Technology peripherals

Technology peripherals

AI

AI

ChatGPT leads the new wave! AI large models drive financial technology innovation and development, empowering business to continue a new chapter

ChatGPT leads the new wave! AI large models drive financial technology innovation and development, empowering business to continue a new chapter

ChatGPT leads the new wave! AI large models drive financial technology innovation and development, empowering business to continue a new chapter

The emergence of the Internet has changed the way information flows and promoted the form of new corporate paradigms. And changes are still continuing, especially the emergence of ChatGPT, which brings people a more in-depth intelligent interactive experience.

Based on GPT (generative pre-training change model), the all-round AI conversational robot-ChatGPT may make errors when answering questions, but its logical ability in chatting with people is astonishing.

For a time, the craze for artificial intelligence large models represented by ChatGPT surged, attracting unprecedented attention from the market. Baidu, 360, Alibaba Cloud, SenseTime, iFlytek, etc. have joined in this large model melee. .

For the financial industry, as a highly digital and professional field, it has naturally become the best scenario for the implementation of large models.

01 How can large models show their “magic powers” when empowering the financial industry?

A report jointly released by the Boston Consulting Group (BCG) and the China Development Foundation stated that it is expected that by 2027, about 23% of jobs in China’s financial industry will be disrupted by artificial intelligence, and the rest 77% of jobs will be supported by artificial intelligence, and working hours will be reduced by about 27%.

The forecast of the impact on the labor force in the financial industry proves that AI is no longer the robot boy who was programmed with emotions in the great director Spielberg's work "Artificial Intelligence", but has truly penetrated into the entire business chain. And now, with the general wave of large models rolling out, the financial industry also has new expectations for artificial intelligence.

The convergence point between the two parties is that the financial industry produces and processes large amounts of data, and large artificial intelligence models, especially those based on deep learning, are good at handling this data-intensive environment. This ability is very important for risk assessment and fraud detection. , market expectations and other aspects are crucial.

And financial data usually contains complex patterns. Artificial intelligence models have unique advantages in processing complex patterns and can better cope with high noise, high-dimensional and non-linear characteristics in the data, thereby helping financial institutions identify market trends and make decisions. Make more accurate decisions. In addition, large-scale artificial intelligence models can efficiently process and analyze large-scale financial data in a short time, allowing financial institutions to quickly respond to market changes and identify anomalies.

In the Malaysian Consumer Artificial Intelligence Research Institute According to the relevant person in charge, in terms of intelligent interaction, by equipping robot customer service to add financial knowledge and product-related information to the knowledge base one by one, despite "feeding" With a lot of data, robot answers cannot be avoided from being mechanistic and accurate, because its recognition ability is limited and it plays more of a role in assisting human customer service. The large model itself has a large amount of general knowledge. In addition to financial common sense, other special content can be injected into the large model through knowledge injection. And through continuous and sufficient training, the large model can have more accurate semantic understanding capabilities and Powerful natural language generation capabilities. Naturally, big models become “experts” in understanding finance.

In addition, Rong360 stated that artificial intelligence large models can help financial institutions improve customer service quality. By analyzing massive amounts of customer data, these models can personalize services, predict customer needs, and provide tailored recommendations. Not only that, artificial intelligence general large models can also improve the efficiency and accuracy of risk assessment. The capabilities of large models include technologies such as deep learning and natural language processing, which enable them to process and understand large-scale information, bringing more efficient and precise risk management to the financial industry, allowing financial institutions to make smarter loans decision making.

And artificial intelligence large models can greatly enhance fraud detection capabilities. They can analyze and understand large amounts of structured and unstructured data, so they can identify fraudulent behaviors and abnormal patterns hidden in huge data sets, and continuously improve them. The accuracy and efficiency of fraud detection enable financial institutions, e-commerce platforms, etc. to detect fraud in a timely manner, reduce financial losses and protect the interests of users.

02 Promote the application and construction of large model technology, data elements become the key

No matter how "gorgeous" the technology is, it is not as practical as practical application. According to data from CCID Consulting, it is expected that the scale of the domestic artificial intelligence industry will reach 336.93 billion yuan by 2025, an increase of 63.85% from 2022; the market size of comprehensive solution services driven by industry applications will exceed 3 trillion yuan.

For the financial industry, Beijing’s "Several Measures to Promote the Innovative Development of General Artificial Intelligence (2023-2025) (Draft for Comments)" issued by Beijing clearly states that financial technology companies are supported to deal with high information load in financial scenarios. Information updates quickly, making it difficult for financial practitioners to quickly and comprehensively obtain accurate information. We need to explore the application of artificial intelligence technology for in-depth understanding and analysis of financial texts.

On the basis of focusing on intelligent risk control, intelligent investment advisory, intelligent customer service and other links, we will promote the accurate analysis of long texts in financial majors and the update of model knowledge, and break through the integration technology between complex decision-making logic and model information processing capabilities. Realize the transformation from complex financial information processing to investment decision-making suggestions, and support investment-assisted decision-making in the financial field.

In this regard, the relevant person in charge of the Malaysian Consumer Artificial Intelligence Research Institute mentioned that if the general large model is regarded as a wild horse with superior qualifications, it will create a large model focusing on financial vertical fields and segmented scenarios. Model application is equivalent to taming wild horses. First, it needs to be "fed" with proprietary processed vertical domain data as "forage"; secondly, the model must be fine-tuned and aligned in the vertical domain, which is equivalent to putting a "bridle" on the wild horse; thirdly, Use large model inference acceleration technology to add a "saddle" and "stirrup" to it to make this horse run faster and more controllable; finally, there must be enough application scenarios for this horse to run and iterate, and use The more people there are, the more evaluation feedback there will be, and the faster the model will iterate, the better it will be. In this regard, large financial institutions have inherent advantages and can produce strong practical effects. In comparison, the first difficulty facing small and medium-sized financial institutions is the resource threshold. Under the influence of strong power demand, they will seek assistance from large institutions in the financial industry or fintech platforms with technical advantages to establish relevant technological capabilities.

According to Qi Finance’s understanding, Qifu Technology’s self-developed large-scale industry model Qifu GPT has achieved initial results. As the first general large-scale model for the financial industry in China, the product-level applications it supports are expected to be launched within the year and open to financial institutions. Qifu Technology believes that as a large model in the financial industry, it must achieve the ultimate in accuracy and applicability. Therefore, the quantity and quality of training data and the understanding and insights into financial business have become the core competitiveness of large models in the financial industry.

Qifu GPT relies on a large amount of financial business data accumulated by Qifu Technology over the years, whether it is 50 million credit reports and interpretations, in-depth conversations with an average of 3.5 million users per month, or relying on data covering more than 900 industries, The corporate financial behavior network of 16 million enterprises with 3000 attributes and the knowledge graph and industry knowledge derived from it are the basis for Qifu GPT to better understand finance, understand users better, and better support various financial services in the credit field.

At present, Xinye Technology combines large models to explore the layout of artificial intelligence. On the one hand, it has been verified that large models can help improve accuracy in some existing scenarios, such as improving robot voice and text analysis and understanding. and generative capabilities to create a better user experience; on the other hand, it is also exploring new scenarios based on generative models, including automatic code generation, visual material design, etc., to embrace the productivity changes brought about by generative AI.

In the first quarter of 2023, 乐信 has accelerated the application of large artificial intelligence models in the financial vertical field in business. At present, Lexin's artificial intelligence large model has been implemented in the fields of R&D code assistance, design creativity generation, telemarketing and customer service intelligent services, and has achieved significant efficiency improvements. In the future, Lexin will continue to promote the in-depth exploration of large artificial intelligence models in areas such as risk management and anti-fraud.

In addition, Samoyed Cloud Technology Group mentioned that based on the accumulation of AI decision-making intelligence, big data and other technologies, the company conducts research on large models from the following fields and continues to increase technology investment to explore more Scenario application: First, automatic modeling, using the latest NLP large model technology, explores automatic model construction through multiple rounds of dialogue, allowing users to describe the application they want to create through natural language to build a model. Moreover, users can provide improvement suggestions through continuous natural language and automatically make modeling adjustments; second, ChatGPT technology is introduced in the field of cross-border e-commerce to create new AI tools for Amazon sellers for free, helping small and medium-sized enterprises to reduce costs and increase efficiency.

According to Zhongyuan Consumer Finance, with the popularity of ChatGPT, it has once again been proved that the era when innovation is king has arrived. Only reformers advance, only innovators are strong, and only reformers and innovators win. The company uses digital to "empower" business management, "empower" financial services and accelerate the pace of development, creating a market-leading three digital core capability systems of "independent customer acquisition", "intelligent risk control" and "digital operations" to provide customers with High-quality, efficient, convenient and warm integrated consumer financial services.

The above is the detailed content of ChatGPT leads the new wave! AI large models drive financial technology innovation and development, empowering business to continue a new chapter. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

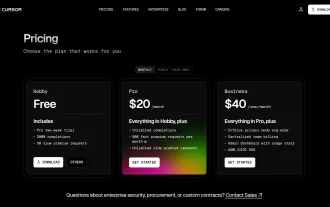

I Tried Vibe Coding with Cursor AI and It's Amazing!

Mar 20, 2025 pm 03:34 PM

I Tried Vibe Coding with Cursor AI and It's Amazing!

Mar 20, 2025 pm 03:34 PM

Vibe coding is reshaping the world of software development by letting us create applications using natural language instead of endless lines of code. Inspired by visionaries like Andrej Karpathy, this innovative approach lets dev

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!

Mar 22, 2025 am 10:58 AM

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!

Mar 22, 2025 am 10:58 AM

February 2025 has been yet another game-changing month for generative AI, bringing us some of the most anticipated model upgrades and groundbreaking new features. From xAI’s Grok 3 and Anthropic’s Claude 3.7 Sonnet, to OpenAI’s G

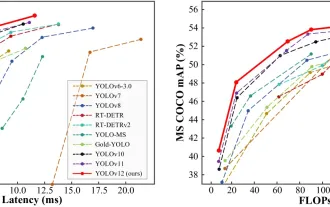

How to Use YOLO v12 for Object Detection?

Mar 22, 2025 am 11:07 AM

How to Use YOLO v12 for Object Detection?

Mar 22, 2025 am 11:07 AM

YOLO (You Only Look Once) has been a leading real-time object detection framework, with each iteration improving upon the previous versions. The latest version YOLO v12 introduces advancements that significantly enhance accuracy

Best AI Art Generators (Free & Paid) for Creative Projects

Apr 02, 2025 pm 06:10 PM

Best AI Art Generators (Free & Paid) for Creative Projects

Apr 02, 2025 pm 06:10 PM

The article reviews top AI art generators, discussing their features, suitability for creative projects, and value. It highlights Midjourney as the best value for professionals and recommends DALL-E 2 for high-quality, customizable art.

Is ChatGPT 4 O available?

Mar 28, 2025 pm 05:29 PM

Is ChatGPT 4 O available?

Mar 28, 2025 pm 05:29 PM

ChatGPT 4 is currently available and widely used, demonstrating significant improvements in understanding context and generating coherent responses compared to its predecessors like ChatGPT 3.5. Future developments may include more personalized interactions and real-time data processing capabilities, further enhancing its potential for various applications.

Best AI Chatbots Compared (ChatGPT, Gemini, Claude & More)

Apr 02, 2025 pm 06:09 PM

Best AI Chatbots Compared (ChatGPT, Gemini, Claude & More)

Apr 02, 2025 pm 06:09 PM

The article compares top AI chatbots like ChatGPT, Gemini, and Claude, focusing on their unique features, customization options, and performance in natural language processing and reliability.

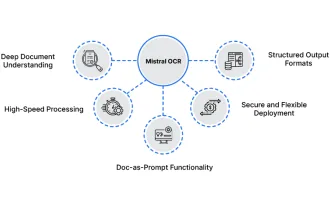

How to Use Mistral OCR for Your Next RAG Model

Mar 21, 2025 am 11:11 AM

How to Use Mistral OCR for Your Next RAG Model

Mar 21, 2025 am 11:11 AM

Mistral OCR: Revolutionizing Retrieval-Augmented Generation with Multimodal Document Understanding Retrieval-Augmented Generation (RAG) systems have significantly advanced AI capabilities, enabling access to vast data stores for more informed respons

Top AI Writing Assistants to Boost Your Content Creation

Apr 02, 2025 pm 06:11 PM

Top AI Writing Assistants to Boost Your Content Creation

Apr 02, 2025 pm 06:11 PM

The article discusses top AI writing assistants like Grammarly, Jasper, Copy.ai, Writesonic, and Rytr, focusing on their unique features for content creation. It argues that Jasper excels in SEO optimization, while AI tools help maintain tone consist