web3.0

web3.0

Learn about Pendle's 2025 roadmap in three minutes: V2 improvement and promotion of perpetual contract hedging products

Learn about Pendle's 2025 roadmap in three minutes: V2 improvement and promotion of perpetual contract hedging products

Learn about Pendle's 2025 roadmap in three minutes: V2 improvement and promotion of perpetual contract hedging products

Pendle 2025 Roadmap: Upgrade V2 and enter the traditional finance and Islamic financial markets

In 2024, Pendle achieved remarkable achievements in the DeFi fixed income market, with a total locked position (TVL) reaching US$5.1 billion, and a 100-fold increase in trading volume. Pendle co-founder TN recently announced the 2025 roadmap, planning V2 upgrades, Citadels plans and Boros earnings hedging products, with the goal of building Pendle into the core platform of the global earnings market and expanding to traditional finance (TradFi) and Islamic financial markets.

Pendle's outstanding performance in 2024:

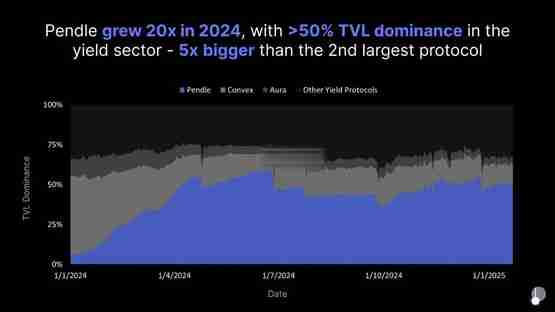

- Fixed Income Market Navigator: Pendle has successfully opened up the DeFi fixed income market. TVL has grown by more than 20 times to US$5.17 billion, accounting for more than 50% of the DeFi revenue market, and daily trading volume has increased by nearly 100 times to US$964 million.

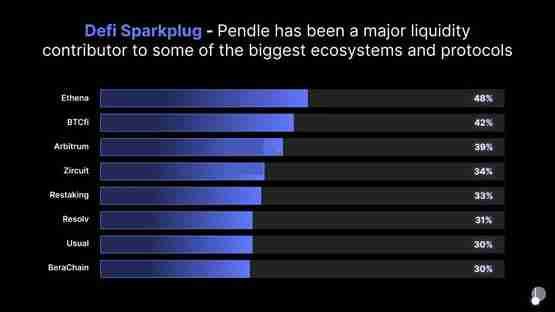

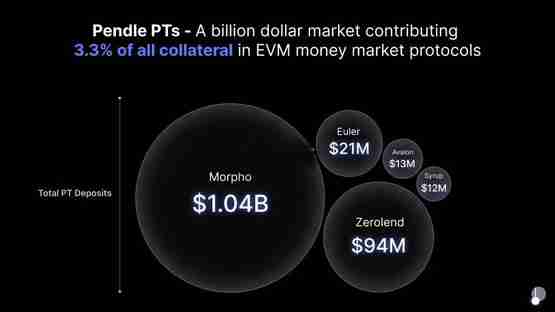

- DeFi Eco-Core Engine: Pendle has become a key pillar of many DeFi projects, such as Ethena, Usual, Arbitrum, Zircuit and Berachain. Pendle principal tokens (PT) have also formed a US$1.2 billion market, accounting for 3.3% of the total collateral of the EVM on-chain lending market.

Pendle's three strategic pillars in 2025:

-

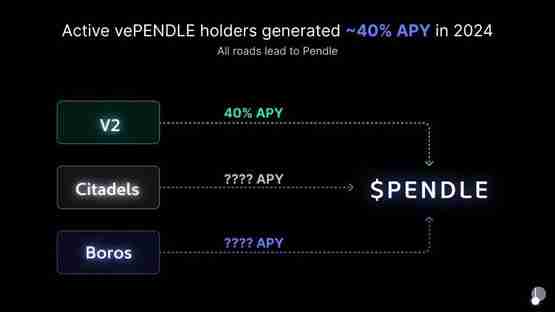

Pendle V2 upgrade: In order to further expand market share, Pendle V2 will improve openness, allowing users to create a profit market without technical background; adjust dynamic rates, optimize the fee structure between liquidity providers, users and protocols; improve the vePENDLE voting mechanism, and improve the participation and profit distribution efficiency of token holders.

-

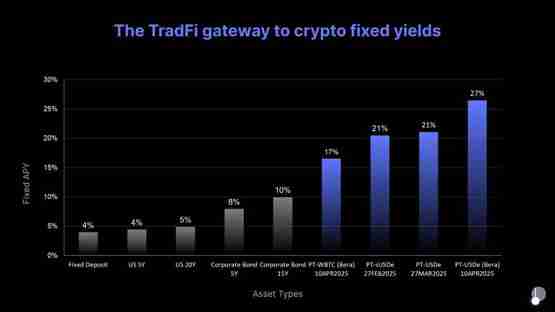

Citadels Plan: Expand the Market Landscape: Pendle will expand to non-EVM chains (Solana, TON, HYPE, etc.), TradFi markets and Islamic financial markets through the "Citadels Plan", with the goal of expanding the market size from billions of dollars to trillions of dollars.

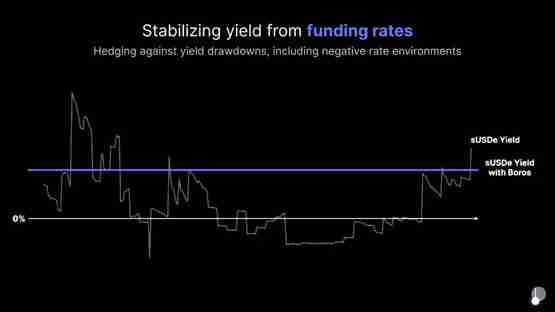

- Boros: Perpetual Contract Earnings Hedging Products: Boros aims to solve the problem of the lack of effective hedging tools in the perpetual Contract market, helping traders convert floating capital rates into fixed rates, reduce risks and stabilize returns.

Future Outlook:

Pendle's goal is to become the core agreement in the global income market, serving DeFi investors, institutional fund managers and sovereign funds. In 2025, Pendle will comprehensively promote V2 upgrades and launch two new products, Citadels and Boros, to meet future challenges.

The above is the detailed content of Learn about Pendle's 2025 roadmap in three minutes: V2 improvement and promotion of perpetual contract hedging products. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Recommended apps on top ten digital currency exchanges: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp, these apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

The reliable and easy-to-use virtual currency exchange apps are: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi Global, 7. Bitfinex, 8. KuCoin, 9. Bittrex, 10. Poloniex. These platforms were selected as the best for their transaction volume, user experience and security, and all offer registration, verification, deposit, withdrawal and transaction operations.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

The top three top ten free market viewing software in the currency circle are OKX, Binance and gate.io. 1. OKX provides a simple interface and real-time data, supporting a variety of charts and market analysis. 2. Binance has powerful functions, accurate data, and is suitable for all kinds of traders. 3. gate.io is known for its stability and comprehensiveness, and is suitable for long-term and short-term investors.

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.