Technology peripherals

Technology peripherals

AI

AI

Tesla's market value has evaporated by 600 billion! Musk: Freeze hiring, lay off employees next year, and find a 'fool' to take over Twitter

Tesla's market value has evaporated by 600 billion! Musk: Freeze hiring, lay off employees next year, and find a 'fool' to take over Twitter

Tesla's market value has evaporated by 600 billion! Musk: Freeze hiring, lay off employees next year, and find a 'fool' to take over Twitter

Musk, who just lost his job as the "world's richest man" not long ago, is still dealing with the matter of whether to vote to step down as CEO of Twitter. Here he looks back and sees that his "cash cow" Tesla Alas, the leaves are bald again.

#The end of the year is approaching, and Tesla’s stock price cannot escape the fate of falling continuously. As of the close of the U.S. stock market on Tuesday, the company's stock price fell another 8.05% to a more than two-year low of $137.80. The decline this year has expanded to an astonishing 65.54%.

Twitter is already in a mess, and Tesla is "falling down" again. It is reported that Musk has decided that Tesla, like major Silicon Valley manufacturers in the past few months, will implement a hiring freeze and is expected to start layoffs in the first quarter of next year.

Tesla will freeze hiring and lay off employees next year

According to a source familiar with the situation, Tesla La has begun notifying employees that the company has implemented a hiring freeze and confirmed that there will be another wave of layoffs in the next quarter.

#This is actually not the first time Tesla has taken similar measures. In June of this year, Musk asked Tesla executives to "suspend all recruitment" and reduce the number of employees by 10%.

The CEO gave different reasons for the layoffs to different people, including that he had a "really bad feeling" about the economy. This reason also became the reason why he wanted to "take action" on Tesla a few months ago.

# Compared with layoffs, hiring suspensions are more worrying.

Tesla has been growing rapidly since its inception, or there are always several projects growing rapidly. Currently, it has "super The factory has been recruiting a large number of employees. Not long ago, Musk also transferred Zhu Xiaotong, the head of China, to the United States to be fully responsible for the production capacity of the Texas factory.

According to foreign media Electrek, Tesla is implementing a new hiring freeze and plans to implement a new hiring freeze in 2023, according to a reliable source familiar with the matter. Further layoffs were announced in the first quarter of the year.

It’s unclear how widespread the hiring freeze and layoffs will be, as Tesla is still planning staff expansion at some manufacturing sites and factories. However, according to Musk's management style, everything from expansion to layoffs may be a matter of a tweet.

#While Tesla’s financial numbers set new records nearly every quarter, its stock price has fallen throughout the year.

In addition to the reasons for the electric vehicle industry itself, an important source of funds for Musk’s acquisition of Twitter was the sale of a large number of Tesla shares, especially The decline in Tesla's stock price in the past year is generally closely related to Musk's large-scale stock selling behavior.

#Just last week, Musk sold about 22 million more Tesla shares, worth about $3.6 billion.

Musk has sold 94,202,321 Tesla shares so far this year, at an average price of $243.46 per share, tax, according to financial research firm VerityData. Previous earnings were approximately $22.93 billion.

#No matter how fat the sheep are, they can’t withstand being so crowded by the major shareholders.

#In addition, there have been some recent signs that Tesla's problems are not just in the market.

Tesla recently began offering temporary discounts and offers on its vehicles, and some have speculated that Tesla may be facing some rare demand issues.

Until recently, Tesla shareholders could cling to the idea that while Tesla's stock price was underperforming, Tesla's finances and operations remained virtually unscathed. Now it appears that may not be the case, and there may be some worrying trends within Tesla that are leading to these layoffs and hiring freezes.

#In addition, Tesla is not the only company that is implementing layoffs. Several other companies, including Goldman Sachs and Cisco, have recently announced upcoming rounds of layoffs in response to macroeconomic changes in early 2023.

#On Twitter, Musk was talking about macroeconomic trends as always, and told the outside world that his acquisition of Twitter was responsible for the decline in Tesla’s stock price. scorned the explanation of the reason. He attributed the main reason to the Federal Reserve's interest rate hikes.

He tweeted:

"Simply speaking, it is a bank that guarantees income during droughts and floods. Savings interest rates begin to approach the market rate of return, so people will be more willing to convert money from stocks to cash, causing stock prices to fall."

As for the wide range of outside investment Another factor blamed by critics: Spending too much energy on Twitter has led to Tesla's "main business" being abandoned. Musk's previous vote on Twitter to step down as CEO has ended, with 57.5% of users approving of him. Resign.

## Faced with this result, Musk has stated that he is by no means a power-lover. If someone is willing to take over, he will immediately step down as Twitter CEO and will only be responsible for the software and service teams.

As for the statement that "the CEO successor has been decided", Musk responded: "If you have the ability and level, No one who continues to maintain Twitter is willing to take over this job, and there is currently no successor.

The cash cow Tesla has plummeted, and his position as the richest man has been lost

Although Tesla’s financial performance in 2022 Conditions hit new records almost every quarter, but the stock price didn't go all the way higher.

#On the contrary, Tesla’s stock price has plummeted 65.5% this year, becoming the 11th worst-performing stock in the S&P 500 this year.

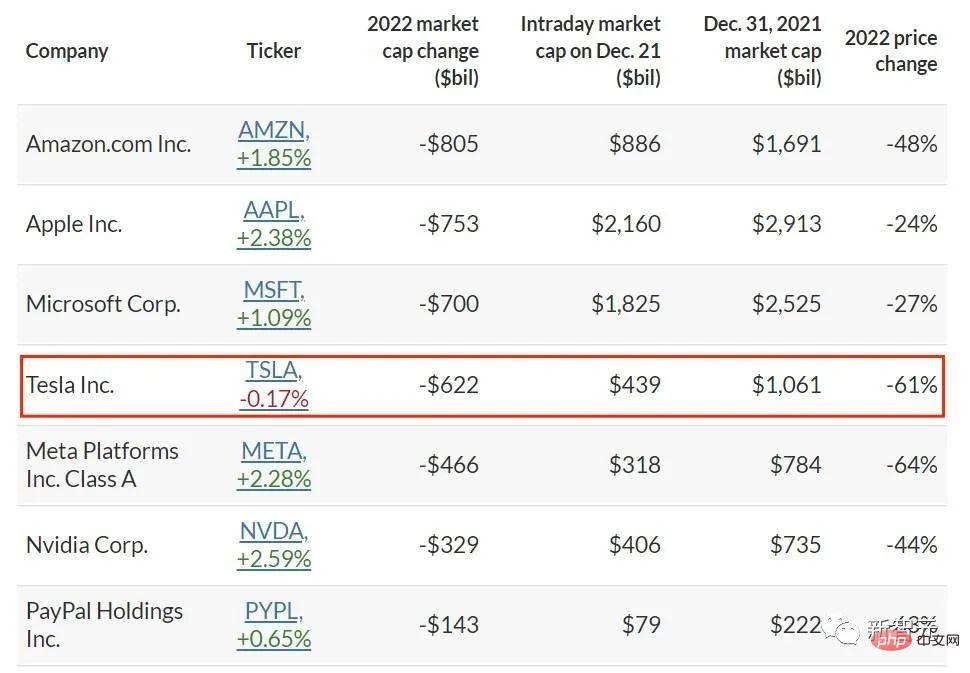

Tesla is the fourth-worst performer in the benchmark S&P 500 index this year from a market capitalization perspective

Tesla’s stock price fell 65.5% in 2022, outpacing the declines of its auto rivals and wiping out its market value 600 billion US dollars. In comparison, the tech-heavy Nasdaq Composite Index fell about 30% during the same period.

It can be found that the latest decline in Tesla’s stock price matches the time when Musk acquired Twitter and sold Tesla shares.

#This is why investors called on Academician Ma to give up transforming Twitter as soon as possible and focus on the development of Tesla.

After Tesla froze hiring and announced layoff plans, the stock price did not improve. On Monday, shares fell below $150, which one analyst called "a key front for showing whether the company is weakening."

On Wednesday, the stock price fell 0.2% to 137.57 points. The stock price fell for four consecutive trading days. In the past 13 trading days, it has fallen in 11 trading days. fell.

The company’s shares are down about 62% since their peak in November 2021 and fell in December More than 22%.

Tesla’s recent plunge is worse than its 60.6% plunge from February to March 2020, according to data compiled by Yahoo Finance. It was the worst decline ever.

#The plummeting stock price also means that Musk’s personal wealth has shrunk rapidly. According to Forbes estimates, Musk's current net worth is US$174 billion, which is far lower than the US$320 billion in November 2021.

#Just last week, Musk relinquished his position as the world’s richest man to LVMH CEO Bernard Arnold Bernard Arnault.

##Left: Former richest man in the world; Right: Current richest man in the world

## For Tesla, Academician Ma tried his best. From sleeping in factories personally, to moving reinforcements from China, to the current layoffs and suspension of recruitment, all of them have had little effect.

After fulfilling his promise to find a successor for Twitter (if he can find one), what new plan will Musk have for his cash cow?

The above is the detailed content of Tesla's market value has evaporated by 600 billion! Musk: Freeze hiring, lay off employees next year, and find a 'fool' to take over Twitter. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

what is twitter

Aug 15, 2023 am 09:36 AM

what is twitter

Aug 15, 2023 am 09:36 AM

Twitter is a social media platform that allows users to send and read short messages called "tweets." Each tweet can contain up to 280 characters, and users can share their opinions, news, pictures and other content through text, pictures, videos and links. Twitter users can follow other users to see their posts on their timelines and interact with other users through replies, retweets, and likes.

Musk opens a new chapter for Tesla: plans to launch new, lower-cost electric models in 2025

Jan 25, 2024 pm 05:51 PM

Musk opens a new chapter for Tesla: plans to launch new, lower-cost electric models in 2025

Jan 25, 2024 pm 05:51 PM

According to news on January 25, Tesla CEO Elon Musk revealed during today’s 2023 fourth quarter and full-year results conference call that Tesla is about to usher in an important milestone. Faced with the challenge that the cost of current models is close to the limit, Musk made it clear that Tesla is actively preparing to put into production new models next year. This move is aimed at further improving Tesla's production efficiency and reducing costs to meet growing market demand. Musk also said that Tesla will continue to be committed to innovation and technological advancement to provide consumers with better electric vehicle products. Tesla’s future development prospects are exciting. It is understood that Musk plans to start the production of next-generation electric vehicles at Tesla’s Gigafactory in Texas in the second half of 2025.

Microsoft, OpenAI plan to invest $100 million in humanoid robots! Netizens are calling Musk

Feb 01, 2024 am 11:18 AM

Microsoft, OpenAI plan to invest $100 million in humanoid robots! Netizens are calling Musk

Feb 01, 2024 am 11:18 AM

Microsoft and OpenAI were revealed to be investing large sums of money into a humanoid robot startup at the beginning of the year. Among them, Microsoft plans to invest US$95 million, and OpenAI will invest US$5 million. According to Bloomberg, the company is expected to raise a total of US$500 million in this round, and its pre-money valuation may reach US$1.9 billion. What attracts them? Let’s take a look at this company’s robotics achievements first. This robot is all silver and black, and its appearance resembles the image of a robot in a Hollywood science fiction blockbuster: Now, he is putting a coffee capsule into the coffee machine: If it is not placed correctly, it will adjust itself without any human remote control: However, After a while, a cup of coffee can be taken away and enjoyed: Do you have any family members who have recognized it? Yes, this robot was created some time ago.

Musk satirizes artificial intelligence AI hype: The essence of 'machine learning' is statistics

Jun 13, 2023 pm 12:13 PM

Musk satirizes artificial intelligence AI hype: The essence of 'machine learning' is statistics

Jun 13, 2023 pm 12:13 PM

Drive China News on June 12, 2023 Recently, Tesla CEO Elon Musk posted a picture on Twitter on Saturday, which seemed to be a satire on the current hype about "artificial intelligence". The picture shows a passerby wearing a "Machine Learning" mask. When he took off his mask, a face with "Statistics" written on it appeared. The essence of artificial intelligence, which means the current fire, is the result of data statistics. It is worth noting that there are probably not a few technology leaders who hold such opinions. Musk had previously signed an open letter with Apple co-founder Steve Wozniak and thousands of AI researchers, calling for a suspension of research on more advanced AI. AI technology. However, this letter was questioned by many experts and even the signers

Tesla will support Apple Watch to control cars, Musk personally confirms

Mar 07, 2024 pm 01:19 PM

Tesla will support Apple Watch to control cars, Musk personally confirms

Mar 07, 2024 pm 01:19 PM

Recently, Tesla CEO Musk responded positively to whether Tesla will increase integration functions with Apple Watch. He said that Tesla owners can expect to use Apple Watch to control their cars, which received widespread attention. However, the specific implementation timetable for this feature has not yet been announced, making people's expectations for the future even higher. It is understood that Tesla’s Apple Watch app plans to provide a series of practical functions, including unlocking the car, preheating or precooling the interior environment, enabling or disabling Sentry mode, and remotely locking or unlocking the car. These features will greatly enhance the convenience and experience of Tesla owners. Currently, there are some third-party applications in the AppStore, such as Tess

![Musk exposed his own 'clothes-folding robot': its authenticity has been questioned, he explained [the trend of the humanoid robot market]](https://img.php.cn/upload/article/000/465/014/170541524165900.jpg?x-oss-process=image/resize,m_fill,h_207,w_330) Musk exposed his own 'clothes-folding robot': its authenticity has been questioned, he explained [the trend of the humanoid robot market]

Jan 16, 2024 pm 10:27 PM

Musk exposed his own 'clothes-folding robot': its authenticity has been questioned, he explained [the trend of the humanoid robot market]

Jan 16, 2024 pm 10:27 PM

On January 15, Tesla CEO Elon Musk released a new video on the X platform, showing the company's humanoid robot "Optimus Prime" doing housework. In the video, Optimus Prime can be observed taking a shirt out of a basket, folding it carefully, and setting it aside. Notably, the robot appears to move slightly slower than humans. As soon as the video was released, countless netizens questioned whether the video was fake. Musk added in a post half an hour after the video was released that the Optimus Prime robot shown in the video is not as powerful as it looks. "Important note: Optimus Prime cannot yet fold his shirts autonomously, but (in the future) he will certainly be able to do so completely autonomously in any environment (without a fixed table, and in the box above

The number one Blizzard player in history and the richest man in the world also collapsed and bluntly said he would give up Blizzard games.

Feb 07, 2024 am 09:12 AM

The number one Blizzard player in history and the richest man in the world also collapsed and bluntly said he would give up Blizzard games.

Feb 07, 2024 am 09:12 AM

The Light of Technology, Iron Man, and the World's Richest Man are all one of the many shining labels on Musk. In fact, Musk also has another label, which is that he is an avid fan of Blizzard games. Even though he runs some of the most important companies in the world, Technology company, Musk will still spend a lot of time playing Blizzard games. After Blizzard launched the new game Diablo 4 in 2023, Musk was full of praise for it, even though this game was abandoned by most old players. But the recent poor performance of Diablo 4 Season 3 has made Musk unable to hold back. How obsessed is Musk with playing Blizzard games? Xiaotan will give you a few examples first. On October 2 last year, Musk’s X (twitter) platform launched the live broadcast function, and Musk led the live broadcast debut, using explosives to play Diablo 4.

SpaceX Starship Base adds new tower, one step closer to Musk's dream of Mars

Aug 23, 2024 am 07:33 AM

SpaceX Starship Base adds new tower, one step closer to Musk's dream of Mars

Aug 23, 2024 am 07:33 AM

According to news from this site on August 22, SpaceX officially announced that the second starship launch tower at its Starbase (i.e. South Texas launch site) has now been capped (completed all stacking of the tower). This process only requires 41 days. fenyeSpaceX also said that they are preparing to launch two manned Dragon spacecrafts within the next month to carry out SpaceX's 14th and 15th manned missions, namely the "Polaris Dawn" commercial space mission and NASA's Crew- 9 tasks. Among them, the "Polaris Dawn" mission will complete mankind's first commercial spacewalk and break the record for the highest orbital altitude of a manned mission in low-Earth orbit. Details can be found in previous reports on this site. Furthermore, if Boeing cannot pass its own