Technology peripherals

Technology peripherals

AI

AI

2022 L4 autonomous driving annual answer sheet, really 'no one' has the last laugh

2022 L4 autonomous driving annual answer sheet, really 'no one' has the last laugh

2022 L4 autonomous driving annual answer sheet, really 'no one' has the last laugh

L4 autonomous driving has reached a moment of "big reshuffle" and "big change" this year.

Half of winter. Aurora, the platform-based self-driving star, and Argo, which is backed by Ford and Volkswagen... have all reported news of layoffs or bankruptcy this year, and many companies that previously focused on Robotaxi have switched to assisted driving for passenger cars.

Capital has become extremely cautious about L4’s story. So people say: L4 winter has arrived.

The other half is a flame.

The jewel in the crown is far away, and the leading company has already glimpsed the dawn of the finals and obtained tickets.

Baidu Apollo, Google Waymo, and General Cruise are making rapid progress and making continuous progress.

For example, Waymo and Cruise have continued to make breakthroughs in the scope and duration of their commercial operations in San Francisco and Phoenix; while in China, Baidu Apollo’s Carrot Run has also launched in more than ten cities, with fully driverless operations in Beijing and Wuhan , Chongqing achieved a milestone, and the number of commercial miles and waybills increased rapidly.

how to explain?

It’s actually very simple: in the wave of reshuffle in the autonomous driving industry, only truly “unmanned” people can be the first to see the dawn.

Why is "no one on the ground" so important?

Baidu Apollo, Waymo, and Cruise, the three players that have made the fastest progress in L4 commercialization, all show the same characteristics.

Being backed by giants is just one of them. More importantly, their implementation projects are based on the premise of "no one at all".

For example, in Wuhan, Hubei, you can call a fully unmanned self-driving car through the Luobo Kuaipao App, and the technology behind this comes from Baidu Apollo.

Why is "fully unmanned" the key to the implementation of L4 and above autonomous driving technology?

First of all, from a business perspective, "completely unmanned" is a necessary prerequisite for the initial success of Robotaxi's business model.

For Robotaxi, the biggest challenge to commercialization is cost. The first is the cost of vehicle modifications. In the early days, without reaching pre-installation mass production cooperation with the OEM, it was common for a Robotaxi to cost millions.

In the operational stage, the biggest cost is the safety officer on the vehicle.

The minimum labor cost for an online ride-hailing car driven by an ordinary human driver is about 120,000 yuan a year, and the safety officer is only higher than the driver.

It was difficult for the previous Robotaxi to balance its own costs during the entire operation life cycle

Technically achieving "full unmanned operation" means that labor costs are saved first.

Secondly, the fully unmanned self-driving technology stack must be implemented on pre-installed and mass-produced models, so at the level of the vehicle itself, it also means entering the same cost range as ordinary online ride-hailing.

In addition, "fully unmanned" also means that technology providers have been able to meet the high reliability and safety of autonomous driving travel.

The policy is also more inclined to open operating licenses to such technology providers.

Therefore, the most critical and direct point for the implementation of "fully unmanned" autonomous driving is "lowering costs". The more important and profound influencing factor behind it is the improvement of safety and reliability brought about by the maturity of technology.

The data given by Baidu Apollo is that it has accumulated more than 40 million kilometers of test miles. Robotaxi's successful delivery rate has exceeded 99.99%.

Behind this, there is Apollo’s closed loop of autonomous driving data through L2 and L4, as well as the foundation laid by Baidu’s other accumulation in the AI field.

For example, relying on the thousands of object recognition capabilities of the Wenxin large model, we can greatly expand the semantic recognition data of autonomous driving, especially in the recognition of special vehicles (fire trucks, ambulances), plastic bags and other special-shaped objects. Greatly improve the coverage of long-tail scenarios and improve the reliability of autonomous driving.

In addition, the Apollo self-driving high-precision map has a construction automation rate of 96%. It is based on Baidu Map’s 12 million kilometers of leading road network coverage and massive spatio-temporal data, combined with the driving knowledge accumulated by hundreds of millions of drivers. Build a driving knowledge graph at the entire road network level to improve the comfort of autonomous driving decision-making.

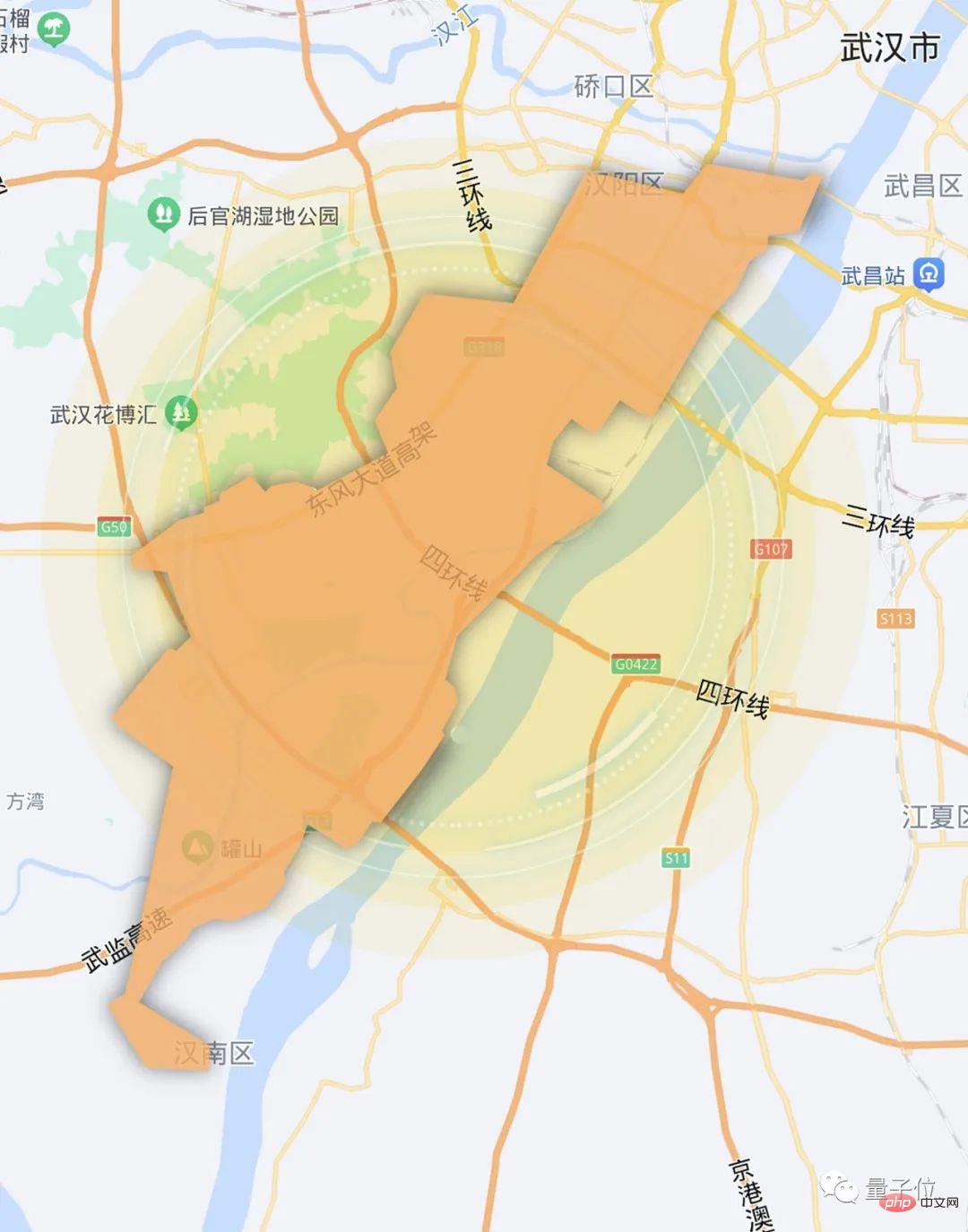

Currently, the commercial operation and testing of Luobo Kuaipao’s fully unmanned self-driving fleet continues to expand the area, increase the volume, and increase the time. It has already landed in Beijing, Chongqing and Wuhan.

Take Wuhan Economic Development Zone as an example, covering a total area of more than 130 square kilometers and covering more than 1 million residents. The operation scenarios of the autonomous driving fleet include urban elevated roads and ordinary roads, and the operation period covers day and night. The long-tail scenarios and complex challenges encountered in the process draft are no different from ordinary online ride-hailing private cars.

The accumulation and training of data in real scenarios can directly accelerate Apollo’s technical iteration efficiency, thereby exploring more long-tail scenarios and forming a data closed-loop “flywheel” effect.

Fully unmanned technology has matured, bringing about the initial run-through of the business model and enabling large-scale operations in some cities.

In this process, capable players will further verify and improve the Robotaxi business model, and further expand the scope of implementation, thereby forming a leading advantage.

This is exactly the path that players such as Baidu Apollo and Waymo are currently taking, and it is also the "torch" that allows people to still believe in technology and autonomous driving in the cold winter.

What kind of technology is required?

To achieve the goal of no one landing, the technology behind it needs to be solid and hard enough.

As for Baidu, as the one that has been developing steadily in this industry reshuffle and polarization, and has always been the leader in autonomous driving in China, its technological development can be said to have certain reference significance.

Therefore, we might as well look at this issue from the perspective of Baidu’s autonomous driving technology development path.

Different from other players’ play styles, a very distinctive feature of Baidu’s autonomous driving is its in-depth integration with Wenxin’s large model.

And looking at the entire industry, Baidu is still the first to apply large models in autonomous driving perception.

Specifically, to solve the long-tail data mining problem of autonomous driving, Baidu uses the Wenxin large model - a weakly supervised image and text pre-training model.

Several more typical long-tail data mining problems include:

• Rare vehicle models: such as fire trucks, ambulances, etc., due to their low "appearance rate" on the road, And the shape and shape are irregular, which brings certain challenges to perception and understanding. • Pedestrians in various postures: On the road, there is often not one person appearing on the road. This not only brings challenges to identification, but also brings certain difficulties to subsequent prediction and tracking. • Low objects and elements of traffic and construction: Low objects (such as guardrails on roads, etc.) have always been a very challenging problem to perceive.

Faced with the above inherent problems, with the help of the Wenxin large model's ability to recognize thousands of objects, Baidu's semantic recognition data for autonomous driving can be greatly expanded, achieving exponential improvements in efficiency.

In addition, thanks to the Wenxin Large Model-Autonomous Driving Perception Model with a parameter scale of more than 1 billion, through the large model training of small models, the generalization ability of autonomous driving perception has also been significantly enhanced.

In this regard, Baidu autonomous driving technology expert Wang Jingdong said:

Large models have become the core driving force for improving autonomous driving capabilities.

The "second magic weapon" that enables Baidu's autonomous driving to quickly realize unmanned landing is the Baidu Apollo autonomous driving map.

Different from the navigation maps we usually use, high-precision maps can be said to be indispensable for realizing intelligent driving.

Overall, high-precision maps need to meet three major characteristics.

The first is centimeter-level high precision.

When humans use ordinary navigation maps, they only need to be accurate to 5-10 meters, plus the driver's own judgment.

But smart cars do not have the judgment ability of humans, so an error of 1-2 meters may lead to problems such as line pressing. This is why the accuracy must be kept within the centimeter range. .

The second is the large amount of road information covered.

The information that high-precision maps need to provide to smart cars can go beyond the basic information such as road selection, congestion, and driving time contained in ordinary navigation maps. It also needs to include a large amount of driving assistance information, such as lane width change offset points, diversion areas, circular signs, highway exits, etc.

The most important thing is the accurate three-dimensional representation of the road network, as well as more than 100 road features including how many lanes there are, where the boundary lines are, guardrails, street lights, and even the size of the curbs.

The third is that there will be detours on high-precision maps.

This is because the high-precision map is aimed at smart cars rather than humans. The information it provides is used for the positioning system, perception system and decision-making system of smart cars.

Therefore, when faced with situations such as tunnels, the high-precision map may "detour" because in its eyes, this road does not exist.

It can be seen that in order to achieve a fully unmanned landing, high-precision maps are indispensable, and it is not easy to achieve.

But as the Baidu Apollo self-driving map that has been "on duty", it must have held the above-mentioned difficulties.

It is understood that Baidu’s high-precision construction automation rate has reached 96%, which means that the problem of high application costs can be solved to a greater extent.

At the same time, it also has the ability to generate online maps in real time, and can integrate tear-off sensing data and multi-source maps to protect the safety of autonomous driving.

In terms of decision-making, based on Baidu Maps’ 12 million kilometers of leading road network coverage level massive spatio-temporal data and hundreds of millions of drivers’ driving knowledge data, Baidu has also built a driving knowledge graph at the entire road network level. To improve the comfort of autonomous driving decision-making.

In addition to the algorithm and software levels, Baidu has achieved no-one implementation and has not neglected its efforts in hardware.

It is understood that Baidu’s self-developed AI chip Kunlun Core 2 has completed end-to-end performance adaptation for autonomous driving scenarios, in order to consolidate Baidu’s advantages in the integration of software and hardware for autonomous driving.

Of course, Baidu’s ability to take the lead in autonomous driving is not something that can be achieved overnight. It is actually the result of “ten years of hard work in the field” and continuous technological accumulation.

A set of public data can be seen at a glance:

At present, Baidu Apollo has grown into the world's most active autonomous driving open platform, with more than 210 global ecological partners, 80,000 global developers, 700,000 lines of open source code, and a total test mileage of more than 40 million kilometers; there are 3,477 autonomous driving patents, ranking first in the world for four consecutive years.

The above is the technical strength behind the players who are the first to realize unmanned landing.

The tickets for the finals have been decided

As we mentioned at the beginning, this year the global autonomous driving industry is undergoing a "major reshuffle".

Judging from the self-driving companies that have been exposed to bankruptcy, filing for bankruptcy, and massive layoffs, they seem to have one thing in common - they have failed to achieve the goal of fully autonomous driving.

After all, autonomous driving is not only a competition in technical strength, but also a contest in time and endurance.

Just like you can only see who is swimming naked when the tide recedes, standing at the end of 2022, accelerating the landing of no one has become an inevitable node for "coming ashore" players.

Not only Baidu, the domestic leader in autonomous driving, is doing this, but also leading international players.

Autonomous driving companies such as Waymo and Cruise are accelerating the large-scale commercialization of autonomous driving.

It is understood that San Francisco in the United States has now opened a 24/7 driverless travel service in the entire city. At the same time, Phoenix’s autonomous driving operation area continues to expand to the core urban area.

In addition, the world's first fully driverless taxi-hailing service has been launched from Phoenix Sky Harbor International Airport to the city center, operating 24/7.

Baidu has also recently released a new signal:

In 2023, Baidu Apollo will continue to expand its business scale and plans to launch an additional 200 wireless devices nationwide. We will operate vehicles driven by humans and strive to build the world’s largest driverless operation service area.

It is understood that Baidu’s sixth-generation unmanned vehicle Apollo RT6 (costing only 250,000 yuan), which will be mass-produced this year, will be put into use on Luobo Kuaipao next year.

Generally speaking, Baidu has achieved cost reduction, safety and quality assurance in fully unmanned implementation, and at the same time, it is continuing to accelerate the expansion of scale.

The reason is that what Baidu currently wants to ensure is that each city can run its business model at low cost (gross profit is positive); but if it takes a long-term view, the exponential growth of its operating scale is foreseeable. .

It can be seen that "no one lands on the ground" has become the key for players to enter the autonomous driving finals.

So in this second half of autonomous driving, who can have the last laugh?

Baidu is undoubtedly one of them.

The above is the detailed content of 2022 L4 autonomous driving annual answer sheet, really 'no one' has the last laugh. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

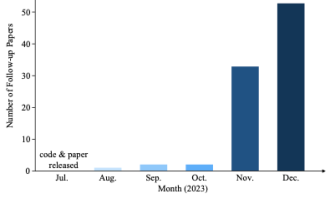

Why is Gaussian Splatting so popular in autonomous driving that NeRF is starting to be abandoned?

Jan 17, 2024 pm 02:57 PM

Why is Gaussian Splatting so popular in autonomous driving that NeRF is starting to be abandoned?

Jan 17, 2024 pm 02:57 PM

Written above & the author’s personal understanding Three-dimensional Gaussiansplatting (3DGS) is a transformative technology that has emerged in the fields of explicit radiation fields and computer graphics in recent years. This innovative method is characterized by the use of millions of 3D Gaussians, which is very different from the neural radiation field (NeRF) method, which mainly uses an implicit coordinate-based model to map spatial coordinates to pixel values. With its explicit scene representation and differentiable rendering algorithms, 3DGS not only guarantees real-time rendering capabilities, but also introduces an unprecedented level of control and scene editing. This positions 3DGS as a potential game-changer for next-generation 3D reconstruction and representation. To this end, we provide a systematic overview of the latest developments and concerns in the field of 3DGS for the first time.

How to solve the long tail problem in autonomous driving scenarios?

Jun 02, 2024 pm 02:44 PM

How to solve the long tail problem in autonomous driving scenarios?

Jun 02, 2024 pm 02:44 PM

Yesterday during the interview, I was asked whether I had done any long-tail related questions, so I thought I would give a brief summary. The long-tail problem of autonomous driving refers to edge cases in autonomous vehicles, that is, possible scenarios with a low probability of occurrence. The perceived long-tail problem is one of the main reasons currently limiting the operational design domain of single-vehicle intelligent autonomous vehicles. The underlying architecture and most technical issues of autonomous driving have been solved, and the remaining 5% of long-tail problems have gradually become the key to restricting the development of autonomous driving. These problems include a variety of fragmented scenarios, extreme situations, and unpredictable human behavior. The "long tail" of edge scenarios in autonomous driving refers to edge cases in autonomous vehicles (AVs). Edge cases are possible scenarios with a low probability of occurrence. these rare events

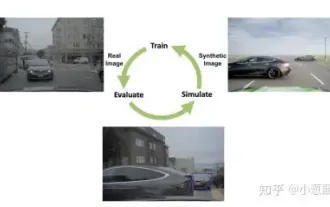

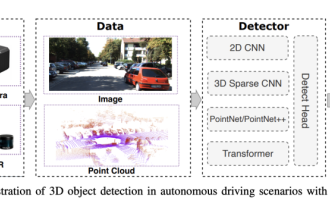

Choose camera or lidar? A recent review on achieving robust 3D object detection

Jan 26, 2024 am 11:18 AM

Choose camera or lidar? A recent review on achieving robust 3D object detection

Jan 26, 2024 am 11:18 AM

0.Written in front&& Personal understanding that autonomous driving systems rely on advanced perception, decision-making and control technologies, by using various sensors (such as cameras, lidar, radar, etc.) to perceive the surrounding environment, and using algorithms and models for real-time analysis and decision-making. This enables vehicles to recognize road signs, detect and track other vehicles, predict pedestrian behavior, etc., thereby safely operating and adapting to complex traffic environments. This technology is currently attracting widespread attention and is considered an important development area in the future of transportation. one. But what makes autonomous driving difficult is figuring out how to make the car understand what's going on around it. This requires that the three-dimensional object detection algorithm in the autonomous driving system can accurately perceive and describe objects in the surrounding environment, including their locations,

Swiss crypto-friendly bank FlowBank forced into bankruptcy due to serious breaches

Jun 14, 2024 pm 10:40 PM

Swiss crypto-friendly bank FlowBank forced into bankruptcy due to serious breaches

Jun 14, 2024 pm 10:40 PM

The Swiss Financial Market Supervisory Authority (FINMA) announced that it has forced crypto-friendly online banks doing business with TrueUSD stablecoin issuer Techteryx, crypto asset management company CoinShares and the world’s largest cryptocurrency exchange Binance after discovering major violations. FlowBank goes bankrupt. FINMA found that FlowBank seriously violated capital adequacy requirements. FINMA pointed out in a statement on June 13 that FlowBank no longer had the minimum capital required for business operations and there was no possibility of restructuring. There were concerns about the bank's excessive debt, so it took the closure measure. Previously, FINMA found in its investigation that FlowBank seriously violated the requirements for holding sufficient capital.

Have you really mastered coordinate system conversion? Multi-sensor issues that are inseparable from autonomous driving

Oct 12, 2023 am 11:21 AM

Have you really mastered coordinate system conversion? Multi-sensor issues that are inseparable from autonomous driving

Oct 12, 2023 am 11:21 AM

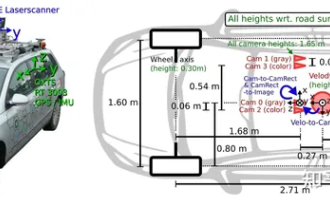

The first pilot and key article mainly introduces several commonly used coordinate systems in autonomous driving technology, and how to complete the correlation and conversion between them, and finally build a unified environment model. The focus here is to understand the conversion from vehicle to camera rigid body (external parameters), camera to image conversion (internal parameters), and image to pixel unit conversion. The conversion from 3D to 2D will have corresponding distortion, translation, etc. Key points: The vehicle coordinate system and the camera body coordinate system need to be rewritten: the plane coordinate system and the pixel coordinate system. Difficulty: image distortion must be considered. Both de-distortion and distortion addition are compensated on the image plane. 2. Introduction There are four vision systems in total. Coordinate system: pixel plane coordinate system (u, v), image coordinate system (x, y), camera coordinate system () and world coordinate system (). There is a relationship between each coordinate system,

This article is enough for you to read about autonomous driving and trajectory prediction!

Feb 28, 2024 pm 07:20 PM

This article is enough for you to read about autonomous driving and trajectory prediction!

Feb 28, 2024 pm 07:20 PM

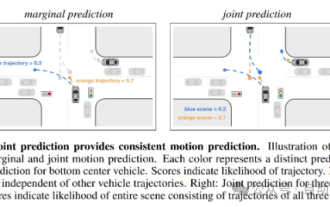

Trajectory prediction plays an important role in autonomous driving. Autonomous driving trajectory prediction refers to predicting the future driving trajectory of the vehicle by analyzing various data during the vehicle's driving process. As the core module of autonomous driving, the quality of trajectory prediction is crucial to downstream planning control. The trajectory prediction task has a rich technology stack and requires familiarity with autonomous driving dynamic/static perception, high-precision maps, lane lines, neural network architecture (CNN&GNN&Transformer) skills, etc. It is very difficult to get started! Many fans hope to get started with trajectory prediction as soon as possible and avoid pitfalls. Today I will take stock of some common problems and introductory learning methods for trajectory prediction! Introductory related knowledge 1. Are the preview papers in order? A: Look at the survey first, p

Let's talk about end-to-end and next-generation autonomous driving systems, as well as some misunderstandings about end-to-end autonomous driving?

Apr 15, 2024 pm 04:13 PM

Let's talk about end-to-end and next-generation autonomous driving systems, as well as some misunderstandings about end-to-end autonomous driving?

Apr 15, 2024 pm 04:13 PM

In the past month, due to some well-known reasons, I have had very intensive exchanges with various teachers and classmates in the industry. An inevitable topic in the exchange is naturally end-to-end and the popular Tesla FSDV12. I would like to take this opportunity to sort out some of my thoughts and opinions at this moment for your reference and discussion. How to define an end-to-end autonomous driving system, and what problems should be expected to be solved end-to-end? According to the most traditional definition, an end-to-end system refers to a system that inputs raw information from sensors and directly outputs variables of concern to the task. For example, in image recognition, CNN can be called end-to-end compared to the traditional feature extractor + classifier method. In autonomous driving tasks, input data from various sensors (camera/LiDAR

SIMPL: A simple and efficient multi-agent motion prediction benchmark for autonomous driving

Feb 20, 2024 am 11:48 AM

SIMPL: A simple and efficient multi-agent motion prediction benchmark for autonomous driving

Feb 20, 2024 am 11:48 AM

Original title: SIMPL: ASimpleandEfficientMulti-agentMotionPredictionBaselineforAutonomousDriving Paper link: https://arxiv.org/pdf/2402.02519.pdf Code link: https://github.com/HKUST-Aerial-Robotics/SIMPL Author unit: Hong Kong University of Science and Technology DJI Paper idea: This paper proposes a simple and efficient motion prediction baseline (SIMPL) for autonomous vehicles. Compared with traditional agent-cent