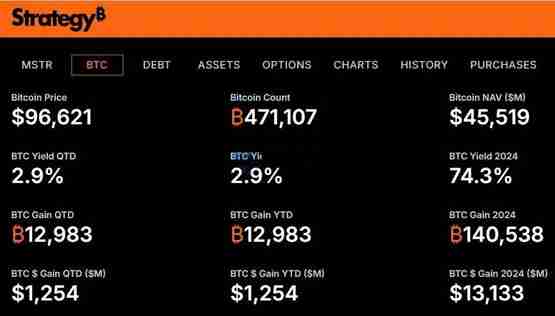

Strategy (formerly known as MicroStrategy) officially changed its name and released its fourth quarter 2024 financial report, demonstrating its firm commitment to digital assets. Despite four consecutive quarters of losses, the company significantly increased its holdings of Bitcoin in the fourth quarter, with a new high of 471,107 holdings with a total value of more than $45 billion, consolidating its global corporate Bitcoin holdings title.

Interpretation of the fourth quarter financial report: revenue is lower than expected, losses expanding

Strategy's fourth-quarter revenue was US$120.7 million, lower than market expectations and a year-on-year decrease of 3%. Operating expenses surged to US$1.1 billion, an increase of nearly 700% year-on-year, mainly due to the capital allocation of the "21/21 Plan". The plan aims to invest $42 billion in three years to increase its holdings of Bitcoin. It has now completed $20 billion, and the progress exceeds expectations. The company's net loss expanded to $670.8 million, with a diluted loss of $3.03 per share. It is worth noting that the company used the old accounting method, which included $1 billion in impairment losses. Starting from 2025, the company will adopt new accounting standards, when the unrealized income of its huge Bitcoin assets will be reflected in its financial reports, thereby reflecting the company's financial situation more clearly.

Bitcoin holdings hit a new high, adjusting the holding increase strategy

In the fourth quarter, Strategy increased its holdings of 218,887 bitcoins, with a total holding of 471,107. Although the BTC yield in 2024 is as high as 74.3%, the target yield in 2025 has been lowered to 15% due to the company's large-scale additional stock issuance.

Renamed "Strategy" to strengthen Bitcoin's strategic positioning

MicroStrategy is renamed Strategy to clarify its market positioning as a fintech company with Bitcoin as its core. The new brand logo uses orange and “₿” symbols, symbolizing the company’s long-term commitment and confidence in digital assets. The company's founder Michael Saylor said the new name is concise and clear, highlighting the focus of the company's strategy.

Stock price performance and future prospects

Strategy's stock price closed down 3.3% yesterday to close at $336.7. As the company continues to increase its holdings in Bitcoin, its stock price is greatly affected by the fluctuations in Bitcoin prices. The company looks forward to a BTC earnings target of US$10 billion in 2025 and plans to further expand its Bitcoin holdings. CEO Phong Le said the company will continue to use institutional and retail funds to enhance shareholder value.

The above is the detailed content of Strategy mainly strengthens Bitcoin positioning! Will losses affect buying coins for four consecutive quarters?. For more information, please follow other related articles on the PHP Chinese website!