AI data, traditional trading and modern investing

Artificial intelligence technology helps investors significantly reduce risks and maximize returns.

Artificial intelligence is revolutionizing the future of finance. Last year, financial institutions invested more than $10.1 billion in artificial intelligence. One of the many ways artificial intelligence is playing a role in finance is by helping to improve the investor experience.

The modern investor’s trading experience is much smoother than that of their predecessors. Thanks to the invention of the Internet, going from making a trade to downloading a comprehensive report can be done almost instantly. Tasks that previously took weeks now take just minutes, which has certainly encouraged the next generation of young investors. This is just one of the many ways artificial intelligence is changing the financial industry.

However, innovation never stops, so the modern investing landscape continues to change (this time with the introduction of artificial intelligence). Nonetheless, AI as a whole is still a technology in its infancy, with no specifications and universal standards. Will implementing artificial intelligence and artificial intelligence data in the modern trading world really bring any benefits? In this article, we aim to find out!

questions of traditional methods

Market It's constantly changing, which is why many professional analysts make a career out of studying the market. By analyzing, identifying and predicting these trends, analysts are able to help their clients enjoy high returns while minimizing risk. In this regard, artificial intelligence greatly helps investors. To a certain extent, the price is determined in part by public interaction and perception of the asset's value. Human analysts are able to incorporate these emotional responses into their stock forecasts and combine them with trend data to produce relatively accurate analysis. However, making these calculations can be time-consuming and, because humans are prone to error, not always accurate. Unfortunately, even the same trend can be interpreted differently by different analysts.

Modern Methods

Modern analysts don’t do all their calculations with pen and paper; they utilize a variety of tools. There are many different software solutions designed to help analysts and investors, allowing them to compile large amounts of data in a short period of time. These programs are often able to represent data in many different ways—such as line charts or candlestick charts—which make working with the data easier. Still, analyzing data manually can still be somewhat time-consuming, even with the help of software solutions. That’s why many companies have begun applying AI data to their investment strategies.

The Rise of Robo-Advisors

For years, many financial experts have promoted the idea of investing early, but it actually takes a lot of effort to start investing. Even after stocks and other assets became available for purchase through online brokers, earning consistent returns still required some understanding of the stock market. Fortunately, the first robo-advisors were born in 2008.

Robo-advisor is a unique service that simplifies investing for the masses. Instead of making personal investments, analyzing the market and actively trading, users can simply deposit funds and wait. Robo-advisors handle the actual investing process, using AI data analysis and automation to complete transactions and react to market changes. Today, consumers have many robo-advisors to choose from, making it easy for almost anyone to start investing.

The pros and cons of artificial intelligence data

The main difference between artificial intelligence data and human data is that artificial intelligence data lacks the emotional component. In some cases, this can be a disadvantage (especially for short-term trading). For example, current political or PR issues (and their consequences) can be sentiment analyzed by humans. This emotional insight allows them to incorporate public perceptions into their forecasts and make positive adjustments. Because AI data is based entirely on statistics and does not take emotions into account, the robo-advisor can only react: it cannot make positive choices based on the emotional reactions of shareholders.

On the other hand, a system that relies entirely on AI data will not make emotional decisions. When the downturn persists, humans may start to reconsider their investments, while AI will only consider historical data for decision-making. Every decision is based solely on a comprehensive analysis of the past, which is more inclusive than decisions made by human analysts.

Improving Consumer Accessibility

Another benefit of incorporating AI data into investments is improved customer accessibility. Investing early allows one to take advantage of compound interest, but the interest rates and fees charged by human consultants may make hiring one impractical. Robo-advisors are able to provide portfolio management services at a fraction of the cost, making them more affordable for potential young investors. While the average robo-advisor returns (typically between 11.7% and 13.4%) are not as impressive as other investment options, they offer one of the easiest ways to start building a portfolio with limited income.

AI DATA OF THE FUTURE

The technology may still be relatively new, but there is reason to expect that modern artificial intelligence will continue to become more popular in the future. While it may never completely replace human analysts, it will certainly play a role in the market going forward. It has a wide range of uses, from personal financial management to market tracking, and we expect its options will only grow as technology advances.

The above is the detailed content of AI data, traditional trading and modern investing. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1382

1382

52

52

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

This site reported on June 27 that Jianying is a video editing software developed by FaceMeng Technology, a subsidiary of ByteDance. It relies on the Douyin platform and basically produces short video content for users of the platform. It is compatible with iOS, Android, and Windows. , MacOS and other operating systems. Jianying officially announced the upgrade of its membership system and launched a new SVIP, which includes a variety of AI black technologies, such as intelligent translation, intelligent highlighting, intelligent packaging, digital human synthesis, etc. In terms of price, the monthly fee for clipping SVIP is 79 yuan, the annual fee is 599 yuan (note on this site: equivalent to 49.9 yuan per month), the continuous monthly subscription is 59 yuan per month, and the continuous annual subscription is 499 yuan per year (equivalent to 41.6 yuan per month) . In addition, the cut official also stated that in order to improve the user experience, those who have subscribed to the original VIP

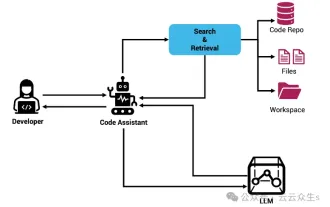

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Improve developer productivity, efficiency, and accuracy by incorporating retrieval-enhanced generation and semantic memory into AI coding assistants. Translated from EnhancingAICodingAssistantswithContextUsingRAGandSEM-RAG, author JanakiramMSV. While basic AI programming assistants are naturally helpful, they often fail to provide the most relevant and correct code suggestions because they rely on a general understanding of the software language and the most common patterns of writing software. The code generated by these coding assistants is suitable for solving the problems they are responsible for solving, but often does not conform to the coding standards, conventions and styles of the individual teams. This often results in suggestions that need to be modified or refined in order for the code to be accepted into the application

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Large Language Models (LLMs) are trained on huge text databases, where they acquire large amounts of real-world knowledge. This knowledge is embedded into their parameters and can then be used when needed. The knowledge of these models is "reified" at the end of training. At the end of pre-training, the model actually stops learning. Align or fine-tune the model to learn how to leverage this knowledge and respond more naturally to user questions. But sometimes model knowledge is not enough, and although the model can access external content through RAG, it is considered beneficial to adapt the model to new domains through fine-tuning. This fine-tuning is performed using input from human annotators or other LLM creations, where the model encounters additional real-world knowledge and integrates it

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

To learn more about AIGC, please visit: 51CTOAI.x Community https://www.51cto.com/aigc/Translator|Jingyan Reviewer|Chonglou is different from the traditional question bank that can be seen everywhere on the Internet. These questions It requires thinking outside the box. Large Language Models (LLMs) are increasingly important in the fields of data science, generative artificial intelligence (GenAI), and artificial intelligence. These complex algorithms enhance human skills and drive efficiency and innovation in many industries, becoming the key for companies to remain competitive. LLM has a wide range of applications. It can be used in fields such as natural language processing, text generation, speech recognition and recommendation systems. By learning from large amounts of data, LLM is able to generate text

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Machine learning is an important branch of artificial intelligence that gives computers the ability to learn from data and improve their capabilities without being explicitly programmed. Machine learning has a wide range of applications in various fields, from image recognition and natural language processing to recommendation systems and fraud detection, and it is changing the way we live. There are many different methods and theories in the field of machine learning, among which the five most influential methods are called the "Five Schools of Machine Learning". The five major schools are the symbolic school, the connectionist school, the evolutionary school, the Bayesian school and the analogy school. 1. Symbolism, also known as symbolism, emphasizes the use of symbols for logical reasoning and expression of knowledge. This school of thought believes that learning is a process of reverse deduction, through existing

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

Editor |ScienceAI Question Answering (QA) data set plays a vital role in promoting natural language processing (NLP) research. High-quality QA data sets can not only be used to fine-tune models, but also effectively evaluate the capabilities of large language models (LLM), especially the ability to understand and reason about scientific knowledge. Although there are currently many scientific QA data sets covering medicine, chemistry, biology and other fields, these data sets still have some shortcomings. First, the data form is relatively simple, most of which are multiple-choice questions. They are easy to evaluate, but limit the model's answer selection range and cannot fully test the model's ability to answer scientific questions. In contrast, open-ended Q&A

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

Editor | KX In the field of drug research and development, accurately and effectively predicting the binding affinity of proteins and ligands is crucial for drug screening and optimization. However, current studies do not take into account the important role of molecular surface information in protein-ligand interactions. Based on this, researchers from Xiamen University proposed a novel multi-modal feature extraction (MFE) framework, which for the first time combines information on protein surface, 3D structure and sequence, and uses a cross-attention mechanism to compare different modalities. feature alignment. Experimental results demonstrate that this method achieves state-of-the-art performance in predicting protein-ligand binding affinities. Furthermore, ablation studies demonstrate the effectiveness and necessity of protein surface information and multimodal feature alignment within this framework. Related research begins with "S

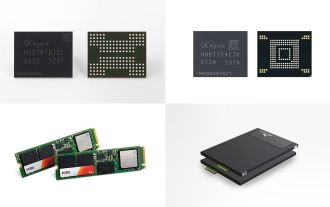

SK Hynix will display new AI-related products on August 6: 12-layer HBM3E, 321-high NAND, etc.

Aug 01, 2024 pm 09:40 PM

SK Hynix will display new AI-related products on August 6: 12-layer HBM3E, 321-high NAND, etc.

Aug 01, 2024 pm 09:40 PM

According to news from this site on August 1, SK Hynix released a blog post today (August 1), announcing that it will attend the Global Semiconductor Memory Summit FMS2024 to be held in Santa Clara, California, USA from August 6 to 8, showcasing many new technologies. generation product. Introduction to the Future Memory and Storage Summit (FutureMemoryandStorage), formerly the Flash Memory Summit (FlashMemorySummit) mainly for NAND suppliers, in the context of increasing attention to artificial intelligence technology, this year was renamed the Future Memory and Storage Summit (FutureMemoryandStorage) to invite DRAM and storage vendors and many more players. New product SK hynix launched last year