Technology peripherals

Technology peripherals

AI

AI

Nanyang Polytechnic releases quantitative trading master TradeMaster, covering 15 reinforcement learning algorithms

Nanyang Polytechnic releases quantitative trading master TradeMaster, covering 15 reinforcement learning algorithms

Nanyang Polytechnic releases quantitative trading master TradeMaster, covering 15 reinforcement learning algorithms

Recently, the quantitative platform family has welcomed a new member, an open source platform based on reinforcement learning: TradeMaster—Trading Master.

#TradeMaster Developed by Nanyang Technological University is a unified, end-to-end, user-friendly quantitative trading platform covering four major financial markets, six major trading scenarios, 15 reinforcement learning algorithms and a series of visual evaluation tools!

Platform address: https://github.com/TradeMaster-NTU/TradeMaster

Background introductionIn recent years, artificial intelligence technology is occupying an increasingly important position in quantitative trading strategies. Due to its outstanding decision-making ability in complex environments, there is huge potential in applying reinforcement learning technology to tasks in quantitative trading. However, the low signal-to-noise ratio of the financial market and the unstable training of reinforcement learning algorithms make reinforcement learning algorithms currently unable to be deployed on a large scale in real financial markets. The specific challenges are as follows:

- Development The process is complex and involves a huge amount of engineering, making it difficult to realize

- The performance of the algorithm is highly dependent on the market state at the time of testing, the risk is high, and it is difficult to systematically evaluate

- The design, optimization, and maintenance of the algorithm There is a high technical threshold and it is difficult to deploy on a large scale.

TradeMaster’s potential contribution to the deep integration of industry, academia, research and application

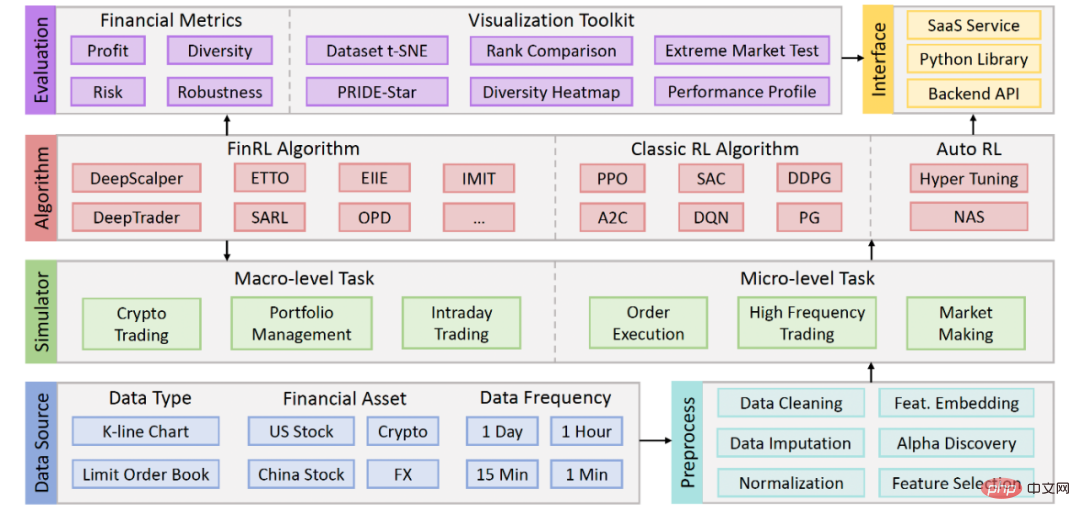

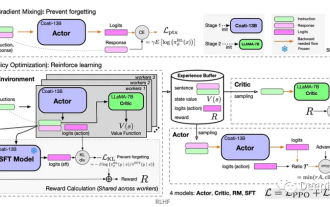

TradeMaster FrameworkTradeMaster consists ofsix core modules, including the complete process of design, implementation, testing and deployment of reinforcement learning algorithms for quantitative trading , below we will introduce it to you in detail:

# The framework structure of the TradeMaster platform

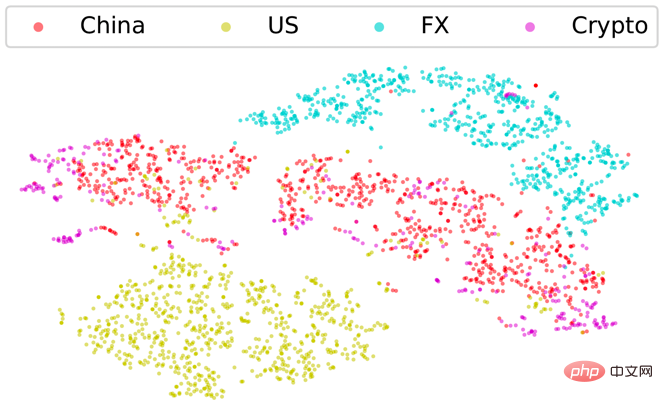

Data module: TradeMaster provides long-term multi-modal (K-line and order flow) financial data at different granularities (minute level to daily level), covering four major markets: China, US stocks and foreign exchange.Preprocessing module: TradeMaster provides a standardized financial time series data preprocessing pipeline, including 6 steps: 1. Data cleaning 2. Data filling 3. Regularization 4. Automatic features Discovery 5. Feature embedding 6. Feature selection

Simulator module: TradeMaster provides a series of data-driven high-quality financial market simulators, supporting 6 mainstream quantitative trading tasks: 1 . Currency trading 2. Portfolio management 3. Intraday trading 4. Order execution 5. High-frequency trading 6. Market making

Algorithm module: TradeMaster implements 7 latest reinforcement learning-based trading algorithms (DeepScalper, OPD, DeepTrader, SARL, ETTO, Investor-Imitator, EIIE) and 8 classic reinforcement algorithms (PPO, A2C, Rainbow, SAC, DDPG, DQN, PG, TD3). At the same time, TradeMaster introduces automated machine learning technology to help users efficiently adjust the hyperparameters of training reinforcement learning algorithms.

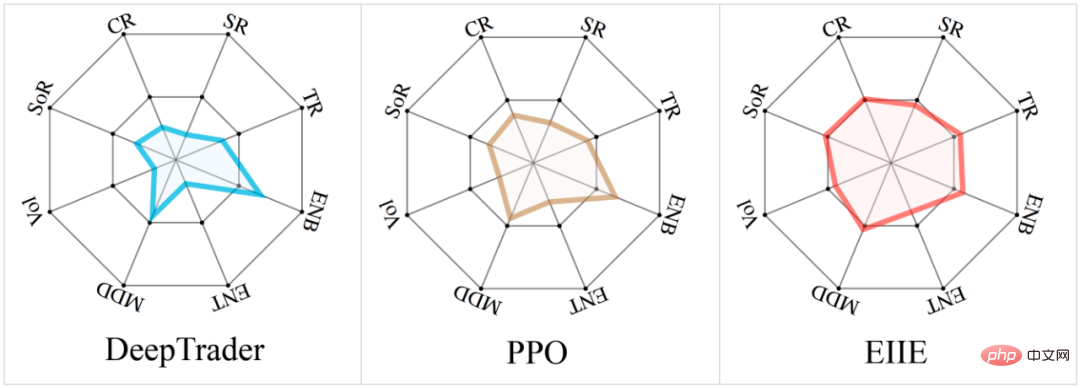

Evaluation module: TradeMaster implements 17 evaluation indicators and visualization tools from 6 dimensions: profitability, risk control, diversity, interpretability, robustness, and universality Systematic evaluation. The following are two examples:

Radar chart indicating profitability, risk control, and strategy diversity

Financial time series data visualization

Running process pseudocode

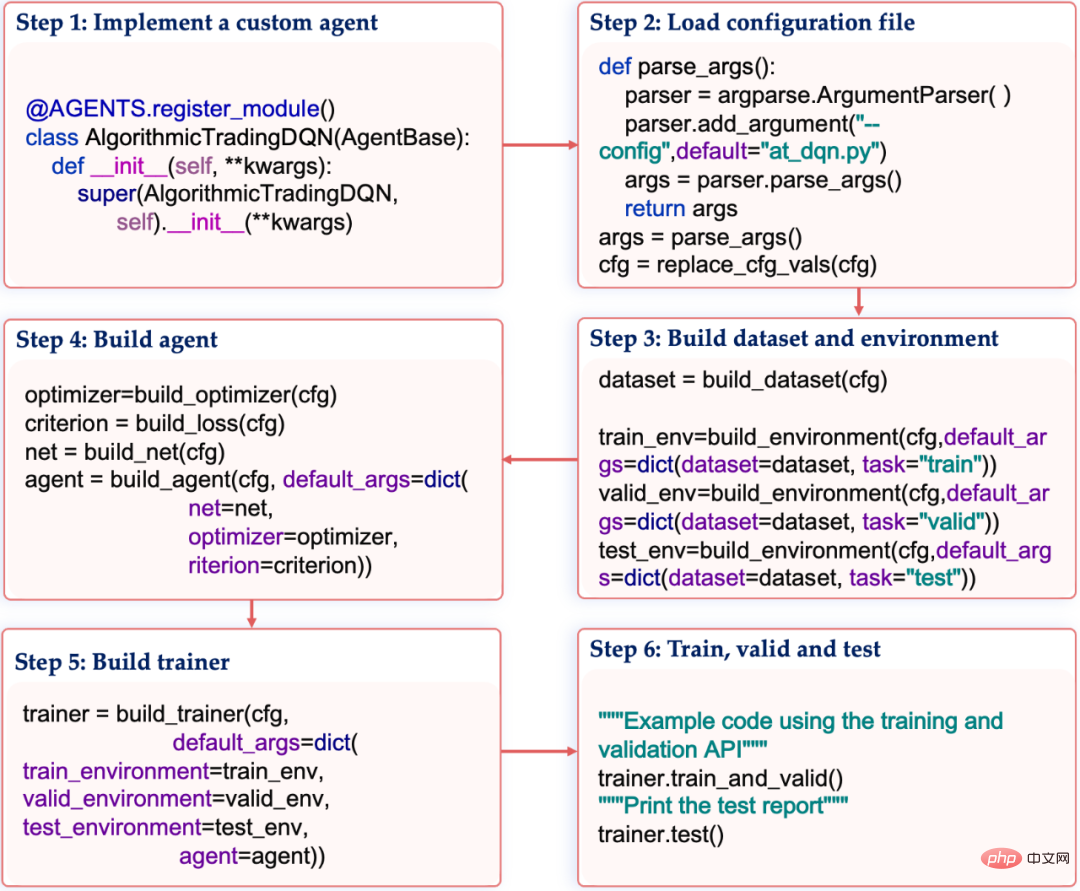

TradeMaster is based on object-oriented programming ideas, encapsulates different functional modules, realizes functional decoupling and encapsulation of different modules, and has good scalability and reusability. The specific process includes the following 6 steps:

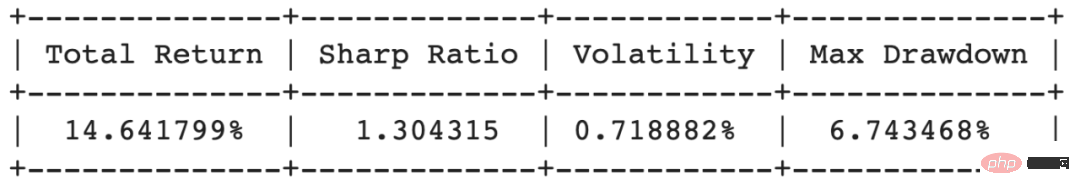

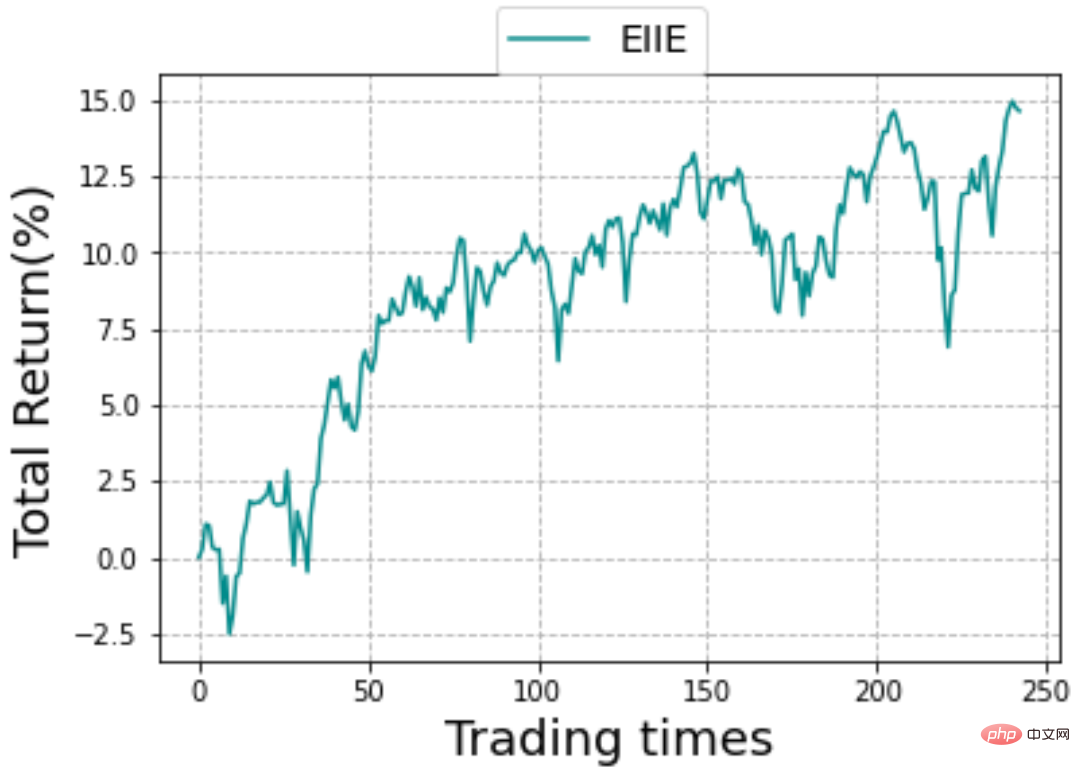

Test result

Based on the Dow Jones 30 Index Taking the classic task of investment portfolio as an example, the EIIE algorithm achieved stable positive returns and a high Sharpe ratio on the test set:

TradeMaster provides a series of different Reinforcement learning algorithm tutorial for trading tasks, presented in the form of Jupyter Notebook to facilitate users to get started quickly:

For details, see: https://github.com/TradeMaster-NTU/TradeMaster/tree/1.0.0/tutorial

The above is the detailed content of Nanyang Polytechnic releases quantitative trading master TradeMaster, covering 15 reinforcement learning algorithms. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Ten recommended open source free text annotation tools

Mar 26, 2024 pm 08:20 PM

Ten recommended open source free text annotation tools

Mar 26, 2024 pm 08:20 PM

Text annotation is the work of corresponding labels or tags to specific content in text. Its main purpose is to provide additional information to the text for deeper analysis and processing, especially in the field of artificial intelligence. Text annotation is crucial for supervised machine learning tasks in artificial intelligence applications. It is used to train AI models to help more accurately understand natural language text information and improve the performance of tasks such as text classification, sentiment analysis, and language translation. Through text annotation, we can teach AI models to recognize entities in text, understand context, and make accurate predictions when new similar data appears. This article mainly recommends some better open source text annotation tools. 1.LabelStudiohttps://github.com/Hu

15 recommended open source free image annotation tools

Mar 28, 2024 pm 01:21 PM

15 recommended open source free image annotation tools

Mar 28, 2024 pm 01:21 PM

Image annotation is the process of associating labels or descriptive information with images to give deeper meaning and explanation to the image content. This process is critical to machine learning, which helps train vision models to more accurately identify individual elements in images. By adding annotations to images, the computer can understand the semantics and context behind the images, thereby improving the ability to understand and analyze the image content. Image annotation has a wide range of applications, covering many fields, such as computer vision, natural language processing, and graph vision models. It has a wide range of applications, such as assisting vehicles in identifying obstacles on the road, and helping in the detection and diagnosis of diseases through medical image recognition. . This article mainly recommends some better open source and free image annotation tools. 1.Makesens

Recommended: Excellent JS open source face detection and recognition project

Apr 03, 2024 am 11:55 AM

Recommended: Excellent JS open source face detection and recognition project

Apr 03, 2024 am 11:55 AM

Face detection and recognition technology is already a relatively mature and widely used technology. Currently, the most widely used Internet application language is JS. Implementing face detection and recognition on the Web front-end has advantages and disadvantages compared to back-end face recognition. Advantages include reducing network interaction and real-time recognition, which greatly shortens user waiting time and improves user experience; disadvantages include: being limited by model size, the accuracy is also limited. How to use js to implement face detection on the web? In order to implement face recognition on the Web, you need to be familiar with related programming languages and technologies, such as JavaScript, HTML, CSS, WebRTC, etc. At the same time, you also need to master relevant computer vision and artificial intelligence technologies. It is worth noting that due to the design of the Web side

The source code of 25 AI agents is now public, inspired by Stanford's 'Virtual Town' and 'Westworld'

Aug 11, 2023 pm 06:49 PM

The source code of 25 AI agents is now public, inspired by Stanford's 'Virtual Town' and 'Westworld'

Aug 11, 2023 pm 06:49 PM

Audiences familiar with "Westworld" know that this show is set in a huge high-tech adult theme park in the future world. The robots have similar behavioral capabilities to humans, and can remember what they see and hear, and repeat the core storyline. Every day, these robots will be reset and returned to their initial state. After the release of the Stanford paper "Generative Agents: Interactive Simulacra of Human Behavior", this scenario is no longer limited to movies and TV series. AI has successfully reproduced this scene in Smallville's "Virtual Town" 》Overview map paper address: https://arxiv.org/pdf/2304.03442v1.pdf

Reward function design issues in reinforcement learning

Oct 09, 2023 am 11:58 AM

Reward function design issues in reinforcement learning

Oct 09, 2023 am 11:58 AM

Reward function design issues in reinforcement learning Introduction Reinforcement learning is a method that learns optimal strategies through the interaction between an agent and the environment. In reinforcement learning, the design of the reward function is crucial to the learning effect of the agent. This article will explore reward function design issues in reinforcement learning and provide specific code examples. The role of the reward function and the target reward function are an important part of reinforcement learning and are used to evaluate the reward value obtained by the agent in a certain state. Its design helps guide the agent to maximize long-term fatigue by choosing optimal actions.

Alibaba 7B multi-modal document understanding large model wins new SOTA

Apr 02, 2024 am 11:31 AM

Alibaba 7B multi-modal document understanding large model wins new SOTA

Apr 02, 2024 am 11:31 AM

New SOTA for multimodal document understanding capabilities! Alibaba's mPLUG team released the latest open source work mPLUG-DocOwl1.5, which proposed a series of solutions to address the four major challenges of high-resolution image text recognition, general document structure understanding, instruction following, and introduction of external knowledge. Without further ado, let’s look at the effects first. One-click recognition and conversion of charts with complex structures into Markdown format: Charts of different styles are available: More detailed text recognition and positioning can also be easily handled: Detailed explanations of document understanding can also be given: You know, "Document Understanding" is currently An important scenario for the implementation of large language models. There are many products on the market to assist document reading. Some of them mainly use OCR systems for text recognition and cooperate with LLM for text processing.

Deep reinforcement learning technology in C++

Aug 21, 2023 pm 11:33 PM

Deep reinforcement learning technology in C++

Aug 21, 2023 pm 11:33 PM

Deep reinforcement learning technology is a branch of artificial intelligence that has attracted much attention. It has won multiple international competitions and is also widely used in personal assistants, autonomous driving, game intelligence and other fields. In the process of realizing deep reinforcement learning, C++, as an efficient and excellent programming language, is especially important when hardware resources are limited. Deep reinforcement learning, as the name suggests, combines technologies from the two fields of deep learning and reinforcement learning. To simply understand, deep learning refers to learning features from data and making decisions by building a multi-layer neural network.

Deep Q-learning reinforcement learning using Panda-Gym's robotic arm simulation

Oct 31, 2023 pm 05:57 PM

Deep Q-learning reinforcement learning using Panda-Gym's robotic arm simulation

Oct 31, 2023 pm 05:57 PM

Reinforcement learning (RL) is a machine learning method that allows an agent to learn how to behave in its environment through trial and error. Agents are rewarded or punished for taking actions that lead to desired outcomes. Over time, the agent learns to take actions that maximize its expected reward. RL agents are typically trained using a Markov decision process (MDP), a mathematical framework for modeling sequential decision problems. MDP consists of four parts: State: a set of possible states of the environment. Action: A set of actions that an agent can take. Transition function: A function that predicts the probability of transitioning to a new state given the current state and action. Reward function: A function that assigns a reward to the agent for each conversion. The agent's goal is to learn a policy function,