How will global supply chain disruption drive robot adoption?

Diversifying supply chains has become a priority as companies look to maintain greater control and avoid costly disruptions, moving manufacturing onshore. While some may expect these efforts to increase labor costs, companies can help control and reduce costs by embracing robotics and automation.

Outsourcing Transformed Supply Chain

Historically, offshore manufacturing has provided companies with an alternative to domestic production. Attractive alternatives. With low labor costs, attractive exchange rates, a loose regulatory environment and strong support from local governments, many companies outsource or offshor much of their manufacturing operations to developing economies. In particular, China has become the world's factory, accounting for approximately 13% of global exports and 11% of global imports. Other emerging markets have followed suit, with countries such as India, Vietnam and Thailand approaching the company to build factories within their borders.

Today, approximately $20 trillion worth of physical goods are traded globally. Emerging economies account for almost half of this amount, with exports totaling $8.2 trillion, as most of these goods are manufactured and assembled in emerging markets and consumed by wealthier countries.

The Consequences of Offshoring

However, as companies realize the unintended consequences of offshoring, they may be in the midst of a paradigm shift on the cusp of. The U.S.-China trade conflict has sounded the alarm about the fragility of global supply chains. Brexit and the United States-Mexico-Canada Agreement (USMCA) have further undermined confidence in international trade agreements. In addition to these policy-driven concerns, the COVID-19 crisis and its impact on production plants has highlighted the risks associated with concentrating manufacturing jobs in one specific region.

In short, companies must prioritize supply chain integrity over the cost savings associated with offshoring. While leveraging low-cost labor overseas may improve profit margins, if the supply chain is disrupted due to changes in the geopolitical landscape, health risks, or other black swan events, revenue will be lost, resulting in no product to sell.

After the COVID-19 crisis, many companies have become increasingly aware of this truth. After the outbreak, about 31% of China's factories were closed and 32% of people worked remotely from home. Given that many factories implement just-in-time production, restarting production after a long shutdown may take weeks for the supply chain to fully recover.

Some businesses have warned that continued supply chain disruptions could lead to more lost sales. Car companies around the world have also halted some production due to shortages of parts from China. Nissan, Fiat Chrysler, Hyundai, Honda and a number of other automakers have announced supply disruptions.

Ensure operations through reshoring

Labor costs in developed economies are undoubtedly much higher than in emerging economies. While the average wage in China's manufacturing industry is about $10,000 per year, the average wage in the United States is $46,000, more than four times higher. This huge cost differential has historically accelerated the trend toward offshoring. But local manufacturing has non-monetary advantages that should also be considered, such as bringing operations closer to corporate management, R&D teams and customers. Local manufacturing also operates within domestic regulatory regimes, which are more familiar to local businesses and often more stable than international agreements.

Robotics could speed up reshoring efforts

Robotics and artificial intelligence as companies consider trade-offs between onshore and offshore manufacturing It is likely that there are unknown factors that tilt the scale in favor of onshore production. Automation allows companies to offset some of the reshoring costs by recruiting robots instead of workers to complete certain tasks. Robots can work tirelessly around the clock and complete certain tasks faster and more accurately than humans, all while requiring no pay raises or benefits.

Some studies have shown that the adoption of robotics is associated with a decrease in offshoring. In advanced economies, a 10% increase in robot adoption leads to a 0.54% decrease in offshoring. South Korea’s Small and Medium Enterprises (SME) and Startup Administration recently announced that it will work to help the manufacturing industry return to the market through smart factories. The American Reshoring Institute has released the results of its 2019 annual survey, showing that more than half of business executives said they are planning or considering reshoring activities within the next five years. The survey also found that more than 80% of respondents are considering adopting new software systems. 70% are considering investing in robotics.

Lower cost is a major factor. Although a complex industrial robotic arm costs approximately $250,000, companies may reach a break-even point on traditional labor costs in less than two years.

Total Robot Cost vs. Current Operating Cost

Over time, as robot costs decline and labor costs continue to rise, Adopting robots may only become more attractive. Over the past 30 years, average robot prices have actually fallen by more than 50%, while labor costs have increased by more than 100%.

Robot Cost vs. Labor Cost

However, falling costs are only one reason for the increasing adoption of robotics. Another consideration is the easy availability of robots. New manufacturing technologies, a surge in data and computing power, and customer preferences for on-demand manufacturing are driving significant changes in how goods are produced. Enterprises can now seek Robotics-as-a-Service (RaaS) subscriptions to extend robotics into their manufacturing processes to reduce upfront costs and barriers to entry for technology acquisition.

Finally, improved robotics and artificial intelligence technology are further driving adoption. Robot dexterity continues to improve thanks to advanced 3D vision capabilities and end-of-arm tooling. They can now work alongside workers in warehouses to transport goods and have the flexibility to pick and place fragile items. Robots can perform these tasks with virtually no downtime and can even use networked sensors to predict and avoid failures in advance.

Due to these trends, sales of industrial robots continue to grow. From 2013 to 2019, sales grew at a compound annual growth rate of 15%, reaching approximately 420,000 units in 2019. The International Federation of Robotics estimates that adoption will increase to 584,000 units by 2022. If reshoring accelerates in this new global paradigm, this estimate may be on the low side.

Robot density can be measured by the number of robots per 10,000 workers, which shows the potential for long-term growth in robot adoption. Currently, there are only 99 industrial robots per 10,000 jobs in the global manufacturing industry, which means that the robot density is about 1%. But manufacturing hubs such as Singapore and South Korea have robot densities that are eight times higher, at 8.3% and 7.7% respectively, and continue to rise. Large countries such as the United States, Germany, and China are still well below these levels, but they may converge over time as robotics adoption accelerates.

Conclusion

The decades-old offshoring trend is expected to reverse as businesses increasingly focus on supply chain integrity . Macro-disruptive events such as trade conflicts and the COVID-19 pandemic have brought uncertainty to companies’ operational capabilities and supply chains. This is likely to further accelerate reshoring as robotics and automation become more capable, cheaper and easier to implement, and as companies realize the benefits of local manufacturing outweigh the risks of producing goods abroad.

The above is the detailed content of How will global supply chain disruption drive robot adoption?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

This site reported on June 27 that Jianying is a video editing software developed by FaceMeng Technology, a subsidiary of ByteDance. It relies on the Douyin platform and basically produces short video content for users of the platform. It is compatible with iOS, Android, and Windows. , MacOS and other operating systems. Jianying officially announced the upgrade of its membership system and launched a new SVIP, which includes a variety of AI black technologies, such as intelligent translation, intelligent highlighting, intelligent packaging, digital human synthesis, etc. In terms of price, the monthly fee for clipping SVIP is 79 yuan, the annual fee is 599 yuan (note on this site: equivalent to 49.9 yuan per month), the continuous monthly subscription is 59 yuan per month, and the continuous annual subscription is 499 yuan per year (equivalent to 41.6 yuan per month) . In addition, the cut official also stated that in order to improve the user experience, those who have subscribed to the original VIP

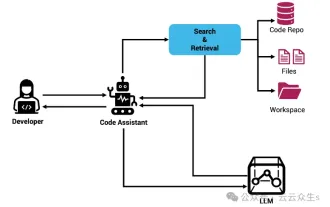

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Improve developer productivity, efficiency, and accuracy by incorporating retrieval-enhanced generation and semantic memory into AI coding assistants. Translated from EnhancingAICodingAssistantswithContextUsingRAGandSEM-RAG, author JanakiramMSV. While basic AI programming assistants are naturally helpful, they often fail to provide the most relevant and correct code suggestions because they rely on a general understanding of the software language and the most common patterns of writing software. The code generated by these coding assistants is suitable for solving the problems they are responsible for solving, but often does not conform to the coding standards, conventions and styles of the individual teams. This often results in suggestions that need to be modified or refined in order for the code to be accepted into the application

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Large Language Models (LLMs) are trained on huge text databases, where they acquire large amounts of real-world knowledge. This knowledge is embedded into their parameters and can then be used when needed. The knowledge of these models is "reified" at the end of training. At the end of pre-training, the model actually stops learning. Align or fine-tune the model to learn how to leverage this knowledge and respond more naturally to user questions. But sometimes model knowledge is not enough, and although the model can access external content through RAG, it is considered beneficial to adapt the model to new domains through fine-tuning. This fine-tuning is performed using input from human annotators or other LLM creations, where the model encounters additional real-world knowledge and integrates it

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

To learn more about AIGC, please visit: 51CTOAI.x Community https://www.51cto.com/aigc/Translator|Jingyan Reviewer|Chonglou is different from the traditional question bank that can be seen everywhere on the Internet. These questions It requires thinking outside the box. Large Language Models (LLMs) are increasingly important in the fields of data science, generative artificial intelligence (GenAI), and artificial intelligence. These complex algorithms enhance human skills and drive efficiency and innovation in many industries, becoming the key for companies to remain competitive. LLM has a wide range of applications. It can be used in fields such as natural language processing, text generation, speech recognition and recommendation systems. By learning from large amounts of data, LLM is able to generate text

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

Editor |ScienceAI Question Answering (QA) data set plays a vital role in promoting natural language processing (NLP) research. High-quality QA data sets can not only be used to fine-tune models, but also effectively evaluate the capabilities of large language models (LLM), especially the ability to understand and reason about scientific knowledge. Although there are currently many scientific QA data sets covering medicine, chemistry, biology and other fields, these data sets still have some shortcomings. First, the data form is relatively simple, most of which are multiple-choice questions. They are easy to evaluate, but limit the model's answer selection range and cannot fully test the model's ability to answer scientific questions. In contrast, open-ended Q&A

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Machine learning is an important branch of artificial intelligence that gives computers the ability to learn from data and improve their capabilities without being explicitly programmed. Machine learning has a wide range of applications in various fields, from image recognition and natural language processing to recommendation systems and fraud detection, and it is changing the way we live. There are many different methods and theories in the field of machine learning, among which the five most influential methods are called the "Five Schools of Machine Learning". The five major schools are the symbolic school, the connectionist school, the evolutionary school, the Bayesian school and the analogy school. 1. Symbolism, also known as symbolism, emphasizes the use of symbols for logical reasoning and expression of knowledge. This school of thought believes that learning is a process of reverse deduction, through existing

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

Editor | KX In the field of drug research and development, accurately and effectively predicting the binding affinity of proteins and ligands is crucial for drug screening and optimization. However, current studies do not take into account the important role of molecular surface information in protein-ligand interactions. Based on this, researchers from Xiamen University proposed a novel multi-modal feature extraction (MFE) framework, which for the first time combines information on protein surface, 3D structure and sequence, and uses a cross-attention mechanism to compare different modalities. feature alignment. Experimental results demonstrate that this method achieves state-of-the-art performance in predicting protein-ligand binding affinities. Furthermore, ablation studies demonstrate the effectiveness and necessity of protein surface information and multimodal feature alignment within this framework. Related research begins with "S

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

According to news from this website on July 5, GlobalFoundries issued a press release on July 1 this year, announcing the acquisition of Tagore Technology’s power gallium nitride (GaN) technology and intellectual property portfolio, hoping to expand its market share in automobiles and the Internet of Things. and artificial intelligence data center application areas to explore higher efficiency and better performance. As technologies such as generative AI continue to develop in the digital world, gallium nitride (GaN) has become a key solution for sustainable and efficient power management, especially in data centers. This website quoted the official announcement that during this acquisition, Tagore Technology’s engineering team will join GLOBALFOUNDRIES to further develop gallium nitride technology. G