Technology peripherals

Technology peripherals

AI

AI

ChatGPT boss throws money to rescue companies: One million dollars to help companies victimized by Silicon Valley Bank, no IOUs or commitments, pay back when you can

ChatGPT boss throws money to rescue companies: One million dollars to help companies victimized by Silicon Valley Bank, no IOUs or commitments, pay back when you can

ChatGPT boss throws money to rescue companies: One million dollars to help companies victimized by Silicon Valley Bank, no IOUs or commitments, pay back when you can

This article is reprinted with the authorization of AI New Media Qubit (public account ID: QbitAI). Please contact the source for reprinting.

Technology companies affected by the collapse of Silicon Valley Bank can breathe a little easier.

On the one hand, wealthy people in the technology industry have stepped in to help:

Sam Altman, CEO of OpenAI, the company behind ChatGPT, was exposed that he had already paid employees who were unable to pay wages to Silicon Valley Bank. company, providing financial assistance totaling more than $1 million.

And they didn’t ask for any IOUs or documents. They just said, “You can pay me back when you have money.”

On the other hand, U.S. regulators are determined to take the bottom line.

According to a joint statement issued by the U.S. Department of the Treasury, the Federal Reserve (Fed), and the Federal Deposit Insurance Corporation (FDIC), Silicon Valley Bank depositors "will be able to withdraw all funds starting on Monday, March 13."

However, "any losses related to resolving Silicon Valley Bank's problems will not be borne by taxpayers."

The boss comes to the rescue, the Fed steps in to wipe the butt

The CEO of the AI start-up Rad AI revealed that the boss of ChatGPT reached out to help To Reuters.

The CEO named Doktor Gurson claimed that he was not familiar with Altman-

Sam Altman was not an investor in this start-up. Gurson only met Altman once when he attended a Y Combinator event in 2014.

The reason why he asked Altman for help was a bit like seeking medical treatment in a hurry:

The company's money in the Silicon Valley bank account kept failing to be transferred out, and employees' wages were about to be unable to be paid. . At this time, Gurson saw Altman's tweet. The latter used his Twitter account to call on investors to help affected technology companies as soon as possible.

△Photo source: Tony Webster

He sent Altman an email. Unexpectedly, it only took 1-2 hours for the CEO of OpenAI to reply to the letter asking for help and promised to provide at least 6 figures of emergency funds, "without making any other requests."

Gurson conservatively estimates that Altman has spent more than $1 million to assist entrepreneurs like him.

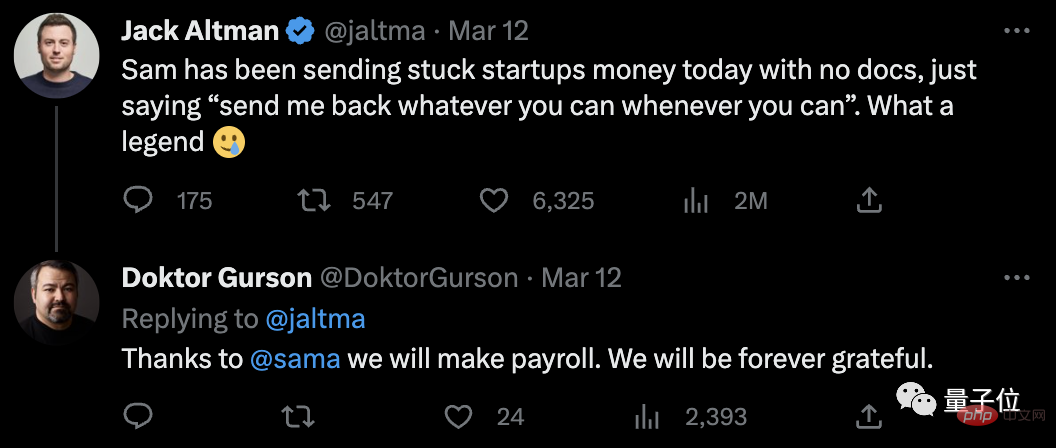

Sam Altman’s brother Jack Altman also confirmed the incident on Twitter.

Sam had been sending money to struggling startups without asking for any documentation, telling them to "pay me back when you have the money." Simply a legend.

In addition, according to Reuters, Y Combinator also invited 3500 CEOs and founders to co-sign a petition calling on U.S. Treasury Secretary Janet Yellen and others support Silicon Valley Bank depositors.

The latest news today is that the U.S. Treasury Department and the Federal Reserve are planning to launch an emergency loan program to support depositors’ withdrawal requests.

The original text of the joint statement from the U.S. Treasury Department, the Federal Reserve and the FDIC reads:

Starting Monday, March 13, Silicon Valley Bank depositors can withdraw all funds in their accounts, and resolve Any losses related to Silicon Valley Bank’s problems will not be borne by taxpayers.

…

Finally, the Federal Reserve Board announced on Sunday that it will provide additional funding to eligible depository institutions to ensure that banks have the ability to meet the needs of all depositors.

It is worth mentioning that the statement mentioned that Signature Bank in New York was also closed due to "systemic risks."

The FDIC’s takeover statement has also been updated. Previously, the FDIC mentioned that "depositors will have access to insured deposits on March 13," but the FDIC's insurance limit was only $250,000.

Now, a new line has been added to the statement: Customers with accounts over $250,000 should call the FDIC’s toll-free number.

#Rad AI CEO believes that this news has given Silicon Valley a "collective sigh of relief."

"Honestly, this weekend took years off my life."

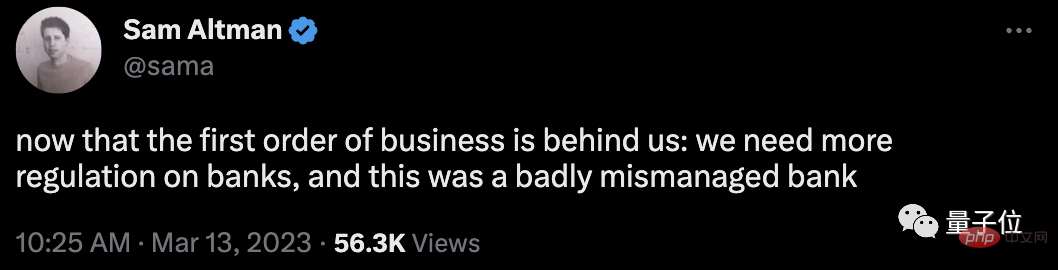

And Sam Altman also updated his Twitter:

Now, first priority Already solved. We need more regulation of banks.

One More Thing

The impact of the collapse of Silicon Valley Bank has not yet subsided.

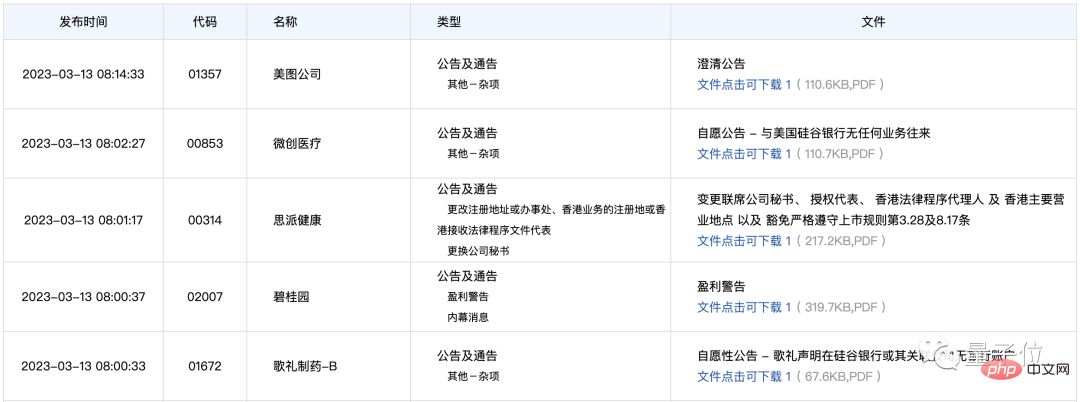

Before the market opened on March 13, many A-share and Hong Kong-listed companies issued voluntary announcements stating their business dealings with Silicon Valley Bank.

Reference link:

[1]https://www.php.cn/link/3817157c9127b4cdb7a8d690ee72d874

[2]https://www.php.cn/link/0a118184382a407bba7aef472932273e

[3]https: //www.php.cn/link/1977ab8c9f9473d8594671be4ddf9e7f

The above is the detailed content of ChatGPT boss throws money to rescue companies: One million dollars to help companies victimized by Silicon Valley Bank, no IOUs or commitments, pay back when you can. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1376

1376

52

52

ChatGPT now allows free users to generate images by using DALL-E 3 with a daily limit

Aug 09, 2024 pm 09:37 PM

ChatGPT now allows free users to generate images by using DALL-E 3 with a daily limit

Aug 09, 2024 pm 09:37 PM

DALL-E 3 was officially introduced in September of 2023 as a vastly improved model than its predecessor. It is considered one of the best AI image generators to date, capable of creating images with intricate detail. However, at launch, it was exclus

The perfect combination of ChatGPT and Python: creating an intelligent customer service chatbot

Oct 27, 2023 pm 06:00 PM

The perfect combination of ChatGPT and Python: creating an intelligent customer service chatbot

Oct 27, 2023 pm 06:00 PM

The perfect combination of ChatGPT and Python: Creating an Intelligent Customer Service Chatbot Introduction: In today’s information age, intelligent customer service systems have become an important communication tool between enterprises and customers. In order to provide a better customer service experience, many companies have begun to turn to chatbots to complete tasks such as customer consultation and question answering. In this article, we will introduce how to use OpenAI’s powerful model ChatGPT and Python language to create an intelligent customer service chatbot to improve

How to install chatgpt on mobile phone

Mar 05, 2024 pm 02:31 PM

How to install chatgpt on mobile phone

Mar 05, 2024 pm 02:31 PM

Installation steps: 1. Download the ChatGTP software from the ChatGTP official website or mobile store; 2. After opening it, in the settings interface, select the language as Chinese; 3. In the game interface, select human-machine game and set the Chinese spectrum; 4 . After starting, enter commands in the chat window to interact with the software.

How to develop an intelligent chatbot using ChatGPT and Java

Oct 28, 2023 am 08:54 AM

How to develop an intelligent chatbot using ChatGPT and Java

Oct 28, 2023 am 08:54 AM

In this article, we will introduce how to develop intelligent chatbots using ChatGPT and Java, and provide some specific code examples. ChatGPT is the latest version of the Generative Pre-training Transformer developed by OpenAI, a neural network-based artificial intelligence technology that can understand natural language and generate human-like text. Using ChatGPT we can easily create adaptive chats

Can chatgpt be used in China?

Mar 05, 2024 pm 03:05 PM

Can chatgpt be used in China?

Mar 05, 2024 pm 03:05 PM

chatgpt can be used in China, but cannot be registered, nor in Hong Kong and Macao. If users want to register, they can use a foreign mobile phone number to register. Note that during the registration process, the network environment must be switched to a foreign IP.

How to build an intelligent customer service robot using ChatGPT PHP

Oct 28, 2023 am 09:34 AM

How to build an intelligent customer service robot using ChatGPT PHP

Oct 28, 2023 am 09:34 AM

How to use ChatGPTPHP to build an intelligent customer service robot Introduction: With the development of artificial intelligence technology, robots are increasingly used in the field of customer service. Using ChatGPTPHP to build an intelligent customer service robot can help companies provide more efficient and personalized customer services. This article will introduce how to use ChatGPTPHP to build an intelligent customer service robot and provide specific code examples. 1. Install ChatGPTPHP and use ChatGPTPHP to build an intelligent customer service robot.

How to use ChatGPT and Python to implement user intent recognition function

Oct 27, 2023 am 09:04 AM

How to use ChatGPT and Python to implement user intent recognition function

Oct 27, 2023 am 09:04 AM

How to use ChatGPT and Python to implement user intent recognition function Introduction: In today's digital era, artificial intelligence technology has gradually become an indispensable part in various fields. Among them, the development of natural language processing (Natural Language Processing, NLP) technology enables machines to understand and process human language. ChatGPT (Chat-GeneratingPretrainedTransformer) is a kind of

SearchGPT: Open AI takes on Google with its own AI search engine

Jul 30, 2024 am 09:58 AM

SearchGPT: Open AI takes on Google with its own AI search engine

Jul 30, 2024 am 09:58 AM

Open AI is finally making its foray into search. The San Francisco company has recently announced a new AI tool with search capabilities. First reported by The Information in February this year, the new tool is aptly called SearchGPT and features a c