Technology peripherals

Technology peripherals

AI

AI

Robot company raised 1.5 billion in 8 years, backed by SoftBank, is there a 'bubble' in the IPO of Jieka to expand production tenfold?

Robot company raised 1.5 billion in 8 years, backed by SoftBank, is there a 'bubble' in the IPO of Jieka to expand production tenfold?

Robot company raised 1.5 billion in 8 years, backed by SoftBank, is there a 'bubble' in the IPO of Jieka to expand production tenfold?

Is it reliable to burn money to grab the market?

Author | Yu Wei

Editor丨Li Baiyu

Source | Yema Finance

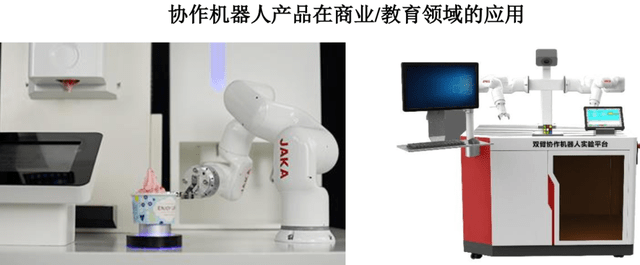

Collaborative robots are increasingly used in mechanical work such as polishing, assembly, transportation, and sorting.

As a new branch developed from the field of industrial robots, collaborative robots are characterized by their ability to interact at close range with humans in a common work space. The most common collaborative robot is the "robotic arm" in industrial production.

As the aging of the domestic population intensifies and the birth rate decreases, the domestic working-age labor force decreases, the manufacturing industry recruits difficulties, and labor costs increase. Collaborative robot products can help companies reduce costs and increase efficiency.

According to statistics from the Advanced Industrial Research Institute (GGII), The unit time cost of collaborative robots in 2021 is only about 6.59 yuan/hour, while labor costs have risen to 37.88 yuan/hour, which is nearly 6 times the former. With the reduction of collaborative robot manufacturing costs and the increase in labor costs caused by the aging workforce in the future, the unit cost difference between the two will continue to expand.

Therefore, many companies have begun to invest in the collaborative robot business, and this field has also been sought after by capital. Since 2020 alone, there have been more than 20 investment and financing events exceeding 100 million yuan.

With the need for capital exit and the fierce competition for market share among collaborative robot companies, many companies in the industry have begun to set their sights on the secondary market, and Jieka Shares is one of them.

Recently, Jieka Co., Ltd. submitted a "Prospectus" on the Science and Technology Innovation Board. Can this collaborative robot manufacturer, which is optimistic about more than ten investment institutions at the same time, win the favor of the secondary market?

Loss of 25 million in 3 years, IPO expansion of production 10 times

Jieka Co., Ltd. is mainly engaged in the research and development, production and sales of collaborative robot products, and is engaged in the robot system integration business including integrated equipment and automated production lines.

Its products are mainly used in intelligent manufacturing fields such as auto parts, 3C electronics, semiconductors, precision manufacturing, new energy, etc., as well as consumer service fields such as retail, logistics, education, and medical care. Customers served include Toyota, Dongshan Precision, CRRC, Xingyu Corporation, Luxshare Precision, Schneider, Flextronics and other companies.

Source: Jieka Shares "Prospectus"

Since the domestic industrial robot market started late compared with manufacturing powers such as Germany, Japan, and the United States, only began to accelerate the process of independence in 2013. Therefore, each company has invested in early R&D costs. All are relatively high. This is especially true for Jieka shares.

Research and development is a money-burning matter. The "Prospectus" shows that from 2020 to 2022 (hereinafter referred to as the "reporting period"), the research and development expenses of Jieka Shares were 18.0149 million yuan, 26.852 million yuan, and 47.5092 million yuan respectively. , R&D expense rates are 37.31%, 15.27%, and 16.92% respectively.The average R&D expense rates of comparable companies in the same industry during the same period were 6.57%, 6.67%, and 2.61% respectively.

Zhang Bing, who has been paying attention to the collaborative robot industry for a long time, once told "Bullet Finance" that the annual salary of a relatively mature collaborative robot algorithm engineer in an enterprise needs to be at least 500,000 yuan/year. Jieka's R&D expenditures also mainly come from employee salaries, accounting for more than 70%.

Long-term high investment in R&D is also intuitively reflected in patent results. As of March 31, 2023, Jieka has obtained 39 authorized invention patents, 107 utility model patents, and 39 software copyrights.

However, the operating income of the card-saving robot during the reporting period was only 48 million yuan, 176 million yuan and 281 million yuan.

The net profits were -23.9578 million yuan, -7.2331 million yuan, 5.7357 million yuan respectively, 3 Annual loss is 25 million yuan.

If the impact of exchange gains and losses is excluded, the net profit of Jieka Shares will continue to be negative, which are -26.0736 million yuan, -18.2744 million yuan, and -29.9219 million yuan respectively.In addition to poor profits, the cash flow generated by Jieka's

operating activities during the reporting period also showed continuous net outflows, which were -42.3878 million yuan, -35.5942 million yuan and -105 million yuan during the reporting period. , with a net outflow of 183 million yuan in three years.

Jieka Shares mentioned in the "Prospectus" that if the company's negative net cash flow from operating activities in the future cannot be effectively improved, the company will face certain risks in capital turnover, which will then affect production and operation. adversely affect performance.

Therefore, choosing to go public to raise funds now is also an important move for Jieka Shares to transfer capital risks.

But it is worth noting that Jieka shares plan to go public to raise 750 million yuan, of which 420 million yuan will be used to expand the annual production capacity of 50,000 sets of intelligent robots. However, the company’s collaborative robot production capacity in 2022 There are only 5,000 units, and the production and sales rate is 78.44%. How to digest the 10-fold expansion of production?

Jiang Han, a senior researcher at Pangu Think Tank, said that intelligent robots are a market with broad prospects, but the current demand is still relatively limited. For Jieka shares, the pressure is actually huge. Raising capital to expand production may be due to its own market direction and demand, but whether it can truly realize these needs, truly generate sales, and even generate profits, this is the biggest problem facing Jieka Shares.

Shen Meng, director of Chanson Capital, believes that corporate IPOs to expand production capacity have become a fixed routine and have nothing to do with actual market digestion and business expansion capabilities. This is not only the inertial thinking of A-shares on the purpose of fundraising in the past, but also corporate blindness. Optimism is a possible reason for the formation of production capacity bubbles.

Financing 1.5 billion in 8 years

Although Jieka Shares is still actively seeking new financing channels, in fact, the company has received the favor of capital only one year after its establishment, and it is not short of money from a financing perspective.

In October 2015, Hejun Capital entered the market with 15 million yuan; in March 2018, Fangguang Capital invested 60 million yuan in the A-round financing process. Fangguang Capital was composed of the former rotating CEO of Huawei and the former Co-founded by Fidelity Asia partners in China, it focuses on finding and cultivating world-class companies in the upstream and downstream of the IT industry chain, and mainly invests in technology companies that are experiencing explosive growth.

After Fangguang Capital, many star institutions began to invest in Jieka Shares. For example, in April 2019, Jieka Shares received 100 million yuan in Series B financing, led by SAIF Investment Fund, followed by Huaxing Capital. .

SAIF Investment Fund, formerly known as SoftBank Asia Infrastructure Investment Fund/SoftBank SAIF, is a leading private equity company that provides financial support to high-growth companies in the Asia-Pacific region. Its investment cases include 58.com , Peking University Qianfang, Huiyuan, etc.

With the entry of SoftBank, Jieka Shares has received no less than 1.3 billion yuan in financing between 2021 and 2022. Investment institutions include CPE Yuanfeng, SDIC Investment, Temasek Temasek, and SoftBank Vision Fund , Prosperity7 Ventures, Danming Capital and many other well-known investment institutions.

Source: IT Orange

Upon completion of the last round of financing before the IPO, Jieka shares were valued at RMB 3.5 billion.

From packaging sales to robot boss

The establishment of Jieka Co., Ltd. just caught up with the trend of accelerating the process of autonomy in the domestic industrial robot market.

The founder Li Mingyang was born in 1981 and has a bachelor's degree. After graduating from university, he first worked as an engineer at Shanghai Ziquan Beverage Industry Co., Ltd., and then moved to Tetra Pak as a sales manager. I have never worked in robotics-related fields in my past experience.

When Li Mingyang was working in sales at a packaging company, he discovered that each production line needed to be equipped with many workers working in second or third shifts to do mechanical work. Day after day, there were fewer and fewer young people on the production line.

He was keenly aware of the market demand, so in July 2014, Li Mingyang and a group of engineers founded Jieka Shares. Starting from a pain point on the user side, they studied how to make robots collaborate with people.

Li Mingyang believes that the integration, interconnection and interaction of robots, people and the environment is definitely a general direction. Currently, collaborative robots are developing in this direction, but they are still in the early stages and will still be Continue to make progress in this area. There may be more robots than people in the future, and robots will be everywhere in the future.

Riding on the booming development of China's robot industry, Jieka Co., Ltd. has quickly grown into a leading brand in the field of collaborative robots. 2,267 units were sold in 2021, with a global market share of approximately 6%.

However, since the development of collaborative robots is still in its early stages, the formulation of many rules and standards is immature. During the reporting period, Jieka Co., Ltd. had a contract dispute with Inner Mongolia Grassland Red Sun Food Co., Ltd. The main reason was that after Jieka Co., Ltd. completed product delivery, the front-end equipment purchased by Red Sun could not match the Jieka Co., Ltd. automated production line. As a result, some production lines were unable to operate normally during the installation and commissioning phase. Therefore, Red Sun sued the court to request returns, refunds, etc. The second instance of the case is still pending.

In addition, Jieka Co., Ltd. also has similar contract disputes with Xinjiang Western Tianshan Dairy Co., Ltd.

Li Mingyang once lamented to the media, "When we follow the transformation and development of Made in China, we will step into a gold industry for the next few decades or longer."

Now that Jieka Shares has reached the critical period of IPO, can Li Mingyang lead the company to successfully enter the capital market? If you are optimistic about the future development of collaborative robots, let’s chat in the comment area.

The above is the detailed content of Robot company raised 1.5 billion in 8 years, backed by SoftBank, is there a 'bubble' in the IPO of Jieka to expand production tenfold?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

The second generation Ameca is here! He can communicate with the audience fluently, his facial expressions are more realistic, and he can speak dozens of languages.

Mar 04, 2024 am 09:10 AM

The second generation Ameca is here! He can communicate with the audience fluently, his facial expressions are more realistic, and he can speak dozens of languages.

Mar 04, 2024 am 09:10 AM

The humanoid robot Ameca has been upgraded to the second generation! Recently, at the World Mobile Communications Conference MWC2024, the world's most advanced robot Ameca appeared again. Around the venue, Ameca attracted a large number of spectators. With the blessing of GPT-4, Ameca can respond to various problems in real time. "Let's have a dance." When asked if she had emotions, Ameca responded with a series of facial expressions that looked very lifelike. Just a few days ago, EngineeredArts, the British robotics company behind Ameca, just demonstrated the team’s latest development results. In the video, the robot Ameca has visual capabilities and can see and describe the entire room and specific objects. The most amazing thing is that she can also

How can AI make robots more autonomous and adaptable?

Jun 03, 2024 pm 07:18 PM

How can AI make robots more autonomous and adaptable?

Jun 03, 2024 pm 07:18 PM

In the field of industrial automation technology, there are two recent hot spots that are difficult to ignore: artificial intelligence (AI) and Nvidia. Don’t change the meaning of the original content, fine-tune the content, rewrite the content, don’t continue: “Not only that, the two are closely related, because Nvidia is expanding beyond just its original graphics processing units (GPUs). The technology extends to the field of digital twins and is closely connected to emerging AI technologies. "Recently, NVIDIA has reached cooperation with many industrial companies, including leading industrial automation companies such as Aveva, Rockwell Automation, Siemens and Schneider Electric, as well as Teradyne Robotics and its MiR and Universal Robots companies. Recently,Nvidiahascoll

After 2 months, the humanoid robot Walker S can fold clothes

Apr 03, 2024 am 08:01 AM

After 2 months, the humanoid robot Walker S can fold clothes

Apr 03, 2024 am 08:01 AM

Editor of Machine Power Report: Wu Xin The domestic version of the humanoid robot + large model team completed the operation task of complex flexible materials such as folding clothes for the first time. With the unveiling of Figure01, which integrates OpenAI's multi-modal large model, the related progress of domestic peers has been attracting attention. Just yesterday, UBTECH, China's "number one humanoid robot stock", released the first demo of the humanoid robot WalkerS that is deeply integrated with Baidu Wenxin's large model, showing some interesting new features. Now, WalkerS, blessed by Baidu Wenxin’s large model capabilities, looks like this. Like Figure01, WalkerS does not move around, but stands behind a desk to complete a series of tasks. It can follow human commands and fold clothes

The first robot to autonomously complete human tasks appears, with five fingers that are flexible and fast, and large models support virtual space training

Mar 11, 2024 pm 12:10 PM

The first robot to autonomously complete human tasks appears, with five fingers that are flexible and fast, and large models support virtual space training

Mar 11, 2024 pm 12:10 PM

This week, FigureAI, a robotics company invested by OpenAI, Microsoft, Bezos, and Nvidia, announced that it has received nearly $700 million in financing and plans to develop a humanoid robot that can walk independently within the next year. And Tesla’s Optimus Prime has repeatedly received good news. No one doubts that this year will be the year when humanoid robots explode. SanctuaryAI, a Canadian-based robotics company, recently released a new humanoid robot, Phoenix. Officials claim that it can complete many tasks autonomously at the same speed as humans. Pheonix, the world's first robot that can autonomously complete tasks at human speeds, can gently grab, move and elegantly place each object to its left and right sides. It can autonomously identify objects

Cloud Whale Xiaoyao 001 sweeping and mopping robot has a 'brain'! | Experience

Apr 26, 2024 pm 04:22 PM

Cloud Whale Xiaoyao 001 sweeping and mopping robot has a 'brain'! | Experience

Apr 26, 2024 pm 04:22 PM

Sweeping and mopping robots are one of the most popular smart home appliances among consumers in recent years. The convenience of operation it brings, or even the need for no operation, allows lazy people to free their hands, allowing consumers to "liberate" from daily housework and spend more time on the things they like. Improved quality of life in disguised form. Riding on this craze, almost all home appliance brands on the market are making their own sweeping and mopping robots, making the entire sweeping and mopping robot market very lively. However, the rapid expansion of the market will inevitably bring about a hidden danger: many manufacturers will use the tactics of sea of machines to quickly occupy more market share, resulting in many new products without any upgrade points. It is also said that they are "matryoshka" models. Not an exaggeration. However, not all sweeping and mopping robots are

The humanoid robot can do magic, let the Spring Festival Gala program team find out more

Feb 04, 2024 am 09:03 AM

The humanoid robot can do magic, let the Spring Festival Gala program team find out more

Feb 04, 2024 am 09:03 AM

In the blink of an eye, robots have learned to do magic? It was seen that it first picked up the water spoon on the table and proved to the audience that there was nothing in it... Then it put the egg-like object in its hand, then put the water spoon back on the table and started to "cast a spell"... …Just when it picked up the water spoon again, a miracle happened. The egg that was originally put in disappeared, and the thing that jumped out turned into a basketball... Let’s look at the continuous actions again: △ This animation shows a set of actions at 2x speed, and it flows smoothly. Only by watching the video repeatedly at 0.5x speed can it be understood. Finally, I discovered the clues: if my hand speed were faster, I might be able to hide it from the enemy. Some netizens lamented that the robot’s magic skills were even higher than their own: Mag was the one who performed this magic for us.

Ten humanoid robots shaping the future

Mar 22, 2024 pm 08:51 PM

Ten humanoid robots shaping the future

Mar 22, 2024 pm 08:51 PM

The following 10 humanoid robots are shaping our future: 1. ASIMO: Developed by Honda, ASIMO is one of the most well-known humanoid robots. Standing 4 feet tall and weighing 119 pounds, ASIMO is equipped with advanced sensors and artificial intelligence capabilities that allow it to navigate complex environments and interact with humans. ASIMO's versatility makes it suitable for a variety of tasks, from assisting people with disabilities to delivering presentations at events. 2. Pepper: Created by Softbank Robotics, Pepper aims to be a social companion for humans. With its expressive face and ability to recognize emotions, Pepper can participate in conversations, help in retail settings, and even provide educational support. Pepper's

Is robotic IoT the future of manufacturing?

Mar 01, 2024 pm 06:10 PM

Is robotic IoT the future of manufacturing?

Mar 01, 2024 pm 06:10 PM

Robotic IoT is an emerging development that promises to bring together two valuable technologies: industrial robots and IoT sensors. Will the Internet of Robotic Things become mainstream in manufacturing? What is the Internet of Robotic Things? The Internet of Robotic Things (IoRT) is a form of network that connects robots to the Internet. These robots use IoT sensors to collect data and interpret their surroundings. They are often combined with various technologies such as artificial intelligence and cloud computing to speed up data processing and optimize resource utilization. The development of IoRT enables robots to sense and respond to environmental changes more intelligently, bringing more efficient solutions to various industries. By integrating with IoT technology, IoRT can not only realize autonomous operation and self-learning, but also