Has the underlying structure of slice changed in Go 1.20?

Go version 1.20: Major adjustments to the underlying structure of Slice

The Slice structure in the Go language has always attracted much attention. This article will explore the significant changes in the underlying structure of Slice in Go 1.20. Previously, the reflect.sliceheader structure was the underlying implementation of Slice. However, Go 1.20 has adjusted this.

Source code analysis shows that reflect.sliceheader and reflect.stringheader have been deprecated, instead being a new structure based on unsafe.pointer pointer. This change enhances security and prevents the Garbage Collecting Mechanism (GC) from accidentally recycling underlying data.

The source code comments clearly state:

// deprecated: use unsafe.slice or unsafe.slicedata instead.

type sliceheader struct {

...

}The new Slice structure is defined as follows:

// Unlike reflect.SliceHeader, its Data field is sufficient to guarantee the

// data it references will not be garbage collected.

type Slice struct {

...

} The official Go document also mentions slicedata , string and stringdata functions added to the unsafe package. These functions work in conjunction with the slice function in Go 1.17, providing more complete Slice and string value building and parsing capabilities without relying on their precise underlying representation.

The issue with the search results of the official GitHub repository code of Go is empty, which may be caused by search function settings or permission restrictions.

In short, Go 1.20 has made important updates to the underlying structure of Slice, adopting a safer unsafe.pointer type, and providing new functions to facilitate developers to manipulate Slice and strings more efficiently. This change improves security and simplifies underlying operations.

The above is the detailed content of Has the underlying structure of slice changed in Go 1.20?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1359

1359

52

52

What are the Grayscale Encryption Trust Funds? Common Grayscale Encryption Trust Funds Inventory

Mar 05, 2025 pm 12:33 PM

What are the Grayscale Encryption Trust Funds? Common Grayscale Encryption Trust Funds Inventory

Mar 05, 2025 pm 12:33 PM

Grayscale Investment: The channel for institutional investors to enter the cryptocurrency market. Grayscale Investment Company provides digital currency investment services to institutions and investors. It allows investors to indirectly participate in cryptocurrency investment through the form of trust funds. The company has launched several crypto trusts, which has attracted widespread market attention, but the impact of these funds on token prices varies significantly. This article will introduce in detail some of Grayscale's major crypto trust funds. Grayscale Major Crypto Trust Funds Available at a glance Grayscale Investment (founded by DigitalCurrencyGroup in 2013) manages a variety of crypto asset trust funds, providing institutional investors and high-net-worth individuals with compliant investment channels. Its main funds include: Zcash (ZEC), SOL,

Delphi Digital: How to change the new AI economy by parsing the new ElizaOS v2 architecture?

Mar 04, 2025 pm 07:00 PM

Delphi Digital: How to change the new AI economy by parsing the new ElizaOS v2 architecture?

Mar 04, 2025 pm 07:00 PM

ElizaOSv2: Empowering AI and leading the new economy of Web3. AI is evolving from auxiliary tools to independent entities. ElizaOSv2 plays a key role in it, which gives AI the ability to manage funds and operate Web3 businesses. This article will dive into the key innovations of ElizaOSv2 and how it shapes an AI-driven future economy. AI Automation: Going to independently operate ElizaOS was originally an AI framework focusing on Web3 automation. v1 version allows AI to interact with smart contracts and blockchain data, while v2 version achieves significant performance improvements. Instead of just executing simple instructions, AI can independently manage workflows, operate business and develop financial strategies. Architecture upgrade: Enhanced A

As top market makers enter the crypto market, what impact will Castle Securities have on the industry?

Mar 04, 2025 pm 08:03 PM

As top market makers enter the crypto market, what impact will Castle Securities have on the industry?

Mar 04, 2025 pm 08:03 PM

The entry of top market maker Castle Securities into Bitcoin market maker is a symbol of the maturity of the Bitcoin market and a key step for traditional financial forces to compete for future asset pricing power. At the same time, for retail investors, it may mean the gradual weakening of their voice. On February 25, according to Bloomberg, Citadel Securities is seeking to become a liquidity provider for cryptocurrencies. The company aims to join the list of market makers on various exchanges, including exchanges operated by CoinbaseGlobal, BinanceHoldings and Crypto.com, people familiar with the matter said. Once approved by the exchange, the company initially planned to set up a market maker team outside the United States. This move is not only a sign

Bitwise: Businesses Buy Bitcoin A Neglected Big Trend

Mar 05, 2025 pm 02:42 PM

Bitwise: Businesses Buy Bitcoin A Neglected Big Trend

Mar 05, 2025 pm 02:42 PM

Weekly Observation: Businesses Hoarding Bitcoin – A Brewing Change I often point out some overlooked market trends in weekly memos. MicroStrategy's move is a stark example. Many people may say, "MicroStrategy and MichaelSaylor are already well-known, what are you going to pay attention to?" This is true, but many investors regard it as a special case and ignore the deeper market forces behind it. This view is one-sided. In-depth research on the adoption of Bitcoin as a reserve asset in recent months shows that this is not an isolated case, but a major trend that is emerging. I predict that in the next 12-18 months, hundreds of companies will follow suit and buy large quantities of Bitcoin

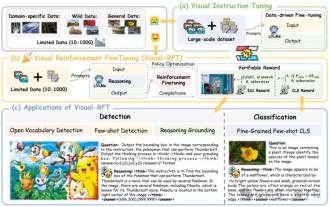

Significantly surpassing SFT, the secret behind o1/DeepSeek-R1 can also be used in multimodal large models

Mar 12, 2025 pm 01:03 PM

Significantly surpassing SFT, the secret behind o1/DeepSeek-R1 can also be used in multimodal large models

Mar 12, 2025 pm 01:03 PM

Researchers from Shanghai Jiaotong University, Shanghai AILab and the Chinese University of Hong Kong have launched the Visual-RFT (Visual Enhancement Fine Tuning) open source project, which requires only a small amount of data to significantly improve the performance of visual language big model (LVLM). Visual-RFT cleverly combines DeepSeek-R1's rule-based reinforcement learning approach with OpenAI's reinforcement fine-tuning (RFT) paradigm, successfully extending this approach from the text field to the visual field. By designing corresponding rule rewards for tasks such as visual subcategorization and object detection, Visual-RFT overcomes the limitations of the DeepSeek-R1 method being limited to text, mathematical reasoning and other fields, providing a new way for LVLM training. Vis

What libraries are used for floating point number operations in Go?

Apr 02, 2025 pm 02:06 PM

What libraries are used for floating point number operations in Go?

Apr 02, 2025 pm 02:06 PM

The library used for floating-point number operation in Go language introduces how to ensure the accuracy is...

Altcoin Investment Guide: Teach you how to pay money on the DEX Exchange, now is a good time to build positions at low prices

Mar 05, 2025 am 09:45 AM

Altcoin Investment Guide: Teach you how to pay money on the DEX Exchange, now is a good time to build positions at low prices

Mar 05, 2025 am 09:45 AM

In the cold winter of 2018, I inspected the photovoltaic power station in the Gobi in Qinghai. In the cold wind of minus 20 degrees Celsius, the engineer pointed to the shutdown photovoltaic panels and said, "These are the legacy of the previous round of expansion. Only when the market is cleared will new technologies rise." Now looking at the Binance altcoin list, those long-term sideways K-line charts are very similar to the photovoltaic panel arrays that were back then. The crypto market is undergoing the same cycle as traditional industries. Just like the knockout match of the photovoltaic industry from 2012 to 2016, the CEX altcoin market has entered a cruel liquidation stage: the daily trading volume of many star projects in 2021 fell below 10 million US dollars, and the median market value shrank by more than 70% from its peak. This is just like the trajectory of photovoltaic, Internet and coal giants falling from high-priced stocks to low-priced stocks. But behind the cyclical cruelty,

Bitwise: Corporate Bitcoin acquisition strategy is about to explode! The price of the currency will rise sharply

Mar 05, 2025 am 09:57 AM

Bitwise: Corporate Bitcoin acquisition strategy is about to explode! The price of the currency will rise sharply

Mar 05, 2025 am 09:57 AM

Bitwise founder Matt Hougan pointed out that the trend of enterprises hoarding Bitcoin is underestimated. In addition to MicroStrategy, 70 listed companies already hold Bitcoin, and this number is about to grow significantly enough to significantly push up the price of Bitcoin this year. MicroStrategy's influence far exceeds expectations MicroStrategy is not a giant company, and its global market value ranks only about 220. However, the company purchased about 257,000 bitcoins last year, exceeding the amount of bitcoins mined throughout 2024 (218,829). MicroStrategy recently announced plans to spend more than $42 billion to increase its holdings of Bitcoin, which is quite the same as the current price.