Backend Development

Backend Development

Python Tutorial

Python Tutorial

Python's acquisition and simple processing of financial data

Python's acquisition and simple processing of financial data

Python's acquisition and simple processing of financial data

Python’s functions cannot be said to be insignificant, and it has very convenient applications in financial data analysis. The content of this article is to share with you the acquisition and simple processing of financial data in Python. It has certain reference value. Friends in need can refer to it

1. Data acquisition

The pandas package has its own data acquisition interface. For details, you can go to its official website to find it. It is the DataReader method under io.data.

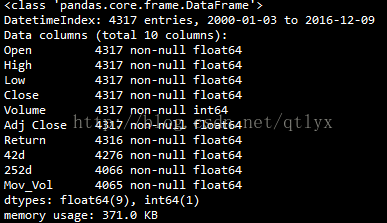

import numpy as np import pandas as pd import pandas.io.data as web import math #从雅虎财经获取DAX指数的数据 DAX = web.DataReader(name='^GDAXI', data_source='yahoo',start = '2000-1-1') #查看一下数据的一些信息 上面这一方法返回的是一个pandas dataframe的数据结构 print DAX.info() #绘制收盘价的曲线 DAX['Close'].plot(figsize=(8,5))

The data we obtain is the structure of dataframe, after all, it is the interface of pandas. Then we draw the closing price curve.

This is the information of the data we obtained.

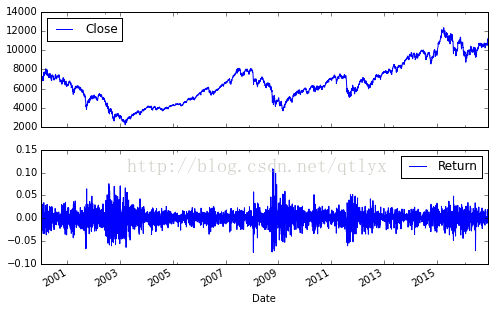

The closing price curve drawn is like this.

2. Simple data processing

With the stock price, we will calculate the daily rise and fall. , in other words, is the daily rate of return, as well as the moving average of the stock price and the volatility of the stock price.

##

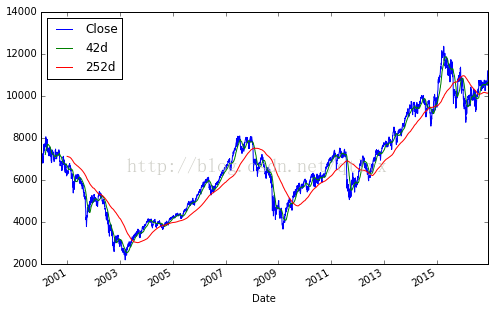

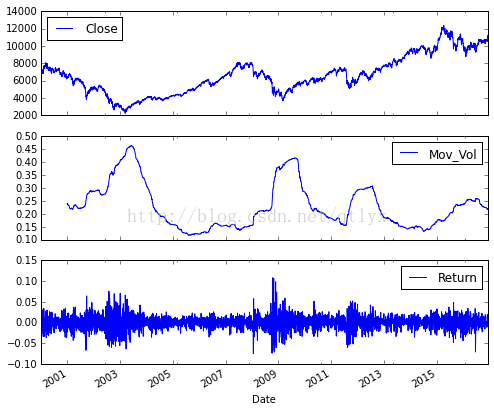

#计算每日的涨跌幅 DAX['Return'] = np.log(DAX['Close']/DAX['Close'].shift(1)) print DAX[['Close','Return']].tail() #将收盘价与每日涨跌幅度放在一张图上 DAX[['Close','Return']].plot(subplots = True,style = 'b',figsize=(8,5)) #42与252个交易日为窗口取移动平均 DAX['42d']=pd.rolling_mean(DAX['Close'],window=42) DAX['252d']=pd.rolling_mean(DAX['Close'],window=252) #绘制MA与收盘价 DAX[['Close','42d','252d']].plot(figsize=(8,5)) #计算波动率,然后根据均方根法则进行年化 DAX['Mov_Vol']=pd.rolling_std(DAX['Return'],window = 252)*math.sqrt(252) DAX[['Close','Mov_Vol','Return']].plot(subplots = True, style = 'b',figsize = (8,7))

##We can master this kind of subplots Drawing method, put together several trend pictures.

This is a picture of the moving average. The attribute of subplots is false. Then they are drawn together.

Python in finance, data Analysis, and applications in artificial intelligence

##Use Python to obtain Google, Yahoo financial data toolsThe above is the detailed content of Python's acquisition and simple processing of financial data. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to solve the permissions problem encountered when viewing Python version in Linux terminal?

Apr 01, 2025 pm 05:09 PM

How to solve the permissions problem encountered when viewing Python version in Linux terminal?

Apr 01, 2025 pm 05:09 PM

Solution to permission issues when viewing Python version in Linux terminal When you try to view Python version in Linux terminal, enter python...

How to efficiently copy the entire column of one DataFrame into another DataFrame with different structures in Python?

Apr 01, 2025 pm 11:15 PM

How to efficiently copy the entire column of one DataFrame into another DataFrame with different structures in Python?

Apr 01, 2025 pm 11:15 PM

When using Python's pandas library, how to copy whole columns between two DataFrames with different structures is a common problem. Suppose we have two Dats...

Python hourglass graph drawing: How to avoid variable undefined errors?

Apr 01, 2025 pm 06:27 PM

Python hourglass graph drawing: How to avoid variable undefined errors?

Apr 01, 2025 pm 06:27 PM

Getting started with Python: Hourglass Graphic Drawing and Input Verification This article will solve the variable definition problem encountered by a Python novice in the hourglass Graphic Drawing Program. Code...

Python Cross-platform Desktop Application Development: Which GUI Library is the best for you?

Apr 01, 2025 pm 05:24 PM

Python Cross-platform Desktop Application Development: Which GUI Library is the best for you?

Apr 01, 2025 pm 05:24 PM

Choice of Python Cross-platform desktop application development library Many Python developers want to develop desktop applications that can run on both Windows and Linux systems...

Do Google and AWS provide public PyPI image sources?

Apr 01, 2025 pm 05:15 PM

Do Google and AWS provide public PyPI image sources?

Apr 01, 2025 pm 05:15 PM

Many developers rely on PyPI (PythonPackageIndex)...

How to efficiently count and sort large product data sets in Python?

Apr 01, 2025 pm 08:03 PM

How to efficiently count and sort large product data sets in Python?

Apr 01, 2025 pm 08:03 PM

Data Conversion and Statistics: Efficient Processing of Large Data Sets This article will introduce in detail how to convert a data list containing product information to another containing...

How to optimize processing of high-resolution images in Python to find precise white circular areas?

Apr 01, 2025 pm 06:12 PM

How to optimize processing of high-resolution images in Python to find precise white circular areas?

Apr 01, 2025 pm 06:12 PM

How to handle high resolution images in Python to find white areas? Processing a high-resolution picture of 9000x7000 pixels, how to accurately find two of the picture...

How to solve the problem of file name encoding when connecting to FTP server in Python?

Apr 01, 2025 pm 06:21 PM

How to solve the problem of file name encoding when connecting to FTP server in Python?

Apr 01, 2025 pm 06:21 PM

When using Python to connect to an FTP server, you may encounter encoding problems when obtaining files in the specified directory and downloading them, especially text on the FTP server...