Gemini's latest cryptocurrency trend report: Generation Z leads the trend, regulation becomes the key

Gemini's recent survey report shows that Generation Z has become the most active participant in the cryptocurrency market, with more than half of the respondents holding or have held crypto assets. They view cryptocurrencies as an effective tool to combat inflation and are optimistic about the future regulatory environment, which heralds a further integration of cryptocurrencies into the mainstream financial system.

The market recovers, and institutional investment helps growth

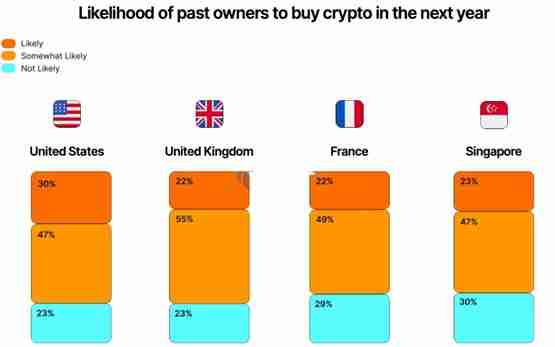

Gemini's Crypto Status Report pointed out that the crypto market has recovered from the sluggish 2022, and the price of Bitcoin hit a record high at the end of 2024. The launch of US spot Bitcoin ETFs and billions of dollars in inflows of institutional investment funds have greatly promoted market activity. Although the market downturn in 2022 caused some investors to withdraw, data shows that more than 70% of original cryptocurrency holders are interested in returning to the market, indicating that market confidence is increasing.

Global cryptocurrency holding rate remains stable

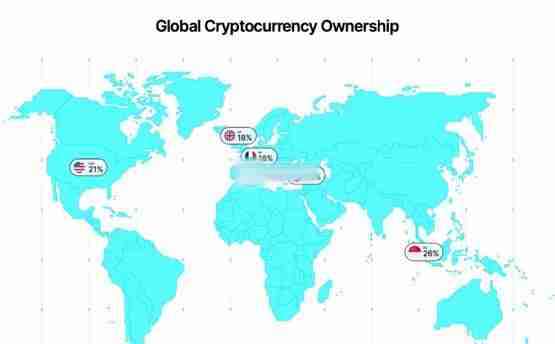

The survey covers many countries including the United States, the United Kingdom, France, Singapore and Türkiye. The results show that cryptocurrency holding rates remain stable in most regions:

It is worth noting that even after experiencing market volatility, 65% of holders still regard cryptocurrencies as long-term investments, and 38% of investors believe it is an effective inflation hedge.

Gen Z leads the crypto investment boom

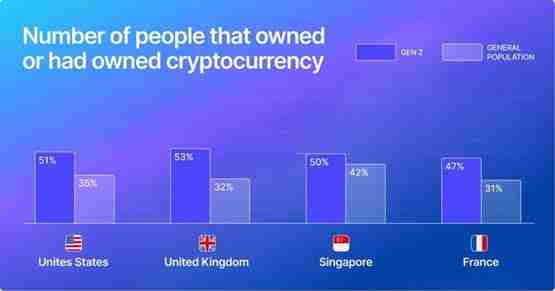

The report shows that Generation Z (18-29 years old) is the most active group in the cryptocurrency market, and its participation is much higher than other generations.

Nearly one-third of U.S. Gen Z investors say they are willing to allocate more than 5% of their portfolios to cryptocurrencies. This trend has also been confirmed in countries such as the UK, France and Singapore. Generation Z's cryptocurrency holding rate ranges from 47% to 53%, accounting for 31% to 42% of the overall market holding rate.

ETF lowers the entry threshold and attracts new investors

In early 2024, the Bitcoin spot ETF launched by the United States lowered the investment threshold, attracting more traditional investors to enter the crypto market without directly holding digital assets:

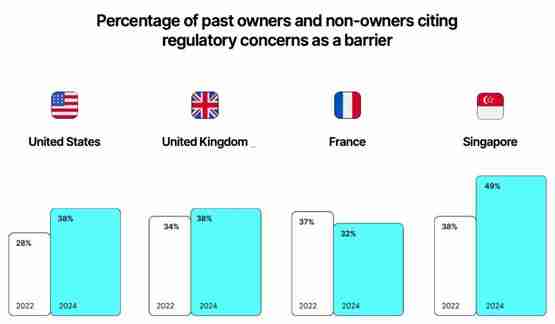

Regulatory uncertainty remains the main challenge

Despite the positive market outlook, regulatory uncertainty remains a key factor affecting investor confidence:

However, Generation Z is more optimistic about regulation than other generations, indicating that they are confident in the long-term development of the crypto market.

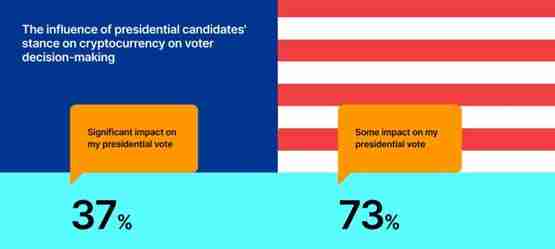

Cryptocurrencies became the focus of the US election for the first time

The report points out that cryptocurrencies have become an important topic for the first time in the 2024 US presidential election:

This shows that the US crypto community is paying more and more attention to government policies, and future regulatory policies will become an important variable in market development.

All in all, Gemini's report shows that the crypto market is recovering its growth momentum, and Gen Z investors are an important driving force. The rise of ETFs, the gradual clarity of regulatory policies and the increase in institutional investment have all brought positive prospects to the crypto market. However, regulatory challenges remain a risk factor that investors need to pay attention to.

The above is the detailed content of Gemini Cryptocurrency Trend Report: More than 50% of Gen Z respondents hold cryptocurrencies. For more information, please follow other related articles on the PHP Chinese website!