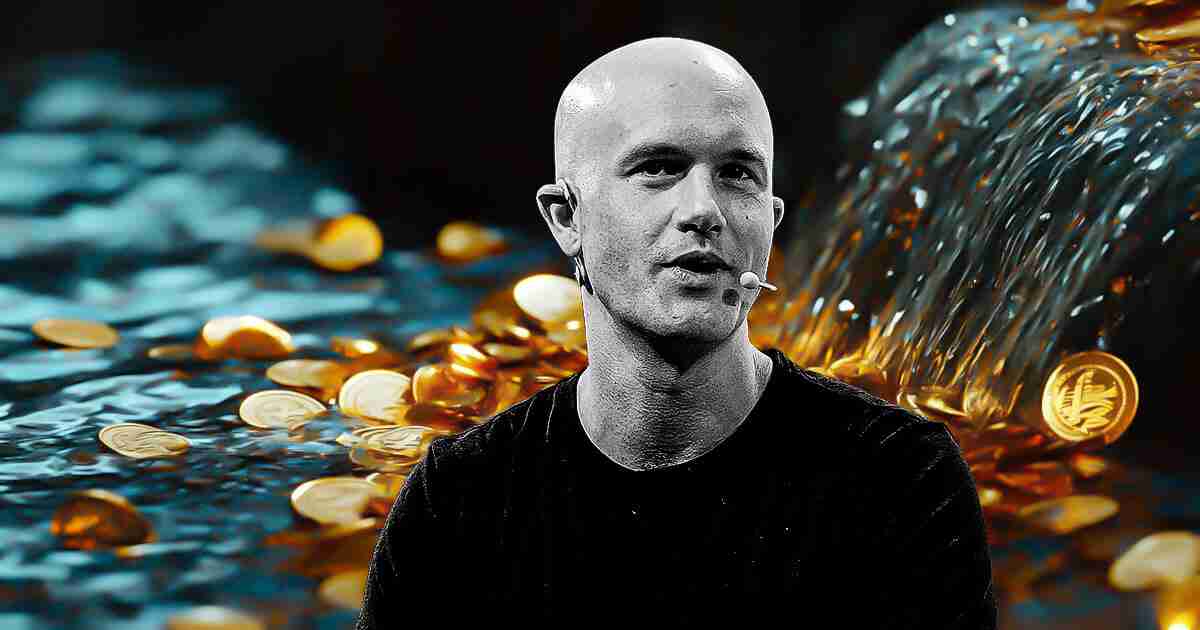

Coinbase CEO Brian Armstrong calls on lawmakers to support Stablecoin legislation

Coinbase CEO Brian Armstrong called on U.S. lawmakers to support a stablecoin bill that allows consumers to earn interest income directly from their dollar stablecoin holdings. He believes this move will be a "win-win" situation.

Armstrong elaborated on this view in a blog post on March 31 and argued that the next stage of stablecoin innovation must include the "OnChain Interest" mechanism. The mechanism will allocate the proceeds generated by stablecoin reserve assets, such as short-term U.S. Treasury bonds, to stablecoin holders.

Currently, stablecoin issuers face legal uncertainty as they cannot share interest with users without violating securities laws or engaging in activities deemed to be “investment banking.” Banks have long enjoyed regulatory exemptions for providing interest accounts, while stablecoin issuers lack such exemptions.

Armstrong believes:

"Consumers should get more. Open on-chain interest will drive us to improve the system, ultimately benefit consumers and drive this innovation to grow within the United States."

A fairer financial future

Stablecoins have been widely adopted as a digital representative of fiat currencies, but Armstrong believes its potential has not been fully released. He pointed out that although the average federal funds rate in 2024 is 4.75%, the interest income of most consumer savings accounts is well below 0.5%, or even below the inflation rate (about 3%), resulting in a decline in actual purchasing power.

Armstrong pointed out:

“On-chain interest will democratize gains in market interest rates, allowing ordinary people to maintain and increase wealth more equitably.”

He further highlighted the potential of stablecoins to change financial channels globally. Billions of people around the world cannot easily obtain the dollar or are forced to use local currencies with unstable value and rapidly depreciating.

By allowing stablecoins to claim interest, the United States can attract a large number of new users around the world, creating a financial system that is instant, transparent and easy to access with just an internet connection.

Armstrong added:

“No bank outlets are required, no high overdraft fees or remittance fees. This is a financial channel that is equal to everyone, powered by cryptocurrencies.”

Strategic Advantages to the U.S. Economy

Armstrong also explains how to combine the allowable on-chain interest on stablecoin with broader U.S. economic policy goals.

Stablecoin issuers are already one of the main buyers of U.S. Treasury bonds, and their purchases are even more than many foreign governments. If global consumers can earn interest from dollar stablecoins, the resulting increase in adoption will further increase demand for government bonds, enhance the dollar's position in the global financial system, and stimulate economic growth through higher consumer spending and investment.

Armstrong said:

“More interest from consumers means more spending, savings and investments – which will boost growth across the economy holding stablecoins.”

However, Armstrong warns that the U.S. could miss trillions of dollars in global financial flows in the coming decades without promptly incorporating on-chain interest into new stablecoin legislation. He urged lawmakers to quickly formulate clear legal provisions to ensure regulated stablecoin issuers can allocate interest to users without triggering complex disclosure requirements or exposing issuers to the securities laws.

Armstrong concluded:

“At a time when the government and Congress are actively involved in stablecoin regulation, we have a unique opportunity. We can modernize the system to benefit consumers or stick to an outdated middle-level institutional model.”

The above is the detailed content of Coinbase CEO Brian Armstrong calls on lawmakers to support Stablecoin legislation. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1393

1393

52

52

1205

1205

24

24

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

A list of special services for major virtual currency trading platforms

Apr 22, 2025 am 08:09 AM

Institutional investors should choose compliant platforms such as Coinbase Pro and Genesis Trading, focusing on cold storage ratios and audit transparency; retail investors should choose large platforms such as Binance and Huobi, focusing on user experience and security; users in compliance-sensitive areas can conduct fiat currency trading through Circle Trade and Huobi Global, and mainland Chinese users need to go through compliant over-the-counter channels.

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

The top ten free platform recommendations for real-time data on currency circle markets are released

Apr 22, 2025 am 08:12 AM

Cryptocurrency data platforms suitable for beginners include CoinMarketCap and non-small trumpet. 1. CoinMarketCap provides global real-time price, market value, and trading volume rankings for novice and basic analysis needs. 2. The non-small quotation provides a Chinese-friendly interface, suitable for Chinese users to quickly screen low-risk potential projects.

A inventory of special services for major virtual currency trading platforms around the world

Apr 22, 2025 am 08:27 AM

A inventory of special services for major virtual currency trading platforms around the world

Apr 22, 2025 am 08:27 AM

The special services of global virtual currency trading platforms include: 1. Comprehensive ecological platforms such as Binance and OKX, providing a variety of cryptocurrency trading pairs and ecosystems; 2. Compliance and security platforms such as Coinbase and Gemini, emphasizing regulatory compliance and user asset security; 3. Professional trading platforms such as Bitfinex and Kraken, focusing on high-leverage trading and technical support; 4. Innovative service platforms such as Crypto.com and FTX, launching innovative financial products; 5. Regional featured platforms such as Bitstamp and Huobi Global, providing localized services and compliance solutions.

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

Meme Coin Exchange Ranking Meme Coin Main Exchange Top 10 Spots

Apr 22, 2025 am 09:57 AM

The most suitable platforms for trading Meme coins include: 1. Binance, the world's largest, with high liquidity and low handling fees; 2. OkX, an efficient trading engine, supporting a variety of Meme coins; 3. XBIT, decentralized, supporting cross-chain trading; 4. Redim (Solana DEX), low cost, combined with Serum order book; 5. PancakeSwap (BSC DEX), low transaction fees and fast speed; 6. Orca (Solana DEX), user experience optimization; 7. Coinbase, high security, suitable for beginners; 8. Huobi, well-known in Asia, rich trading pairs; 9. DEXRabbit, intelligent

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

The top three top ten free market viewing software in the currency circle are OKX, Binance and gate.io. 1. OKX provides a simple interface and real-time data, supporting a variety of charts and market analysis. 2. Binance has powerful functions, accurate data, and is suitable for all kinds of traders. 3. gate.io is known for its stability and comprehensiveness, and is suitable for long-term and short-term investors.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.