Backend Development

Backend Development

C#.Net Tutorial

C#.Net Tutorial

Graphic and text details of a mortgage analyzer written in visual studio based on c#

Graphic and text details of a mortgage analyzer written in visual studio based on c#

Graphic and text details of a mortgage analyzer written in visual studio based on c#

Question

To buy a house loan, choose equal principal and interest? Or an equal amount of principal? How much interest do each need to pay?

Of the monthly loan repayments, how much is the principal and how much is the interest?

If the loan is for 30 years, can you calculate the monthly repayment details for these 360 months?

Do you know how many methods there are to repay a large amount? How much money can you save with a balloon payment?

Background

There are two ways to get a loan from a bank: equal principal and equal principal and interest. Equal principal, the principal of the monthly loan repayment is fixed, for example, a loan of 300,000 yuan, repaid in 30 years, the first month’s repayment is about 2,100 yuan, of which the principal is more than 800 yuan and the interest is more than 1,200 yuan. , the principal will be the same every month in the future. This method will generate less interest than the same amount of principal and interest. Equal principal and interest, the monthly principal and interest repayment is fixed, the same loan is 300,000 yuan, and it will be repaid in 30 years. In this way, the monthly repayment is close to 1,600 yuan, although the monthly repayment is more than the equal principal amount. The loan is smaller, but during the repayment cycle, the interest accrued is more than the equivalent principal amount.

Mortgage Analyzer

The software source code is open source, github download address: Despositor source code: visual studio 2013 C#.net, welcome to download.

Support functions

1) Support configuration of loan information; 2) Support loan repayment status and monthly details under two loan methods: principal and interest, principal, interest, interest rate; 3) Large-amount repayment currently only supports one large-amount repayment method: after shortening the repayment cycle, the latest loan repayment status and details; 4) Provides paged browsing and display function.

Software structure

Public 4-layer structure: Lib layer, which provides local storage service for XML loan configuration, business model layer, business logic layer, and interface layer. The main objects include:

Model layer: IMRoot: model root interface; MDebt: loan model base object; MEqualCaptial: equal principal model object; MEqualInterest: Equal principal and interest model object.

Business layer: DebtAnalysis: provides business logic for loan-related analysis; BaseBigRepay; base class for large-amount repayment business analysis. The reason why this object is separated is because of the large-amount repayment There are many ways to repay a loan; ShortMonthsBigRepay: Base class for shortening the period of large-amount repayment; IBigRepayDebt Large-amount repayment interface; ShortMonthsBigRepayS1: The loan method is equal amount of principal Fund; ShortMonthsBigRepayS2: The loan method is equal amounts of principal and interest.

Interface layer: BaseDlg: The master page of the page, the root class of all pages; BaseSettingDlg: Loan configuration base dialog box; DebtSettingDlg: Loan configuration Dialog box; DebtAnalysisDlg: Loan analysis dialog box; DetailDebtDlg: Loan details dialog box; MainForm: The main interface of the software.

The UML diagram of the software structure is as follows:

Test

Assume that the loan amount is 300,000, the loan duration is 30 years, the loan method is: equal principal amount, the annual interest rate of the loan is 4.9%, and the loan starting date is assumed to be October 2015.

Open the software. The interface is as shown below. Click "Loan Settings". In this interface, enter the loan information. After setting, click Save to save the configuration information locally.

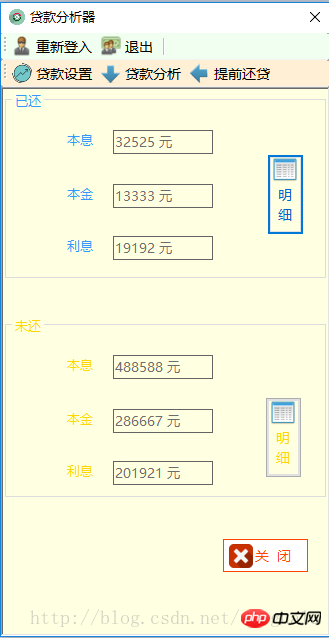

Loan Analysis. The loan analysis interface is as shown below. The analysis results show that the repaid amount column shows that the principal and interest repaid: 32,500, the principal repaid: 13,300, and the interest repaid: 19,100. You can see how the bank makes money, right? !

# In this interface, click the "Details" button to get

:

# # It can be seen from the unpaid column that the unpaid principal and interest are: 488,600, principal: 286,700, and interest: 201,900. The detailed chart of the outstanding amount is shown below:

Large loan repayment

As you can see, the interest rate for loan repayment was still very high at first. About 60%. So, if you have some money on hand, it’s better to get more loans! Click the "Repay Loan in Advance" button, enter the large-amount repayment time: "2017-02", enter the large-amount loan repayment amount of 100,000, and click "Calculate".

## Comparison before and after large repayment:

| Time | Principal and Interest | Principal | Interest | Interest Rate | |

|---|---|---|---|---|---|

| 2019-3 | 1922 | 833 | 1089 | 57% | |

| 2019-3 | 1514 | 833 | 681 | 45 % |

The above is the graphic and text details of a mortgage analyzer based on C# and written in visual studio. For more related content, please pay attention to the PHP Chinese website (www.php.cn)!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Active Directory with C#

Sep 03, 2024 pm 03:33 PM

Active Directory with C#

Sep 03, 2024 pm 03:33 PM

Guide to Active Directory with C#. Here we discuss the introduction and how Active Directory works in C# along with the syntax and example.

Random Number Generator in C#

Sep 03, 2024 pm 03:34 PM

Random Number Generator in C#

Sep 03, 2024 pm 03:34 PM

Guide to Random Number Generator in C#. Here we discuss how Random Number Generator work, concept of pseudo-random and secure numbers.

Access Modifiers in C#

Sep 03, 2024 pm 03:24 PM

Access Modifiers in C#

Sep 03, 2024 pm 03:24 PM

Guide to the Access Modifiers in C#. We have discussed the Introduction Types of Access Modifiers in C# along with examples and outputs.

C# Data Grid View

Sep 03, 2024 pm 03:32 PM

C# Data Grid View

Sep 03, 2024 pm 03:32 PM

Guide to C# Data Grid View. Here we discuss the examples of how a data grid view can be loaded and exported from the SQL database or an excel file.

C# Serialization

Sep 03, 2024 pm 03:30 PM

C# Serialization

Sep 03, 2024 pm 03:30 PM

Guide to C# Serialization. Here we discuss the introduction, steps of C# serialization object, working, and example respectively.

Patterns in C#

Sep 03, 2024 pm 03:33 PM

Patterns in C#

Sep 03, 2024 pm 03:33 PM

Guide to Patterns in C#. Here we discuss the introduction and top 3 types of Patterns in C# along with its examples and code implementation.

Prime Numbers in C#

Sep 03, 2024 pm 03:35 PM

Prime Numbers in C#

Sep 03, 2024 pm 03:35 PM

Guide to Prime Numbers in C#. Here we discuss the introduction and examples of prime numbers in c# along with code implementation.

Web Services in C#

Sep 03, 2024 pm 03:32 PM

Web Services in C#

Sep 03, 2024 pm 03:32 PM

Guide to Web Services in C#. Here we discuss an introduction to Web Services in C# with technology use, limitation, and examples.