Five ways to reduce compliance costs with AI and automation

While regulations and rules are enacted to protect consumers and markets, they are often complex, making compliance with them costly and challenging.

Strictly regulated industries like financial services and life sciences must bear the heaviest compliance costs. Deloitte estimates that compliance costs in the banking industry have increased by 60% since the 2008 financial crisis, while the Risk Management Institute found that 50% of financial institutions spend only 6% to 10% of their revenue on compliance costs.

Artificial Intelligence (AI) and intelligent automated processes, such as RPA (Robotic Process Automation) and NLP (Natural Language Processing), can help improve efficiency and reduce costs to meet regulatory requirements. Here are five ways on how:

1. Manage regulatory changes with RPA and NLP

In one year alone, a financial institution may need to process up to 300 million pages of New regulations and these regulations are widely disseminated through numerous channels by multiple state, federal or municipal authorities, etc.

Those tasks that require manual participation, such as collecting, classifying, understanding changes, and mapping them to appropriate businesses, are very time-consuming.

Although RPA can collect system changes through programming, it still needs to be understood and applied to business processes. This is where sophisticated OCR (Optical Character Recognition), NLP and AI models come in.

- First, OCR can convert institutional text into machine language.

- Secondly, use NLP to process these machine languages and understand intricate sentences and complex regulatory terminology.

- The AI model can then leverage the output to provide options for policy changes based on similar past cases and filter through new regulations to identify business-relevant regulations.

All these functions or methods can save analysts a lot of time and thus reduce costs.

2. Streamline regulatory reporting

Determining the content, time and method of regulatory reporting is the most time-consuming. This requires analysts to not only read and reread the relevant systems, but also to explain them, write instructions on how they apply to their own business, and translate them into code so that relevant data can be retrieved.

Alternatively, AI can quickly parse unstructured regulatory data to define reporting requirements, interpret it based on past rules and circumstances, and generate code to trigger automated processes to access multiple company resources to build the report. This approach to regulatory intelligence is increasingly gaining acceptance to support companies such as financial services and life sciences that need to submit new product approvals.

3. Shorten the review process of marketing materials

In a strictly regulated market, compliance is required for marketing materials generated during the sales process. However, the process of approving new marketing materials that are constantly emerging can be cumbersome.

The marketing content trend of pharmaceutical companies is developing toward personalization. At the same time, this development is driving up compliance costs at an exponential rate, as compliance officers need to ensure that every piece of content is consistent with drug labeling and legally compliant. As the cost of adding manpower to scale these policies increases significantly, artificial intelligence is now being used to scan content and determine compliance faster and more efficiently. In some cases, AI bots are even used to edit and write regulatory-compliant marketing copy.

4. Reduce false positives in transaction monitoring

In the traditional rule-based transaction monitoring system of financial services, it is easy to trigger a large number of false positives. In some cases, false alarm rates have reached as high as 90%, with each alert requiring verification by a compliance officer.

By integrating AI into traditional transaction monitoring systems, false compliance alerts can be minimized and review costs reduced. High-risk issues identified as legitimate can be referred to the Compliance Officer, while those that are not legitimate can be resolved automatically.

Since compliance officers are only responsible for processing high-risk-flagged transactions, these resources can be redeployed to other areas of greater value. There is another new trend emerging where artificial intelligence can also be used to update traditional rule engines and monitoring systems.

5. Conduct background and legal checks

To limit criminal and money laundering activities, banks need to conduct due diligence to ensure that new customers are law-abiding throughout the relationship. Depending on someone's risk level, a background check may take anywhere from 2 – 24 hours. Much of that time was spent gathering documents, checking databases and reviewing media outlets.

Artificial intelligence and automation can streamline this process. Bots can be used to scrape customer mentions across the web and use sentiment analysis to flag negative content. Use NLP technology to scan court documents for signs of illegal activity and relevant media exposure.

The above is the detailed content of Five ways to reduce compliance costs with AI and automation. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

This site reported on June 27 that Jianying is a video editing software developed by FaceMeng Technology, a subsidiary of ByteDance. It relies on the Douyin platform and basically produces short video content for users of the platform. It is compatible with iOS, Android, and Windows. , MacOS and other operating systems. Jianying officially announced the upgrade of its membership system and launched a new SVIP, which includes a variety of AI black technologies, such as intelligent translation, intelligent highlighting, intelligent packaging, digital human synthesis, etc. In terms of price, the monthly fee for clipping SVIP is 79 yuan, the annual fee is 599 yuan (note on this site: equivalent to 49.9 yuan per month), the continuous monthly subscription is 59 yuan per month, and the continuous annual subscription is 499 yuan per year (equivalent to 41.6 yuan per month) . In addition, the cut official also stated that in order to improve the user experience, those who have subscribed to the original VIP

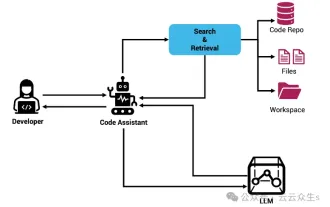

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Improve developer productivity, efficiency, and accuracy by incorporating retrieval-enhanced generation and semantic memory into AI coding assistants. Translated from EnhancingAICodingAssistantswithContextUsingRAGandSEM-RAG, author JanakiramMSV. While basic AI programming assistants are naturally helpful, they often fail to provide the most relevant and correct code suggestions because they rely on a general understanding of the software language and the most common patterns of writing software. The code generated by these coding assistants is suitable for solving the problems they are responsible for solving, but often does not conform to the coding standards, conventions and styles of the individual teams. This often results in suggestions that need to be modified or refined in order for the code to be accepted into the application

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Large Language Models (LLMs) are trained on huge text databases, where they acquire large amounts of real-world knowledge. This knowledge is embedded into their parameters and can then be used when needed. The knowledge of these models is "reified" at the end of training. At the end of pre-training, the model actually stops learning. Align or fine-tune the model to learn how to leverage this knowledge and respond more naturally to user questions. But sometimes model knowledge is not enough, and although the model can access external content through RAG, it is considered beneficial to adapt the model to new domains through fine-tuning. This fine-tuning is performed using input from human annotators or other LLM creations, where the model encounters additional real-world knowledge and integrates it

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

To learn more about AIGC, please visit: 51CTOAI.x Community https://www.51cto.com/aigc/Translator|Jingyan Reviewer|Chonglou is different from the traditional question bank that can be seen everywhere on the Internet. These questions It requires thinking outside the box. Large Language Models (LLMs) are increasingly important in the fields of data science, generative artificial intelligence (GenAI), and artificial intelligence. These complex algorithms enhance human skills and drive efficiency and innovation in many industries, becoming the key for companies to remain competitive. LLM has a wide range of applications. It can be used in fields such as natural language processing, text generation, speech recognition and recommendation systems. By learning from large amounts of data, LLM is able to generate text

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

Editor |ScienceAI Question Answering (QA) data set plays a vital role in promoting natural language processing (NLP) research. High-quality QA data sets can not only be used to fine-tune models, but also effectively evaluate the capabilities of large language models (LLM), especially the ability to understand and reason about scientific knowledge. Although there are currently many scientific QA data sets covering medicine, chemistry, biology and other fields, these data sets still have some shortcomings. First, the data form is relatively simple, most of which are multiple-choice questions. They are easy to evaluate, but limit the model's answer selection range and cannot fully test the model's ability to answer scientific questions. In contrast, open-ended Q&A

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Machine learning is an important branch of artificial intelligence that gives computers the ability to learn from data and improve their capabilities without being explicitly programmed. Machine learning has a wide range of applications in various fields, from image recognition and natural language processing to recommendation systems and fraud detection, and it is changing the way we live. There are many different methods and theories in the field of machine learning, among which the five most influential methods are called the "Five Schools of Machine Learning". The five major schools are the symbolic school, the connectionist school, the evolutionary school, the Bayesian school and the analogy school. 1. Symbolism, also known as symbolism, emphasizes the use of symbols for logical reasoning and expression of knowledge. This school of thought believes that learning is a process of reverse deduction, through existing

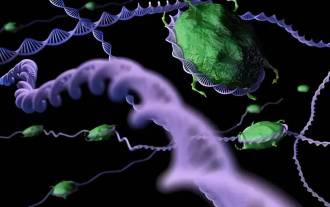

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

Editor | KX In the field of drug research and development, accurately and effectively predicting the binding affinity of proteins and ligands is crucial for drug screening and optimization. However, current studies do not take into account the important role of molecular surface information in protein-ligand interactions. Based on this, researchers from Xiamen University proposed a novel multi-modal feature extraction (MFE) framework, which for the first time combines information on protein surface, 3D structure and sequence, and uses a cross-attention mechanism to compare different modalities. feature alignment. Experimental results demonstrate that this method achieves state-of-the-art performance in predicting protein-ligand binding affinities. Furthermore, ablation studies demonstrate the effectiveness and necessity of protein surface information and multimodal feature alignment within this framework. Related research begins with "S

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

According to news from this website on July 5, GlobalFoundries issued a press release on July 1 this year, announcing the acquisition of Tagore Technology’s power gallium nitride (GaN) technology and intellectual property portfolio, hoping to expand its market share in automobiles and the Internet of Things. and artificial intelligence data center application areas to explore higher efficiency and better performance. As technologies such as generative AI continue to develop in the digital world, gallium nitride (GaN) has become a key solution for sustainable and efficient power management, especially in data centers. This website quoted the official announcement that during this acquisition, Tagore Technology’s engineering team will join GLOBALFOUNDRIES to further develop gallium nitride technology. G