Technology peripherals

Technology peripherals

AI

AI

Heavy! The 8th Rongcheng Cup Fintech Innovation Case Selection has started, and AI singularity is always looking for Fintech best practices

Heavy! The 8th Rongcheng Cup Fintech Innovation Case Selection has started, and AI singularity is always looking for Fintech best practices

Heavy! The 8th Rongcheng Cup Fintech Innovation Case Selection has started, and AI singularity is always looking for Fintech best practices

“Technological innovation may not always be a linear development process. Breakthrough technological progress often changes the general trend and pattern of technological competition and economic development. The advent of ChatGPT has pushed the history of artificial intelligence development to a strange stage. It has brought new impacts and challenges." On May 23, at the launching ceremony of the "8th Rongcheng Cup Financial Technology Innovation Case Selection", Li Lihui, Chairman of the New Financial Alliance and former President of the Bank of China expressed in the keynote speech.

New Finance Alliance Academic Advisor and Director of Peking University Digital Finance Research CenterHuang Yiping also gave a keynote speech. Representatives from a number of commercial banks, financial technology companies, and mainstream media attended the meeting online and offline. Wu Yushan, secretary-general of the New Financial Alliance, presided over the meeting.

It is worth mentioning that this year’s selection has a new individual award - "Financial Technology Leader" to commend pioneers who are determined to forge ahead and lead the industry on the journey of financial technology entrepreneurship and innovation.

Case selection officially starts

Looking for innovative power in the digital age

"Rongcheng Cup Financial Technology Innovation Case Selection" is jointly sponsored by the New Finance Alliance and the Financial City, with academic support from the China Finance Forty Forum and the Digital Finance Research Center of Peking University, aiming to record and witness the power of financial technology progress. , set a benchmark for financial technology innovation, and improve the competitiveness and voice of China's financial industry in the world.

From 2016 to 2022, the case selection has been successfully held for 7 times, and 70 outstanding cases representing the level of domestic financial technology innovation have been selected, winning high recognition from financial regulatory authorities and the market, and gradually becoming a financial technology A professional and authoritative selection brand in the field. At present, the case collections of the first five selections have been published, recording a precious history of financial technology development.

Looking back on previous selections, Judging from the composition of participating institutions, there are 25 commercial banks, 31 financial technology companies, 8 Internet platforms, 6 securities companies, insurance companies and other non-bank financial institutions. In terms of the fields involved, 29 cases focus on inclusive finance, consumer finance, wealth management, digital marketing, insurance claims and other large retail financial fields; 25 cases focus on supply chain finance, financial cloud, transaction banking, etc. In the field of industrial finance; there are another 16 cases involving operational management fields such as intelligent risk management, big data credit reporting, regulatory technology, data governance, and process automation.

“Over the years, we have always adhered to the principles of fairness, impartiality and public welfare, adopted a rigorous, pragmatic and objective review attitude with a professional and authoritative jury lineup, selected the best from the best, and selected the most representative innovative cases in various fields. , focusing on the cutting-edge trends in the application and development of financial technology. Wu Yushan calls on institutions to actively participate in the selection activities and jointly participate in this meaningful and valuable work.

The collection period for the selection is from May 23rd to July 31st, and the primary selection, secondary selection and final selection defense are from from August 1st to September 20th? It will be held on , and the selection results and awards will be announced at the High-end Financial Summit in in September or late October.

A collection of award-winning cases from the past five years

New "Financial Technology Leader" award

This year’s judges are as professional and authoritative as ever, and are composed of leaders from regulatory authorities, industry experts, and well-known scholars. They are:

Yang Kaisheng? ? Former President of Industrial and Commercial Bank of China

李丽伟? ? Chairman of the New Financial Alliance and former President of the Bank of China

黄伊平? Academic Advisor of New Finance Alliance, Director of Peking University Digital Finance Research Center

李文红? Director of Beijing Local Financial Supervision and Administration Bureau

Yao? ? forward? Director of the Science and Technology Supervision Bureau of China Securities Regulatory Commission

LV Zhongtao? Academic Director of New Financial Alliance, Chief Technology Officer of Industrial and Commercial Bank of China

Liu Xiaochun? Vice president of Shanghai New Finance Research Institute and former president of China Zheshang Bank?

Another leader of the Ministry of Finance participated anonymously

This selection will comprehensively select ten representative innovation cases focusing on technical research, model upgrades, data applications, efficiency improvements, risk control optimization, etc. The winning institutions will receive the honorary commendation of "Top Ten Financial Technology Innovation Cases" and be compiled into a book.

In addition to institutional awards, In order to highlight the exemplary value and leading role of outstanding financial technology talents, this year’s selection has established a new individual award for senior managers of financial institutions and financial technology companies - "Financial Technology Leaders". Comprehensive evaluation is conducted through a combination of online voting and expert voting, focusing on aspects such as business management capabilities, industry influence, and social responsibility.

For the sake of fairness, the same institution can participate in the Character Award and the Case Award at the same time, but cannot win at the same time; institutions that have won the "Top Ten Cases" in the past two years can only participate in the Character Award, and the number of Character Awards shall not exceed ten , it is better to lack than to overfill.

Trust in artificial intelligence needs to be reconstructed

Li Lihui, Chairman of the New Financial Alliance and former President of the Bank of China

Li Lihui emphasized that there are two major principles for financial technology innovation: First, the direction is correct. It is very important to conscientiously study and implement the spirit of the Party Central Committee and the guiding and normative documents of financial regulatory agencies. The second is problem orientation. Fintech innovation is a process of constantly discovering problems, solving problems, and making continuous progress. Innovations that can overcome the difficulties and pain points of financial services must be valuable innovations.

He pointed out that , The advent of ChatGPT has pushed the development history of artificial intelligence to a singular point, bringing new impacts and challenges.

First, we face challenges in computing power competition. In the financial field, intelligent credit assessment, customer screening, risk pricing, digital employees and other aspects all require the support of data and computing power. Computing power largely determines the competitiveness of the financial industry. The competition for computing power will in the future be a competition between technology giants and capital giants. We need to discuss how to build a national computing infrastructure that can occupy the global technological high ground while avoiding monopoly; how to build a resource-sharing, business-sustainable, regulatory-inclusive environment where financial institutions and technology companies can benefit financial computing power ecosystem.

Second, AI synthesis and trust are facing challenges. Deep content synthesis blurs the boundary between reality and falsehood. The latest deep synthesis algorithm can resist universal technical screening. People are beginning to worry about the threat posed by AI falsehood and AI manipulation to society. Low-level AI falsehoods are used to defraud and slander individuals and corporate reputations; high-level AI manipulation may be used to slander political figures or government entities, manipulate negative public opinion, create political malice, and intensify social conflicts.

"We urgently need to reconstruct trust in artificial intelligence, effectively combat AI falsehoods technically and institutionally, establish a firewall to prevent AI manipulation, and maintain national security and financial industry security in the digital economy era." Li Lihui emphasized.

Three trends in the development of digital finance

Huang Yiping, academic consultant of the New Finance Alliance and director of the Digital Finance Research Center of Peking University

Huang Yiping said that through the "wind vane" of case selection, we can see two important trends in financial technology. First, in the early years, most of the cases came from technology companies. Now, technology companies and traditional financial institutions pay equal attention to them. There are more and more cases of traditional institutions applying digital technology; second, in the early days, they were basically consumer finance, and now there are more and more cases. Many new applications have been developed, such as the use of digital technology for industrial finance.

In the future, what problems can digital technology help solve in the economic and financial fields? Huang Yiping believes that there are three directions worthy of attention:

First, help people improve the management of investable funds. In the current economic recovery process, the problem of insufficient short-term demand is more prominent. The long-term problem behind it is how to increase the proportion of residents' income in national income. As aging progresses, the importance of property income will continue to increase. How to use digital technology to improve the management of investable funds for ordinary people, thereby increasing asset income and enhancing consumer spending is worth exploring.

Second, help the economy achieve long-term sustainable growth. The core is how to support innovation. In the past, it was the consumer Internet. What role can the industrial Internet play in improving financial services in the future? Whether the economy can be sustained in the long term ultimately depends on whether efficiency can be continuously improved. There is a lot of potential to be tapped in this area.

Third, digital technology should support and maintain financial stability as much as possible. In the innovation process, efficiency and stability must be balanced, and digital technology can be used to help financial institutions and regulatory authorities better monitor and manage risks.

Solve pain points, break through difficulties, and create value

The three award-winning agency representatives from the previous case selection shared the practice and progress of the award-winning cases.

Tian Suli, deputy general manager of the Information Technology Management Department of China CITIC Bank, introduced the application of the bank's "Privacy Computing Blockchain Collaboration Platform" in solving business pain points. For example, it achieves efficient processing and secure transmission of family trust business data; in supply chain finance, it also solves the dilemma of privacy leakage in bill splitting and circulation and corporate information islands.

Wang Yunfeng, general manager of the Big Data Department of Bank of Jiangsu, shared the bank’s latest practices in data governance and innovative applications. The bank’s enterprise-level data governance platform unifies data standards, breaks business barriers, and improves data utilization. Provide strong support for precision marketing, intelligent risk control and intelligent operations.

The "Anxin Compensation" 2-day quick compensation service system is the only insurance case among the award-winning cases last year. Fang Yong, head of claims technology at Ant Insurance, introduced that the system is based on a self-developed artificial intelligence and privacy computing platform , using multi-party data joint analysis technology, it has made important breakthroughs in the three aspects of "fast application for investigation, fast review and fast review". The case will be closed within two working days after the complete materials are submitted. In the future, they also plan to make claims services full-link and front-end to further enhance customer experience.

Source: Financial Industry InformationThe above is the detailed content of Heavy! The 8th Rongcheng Cup Fintech Innovation Case Selection has started, and AI singularity is always looking for Fintech best practices. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

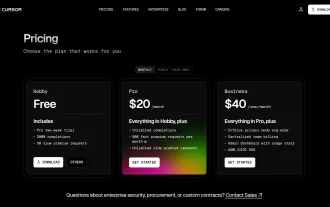

I Tried Vibe Coding with Cursor AI and It's Amazing!

Mar 20, 2025 pm 03:34 PM

I Tried Vibe Coding with Cursor AI and It's Amazing!

Mar 20, 2025 pm 03:34 PM

Vibe coding is reshaping the world of software development by letting us create applications using natural language instead of endless lines of code. Inspired by visionaries like Andrej Karpathy, this innovative approach lets dev

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!

Mar 22, 2025 am 10:58 AM

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!

Mar 22, 2025 am 10:58 AM

February 2025 has been yet another game-changing month for generative AI, bringing us some of the most anticipated model upgrades and groundbreaking new features. From xAI’s Grok 3 and Anthropic’s Claude 3.7 Sonnet, to OpenAI’s G

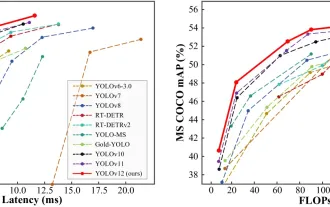

How to Use YOLO v12 for Object Detection?

Mar 22, 2025 am 11:07 AM

How to Use YOLO v12 for Object Detection?

Mar 22, 2025 am 11:07 AM

YOLO (You Only Look Once) has been a leading real-time object detection framework, with each iteration improving upon the previous versions. The latest version YOLO v12 introduces advancements that significantly enhance accuracy

Best AI Art Generators (Free & Paid) for Creative Projects

Apr 02, 2025 pm 06:10 PM

Best AI Art Generators (Free & Paid) for Creative Projects

Apr 02, 2025 pm 06:10 PM

The article reviews top AI art generators, discussing their features, suitability for creative projects, and value. It highlights Midjourney as the best value for professionals and recommends DALL-E 2 for high-quality, customizable art.

Is ChatGPT 4 O available?

Mar 28, 2025 pm 05:29 PM

Is ChatGPT 4 O available?

Mar 28, 2025 pm 05:29 PM

ChatGPT 4 is currently available and widely used, demonstrating significant improvements in understanding context and generating coherent responses compared to its predecessors like ChatGPT 3.5. Future developments may include more personalized interactions and real-time data processing capabilities, further enhancing its potential for various applications.

Best AI Chatbots Compared (ChatGPT, Gemini, Claude & More)

Apr 02, 2025 pm 06:09 PM

Best AI Chatbots Compared (ChatGPT, Gemini, Claude & More)

Apr 02, 2025 pm 06:09 PM

The article compares top AI chatbots like ChatGPT, Gemini, and Claude, focusing on their unique features, customization options, and performance in natural language processing and reliability.

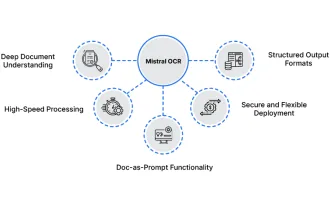

How to Use Mistral OCR for Your Next RAG Model

Mar 21, 2025 am 11:11 AM

How to Use Mistral OCR for Your Next RAG Model

Mar 21, 2025 am 11:11 AM

Mistral OCR: Revolutionizing Retrieval-Augmented Generation with Multimodal Document Understanding Retrieval-Augmented Generation (RAG) systems have significantly advanced AI capabilities, enabling access to vast data stores for more informed respons

Top AI Writing Assistants to Boost Your Content Creation

Apr 02, 2025 pm 06:11 PM

Top AI Writing Assistants to Boost Your Content Creation

Apr 02, 2025 pm 06:11 PM

The article discusses top AI writing assistants like Grammarly, Jasper, Copy.ai, Writesonic, and Rytr, focusing on their unique features for content creation. It argues that Jasper excels in SEO optimization, while AI tools help maintain tone consist