Technology peripherals

Technology peripherals

It Industry

It Industry

New energy vehicle market adjustment: traditional car companies and new forces compete

New energy vehicle market adjustment: traditional car companies and new forces compete

New energy vehicle market adjustment: traditional car companies and new forces compete

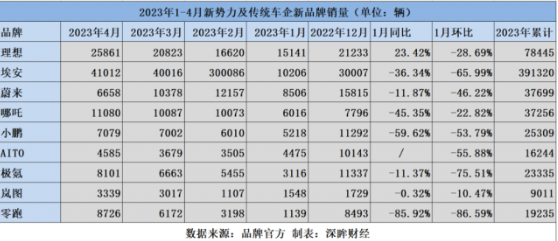

China's new energy vehicle market will face a series of challenges in 2023. The latest data shows that sales of new energy vehicle manufacturers fell sharply at the beginning of this year. Among them, the month-on-month decline rate of Leapo brand was as high as 86.59%.

After the price subsidy war in March, the sales of various car companies have improved slightly. Judging from the cumulative sales in 2023, in addition to BYD firmly ranking first with sales of more than 550,000 vehicles, the growth rates of new power brands such as Aian, Leapao, and Nezha are also relatively outstanding.

Since these three brands have all been selected for this year’s new energy vehicles going to the countryside, it is expected that their sales in May will not be too bad. According to a report released by the China Electric Vehicles Conference of 100, if the travel needs of low-tier cities can be met, there will be a car market worth 500 billion yuan waiting to be developed.

However, despite the market’s high expectations for the demand for cars in the vast third- and fourth-tier cities, new energy vehicles going to the countryside is also regarded as a new force for car companies to achieve a turn. opportunities for overtaking, but these companies face many challenges.

First of all, the price issue is an important factor restricting the development of new energy vehicles in the sinking market. Consumers are price-sensitive, especially in lower-tier cities with limited spending power. For new energy vehicle companies, the most critical challenge is to solve the price problem, not just the charging problem.

After joining the new energy vehicle rural areas plan, various car manufacturers have gradually launched more models. However, this also brings limitations in model selection. Some consumers believe that new energy vehicle companies have actually exhausted their inventory when selling models to rural areas, while sales in first- and second-tier cities have been sluggish.

Even so, the new energy vehicles going to the countryside plan is constantly expanding, and the number of car companies and models participating in the plan has increased this year. From a product perspective, the price limit has been raised to 150,000 yuan, making the choice of models more diverse. Some models that have performed well in first- and second-tier cities have also begun to participate, and there is an obvious trend of developing into the mid-to-high-end market.

Despite the spread of new energy vehicles going to rural areas, car companies are still facing cost challenges. In particular, micro and small electric models account for the majority of sales. The profit margins of car companies are still very limited. Although the price of lithium battery raw materials has dropped, it has not significantly reduced the production costs of models.

In addition to cost issues, the profitability of new energy vehicle brands also deserves attention. Some companies may suffer losses when participating in bringing new energy vehicles to rural areas, and some even believe that new energy vehicle brands mainly make money through subsidies rather than through selling cars.

No matter what, China's new energy vehicle market will gain growth opportunities in sinking markets and overseas markets. China's sinking market has huge potential, and there is also great demand in overseas markets. Although new automotive companies face greater challenges, traditional automobile manufacturers have a more obvious advantage in the field of new energy vehicles.

Overall, the new energy vehicle market prospects are still uncertain. Car companies need to face many challenges, including price, cost, profitability and other issues, despite the huge market potential. Against the backdrop of a ban on the sale of internal combustion engine vehicles in 2035, new energy vehicle companies need to accelerate development and seize opportunities to remain competitive and achieve long-term sustainable development.

The above is the detailed content of New energy vehicle market adjustment: traditional car companies and new forces compete. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1377

1377

52

52

No.9 electric vehicle mechanic MMAX2 released: starting from 7999 yuan

Aug 23, 2024 am 06:59 AM

No.9 electric vehicle mechanic MMAX2 released: starting from 7999 yuan

Aug 23, 2024 am 06:59 AM

On August 22, Nine Company, my country's leading smart two-wheeled electric vehicle company, released three series of multiple new two-wheeled electric vehicle products at once, including both new product series and upgraded products of existing series. The many new products released by No.9 Company this time have been almost fully upgraded to "top-of-the-line" products from configuration, design to intelligence. In addition to iterative upgrades on the product side, Nine Company has also made a lot of layout and optimization in the whole sales process services. In addition to increasing offline pure after-sales outlets, Nine Company will also build a national rapid energy replenishment network. In recent years, my country's two-wheeled electric vehicle market has reached a stage of high-quality development, and consumer demand for two-wheeled electric vehicles has become diversified and "high-end." Correspondingly, on the supply side, the competition between brands has also transitioned from the previous pure "volume price" to

Realme launches 320W super-light speed second charge

Aug 14, 2024 pm 06:46 PM

Realme launches 320W super-light speed second charge

Aug 14, 2024 pm 06:46 PM

On August 14, the Realme mobile phone made the world's first flash charging black technology - 320W super-light speed charging, marking another revolutionary leap in mobile phone flash charging speed, and China's technology once again leads the world! Realme's 320W super-light speed charging has achieved unprecedented breakthroughs in terms of power, safety and efficiency. It not only pushes the industry's flash charging technology to a new height, but also brings a new flash charging experience to users. 320W super-light speed second charging, a miraculous experience of 4 minutes and 30 seconds. 320W super-light speed second charging technology breaks the limit of charging speed again. It only takes 4 and a half minutes to charge a 4420mAh mobile phone battery to 100%, which is faster than the previous 240W. Flash charging technology once again improves charging efficiency. Behind this achievement is actually the combination of "high power, high safety and miniaturization"

Geely's new pure electric car 'Xingyuan' official image released: equipped with Flyme Auto vehicle system

Sep 02, 2024 pm 01:10 PM

Geely's new pure electric car 'Xingyuan' official image released: equipped with Flyme Auto vehicle system

Sep 02, 2024 pm 01:10 PM

DoNews reported on September 2 that Geely Automobile today released the official image of its new pure electric car "Xingyuan". The car will be equipped with the FlymeAuto vehicle system and is expected to compete with BYD Dolphin and other models after its launch. The car adopts a round and lovely styling style, with smooth lines and a full and smooth overall outline. It adopts a dual-color body. Its length, width and height are 4135/1805/1570mm respectively, and the wheelbase is 2650mm. The official released the cockpit design of the new car this time. The interior of the new car also uses a large number of curves, echoing the agile appearance of the exterior. It is equipped with a suspended central control screen, a two-spoke steering wheel, and decorative panels on the doors and in front of the passenger seat. It is embellished with an outline drawing that resembles a group of urban high-rise buildings. The car will be built based on a new pure electric platform.

Wenjie's new M7 Pro is officially launched with prices starting at NT$249,800, equipped with the basic version of HUAWEI ADS

Sep 02, 2024 pm 12:34 PM

Wenjie's new M7 Pro is officially launched with prices starting at NT$249,800, equipped with the basic version of HUAWEI ADS

Sep 02, 2024 pm 12:34 PM

On August 26, Hongmeng Smart held a new product launch conference. Its three major brands, AITO, LUXEED and STELATO, were unveiled with a number of blockbuster new cars. At the press conference, Wenjie's new M7 Pro was officially launched, priced at 249,800-289,800 yuan. It is equipped with the HUAWEIADS basic version of the intelligent driving assistance system, ushering in a new era of intelligent driving for all. Yu Chengdong, Huawei’s Managing Director, Chairman of Terminal BG, and Chairman of Smart Car Solutions BU, said: “Wenjie’s new M7 Pro has the largest space, the best driving control, the strongest intelligent driving and the strongest safety in its class. It is the best in the 250,000 class. SUV! will bring users a more extreme travel experience and help the sales of Hongmeng Zhixing family continue to increase. "Extraordinary space, ever-changing magic comfortable seats."

Hongmeng Zhixing Wenjie's new M7 Pro was officially released, and its first coupe SUV, Zhijie R7, was unveiled on the same stage

Sep 02, 2024 pm 01:40 PM

Hongmeng Zhixing Wenjie's new M7 Pro was officially released, and its first coupe SUV, Zhijie R7, was unveiled on the same stage

Sep 02, 2024 pm 01:40 PM

On August 26, Hongmeng held its first new product launch conference. Wenjie’s new M7 Pro was officially launched, with an official price of 249,800-289,800 yuan. At the same time, Hongmeng Zhixing’s first coupe SUV, the Zhijie R7, was officially unveiled. Yu Chengdong, Huawei’s Managing Director, Chairman of Terminal BG, and Chairman of Smart Car Solutions BU, said: “Wenjie’s new M7 Pro has the largest space, the best driving control, the strongest intelligent driving and the strongest safety in its class. It is the best in the 250,000 class. "SUV!" will bring users a more extreme travel experience and help Hongmeng Zhixing continue to increase sales." At the press conference, Hongmeng Zhixing handed over the latest answer: AITO Wenjie delivered 400,000 vehicles in 2 years and 5 months, creating a smart luxury brand. New record. Gaoyan’s urban performance SUV Wenjie’s new M5 has been delivered with over 20,000 deliveries

Global terminal sales of SAIC Passenger Vehicles exceeded 477,000 units from January to July, a year-on-year increase of over 12%

Aug 12, 2024 pm 06:42 PM

Global terminal sales of SAIC Passenger Vehicles exceeded 477,000 units from January to July, a year-on-year increase of over 12%

Aug 12, 2024 pm 06:42 PM

In July 2024, global terminal sales of SAIC's dual-brand passenger cars exceeded 59,000 units; from January to July, global cumulative terminal sales exceeded 477,000 units, a year-on-year increase of more than 12%. The industry's highest "Super Safety Commitment" pays one for every burn, and the lifetime warranty of three electric vehicles follows the car but not others. With a deep insight into the pulse of the market and an accurate grasp of consumer needs, on July 4, SAIC Passenger Cars officially launched the industry's highest The standard "Super Safe Core Commitment" sets a new industry benchmark for battery zero-combustion guarantee with a service standard of paying new cars within 20 working days. At the same time, it is announced that the lifetime warranty of three electric vehicles is not limited to the first car owner and annual driving mileage, providing users with Provides comprehensive security and worry-free experience. This move goes beyond the current warranty standards of mainstream car companies and bids farewell to the 30,000-kilometer warranty commonly used in the industry.

SAIC-Volkswagen's new SUV unveiled, Tuyue Xinrui sets new benchmark for A-class SUVs

Aug 21, 2024 pm 08:46 PM

SAIC-Volkswagen's new SUV unveiled, Tuyue Xinrui sets new benchmark for A-class SUVs

Aug 21, 2024 pm 08:46 PM

Recently, SAIC Volkswagen’s new SUV TharuXR was unveiled. The new car is positioned as an A-class SUV, and its Chinese name is Tuyue Xinrui. As a new warrior of the Tuyue family, it will join forces with the new Tuyue to accelerate its lead in the A-class SUV market with new development momentum. Since the announcement of the Ministry of Industry and Information Technology’s declaration in June, Tuyue Xinrui has attracted widespread attention with its new-generation Volkswagen SUV design language and its class-leading, powerful and fuel-efficient 1.5TEVOII net-efficiency engine. This debut, along with the release of more model information, creates a new realm of fuel economy and durability, surprising the first batch of KOLs who experienced it. A KOL said: "The Tuyue Xinrui may be the most worth buying A-class SUV, and I am very much looking forward to its launch." You won’t get tired of the appearance for a long time. Tuyue’s cutting-edge appearance adopts Volkswagen’s new generation SU

Canalys: Global tablet shipments will grow by 18% in the second quarter of 2024

Aug 07, 2024 pm 10:18 PM

Canalys: Global tablet shipments will grow by 18% in the second quarter of 2024

Aug 07, 2024 pm 10:18 PM

The latest report from Canalys, a world-renowned technology market analysis agency, shows that in the second quarter of 2024, global tablet shipments increased by 18% year-on-year to 35.9 million units. Meanwhile, Chromebook shipments increased 4% to 6 million units as the education market returned to typical seasonal purchasing patterns. In the second quarter of 2024, Apple continued to lead the global tablet market, shipping 13.9 million units and occupying a 39% market share. Thanks to strong shipments of Samsung's flagship models and growing demand in emerging markets in the Asia-Pacific region, it achieved year-on-year growth of 13%, with shipments of 6.8 million units. Driven by domestic and Europe-China-Africa (EMEA) market demand, Huawei ranked third with shipments of 250