The role of artificial intelligence in B2B transactions

B2B buyers are increasingly looking for more financial control and self-service alternatives.

Artificial intelligence (AI) is increasingly being invested in traditional banks, lenders and financial institutions, which are also keen to integrate it into their technology infrastructure.

Artificial intelligence in payments technology can help fintech startups, banks and social media payment systems improve their ability to detect fraud and help people pay online.

Peer-to-peer lending (P2P) and new players entering the B2C market have well demonstrated the revolutionary shift in digital payments that is now well underway!

Earlier this year , the well-known analysis platform CBInsight predicts that the B2B payment industry will grow to US$20 trillion.

PayPal and many other fintech companies are just a few payment service providers that have tried to make B2B payments less stressful and cumbersome. Why B2B payments took so long to enter the digital age is the key to this case.

Customers of all ages know that prioritizing digital-first B2B interactions mirrors the B2C purchases they are accustomed to today. B2B buyers are increasingly looking for more financial control and self-service alternatives.

As a result, B2B companies are now, in turn, accelerating AI-driven B2B payments processes—by leveraging Robotic Process Automation (RPA) to reduce costs, reduce errors, and more. B2B payments still have a lot of catching up to do, due to the varying complexity of authorizations and the numerous payment terms involved.

RPA is a software technology that helps people do their jobs better by automating part of their work. Today's accountants use tools and processes that are computer-dependent and involve numerous manual steps and keystrokes. RPA can change the way accounting works by integrating different tasks into a single, smooth, automated process.

B2B Payments and Artificial Intelligence Development

Businesses are under a lot of pressure due to lengthy, labor-intensive manual methods and outdated technology that, until recently, were the standard for payments. . On the other hand, artificial intelligence has recently become an integral part of the financial system.

Artificial Intelligence (AI) investments are becoming increasingly active among traditional banks, lenders and financial institutions, which are also keen to integrate AI into their technology infrastructure. If the current development rate is followed, the global financial technology market’s investment in artificial intelligence will reach US$22.26 billion by 2025, with a compound annual growth rate of 23.37%!

By utilizing information management, artificial intelligence-driven RPA Can improve accounting efficiency.

Sending purchase orders, tracking invoices, and negotiating payment and pricing terms are standard procedures in B2B transactions that have traditionally been labor-intensive and largely repetitive. From a communication perspective, the various internal finance departments also need to coordinate seamlessly. All of this is a complex process, with time frames stretched even further due to outdated, siled and monolithic systems.

How can artificial intelligence simplify B2B payments?

Businesses must improve their B2B payment processes to better serve their customers in an increasingly digital world. To reduce time and get rid of human errors, artificial intelligence in B2B payments can help automate payment operations. They are expediting the process to ensure the satisfaction of all relevant stakeholders.

Here are some of the top ways AI is being used to help businesses streamline B2B payments:

Improving access to credit

AI credit scoring makes it cheaper to evaluate a business than other methods Much more! Additionally, when traditional financial information is missing, AI systems can eliminate bias and use current and historical data to make credit choices.

Identify and prevent fraud

Artificial intelligence has been widely used in fraud prevention technology to encrypt or protect customer and supplier data. Machine learning (ML) is now being used in more advanced systems to help uncover suspicious behavior or vulnerabilities that people might overlook, as well as discover and assess potential risk factors.

Automated Payment Process

The time and money required to handle and process payments is greatly reduced as automation eliminates various nonsensical components.

The Changing B2B Payments Environment

While B2C payments technology has grown rapidly over the past few years, B2B payments innovation has slowed significantly. The number of parties involved, the volume of transactions and long payment cycles have led to the gradual disruption of the B2B payment process.

This number is gradually declining due to the widespread use of digital alternatives such as Automated Clearing House (ACH) and Exchange Traded Fund (EFT) transfers.

Fintech companies are also looking for new ways to use artificial intelligence technology as a standard to improve the efficiency of B2B transactions.

Conclusion

Artificial intelligence has huge potential to transform the B2B payments landscape and bring it into the digital age, from instantly assessing a company’s creditworthiness to ensuring fraud prevention. Therefore, by eliminating the extensive manual payment processes that limit business growth, SMBs can free up time and resources for more critical tasks.

Financial institutions and B2B fintech companies are increasing collaboration to develop cutting-edge products that comply with regulatory requirements. ?

The above is the detailed content of The role of artificial intelligence in B2B transactions. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

This site reported on June 27 that Jianying is a video editing software developed by FaceMeng Technology, a subsidiary of ByteDance. It relies on the Douyin platform and basically produces short video content for users of the platform. It is compatible with iOS, Android, and Windows. , MacOS and other operating systems. Jianying officially announced the upgrade of its membership system and launched a new SVIP, which includes a variety of AI black technologies, such as intelligent translation, intelligent highlighting, intelligent packaging, digital human synthesis, etc. In terms of price, the monthly fee for clipping SVIP is 79 yuan, the annual fee is 599 yuan (note on this site: equivalent to 49.9 yuan per month), the continuous monthly subscription is 59 yuan per month, and the continuous annual subscription is 499 yuan per year (equivalent to 41.6 yuan per month) . In addition, the cut official also stated that in order to improve the user experience, those who have subscribed to the original VIP

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

Editor |ScienceAI Question Answering (QA) data set plays a vital role in promoting natural language processing (NLP) research. High-quality QA data sets can not only be used to fine-tune models, but also effectively evaluate the capabilities of large language models (LLM), especially the ability to understand and reason about scientific knowledge. Although there are currently many scientific QA data sets covering medicine, chemistry, biology and other fields, these data sets still have some shortcomings. First, the data form is relatively simple, most of which are multiple-choice questions. They are easy to evaluate, but limit the model's answer selection range and cannot fully test the model's ability to answer scientific questions. In contrast, open-ended Q&A

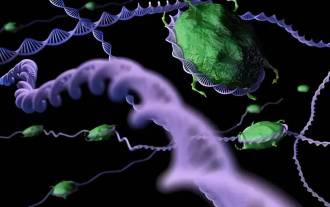

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

Editor | KX In the field of drug research and development, accurately and effectively predicting the binding affinity of proteins and ligands is crucial for drug screening and optimization. However, current studies do not take into account the important role of molecular surface information in protein-ligand interactions. Based on this, researchers from Xiamen University proposed a novel multi-modal feature extraction (MFE) framework, which for the first time combines information on protein surface, 3D structure and sequence, and uses a cross-attention mechanism to compare different modalities. feature alignment. Experimental results demonstrate that this method achieves state-of-the-art performance in predicting protein-ligand binding affinities. Furthermore, ablation studies demonstrate the effectiveness and necessity of protein surface information and multimodal feature alignment within this framework. Related research begins with "S

SK Hynix will display new AI-related products on August 6: 12-layer HBM3E, 321-high NAND, etc.

Aug 01, 2024 pm 09:40 PM

SK Hynix will display new AI-related products on August 6: 12-layer HBM3E, 321-high NAND, etc.

Aug 01, 2024 pm 09:40 PM

According to news from this site on August 1, SK Hynix released a blog post today (August 1), announcing that it will attend the Global Semiconductor Memory Summit FMS2024 to be held in Santa Clara, California, USA from August 6 to 8, showcasing many new technologies. generation product. Introduction to the Future Memory and Storage Summit (FutureMemoryandStorage), formerly the Flash Memory Summit (FlashMemorySummit) mainly for NAND suppliers, in the context of increasing attention to artificial intelligence technology, this year was renamed the Future Memory and Storage Summit (FutureMemoryandStorage) to invite DRAM and storage vendors and many more players. New product SK hynix launched last year

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

According to news from this website on July 5, GlobalFoundries issued a press release on July 1 this year, announcing the acquisition of Tagore Technology’s power gallium nitride (GaN) technology and intellectual property portfolio, hoping to expand its market share in automobiles and the Internet of Things. and artificial intelligence data center application areas to explore higher efficiency and better performance. As technologies such as generative AI continue to develop in the digital world, gallium nitride (GaN) has become a key solution for sustainable and efficient power management, especially in data centers. This website quoted the official announcement that during this acquisition, Tagore Technology’s engineering team will join GLOBALFOUNDRIES to further develop gallium nitride technology. G

Iyo One: Part headphone, part audio computer

Aug 08, 2024 am 01:03 AM

Iyo One: Part headphone, part audio computer

Aug 08, 2024 am 01:03 AM

At any time, concentration is a virtue. Author | Editor Tang Yitao | Jing Yu The resurgence of artificial intelligence has given rise to a new wave of hardware innovation. The most popular AIPin has encountered unprecedented negative reviews. Marques Brownlee (MKBHD) called it the worst product he's ever reviewed; The Verge editor David Pierce said he wouldn't recommend anyone buy this device. Its competitor, the RabbitR1, isn't much better. The biggest doubt about this AI device is that it is obviously just an app, but Rabbit has built a $200 piece of hardware. Many people see AI hardware innovation as an opportunity to subvert the smartphone era and devote themselves to it.

The first fully automated scientific discovery AI system, Transformer author startup Sakana AI launches AI Scientist

Aug 13, 2024 pm 04:43 PM

The first fully automated scientific discovery AI system, Transformer author startup Sakana AI launches AI Scientist

Aug 13, 2024 pm 04:43 PM

Editor | ScienceAI A year ago, Llion Jones, the last author of Google's Transformer paper, left to start a business and co-founded the artificial intelligence company SakanaAI with former Google researcher David Ha. SakanaAI claims to create a new basic model based on nature-inspired intelligence! Now, SakanaAI has handed in its answer sheet. SakanaAI announces the launch of AIScientist, the world’s first AI system for automated scientific research and open discovery! From conceiving, writing code, running experiments and summarizing results, to writing entire papers and conducting peer reviews, AIScientist unlocks AI-driven scientific research and acceleration

Top 10 virtual currency app exchanges in 2025 Summary of the top 10 virtual currency trading apps in the world

Feb 19, 2025 pm 06:30 PM

Top 10 virtual currency app exchanges in 2025 Summary of the top 10 virtual currency trading apps in the world

Feb 19, 2025 pm 06:30 PM

The top ten most trustworthy virtual currency exchanges in 2025 are: Binance, OKX, Gate.io, Bitget, Bybit, KuCoin, Crypto.com, Bitmex, Huobi Global and Phemex. These exchanges provide a wide range of token support, advanced trading tools and competitive fee structures to meet the needs of different traders. However, they also face some challenges such as regulatory scrutiny, customer support issues and liquidity differences.