Gate.io Exchange Perpetual Contract Trading Operation Tutorial

Contract Trading Guide: Risk Avoidance and Make Stable Profits

This article is intended to help you understand the basics of cryptocurrency contract trading and master effective risk management strategies to make steady profits in volatile markets. Contract trading allows investors to trade and make profits by predicting price fluctuations without holding actual assets.

Basic concepts of contract trading

-

Long and short: Long refers to predicting a price increase, buying first and then selling to make a profit; short means predicting a price decline, selling first and then buying to make a profit.

-

Margin and Leverage: Margin is the minimum amount required for trading; leverage amplifies the transaction size, such as 10x leverage means that 100 USDT can control a contract of 1000 USDT, and high leverage amplifies returns while significantly increasing risks.

-

Trading fee:

Each opening and closing position will incur a handling fee. The charging standards of different platforms are different, so you need to know in advance.

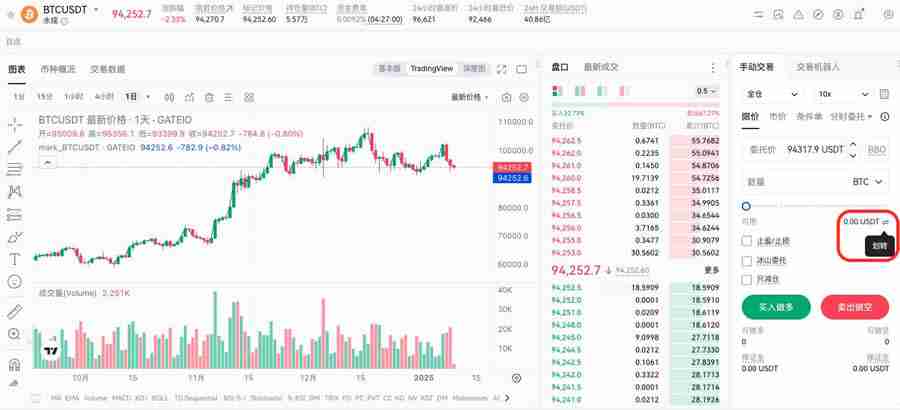

Gate.io platform contract trading steps

- Select contracts and trading pairs: Log in to the official website of Gate.io, select "Contract Trading", then select "Perpetual Contract" or "Delivery Contract" and select the trading currency pair.

- Fund transfer:

- Set margin mode and leverage:

Place an order: Select a limit order (specified price and quantity), market order (market best price transaction), condition order or advanced limit order, enter the price and quantity, and select "Buy long" or "Sell short" to place an order.

Select a limit order (specified price and quantity), market order (market best price transaction), condition order or advanced limit order, enter the price and quantity, and select "Buy long" or "Sell short" to place an order.

- Close position: Click "Position" to view position information, set a stop-profit and stop loss, and select market order, limit order or one-click closing position to close the position.

Binding and risk avoidance

Filing position means that the account margin is not enough to maintain the position, and the system forces the position to be closed to avoid greater losses.

Reason for liquidation:

- High leverage

- Sharp market fluctuations

- No deposit is added in time

Strategy to avoid bankruptcy:

- Choose leverage reasonably: Newbie recommends using low leverage.

- Finally pay attention to the mark price: The mark price is a reasonable price of the contract. Paying attention to its changes will help to adjust the strategy in a timely manner.

- Set stop loss and take profit order: Automatically execute stop loss and take profit, control risks and lock profits.

- Divered investment: Avoid putting all funds into a single contract.

- Add margin in time: Pay attention to margin warning and timely increase margin.

Summary

Contract trading contains huge potential, but the risks are equally huge. This article introduces the basic knowledge and operational processes of contract trading, and emphasizes the importance of risk management. Be sure to operate with caution and control risks reasonably in order to obtain long-term and stable returns in contract trading.

The above is the detailed content of Gate.io Exchange Perpetual Contract Trading Operation Tutorial. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

The reliable and easy-to-use virtual currency exchange apps are: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi Global, 7. Bitfinex, 8. KuCoin, 9. Bittrex, 10. Poloniex. These platforms were selected as the best for their transaction volume, user experience and security, and all offer registration, verification, deposit, withdrawal and transaction operations.

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Recommended apps on top ten digital currency exchanges: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp, these apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

What are the top ten digital currency trading software? The top ten exchange platforms in the currency circle

Apr 22, 2025 pm 03:06 PM

The top ten trading softwares in the currency exchange platform are: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi Global, 5. KuCoin, 6. Coinbase, 7. Kraken, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These platforms provide a variety of trading modes and security measures to ensure the safety of user assets.

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

The top ten digital currency exchange apps are ranked: 1. Binance, 2. OKX, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bybit, 9. Bitfinex, 10. Bittrex, these platforms were selected for their excellent performance in user experience, security, handling fees and transaction volume.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.

Safe and easy-to-use virtual digital currency trading software Recommended by top ten cryptocurrency trading platforms

Apr 22, 2025 pm 12:48 PM

Safe and easy-to-use virtual digital currency trading software Recommended by top ten cryptocurrency trading platforms

Apr 22, 2025 pm 12:48 PM

Safe and easy-to-use virtual digital currency trading software include: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. Bittrex, 8. Poloniex, 9. Bitfinex, 10. KuCoin. These exchanges have their own characteristics, provide a variety of cryptocurrency trading and advanced functions, have a friendly user interface, strong security measures, and are suitable for traders of different levels.