javascript中JSON.parse()与eval()解析json的区别_javascript技巧

本文实例讲述了javascript中JSON.parse()与eval()解析json的区别。分享给大家供大家参考,具体如下:

JSON(JavaScript Object Notation)是一种轻量级的数据格式,采用完全独立于语言的文本格式,是理想的数据交换格式。同时,JSON是Javascript原生格式,这意味着在javascript中处理JSON数据

基本格式:

varjsonData='{"data1":"Hello,","data2":"world!"}'

调用方法jsonData.data1,jsonData.data2

很多json数据存入数组

var jsonData=[

{"name":"LiLei","age":19,"sex":"male"},

{"name":"HanMei","age":18,"sex":"famale"}

]

调用方法jsonData[0].name,jsonData[1].sex

总体而言,json是相对比较容易的理解和使用的,但同时存在很多的陷阱,如果不注意的话很容易掉进去。

json的的解析方法

json的解析方法共有两种:eval() 和 JSON.parse(),使用方法如下:

var jsonData = '{"data1":"Hello,", "data2":"world!}';

var evalJson=eval('('+jsonData+')');

var jsonParseJson=JSON.parse(jsonData);

这样就把jsonData这个json格式的字符串转换成了JSON对象。

二者的区别如下:

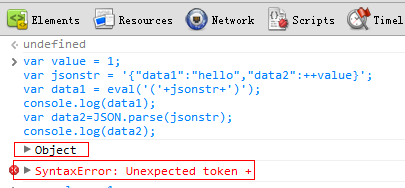

var value = 1;

var jsonstr = '{"data1":"hello","data2":++value}';

var data1 = eval_r('('+jsonstr+')');

console.log(data1);//这时value值为2

var data2=JSON.parse(jsonstr);

console.log(data2);//报错

可以看到控制输出台的结果,第一个eval()顺利执行,第二个报错了。从上例就可以明显地看出,eval在解析字符串时,会执行该字符串中的代码(这样的后果是相当恶劣的),如上例中,由于用eval解析一个json字符串而造成原先的value的值改变。

《高性能Javascript》(本站下载地址:http://www.jb51.net/books/36680.html)一书即指出:

警告:关于JSON和eval需要注意的是:在代码中使用eval是很危险的,特别是用它执行第三方的JSON数据(其中可能包含恶意代码)时,尽可能使用JSON.parse()方法解析字符串本身。该方法可以捕捉JSON中的语法错误,并允许你传入一个函数,用来过滤或转换解析结果。如果此方法以备Firfox 3.5 、IE8 及 Safari 4 原生支持。大多数javascript类库包含的JSON解析代码会直接调用原生版本,如果没有原生支持的话,会调用一个略微不那么强大的非原生版本来处理。

更多关于JavaScript相关内容可查看本站专题:《JavaScript中json操作技巧总结》、《JavaScript切换特效与技巧总结》、《JavaScript查找算法技巧总结》、《JavaScript动画特效与技巧汇总》、《JavaScript错误与调试技巧总结》、《JavaScript数据结构与算法技巧总结》、《JavaScript遍历算法与技巧总结》及《JavaScript数学运算用法总结》

希望本文所述对大家JavaScript程序设计有所帮助。

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What is the difference between pre-market and after-market trading? Detailed explanation of the differences between pre-market and after-market trading

Mar 03, 2025 pm 11:54 PM

What is the difference between pre-market and after-market trading? Detailed explanation of the differences between pre-market and after-market trading

Mar 03, 2025 pm 11:54 PM

In traditional financial markets, pre-market and after-market trading refers to trading activities outside the regular trading period. Although the cryptocurrency market is trading around the clock, trading platforms like Bitget also offer similar features, especially some comprehensive platforms that trade stocks and cryptocurrencies at the same time. This article will clarify the differences in pre-market and after-market trading and explore its impact on currency price. Four major differences between pre-market and after-market trading: The main differences between pre-market and after-market trading and regular trading periods are in four aspects: trading time, liquidity, price fluctuations and trading volume: Trading time: Pre-market trading occurs before the official trading starts, and after-market trading is carried out after the regular trading ends. Liquidity: The liquidity of pre- and after-hours trading is low, there are few traders, and the bid and offer price difference is large; while the liquidity is high during the regular trading period, the price is

Why is Bittensor said to be the 'bitcoin' in the AI track?

Mar 04, 2025 pm 04:06 PM

Why is Bittensor said to be the 'bitcoin' in the AI track?

Mar 04, 2025 pm 04:06 PM

Original title: Bittensor=AIBitcoin? Original author: S4mmyEth, Decentralized AI Research Original translation: zhouzhou, BlockBeats Editor's note: This article discusses Bittensor, a decentralized AI platform, hoping to break the monopoly of centralized AI companies through blockchain technology and promote an open and collaborative AI ecosystem. Bittensor adopts a subnet model that allows the emergence of different AI solutions and inspires innovation through TAO tokens. Although the AI market is mature, Bittensor faces competitive risks and may be subject to other open source

Is there any difference between South Korean Bitcoin and domestic Bitcoin?

Mar 05, 2025 pm 06:51 PM

Is there any difference between South Korean Bitcoin and domestic Bitcoin?

Mar 05, 2025 pm 06:51 PM

The Bitcoin investment boom continues to heat up. As the world's first decentralized digital asset, Bitcoin has attracted much attention on its decentralization and global liquidity. Although China was once the largest market for Bitcoin, policy impacts have led to transaction restrictions. Today, South Korea has become one of the major Bitcoin markets in the world, causing investors to question the differences between it and its domestic Bitcoin. This article will conduct in-depth analysis of the differences between the Bitcoin markets of the two countries. Analysis of the differences between South Korea and China Bitcoin markets. The main differences between South Korea and China’s Bitcoin markets are reflected in prices, market supply and demand, exchange rates, regulatory supervision, market liquidity and trading platforms. Price difference: South Korea’s Bitcoin price is usually higher than China, and this phenomenon is called “Kimchi Premium.” For example, in late October 2024, the price of Bitcoin in South Korea was once

Vertical proxy: Application scenarios and interpretation of disruptive potential of encryption native proxy

Mar 04, 2025 am 10:21 AM

Vertical proxy: Application scenarios and interpretation of disruptive potential of encryption native proxy

Mar 04, 2025 am 10:21 AM

Artificial intelligence agents (AIAgents) are rapidly integrating into daily operations of enterprises, from large companies to small businesses, almost all areas have begun to be used, including sales, marketing, finance, law, IT, project management, logistics, customer service and workflow automation. We are moving from an era of manual processing of data, performing repetitive tasks, and using Excel tables to an era of autonomous operation by AI agents around the clock, which not only improves efficiency but also significantly reduces costs. Application case of AI agents in Web2: YCombinator's Perspective Apten: A sales and marketing optimization tool combining AI and SMS technology. BildAI: A model that can read architectural blueprints,

What exchange is Nexo? Is Nexo exchange safe?

Mar 05, 2025 pm 07:39 PM

What exchange is Nexo? Is Nexo exchange safe?

Mar 05, 2025 pm 07:39 PM

Nexo: Not only is it a cryptocurrency exchange, but also your digital financial manager. Nexo is not a traditional cryptocurrency exchange, but a financial platform that focuses more on cryptocurrency lending. It allows users to obtain loans in cryptocurrency as collateral and provides services to earn interest. While Nexo also offers cryptocurrency buying, selling and redemption capabilities, its core business is crypto lending. This article will explore the operating model and security of Nexo in depth to provide investors with a more comprehensive understanding. Nexo's operating model was founded in 2018 and is headquartered in Zug, Switzerland, and is a pioneer in the field of digital finance. It is different from other centralized exchanges and focuses more on providing comprehensive financial services. Users can buy, sell, trade cryptocurrencies without selling assets and

The difference between Ether and Bitcoin What is the difference between Ether and Bitcoin

Mar 19, 2025 pm 04:54 PM

The difference between Ether and Bitcoin What is the difference between Ether and Bitcoin

Mar 19, 2025 pm 04:54 PM

The difference between Ethereum and Bitcoin is significant. Technically, Bitcoin uses PoW, and Ether has shifted from PoW to PoS. Trading speed is slow for Bitcoin and Ethereum is fast. In application scenarios, Bitcoin focuses on payment storage, while Ether supports smart contracts and DApps. In terms of issuance, the total amount of Bitcoin is 21 million, and there is no fixed total amount of Ether coins. Each security challenge is available. In terms of market value, Bitcoin ranks first, and the price fluctuations of both are large, but due to different characteristics, the price trend of Ethereum is unique.

What does closing a virtual currency position mean? Same as selling? How to avoid forced closing of positions?

Mar 04, 2025 am 06:51 AM

What does closing a virtual currency position mean? Same as selling? How to avoid forced closing of positions?

Mar 04, 2025 am 06:51 AM

Detailed explanation of closing positions in virtual currency trading: Strategies to avoid the risk of liquidation. This article will deeply explore the concept of "closing positions" in the virtual currency market, and clarify the difference between it and "sell", and how to effectively avoid the risk of forced liquidation (filtering positions). What is virtual currency closing? Close positions refers to investors ending existing positions through reverse trading, thereby locking in profits and losses. For example, investors holding long positions (buy) can close their positions by selling equal amounts of virtual currency; investors holding short positions (sell) need to buy equal amounts of virtual currency to close their positions. A closing operation is essentially closing or releasing an established investment position. Is closing a position equal to selling? Although long closing does involve selling operations, closing and selling are not exactly the same. Close position definition: End opened

How many times is the U standard 2 times equivalent to the U standard? What is the difference between U standard and currency standard?

Mar 04, 2025 am 07:48 AM

How many times is the U standard 2 times equivalent to the U standard? What is the difference between U standard and currency standard?

Mar 04, 2025 am 07:48 AM

Coin Standard and U-Material Perpetual Contract: Conversion and risk analysis of leverage multiples. The pricing methods of perpetual contracts are mainly divided into two types: coin Standard and U-Material. The currency standard contract is settled in the transaction cryptocurrency (such as BTC, ETH), with the goal of obtaining more of the cryptocurrency; the U standard contract is settled in the stablecoin (such as USDT), with the goal of earning more stablecoins, similar to the traditional gold standard system. Many investors are curious: How many times the leverage at the currency standard is equivalent to the U standard? To put it simply, the conversion between the 2x leverage of the currency standard and the leverage of the U standard is roughly equivalent to the 2x leverage of the U standard. However, this equivalence relationship is not absolute, as currency price fluctuations significantly affect the actual leverage effect. The risk of currency standard leverage will fluctuate with the currency price