Technology peripherals

Technology peripherals

AI

AI

500% return? Created by ChatGPT, the strongest fund manager in history!

500% return? Created by ChatGPT, the strongest fund manager in history!

500% return? Created by ChatGPT, the strongest fund manager in history!

ChatGPT, are you going to replace human fund managers?

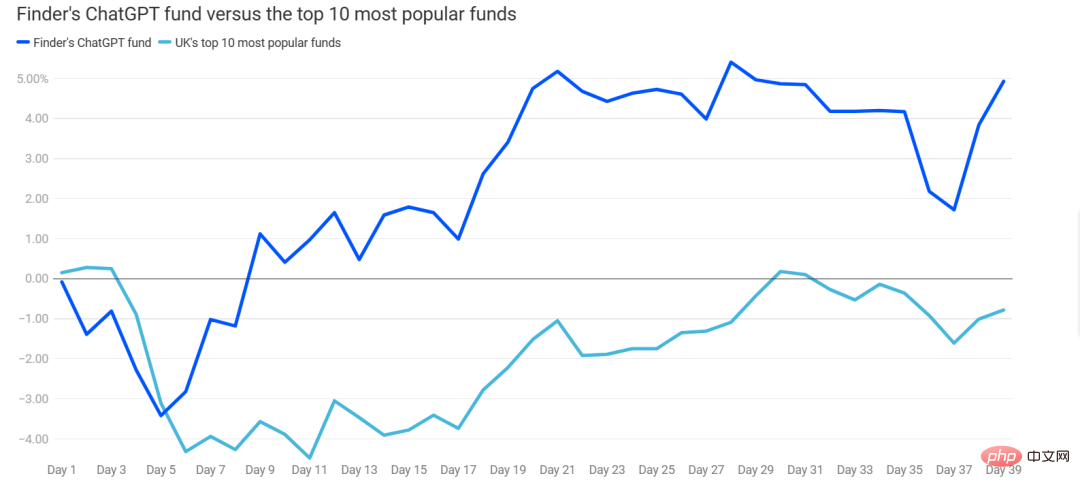

Finder, a financial consulting website in the UK, stated that they created a portfolio composed of stocks selected by ChatGPT on March 6. This portfolio rose 4.93 two months later. %.

During the same period, the average performance of the 10 most popular funds in the UK was -0.78%, and they underperformed the "ChatGPT Index" in 87% of trading days.

Similarly, during the same period, the S&P 500 Index (an index containing the 500 most valuable companies in the United States) only rose 3%.

Is it possible that in addition to the jobs of literary workers being threatened, are fund managers who are the face of "beating workers" also going to lose their jobs?

An Unimagined Road

Who would have thought that foreign researchers actually published a paper to explore the ability of AI stock trading in detail.

## Specifically, give ChatGPT some news headlines and let ChatGPT use Sentiment Analysis ) to determine the impact of these events on the stock market.

ChatGPT will determine whether a certain event is beneficial, negative, or irrelevant to the stock price. Afterwards, researchers will score based on the results and use real stock market returns to see whether ChatGPT is accurate.

Researchers said that ChatGPT is much stronger than other models, and predictions like GPT-1 and GPT-2 are inaccurate.

This shows two things. First, the ability to predict stock market returns is an ability that urgently needs further exploration for language models. Second, more advanced language models are bound to generate more accurate predictions.

The three main data sets used by the research team are the Center for Research in Securities Prices (CRSP) daily return summary, major news headlines, and RavenPack.

The coverage of the data sample starts from October 2021 and ends in December 2022.

The reason for choosing this time period is also very simple. ChatGPT's own training data is up to September 2021, which means that the data before October does not need to be predicted at all. It already knows the results. Therefore, the new data after October 21 is just for ChatGPT to use for practice.

Three data sets, CRSP's daily return data set contains the daily returns of various company stocks listed on major U.S. stock exchanges, including stock prices, trading volume and Market capitalization and other data.

Secondly, the researchers collected all news containing company names or stock codes from various major news organizations, financial news websites and social media platforms.

For each company, the researchers collect all news for the sample period.

Finally, RavenPack deserves to be highlighted.

Since 2003, RavenPack has been one of the leading data analytics providers in financial services.

They help businesses extract valuable parts from large amounts of information quickly and easily. RavenPack's products enable customers to increase revenue, reduce risk and increase operational efficiency.

In general, the role of RavenPack is to ensure that all the information fed to ChatGPT is valid/relevant information.

In the end, the research team matched 67,586 news headlines from 4,138 companies from RavenPack.

At the same time, researchers will give each news a score from 0 to 100, measuring the relationship between each news and the company mentioned.

A score of 0 means that a certain company was passively mentioned in the news, perhaps just in passing. Researchers are looking for a correlation of 100 points.

At the same time, all news that only introduces stock market trends are also excluded. This kind of news violates the original intention of prediction. Duplicate reporting of the same content was also avoided by the research team so that the data collected could better serve the experiment.

At this point, the data to be collected is almost complete, and the next step is to analyze.

Point-based stock trading

Since you want ChatGPT to output content, the first step is to design a prompt.

The research team uses the following prompt:

Assume that you are a financial expert and a financial expert with recommendation experience. If the news is good news, answer "YES", if it is bad news, answer "NO", if you are not sure, answer "UNKNOWN" on the first line, and then elaborate in a short and concise sentence on the next line.

Is this news good or bad for the stock price of _____(company name) in _____ (short term, long term)?

News title: _____

#As you can see, the researchers asked ChatGPT Cosplay a financial expert with recommendation experience, and the horizontal line part Use specific information instead.

For example:

Enter news headline: Rimini Street fined $630,000 in lawsuit against Oracle

Evaluation object: Oracle stock price

Time span: short term

The answer output by ChatGPT is this:

"YES. The fine against Rimini Street will indirectly boost investor confidence in Oracle's ability to protect its intellectual property rights and maintain increased demand for its products and services."

Then, researchers will score based on ChatGPT’s answers. YES counts as 1 point, NO counts as -1 point, and UNKNOWN counts as 0 points.

If there is a lot of news about a company in a day, sum up the scores and output an average.

Finally, use this predicted score to match the subsequent real results.

Good news for retail investors!

By leveraging news headline data and the generated sentiment scores, the researchers found a strong correlation between the ChatGPT assessment results and the subsequent daily returns of the stocks in the sample.

Moreover, ChatGPT’s sentiment score can predict stock returns more accurately than the sentiment indicators provided by existing traditional data providers.

The research team believes that the reason why ChatGPT is better than the existing sentiment index is due to its strong language understanding ability, which allows it to capture the nuances in news headlines, thereby Making the generated sentiment scores more reliable.

So using large language models as tools can provide better investment references than traditional sentiment indexes.

The research team further found that the ChatGPT sentiment score has a better ability to predict the earnings of small-cap stocks than large-cap stocks. Explain that restrictions on shareholder arbitrage may reduce the profitability of this strategy.

The research team uses the sentiment scores generated by ChatGPT to guide stock operations.

The specific operation method is to buy (positive news) or temporarily sell (negative news) stocks as long as there is news.

If the news is released during trading hours, it will be traded at the current price. If it is released outside trading hours, it will be traded at the opening price of the next day.

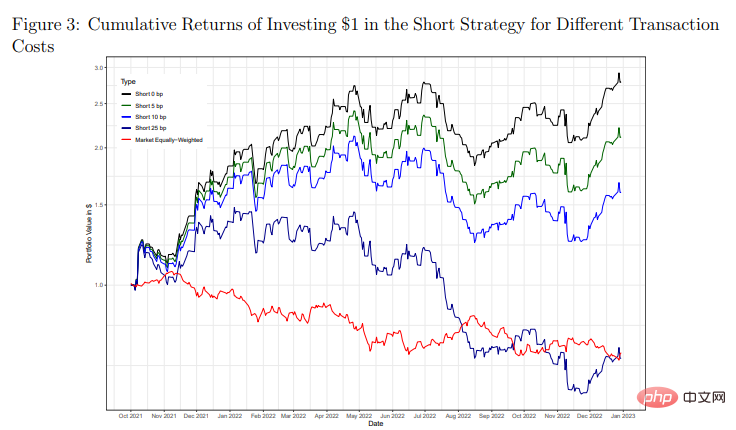

(The black line represents zero-cost income, the green line represents 5% transaction cost income, and the blue line represents 10% transaction cost income. , the dark blue line represents the 25% transaction cost return, and the red line represents the overall market return)

This table shows the results of the regression analysis of the operation, which intuitively reflects the next day Correlation between stock returns and sentiment scores generated by ChatGPT.

500% return rate! ?

Using ChatGPT to perform sentiment analysis on news headlines to predict stock returns outperforms traditional sentiment indexes from major providers.

It shows that there is great potential to continue to develop and explore the application of large language models in the financial industry.

With the development of AI technology itself, designing more complex models to make money in the financial market is a very reliable thing.

From a macro perspective, if most financial practitioners use tools based on large language models to make decisions in the future, it will also have an impact on the price formation mechanism and information dissemination in the financial market. approach, and have a profound impact on market stability.

So, what does the specific return look like?

The long-short strategy, which buys companies with good news and shorts companies with bad news, has the highest return rate, exceeding 500%.

The short-only strategy focuses only on short-selling companies with bad news, and the return rate is close to 400%.

A long-only strategy that only buys companies with good news has a return rate of about 50%.

Of course, this number may look deceptive, but it is actually an ideal situation.

However, putting aside the cold numbers, ChatGPT does have a lot of room for this capability.

This could rewrite stock trading, with retail investors now having access to tools more powerful than corporate sentiment analysis.

Generally speaking, ChatGPT is making obsolete the years of work other companies have poured into proprietary machine learning models.

It spans millions of dollars in research and development and makes this capability easily accessible to anyone.

For ordinary investors, outperforming the market is pretty good.

Of course ordinary people who do not have very complex financial knowledge and stock trading experience cannot do such complex analysis and high-precision operations.

Then based on the recommended stock selection strategy in the "ChatGPT Portfolio" mentioned at the beginning that outperformed the S&P 500:

- Low Debt Ratio

- Historically sustained and stable growth

- Possess assets that can generate competitive advantages.

# can also select good companies to help you allocate your assets efficiently.

However, it should be noted that the reply given by ChatGPT cannot be used as a factual basis for investment.

The above is the detailed content of 500% return? Created by ChatGPT, the strongest fund manager in history!. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

How to implement file sorting by debian readdir

Apr 13, 2025 am 09:06 AM

How to implement file sorting by debian readdir

Apr 13, 2025 am 09:06 AM

In Debian systems, the readdir function is used to read directory contents, but the order in which it returns is not predefined. To sort files in a directory, you need to read all files first, and then sort them using the qsort function. The following code demonstrates how to sort directory files using readdir and qsort in Debian system: #include#include#include#include#include//Custom comparison function, used for qsortintcompare(constvoid*a,constvoid*b){returnstrcmp(*(

How to optimize the performance of debian readdir

Apr 13, 2025 am 08:48 AM

How to optimize the performance of debian readdir

Apr 13, 2025 am 08:48 AM

In Debian systems, readdir system calls are used to read directory contents. If its performance is not good, try the following optimization strategy: Simplify the number of directory files: Split large directories into multiple small directories as much as possible, reducing the number of items processed per readdir call. Enable directory content caching: build a cache mechanism, update the cache regularly or when directory content changes, and reduce frequent calls to readdir. Memory caches (such as Memcached or Redis) or local caches (such as files or databases) can be considered. Adopt efficient data structure: If you implement directory traversal by yourself, select more efficient data structures (such as hash tables instead of linear search) to store and access directory information

How debian readdir integrates with other tools

Apr 13, 2025 am 09:42 AM

How debian readdir integrates with other tools

Apr 13, 2025 am 09:42 AM

The readdir function in the Debian system is a system call used to read directory contents and is often used in C programming. This article will explain how to integrate readdir with other tools to enhance its functionality. Method 1: Combining C language program and pipeline First, write a C program to call the readdir function and output the result: #include#include#include#includeintmain(intargc,char*argv[]){DIR*dir;structdirent*entry;if(argc!=2){

Debian mail server firewall configuration tips

Apr 13, 2025 am 11:42 AM

Debian mail server firewall configuration tips

Apr 13, 2025 am 11:42 AM

Configuring a Debian mail server's firewall is an important step in ensuring server security. The following are several commonly used firewall configuration methods, including the use of iptables and firewalld. Use iptables to configure firewall to install iptables (if not already installed): sudoapt-getupdatesudoapt-getinstalliptablesView current iptables rules: sudoiptables-L configuration

How to configure firewall rules for Debian syslog

Apr 13, 2025 am 06:51 AM

How to configure firewall rules for Debian syslog

Apr 13, 2025 am 06:51 AM

This article describes how to configure firewall rules using iptables or ufw in Debian systems and use Syslog to record firewall activities. Method 1: Use iptablesiptables is a powerful command line firewall tool in Debian system. View existing rules: Use the following command to view the current iptables rules: sudoiptables-L-n-v allows specific IP access: For example, allow IP address 192.168.1.100 to access port 80: sudoiptables-AINPUT-ptcp--dport80-s192.16

How to set the Debian Apache log level

Apr 13, 2025 am 08:33 AM

How to set the Debian Apache log level

Apr 13, 2025 am 08:33 AM

This article describes how to adjust the logging level of the ApacheWeb server in the Debian system. By modifying the configuration file, you can control the verbose level of log information recorded by Apache. Method 1: Modify the main configuration file to locate the configuration file: The configuration file of Apache2.x is usually located in the /etc/apache2/ directory. The file name may be apache2.conf or httpd.conf, depending on your installation method. Edit configuration file: Open configuration file with root permissions using a text editor (such as nano): sudonano/etc/apache2/apache2.conf

How to learn Debian syslog

Apr 13, 2025 am 11:51 AM

How to learn Debian syslog

Apr 13, 2025 am 11:51 AM

This guide will guide you to learn how to use Syslog in Debian systems. Syslog is a key service in Linux systems for logging system and application log messages. It helps administrators monitor and analyze system activity to quickly identify and resolve problems. 1. Basic knowledge of Syslog The core functions of Syslog include: centrally collecting and managing log messages; supporting multiple log output formats and target locations (such as files or networks); providing real-time log viewing and filtering functions. 2. Install and configure Syslog (using Rsyslog) The Debian system uses Rsyslog by default. You can install it with the following command: sudoaptupdatesud

How Debian OpenSSL prevents man-in-the-middle attacks

Apr 13, 2025 am 10:30 AM

How Debian OpenSSL prevents man-in-the-middle attacks

Apr 13, 2025 am 10:30 AM

In Debian systems, OpenSSL is an important library for encryption, decryption and certificate management. To prevent a man-in-the-middle attack (MITM), the following measures can be taken: Use HTTPS: Ensure that all network requests use the HTTPS protocol instead of HTTP. HTTPS uses TLS (Transport Layer Security Protocol) to encrypt communication data to ensure that the data is not stolen or tampered during transmission. Verify server certificate: Manually verify the server certificate on the client to ensure it is trustworthy. The server can be manually verified through the delegate method of URLSession