Technology peripherals

Technology peripherals

AI

AI

Gartner releases three hot technology trends for the banking and investment services industry in 2022

Gartner releases three hot technology trends for the banking and investment services industry in 2022

Gartner releases three hot technology trends for the banking and investment services industry in 2022

Gartner has released three hot technology trends for the banking and investment services industry in 2022, namely: generative artificial intelligence (generative AI), autonomous systems and privacy-enhanced computing. These three trends will continue to grow over the next two to three years, driving growth and transformation for financial services institutions.

Moutusi Sau, research vice president at Gartner, said: "While the top priority for financial services institutions is growth, they also need new technology innovations to manage risks, optimize costs and improve efficiency. Bank CIOs can help by generating AI provides technology solutions for businesses pursuing revenue growth, while autonomous systems and privacy-enhancing computing are long-term solutions that can bring a variety of new options to transform financial services businesses."

Global Banking and Investment Services The company's IT spending in 2022 is expected to be US$623 billion, a year-on-year increase of 6.1%. The largest area of spending is IT services (including consulting and managed services), which is $264 billion, accounting for 42% of the industry’s total IT spending. Software spending is expected to be US$149 billion, a year-on-year increase of 11.5%, making it the fastest growing area.

These three emerging technologies released by Gartner will together help enterprises achieve business operations, growth and transformation goals, and related applications have already emerged in the banking and investment industries.

Trend 1: Generative AI

Gartner predicts that by 2025, 20% of test data used for consumer-facing use cases will be data generated in an integrated manner. Generative AI will learn and create innovative works based on digital forms created by artificial intelligence that are not duplicates of the original.

The banking and investment services industry has applied generative adversarial networks (GAN) and natural language generation (NLG) to most fraud detection, transaction prediction, synthetic data generation and risk factor modeling scenarios. The potential of this technology is to take personalization to new heights.

Trend 2: Autonomous systems

Autonomous systems are physical hardware or software systems that can manage themselves. They can learn from their environment and continuously modify their algorithms in real time to optimize themselves in complex situations. behavior in ecosystems. These systems create an agile set of technical capabilities that can support new needs and situations, optimize performance, and resist attacks without human intervention.

Currently, most autonomous systems in the banking industry are provided in the form of software. And an autonomous system in the form of hardware - humanoid robots - are appearing in smart branches of banks to meet the needs of customers and customers. These bots can be used for autonomous debt management, personal financial assistants and self-service lending. Although robo-investment advisors still have trust issues due to their high degree of automation, they are essentially a low-level autonomous system.

Gartner predicts that in 2024, 20% of companies selling related businesses will require customers to waive compensation clauses for products related to system or device learning.

Trend 3: Privacy-enhanced computing

Privacy-enhanced computing (PEC) can ensure information security when processing personal data in an untrusted environment, and with the continuous development of privacy and data protection laws As well as growing consumer concerns, this is becoming increasingly critical. Privacy-enhanced computing uses a variety of privacy-preserving technologies to enable financial services institutions to obtain value from data while meeting compliance requirements.

Gartner predicts that by 2025, 60% of large enterprise organizations will use one or more privacy-enhancing computing technologies in the fields of analytics, business intelligence, or cloud computing.

Data plays an irreplaceable role in various analysis, calculation and data realization work in the field of financial services. Financial services institutions are increasingly adopting PEC for applications such as fraud analysis, intelligent operation and maintenance, data sharing and anti-money laundering.

Gartner clients can learn more in Key Strategic Technology Trends in the Banking and Investment Services Industry 2022 and Enterprise IT Spending in the Global Banking and Investment Services Market, 2020-2026, Q1 2022 Update.

The above is the detailed content of Gartner releases three hot technology trends for the banking and investment services industry in 2022. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

Chinese mathematician Terence Tao leads the White House Generative AI Working Group, and Li Feifei will speak at the group

May 25, 2023 am 10:36 AM

Chinese mathematician Terence Tao leads the White House Generative AI Working Group, and Li Feifei will speak at the group

May 25, 2023 am 10:36 AM

The Generative AI Working Group established by the President's Council of Advisors on Science and Technology is designed to help assess key opportunities and risks in the field of artificial intelligence and provide advice to the President on ensuring that these technologies are developed and deployed as fairly, safely, and responsibly as possible. AMD CEO Lisa Su and Google Cloud Chief Information Security Officer Phil Venables are also members of the working group. Chinese-American mathematician and Fields Medal winner Terence Tao. On May 13, local time, Chinese-American mathematician and Fields Medal winner Terence Tao announced that he and physicist Laura Greene will co-lead the Generative Artificial Intelligence Working Group of the U.S. Presidential Council of Advisors on Science and Technology (PCAST) .

From 'human + RPA' to 'human + generative AI + RPA', how does LLM affect RPA human-computer interaction?

Jun 05, 2023 pm 12:30 PM

From 'human + RPA' to 'human + generative AI + RPA', how does LLM affect RPA human-computer interaction?

Jun 05, 2023 pm 12:30 PM

Image source@visualchinesewen|Wang Jiwei From "human + RPA" to "human + generative AI + RPA", how does LLM affect RPA human-computer interaction? From another perspective, how does LLM affect RPA from the perspective of human-computer interaction? RPA, which affects human-computer interaction in program development and process automation, will now also be changed by LLM? How does LLM affect human-computer interaction? How does generative AI change RPA human-computer interaction? Learn more about it in one article: The era of large models is coming, and generative AI based on LLM is rapidly transforming RPA human-computer interaction; generative AI redefines human-computer interaction, and LLM is affecting the changes in RPA software architecture. If you ask what contribution RPA has to program development and automation, one of the answers is that it has changed human-computer interaction (HCI, h

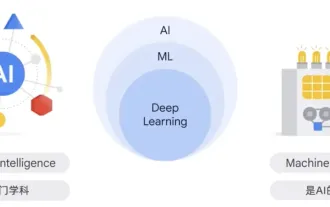

Why is generative AI sought after by various industries?

Mar 30, 2024 pm 07:36 PM

Why is generative AI sought after by various industries?

Mar 30, 2024 pm 07:36 PM

Generative AI is a type of human artificial intelligence technology that can generate various types of content, including text, images, audio and synthetic data. So what is artificial intelligence? What is the difference between artificial intelligence and machine learning? Artificial intelligence is the discipline, a branch of computer science, that studies the creation of intelligent agents, which are systems that can reason, learn, and perform actions autonomously. At its core, artificial intelligence is concerned with the theories and methods of building machines that think and act like humans. Within this discipline, machine learning ML is a field of artificial intelligence. It is a program or system that trains a model based on input data. The trained model can make useful predictions from new or unseen data derived from the unified data on which the model was trained.

Say goodbye to design software to generate renderings in one sentence, generative AI subverts the field of decoration and decoration, with 28 popular tools

Jun 10, 2023 pm 03:33 PM

Say goodbye to design software to generate renderings in one sentence, generative AI subverts the field of decoration and decoration, with 28 popular tools

Jun 10, 2023 pm 03:33 PM

▲This picture was generated by AI. Kujiale, Sanweijia, Dongyi Risheng, etc. have already taken action. The decoration and decoration industry chain has introduced AIGC on a large scale. What are the applications of generative AI in the field of decoration and decoration? What impact does it have on designers? One article to understand and say goodbye to various design software to generate renderings in one sentence. Generative AI is subverting the field of decoration and decoration. Using artificial intelligence to enhance capabilities improves design efficiency. Generative AI is revolutionizing the decoration and decoration industry. What impact does generative AI have on the decoration and decoration industry? What are the future development trends? One article to understand how LLM is revolutionizing decoration and decoration. These 28 popular generative AI decoration design tools are worth trying. Article/Wang Jiwei In the field of decoration and decoration, there has been a lot of news related to AIGC recently. Collov launches generative AI-powered design tool Col

Watch: What is the potential of applying generative AI to network automation?

Aug 17, 2023 pm 07:57 PM

Watch: What is the potential of applying generative AI to network automation?

Aug 17, 2023 pm 07:57 PM

Generative artificial intelligence (GenAI) is expected to become a compelling technology trend by 2023, bringing important applications to businesses and individuals, including education, according to a new report from market research firm Omdia. In the telecom space, use cases for GenAI are mainly focused on delivering personalized marketing content or supporting more sophisticated virtual assistants to enhance customer experience. Although the application of generative AI in network operations is not obvious, EnterpriseWeb has developed an interesting concept. Validation, demonstrating the potential of generative AI in the field, the capabilities and limitations of generative AI in network automation One of the early applications of generative AI in network operations was the use of interactive guidance to replace engineering manuals to help install network elements, from

Which technology giant is behind Haier and Siemens' generative AI innovation?

Nov 21, 2023 am 09:02 AM

Which technology giant is behind Haier and Siemens' generative AI innovation?

Nov 21, 2023 am 09:02 AM

Gu Fan, General Manager of the Strategic Business Development Department of Amazon Cloud Technology Greater China In 2023, large language models and generative AI will "surge" in the global market, not only triggering "an overwhelming" follow-up in the AI and cloud computing industry, but also vigorously Attract manufacturing giants to join the industry. Haier Innovation Design Center created the country's first AIGC industrial design solution, which significantly shortened the design cycle and reduced conceptual design costs. It not only accelerated the overall conceptual design by 83%, but also increased the integrated rendering efficiency by about 90%, effectively solving Problems include high labor costs and low concept output and approval efficiency in the design stage. Siemens China's intelligent knowledge base and intelligent conversational robot "Xiaoyu" based on its own model has natural language processing, knowledge base retrieval, and big language training through data

Tencent Hunyuan upgrades model matrix, launching 256k long text model on the cloud

Jun 01, 2024 pm 01:46 PM

Tencent Hunyuan upgrades model matrix, launching 256k long text model on the cloud

Jun 01, 2024 pm 01:46 PM

The implementation of large models is accelerating, and "industrial practicality" has become a development consensus. On May 17, 2024, the Tencent Cloud Generative AI Industry Application Summit was held in Beijing, announcing a series of progress in large model development and application products. Tencent's Hunyuan large model capabilities continue to upgrade. Multiple versions of models hunyuan-pro, hunyuan-standard, and hunyuan-lite are open to the public through Tencent Cloud to meet the model needs of enterprise customers and developers in different scenarios, and to implement the most cost-effective model solutions. . Tencent Cloud releases three major tools: knowledge engine for large models, image creation engine, and video creation engine, creating a native tool chain for the era of large models, simplifying data access, model fine-tuning, and application development processes through PaaS services to help enterprises

Transformative Trend: Generative Artificial Intelligence and Its Impact on Software Development

Feb 26, 2024 pm 10:28 PM

Transformative Trend: Generative Artificial Intelligence and Its Impact on Software Development

Feb 26, 2024 pm 10:28 PM

The rise of artificial intelligence is driving the rapid development of software development. This powerful technology has the potential to revolutionize the way we build software, with far-reaching impacts on every aspect of design, development, testing and deployment. For companies trying to enter the field of dynamic software development, the emergence of generative artificial intelligence technology provides them with unprecedented development opportunities. By incorporating this cutting-edge technology into their development processes, companies can significantly increase production efficiency, shorten product time to market, and launch high-quality software products that stand out in the fiercely competitive digital market. According to a McKinsey report, it is predicted that the generative artificial intelligence market size is expected to reach US$4.4 trillion by 2031. This forecast not only reflects a trend, but also shows the technology and business landscape.