Calculate NPV in Excel - Net Present Value formula

This tutorial explains how to use Excel's NPV function to determine the net present value (NPV) of an investment and how to avoid common errors.

NPV, a cornerstone of financial analysis, predicts a project's profitability. Its importance stems from the principle that future money is worth less than present money. NPV discounts future cash flows to their present value.

While Excel offers an NPV function, its use can be complex. This article clarifies the function's workings and potential pitfalls when calculating NPV for cash flow series.

Net Present Value (NPV): A Definition

NPV is the present value of a project's cash flows throughout its lifespan. Simply put, it's the present value of future cash flows minus the initial investment:

NPV = PV of future cash flows – Initial Investment

Let's examine the underlying mathematics. For a single cash flow, present value (PV) is:

Where:

-

r= discount or interest rate -

i= cash flow period

For instance, to receive $110 after one year (i) with a 10% annual interest rate (r), the required present investment is:

$110/(1 10%)^1 = $100

$100 is the present value of the future $110.

NPV sums the present values of all future cash flows, then subtracts the initial investment:

Where:

-

r= discount or interest rate -

n= number of time periods -

i= cash flow period

Since any non-zero number raised to the zero power is 1, we can include the initial investment in the sum (where i=0):

To calculate NPV for cash flows (50, 60, 70) discounted at 10% with an initial cost of $100:

Or:

A positive NPV suggests profitability, while a negative NPV indicates unprofitability. This forms the basis of the Net Present Value Rule: only undertake projects with a positive NPV.

Excel's NPV Function

Excel's NPV function calculates an investment's net present value based on a discount rate and future cash flows.

Syntax:

NPV(rate, value1, [value2], …)

Where:

- Rate (required): The discount or interest rate per period (as a percentage or decimal).

- Value1, [value2], …: Numeric values representing regular cash flows. Excel 2007 and later support up to 254 values; older versions, up to 30.

Key Considerations for the NPV Function:

- Timing of Cash Flows: Values represent cash flows at the end of each period. Adjustments are needed if the first cash flow is at the beginning.

- Chronological Order: Values must be in chronological, equally spaced order.

- Sign Convention: Use negative values for outflows (payments) and positive values for inflows (receipts).

- Data Type: Only numerical values are processed.

How Excel's NPV Function Works

Excel's NPV function assumes an investment is made one period before value1. Therefore, the standard NPV function is accurate only if the initial investment is one period in the future, not today.

To illustrate, let's compare manual and Excel NPV calculations. Assume a discount rate in B1, cash flows in B4:B9, and periods in A4:A9. The manual PV calculation is:

=B4/(1 $B$1)^A4 (in C4, copied down)

The sum of present values is: =SUM(C4:C9)

The Excel NPV function equivalent is: =NPV(B1, B4:B9)

If the initial investment is at the start of the first period, the manual calculation becomes: =SUM(C4:C9) B4

This highlights a difference between manual and Excel NPV calculations when the initial investment is at the beginning of the period.

Calculating NPV in Excel

When the initial investment is at the start of the first period, there are two approaches:

Method 1: Exclude the initial cost from the value range and subtract it from the NPV result:

NPV(rate, values) initial cost

Method 2: Include the initial cost and multiply the result by (1 rate):

NPV(rate, values) * (1 rate)

Creating an NPV Calculator in Excel

With initial outlay in B2, cash flows in B3:B7, and the rate in F1, use either:

-

Method 1:

=NPV(F1, B3:B7) B2 -

Method 2:

=NPV(F1, B2:B7) * (1 F1)

PV vs. NPV in Excel

Both PV and NPV discount future cash flows, but:

- PV: Considers only future cash inflows.

- NPV: Considers both inflows and outflows (including the initial investment).

NPV vs. XNPV in Excel

- NPV: Assumes equal time periods.

-

XNPV: Allows specifying dates for each cash flow, providing greater accuracy for irregular intervals. Its syntax includes an additional

datesargument:XNPV(rate, values, dates).

Common Errors in Excel NPV Calculations

- Irregular Intervals: NPV assumes equal periods.

- Missing Periods: NPV ignores empty cells; use zeros for missing cash flows.

- Incorrect Rate: Ensure the rate matches the period (e.g., monthly rate for monthly cash flows).

- Rate Format: Use percentage or decimal format for the rate, not just a number.

This comprehensive guide enables accurate NPV calculation in Excel, avoiding common pitfalls. Remember to choose the appropriate method based on the timing of your initial investment and consider using XNPV for irregular cash flow intervals.

The above is the detailed content of Calculate NPV in Excel - Net Present Value formula. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

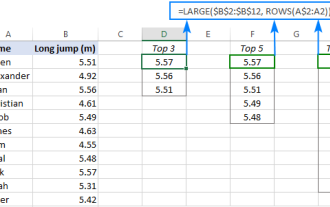

Excel formula to find top 3, 5, 10 values in column or row

Apr 01, 2025 am 05:09 AM

Excel formula to find top 3, 5, 10 values in column or row

Apr 01, 2025 am 05:09 AM

This tutorial demonstrates how to efficiently locate the top N values within a dataset and retrieve associated data using Excel formulas. Whether you need the highest, lowest, or those meeting specific criteria, this guide provides solutions. Findi

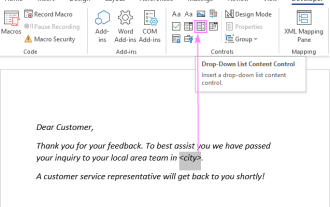

Add a dropdown list to Outlook email template

Apr 01, 2025 am 05:13 AM

Add a dropdown list to Outlook email template

Apr 01, 2025 am 05:13 AM

This tutorial shows you how to add dropdown lists to your Outlook email templates, including multiple selections and database population. While Outlook doesn't directly support dropdowns, this guide provides creative workarounds. Email templates sav

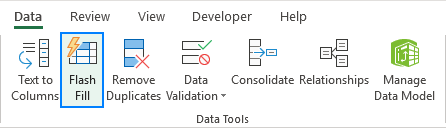

How to use Flash Fill in Excel with examples

Apr 05, 2025 am 09:15 AM

How to use Flash Fill in Excel with examples

Apr 05, 2025 am 09:15 AM

This tutorial provides a comprehensive guide to Excel's Flash Fill feature, a powerful tool for automating data entry tasks. It covers various aspects, from its definition and location to advanced usage and troubleshooting. Understanding Excel's Fla

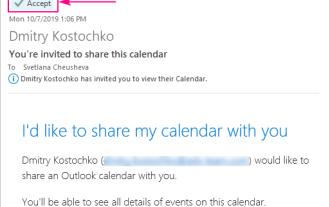

How to add calendar to Outlook: shared, Internet calendar, iCal file

Apr 03, 2025 am 09:06 AM

How to add calendar to Outlook: shared, Internet calendar, iCal file

Apr 03, 2025 am 09:06 AM

This article explains how to access and utilize shared calendars within the Outlook desktop application, including importing iCalendar files. Previously, we covered sharing your Outlook calendar. Now, let's explore how to view calendars shared with

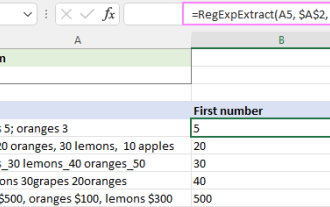

Regex to extract strings in Excel (one or all matches)

Mar 28, 2025 pm 12:19 PM

Regex to extract strings in Excel (one or all matches)

Mar 28, 2025 pm 12:19 PM

In this tutorial, you'll learn how to use regular expressions in Excel to find and extract substrings matching a given pattern. Microsoft Excel provides a number of functions to extract text from cells. Those functions can cope with most

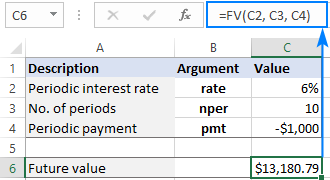

FV function in Excel to calculate future value

Apr 01, 2025 am 04:57 AM

FV function in Excel to calculate future value

Apr 01, 2025 am 04:57 AM

This tutorial explains how to use Excel's FV function to determine the future value of investments, encompassing both regular payments and lump-sum deposits. Effective financial planning hinges on understanding investment growth, and this guide prov

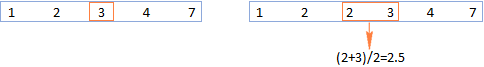

MEDIAN formula in Excel - practical examples

Apr 11, 2025 pm 12:08 PM

MEDIAN formula in Excel - practical examples

Apr 11, 2025 pm 12:08 PM

This tutorial explains how to calculate the median of numerical data in Excel using the MEDIAN function. The median, a key measure of central tendency, identifies the middle value in a dataset, offering a more robust representation of central tenden

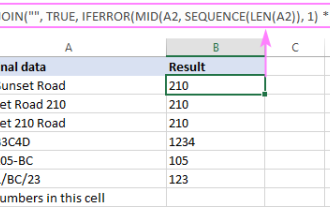

How to remove / split text and numbers in Excel cell

Apr 01, 2025 am 05:07 AM

How to remove / split text and numbers in Excel cell

Apr 01, 2025 am 05:07 AM

This tutorial demonstrates several methods for separating text and numbers within Excel cells, utilizing both built-in functions and custom VBA functions. You'll learn how to extract numbers while removing text, isolate text while discarding numbers