Technology peripherals

Technology peripherals

AI

AI

Opportunities and challenges of artificial intelligence applications in financial technology

Opportunities and challenges of artificial intelligence applications in financial technology

Opportunities and challenges of artificial intelligence applications in financial technology

Artificial intelligence has now been widely used in data analysis and management in the financial field. AI plays a key role in making lending decisions, providing customer support, preventing fraud, predicting credit, assessing risk, and more. Many modern fintech companies are aware of the advantages of AI and are keen to leverage AI technology to improve their efficiency.

In the financial services sector, the level of process automation and digital transformation activities is increasing. Artificial intelligence technology is developing rapidly in the global financial industry. According to industry data, experts predict that the global market size of artificial intelligence in financial technology will reach US$26.67 billion.

The following introduces the opportunities and challenges of artificial intelligence technology in the financial technology industry.

Types of Artificial Intelligence in the Financial Industry

Artificial intelligence technology is much more efficient at identifying patterns in data than humans. This is why financial companies prefer applications powered by artificial intelligence technology. There are two types of artificial intelligence that are popular in the financial industry:

(1) Weak artificial intelligence

Weak artificial intelligence, also known as narrow artificial intelligence system, is specially designed to complete specific tasks. task or solve a specific problem. Artificial intelligence technology is governed by a set of rules and it delivers the best possible job without going beyond the rules. Apple’s Siri assistant is the best example of weak artificial intelligence.

(2)Strong artificial intelligence

Strong artificial intelligence is also called a complete artificial intelligence system. As the name suggests, it is designed to have greater promise than weak artificial intelligence. Applications powered by full artificial intelligence have immense power and functionality. It also has understanding and awareness. Therefore, many people generally believe that the entire artificial intelligence system mimics the human brain.

Application of Artificial Intelligence in Financial Services

Algorithms based on artificial intelligence are being implemented in financial services in almost all financial industries. Here are several key application scenarios of artificial intelligence in financial services:

(1) Personal Finance

Modern consumers prefer financial independence and seek to improve their financial independence by adopting artificial intelligence technology. The ability to manage your own financial health. This is why financial companies are being forced to implement artificial intelligence in personal finance. Businesses prefer to support customers around the clock through AI chatbots and provide consumers with personalized wealth management solutions.

Eno, a subsidiary of U.S.-based Capital One Bank, launched an SMS-based assistant to customers back in 2017. This SMS-based ancillary service offers 12 proactive services, including notifying customers of suspected fraud or price increases.

(2) Financial consumption

In business cases, preventing fraud and cyber attacks is the most important capability of artificial intelligence technology. Consumers are always looking for banks that offer high security for their accounts. According to data released by research institutions, approximately US$48 billion in online fraud is expected to occur in 2023. Banks prefer AI that has the ability to analyze and find irregular patterns in financial services.

JPMorgan Chase & Co. has successfully implemented a key fraud detection artificial intelligence application for all of its account holders. Every time a customer makes a credit card transaction, AI-powered proprietary algorithms detect patterns of fraud.

(3) Corporate Financing

Artificial intelligence technology is the first choice for enterprises to predict and obtain loan risks. In addition to reducing financial risk, AI technology also reduces financial crime by introducing advanced fraud detection operations.

To avoid anti-money laundering and identify bad customers, Bank of America uses artificial intelligence technology in its middle and back-end operations. AI-driven applications will unlock and analyze customer-related data through deep learning.

Real use cases of artificial intelligence in the financial industry

In the financial field, some companies use a large number of artificial intelligence applications in practical ways to solve their problems and save time and money. Here are some real-life examples of companies using artificial intelligence applications to operate effectively.

- Apps with artificial intelligence technology such as virtual financial advisors and chatbots will automate customer support services. Consumers are now interacting with chatbots to seek the answers they want.

- AI-powered applications such as “Contract Analyzer” detect fraud through anomalies. If a customer applies for multiple identical loans within minutes of each other, the AI application will detect it and flag it as suspicious.

- Data analysis is performed by AI-driven applications such as "churn prediction". It eliminates much of the tedious work for analysts, allowing them to focus on the important issues. Meanwhile, it continues working in the background to identify similar and smaller issues. In addition, the application of artificial intelligence technology helps enterprises analyze large amounts of data efficiently in real time.

- Artificial intelligence technology is widely used by the financial sector to identify someone’s creditworthiness. The app with artificial intelligence technology will help avoid overcharging or undercharging when disbursing loans by checking the credit scores of at-risk customers in real time.

Analysis of challenges and solutions facing the fintech industry in 2022

(1) Data breach

The top priority for financial services companies is to protect their sensitive data from Attacked by cybercrime. Compared with other industries, the financial industry is subject to 300 times more cyber attacks.

Solutions: Implementing innovative solutions, such as applications powered by artificial intelligence technology, will ensure financial services stay ahead of cybercriminals.

(2) Comply with the rules

The regulations and terms set by government departments for financial services continue to increase. Financial service providers are forced to spend significant amounts of money to ensure that their operations comply with all these regulations. Additionally, they need to frequently change their systems to keep up with evolving regulations and standards.

Solution: Adapting AI technology will help financial services providers avoid significant costs when complying with changing regulations. AI technology provides the necessary flexibility for businesses to define their own set of rules.

(3)Consumer expectations

Modern consumers have increasing expectations for financial service providers such as personalized financial services.

Solution: Introducing chatbots powered by artificial intelligence will help businesses understand the needs of consumers and provide the exact services they are looking for.

Benefits of Adopting Artificial Intelligence in the Financial Industry

In addition to enabling financial companies to automate tasks, detect fraud, and provide personalized financial services to valuable consumers, artificial intelligence technology also Offers a wide range of benefits to the financial industry.

The perfect implementation of artificial intelligence technology in the front and middle offices of the financial sector will have a significant positive impact on its operations. Let’s take a look at a few of the key benefits financial companies can gain from AI-driven applications.

- Eliminate time wastage on duplicate work.

- Significantly reduce human error through automation.

- High quality, frictionless, 24/7 customer interaction.

- Compliance and fraud detection.

- Help prevent fraud.

- Saving costs, etc.

Furthermore, artificial intelligence technology provides the fintech industry with unique solutions to solve all modern problems. The ability to identify patterns and suspicious behavior helps financial companies effectively deliver sensitive financial services.

The future of fintech is artificial intelligence

The financial sector has experienced substantial growth over the past few years. To solve modern problems and provide smarter services to customers, financial companies need to take full advantage of innovative technologies powered by artificial intelligence. By offering a wide range of benefits, AI technology offers financial companies the potential to conduct innovative financial transactions without changing traditional banking intermediaries.

The above is the detailed content of Opportunities and challenges of artificial intelligence applications in financial technology. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1377

1377

52

52

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

This site reported on June 27 that Jianying is a video editing software developed by FaceMeng Technology, a subsidiary of ByteDance. It relies on the Douyin platform and basically produces short video content for users of the platform. It is compatible with iOS, Android, and Windows. , MacOS and other operating systems. Jianying officially announced the upgrade of its membership system and launched a new SVIP, which includes a variety of AI black technologies, such as intelligent translation, intelligent highlighting, intelligent packaging, digital human synthesis, etc. In terms of price, the monthly fee for clipping SVIP is 79 yuan, the annual fee is 599 yuan (note on this site: equivalent to 49.9 yuan per month), the continuous monthly subscription is 59 yuan per month, and the continuous annual subscription is 499 yuan per year (equivalent to 41.6 yuan per month) . In addition, the cut official also stated that in order to improve the user experience, those who have subscribed to the original VIP

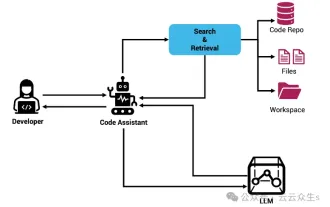

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Improve developer productivity, efficiency, and accuracy by incorporating retrieval-enhanced generation and semantic memory into AI coding assistants. Translated from EnhancingAICodingAssistantswithContextUsingRAGandSEM-RAG, author JanakiramMSV. While basic AI programming assistants are naturally helpful, they often fail to provide the most relevant and correct code suggestions because they rely on a general understanding of the software language and the most common patterns of writing software. The code generated by these coding assistants is suitable for solving the problems they are responsible for solving, but often does not conform to the coding standards, conventions and styles of the individual teams. This often results in suggestions that need to be modified or refined in order for the code to be accepted into the application

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Large Language Models (LLMs) are trained on huge text databases, where they acquire large amounts of real-world knowledge. This knowledge is embedded into their parameters and can then be used when needed. The knowledge of these models is "reified" at the end of training. At the end of pre-training, the model actually stops learning. Align or fine-tune the model to learn how to leverage this knowledge and respond more naturally to user questions. But sometimes model knowledge is not enough, and although the model can access external content through RAG, it is considered beneficial to adapt the model to new domains through fine-tuning. This fine-tuning is performed using input from human annotators or other LLM creations, where the model encounters additional real-world knowledge and integrates it

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

To learn more about AIGC, please visit: 51CTOAI.x Community https://www.51cto.com/aigc/Translator|Jingyan Reviewer|Chonglou is different from the traditional question bank that can be seen everywhere on the Internet. These questions It requires thinking outside the box. Large Language Models (LLMs) are increasingly important in the fields of data science, generative artificial intelligence (GenAI), and artificial intelligence. These complex algorithms enhance human skills and drive efficiency and innovation in many industries, becoming the key for companies to remain competitive. LLM has a wide range of applications. It can be used in fields such as natural language processing, text generation, speech recognition and recommendation systems. By learning from large amounts of data, LLM is able to generate text

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

Editor |ScienceAI Question Answering (QA) data set plays a vital role in promoting natural language processing (NLP) research. High-quality QA data sets can not only be used to fine-tune models, but also effectively evaluate the capabilities of large language models (LLM), especially the ability to understand and reason about scientific knowledge. Although there are currently many scientific QA data sets covering medicine, chemistry, biology and other fields, these data sets still have some shortcomings. First, the data form is relatively simple, most of which are multiple-choice questions. They are easy to evaluate, but limit the model's answer selection range and cannot fully test the model's ability to answer scientific questions. In contrast, open-ended Q&A

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Machine learning is an important branch of artificial intelligence that gives computers the ability to learn from data and improve their capabilities without being explicitly programmed. Machine learning has a wide range of applications in various fields, from image recognition and natural language processing to recommendation systems and fraud detection, and it is changing the way we live. There are many different methods and theories in the field of machine learning, among which the five most influential methods are called the "Five Schools of Machine Learning". The five major schools are the symbolic school, the connectionist school, the evolutionary school, the Bayesian school and the analogy school. 1. Symbolism, also known as symbolism, emphasizes the use of symbols for logical reasoning and expression of knowledge. This school of thought believes that learning is a process of reverse deduction, through existing

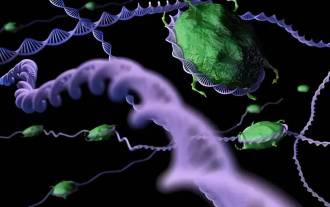

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

Editor | KX In the field of drug research and development, accurately and effectively predicting the binding affinity of proteins and ligands is crucial for drug screening and optimization. However, current studies do not take into account the important role of molecular surface information in protein-ligand interactions. Based on this, researchers from Xiamen University proposed a novel multi-modal feature extraction (MFE) framework, which for the first time combines information on protein surface, 3D structure and sequence, and uses a cross-attention mechanism to compare different modalities. feature alignment. Experimental results demonstrate that this method achieves state-of-the-art performance in predicting protein-ligand binding affinities. Furthermore, ablation studies demonstrate the effectiveness and necessity of protein surface information and multimodal feature alignment within this framework. Related research begins with "S

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

According to news from this website on July 5, GlobalFoundries issued a press release on July 1 this year, announcing the acquisition of Tagore Technology’s power gallium nitride (GaN) technology and intellectual property portfolio, hoping to expand its market share in automobiles and the Internet of Things. and artificial intelligence data center application areas to explore higher efficiency and better performance. As technologies such as generative AI continue to develop in the digital world, gallium nitride (GaN) has become a key solution for sustainable and efficient power management, especially in data centers. This website quoted the official announcement that during this acquisition, Tagore Technology’s engineering team will join GLOBALFOUNDRIES to further develop gallium nitride technology. G