Contract segmentation commission: a strategic guide to efficiently execute large-scale contract transactions

Contract segmentation entrustment refers to a strategy of splitting a large entrustment order into multiple smaller orders and gradually completing transaction execution. This method is especially suitable for large-scale transactions or large market fluctuations, effectively reducing price shocks and slippages, and optimizing transaction results. This article will introduce in detail the operation methods of contract segmentation delegation to help you achieve better execution results in contract transactions.

Ouyi Exchange contract segment entrustment steps:

The following steps demonstrate the operation process of contract segmented entrustment using Ouyi Exchange as an example:

Order modification and cancellation:

Unfinished segmented orders can be modified or cancelled. However, the orders that have been sold will not be modified.

Advantages of segmented commissioning:

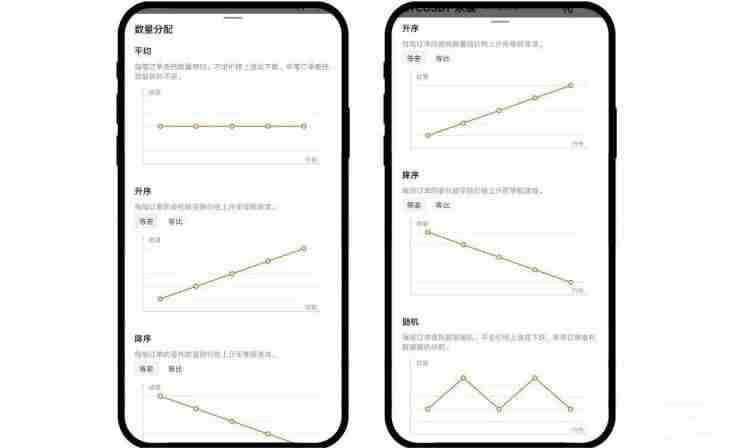

Segmental commissioning splits large orders into multiple small orders, spreads in and out, effectively reducing the impact on the market and reducing the risk of price fluctuations caused by large orders. It provides a variety of delegation modes (such as equalization, ascending, descending, and random) to meet different transaction needs and improve transaction efficiency.

Segmented commission case:

Suppose you want to buy 1000 BTC, placing an order at one time may lead to a price increase. Using segmented orders, you can split your order into 10 small orders of 100 BTC, execute them in batches, reduce the risk of price volatility and obtain a more ideal average buy price.

Risk warning:

Although segmented entrustment can optimize transactions, there are still market risks. Before using it, be sure to fully understand the contract trading rules and risks and operate with caution.

The above is the detailed content of How to operate contract segmentation entrustment? Contract segmented commission operation tutorial. For more information, please follow other related articles on the PHP Chinese website!