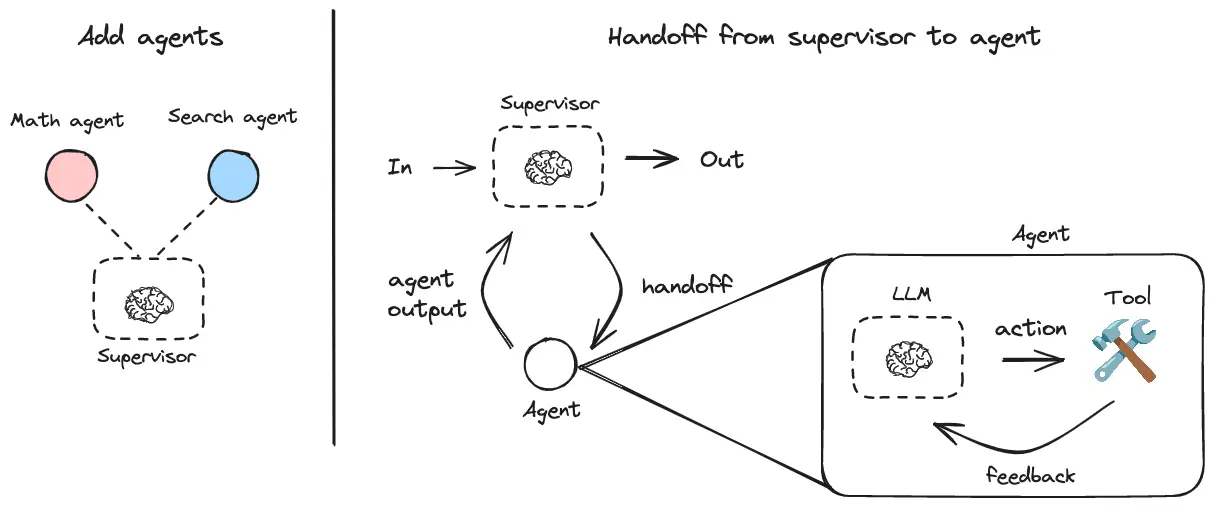

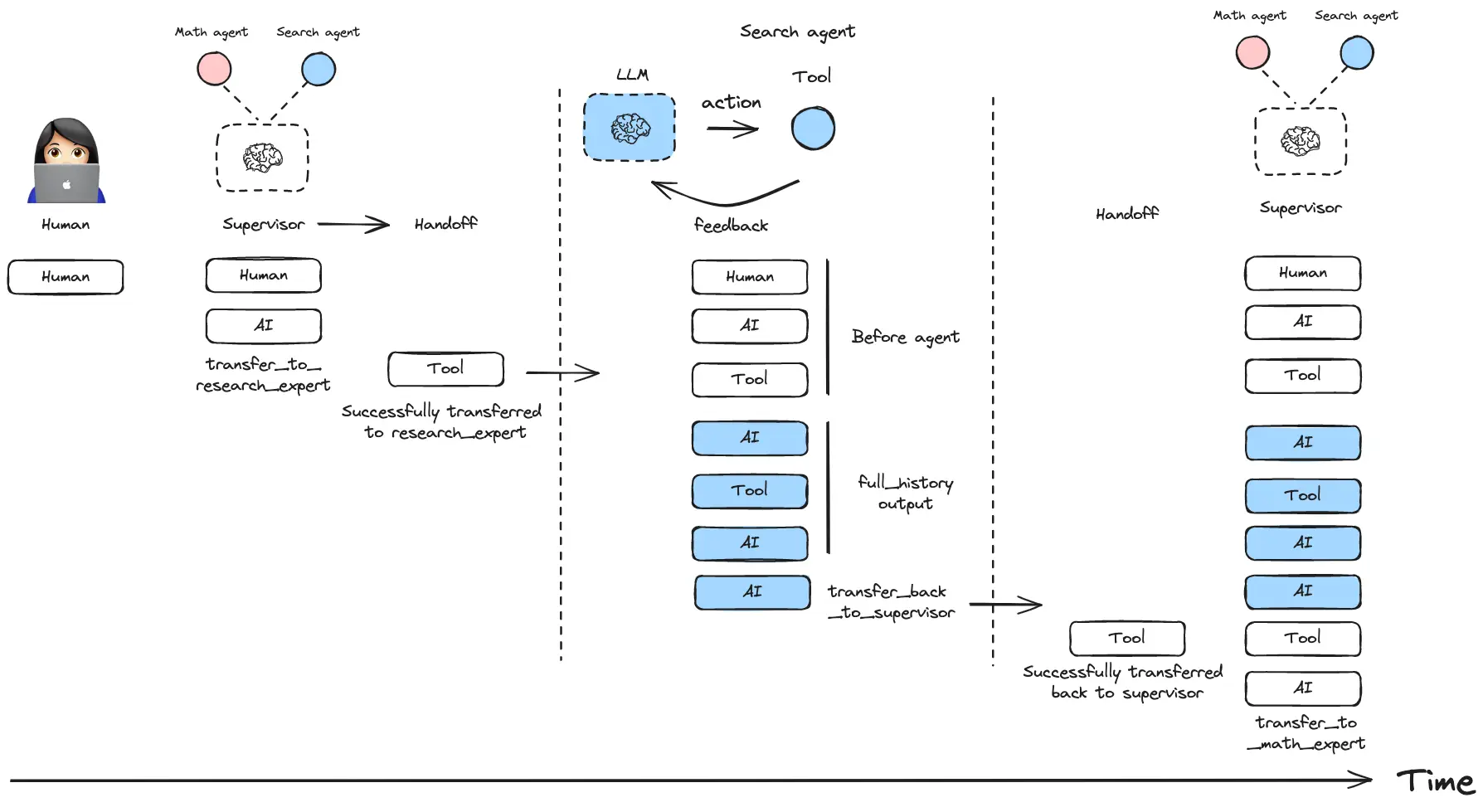

Multi-Agent AI System: LangChain Supervisor

A simple example illustrates a supervisor managing two specialized agents:

Controlling agent message inclusion in the system's overall conversation history: Including complete message history from an agent:

The Multi-Agent Architecture

The system comprises five coordinated AI agents:

-

Market Data Agent (market_data_expert) – Retrieves real-time financial data (stock prices, P/E ratios, EPS, revenue growth). Ensures access to current market information.

-

Sentiment Analysis Agent (sentiment_expert) – Analyzes news and social media sentiment for stocks, categorizing it as positive, neutral, or negative.

-

Quantitative Analysis Agent (quant_expert) – Calculates stock price trends, moving averages, and volatility metrics. Identifies trends and risk levels.

-

Investment Strategy Agent (strategy_expert) – Generates Buy/Sell/Hold recommendations based on all available insights.

-

Supervisor Agent (market_supervisor) – Manages all agents, delegates tasks, monitors workflow, and aggregates recommendations for the user.

Hands-on Multi-Agent AI System for Financial Market Analysis

1. Setting Up the Environment

Install necessary dependencies:

!pip install langgraph-supervisor langchain-openai

Copy after login

Securely configure your OpenAI API key:

import os

os.environ["OPENAI_API_KEY"] = "<your_api_key>"</your_api_key>

Copy after login

2. Defining Specialized Agent Functions

(Code examples for fetching market data, sentiment analysis, quantitative analysis, and investment strategy are provided in the original text and remain unchanged.)

3. Creating and Deploying Agents

(Code examples for creating and deploying agents using LangGraph Supervisor and Langchain are provided in the original text and remain unchanged.)

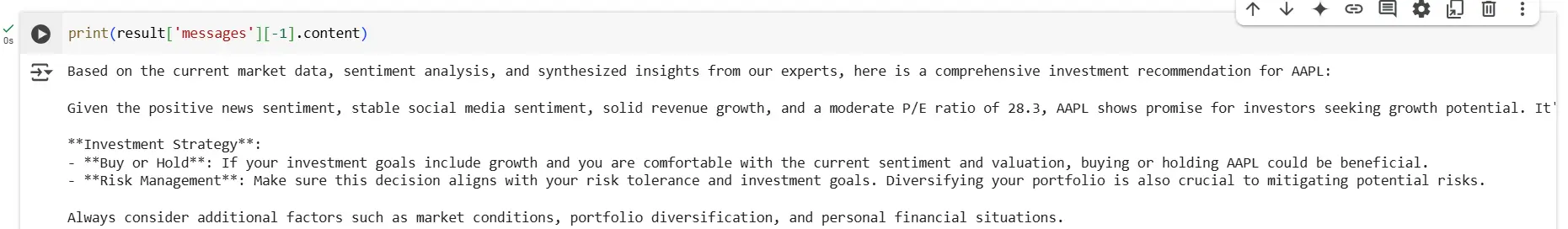

4. Running the System

(Code example for running the system and querying investment recommendations is provided in the original text and remains unchanged.)

Future Enhancements

- Integrate real-time APIs (Yahoo Finance, Alpha Vantage) for live stock data.

- Enhance sentiment analysis with broader social media monitoring.

- Expand portfolio management to incorporate risk assessment and diversification strategies.

Key Takeaways

- This multi-agent AI system automates market analysis, sentiment evaluation, and investment recommendations.

- Specialized agents handle distinct tasks, managed by a supervisor agent for efficient coordination.

- The system uses LangGraph Supervisor, enabling modularity, scalability, and automation.

- Integration of real-time data and advanced features enhances the system's capabilities.

(The media shown in this article is not owned by Analytics Vidhya and is used at the Author’s discretion.)

Frequently Asked Questions

(The FAQ section remains unchanged from the original text.)

The above is the detailed content of Building a Multi-Agent AI System for Financial Market Analysis. For more information, please follow other related articles on the PHP Chinese website!