Technology peripherals

Technology peripherals

It Industry

It Industry

Xiaomi financial report announced: Lu Weibing emphasized that his determination to build cores will not waver

Xiaomi financial report announced: Lu Weibing emphasized that his determination to build cores will not waver

Xiaomi financial report announced: Lu Weibing emphasized that his determination to build cores will not waver

According to news on May 25, Xiaomi announced its financial report for the first quarter of 2023 today. At the financial report communication meeting, it expressed regret for the closure of its chip business by its friend OPPO, and at the same time conveyed Xiaomi’s determination in the chip business. Put in determination.

According to the editor’s understanding, at the financial report communication meeting, Xiaomi President Lu Weibing said that the closure of the chip business by friend OPPO has had a great impact on the entire industry, which is regrettable. He emphasized that manufacturing chips is a very difficult task and every brave attempt should be respected.

Lu Weibing said that Xiaomi has been attaching great importance to this field since it began to develop its own chip business in 2014. Although the process has not been smooth sailing, Xiaomi's determination to invest in chips has never wavered. The power chips and ISP chips launched by Xiaomi have played an important role in supporting the mobile phone terminal business.

Our board of directors and management have jointly made an important decision to invest unswervingly in the chip field. We are fully aware of the difficulty, long-term and complexity of chip investment. In the future, we must respect the laws of chips, not be eager for quick success, and be prepared for a long-term battle. We must not treat it as a 100-meter race, but a marathon. "Lu Weibing said.

Xiaomi's core goal is to improve terminal competitiveness and user experience. Lu Weibing emphasized the need to make this clear. He said that Xiaomi will continue to invest in the chip field.

Finally , Lu Weibing called on everyone to give more encouragement and tolerance to the core-making business. There will not only be applause, but also failures and setbacks.

According to the editor’s understanding, after OPPO closed its chip business, Xiaomi’s chip company. Xuan Jie held an internal mobilization meeting, with the main purpose of stabilizing morale. Xiaomi has a firm determination for the core manufacturing business and has a clear plan for this matter. Now, Xiaomi is conducting normal recruitment work and plans to leave soon. Look for potential talents among Zheku's employees

.The above is the detailed content of Xiaomi financial report announced: Lu Weibing emphasized that his determination to build cores will not waver. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1390

1390

52

52

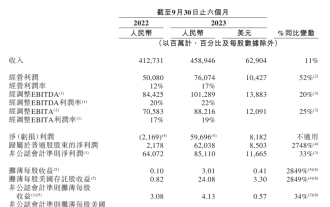

Alibaba's semi-annual financial report for fiscal year 2024 shows that revenue reached 458.946 billion yuan, a year-on-year increase of 11%, and net profit attributable to the parent company increased by 2748% year-on-year.

Jan 04, 2024 pm 06:44 PM

Alibaba's semi-annual financial report for fiscal year 2024 shows that revenue reached 458.946 billion yuan, a year-on-year increase of 11%, and net profit attributable to the parent company increased by 2748% year-on-year.

Jan 04, 2024 pm 06:44 PM

According to news from this site on December 23, Alibaba announced its interim report for fiscal year 2024 (six months ending September 30, 2023), achieving revenue of 458.946 billion yuan, a year-on-year increase of 11%; operating profit of 76.074 billion yuan, a year-on-year increase of 52% %; net profit attributable to parent companies was 62.038 billion yuan, a year-on-year increase of 2748%; diluted earnings per share was 3.01 yuan, a year-on-year increase of 2849%. This site noticed that Taotian Group’s revenue increased by 8% year-on-year. Alibaba International Digital Business Group's overseas business performed strongly, with revenue increasing by 47%. Cainiao Group's revenue increased 29%. Local Living Group's revenue increased 22%. Dawen Entertainment Group's revenue increased 21% for the six-month period ended September 30, 2023, Cainiao

Galaxy Digital reports $296 million in net profit in 2023, after losing $1 billion the year before

Apr 01, 2024 pm 06:55 PM

Galaxy Digital reports $296 million in net profit in 2023, after losing $1 billion the year before

Apr 01, 2024 pm 06:55 PM

As of the end of February this year, Galaxy Digital’s assets under management (AUM) surged to $10.1 billion. The recently released financial statements of Galaxy Digital, a digital asset financial services company owned by Mike Novogratz, show that it achieved a net profit of US$29.6 million for the entire year. This is a significant turnaround after losing $1 billion in 2022. The company said that the fourth quarter of 2023 is particularly turning point for the company. In its official statement, Galaxy Digital said there was a positive change in fortunes in the last quarter of 2023, pushing its net profit to $302 million. This coincides with the much-needed rebound the crypto market has experienced, emerging from a prolonged crypto slump.

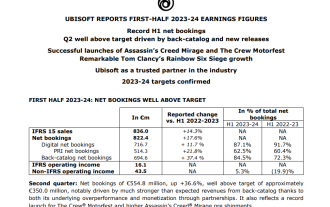

Ubisoft's net bookings in the first half of the year were 822.4 million euros, a year-on-year increase of 17.6%, with 'Rainbow Six: Siege' being the best

Oct 27, 2023 pm 06:49 PM

Ubisoft's net bookings in the first half of the year were 822.4 million euros, a year-on-year increase of 17.6%, with 'Rainbow Six: Siege' being the best

Oct 27, 2023 pm 06:49 PM

According to news from this site on October 27, Ubisoft announced its results for the first half of the 2023-2024 fiscal year (March-September), with operating income of 16.1 million euros (notes from this site: currently about 124 million yuan), compared with 2.15 in the first half of last year billion euros; cumulative revenue reached 836 million euros, a year-on-year increase of 14%; net bookings in the first half of the year reached 822.4 million euros, a significant increase of 17.6% over the previous year. Net bookings in the second quarter were 554.8 million euros (currently approximately 4.283 billion yuan), an increase of 36.6%, much higher than the target of approximately 350 million euros. Ubisoft's revenue growth was partly due to the launch of racing simulation game The Crew: The Crew in September and pre-shipments of Assassin's Creed Phantoms in early October. "rainbow

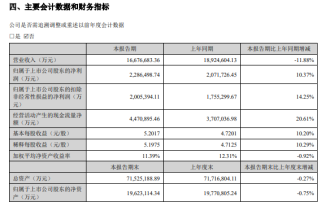

CATL's net profit in the first half of 2024 was 22.865 billion yuan, a year-on-year increase of 10.37%

Jul 27, 2024 am 11:41 AM

CATL's net profit in the first half of 2024 was 22.865 billion yuan, a year-on-year increase of 10.37%

Jul 27, 2024 am 11:41 AM

According to news from this website on July 26, CATL released its 2024 semi-annual report: revenue in the first half of this year was 166.77 billion yuan, a year-on-year decrease of 11.88%; net profit attributable to the parent company in the first half of the year was 22.865 billion yuan, a year-on-year increase of 10.37%. 1. Market share: CATL’s global market share of power battery usage from January to May 2024 was 37.5%, an increase of 2.3 percentage points from the same period last year, and continues to rank first in the world. Energy storage field: CATL has ranked first in the world in terms of energy storage battery shipments for three consecutive years. R&D investment: CATL’s R&D investment in the first half of this year reached 8.592 billion yuan, a year-on-year decrease of 12.77%. In terms of products or services, the gross profit margin of CATL's power battery system in the first half of the year reached 26.90%, an increase of 6.9% compared with the same period last year.

Anker Innovation: Revenue in the first half of the year was 7.066 billion yuan, a year-on-year increase of 20.01%, and net profit increased by 42.3% year-on-year

Sep 12, 2023 pm 01:45 PM

Anker Innovation: Revenue in the first half of the year was 7.066 billion yuan, a year-on-year increase of 20.01%, and net profit increased by 42.3% year-on-year

Sep 12, 2023 pm 01:45 PM

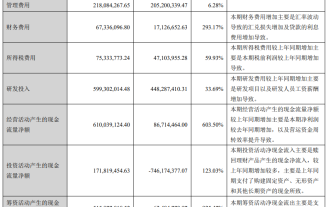

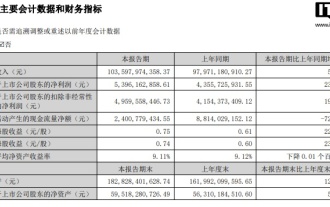

According to news from this site on September 5, Anker Innovation recently announced its 2023 semi-annual report. In the first half of the year, it achieved total operating income of 7.066 billion yuan, a year-on-year increase of 20.01%; it achieved a net profit attributable to shareholders of listed companies of 820 million yuan, a year-on-year increase of 42.33%. . In terms of product categories, the charging category achieved revenue of 3.483 billion yuan, a year-on-year revenue increase of 18.29%, accounting for 49.30% of the total revenue; the intelligent innovation category achieved revenue of 1.946 billion yuan, a year-on-year revenue increase of 16.66%, accounting for 27.54% of the total revenue. ; Wireless audio category achieved revenue of 1.563 billion yuan, with revenue increasing 29.11% year-on-year, accounting for 22.12% of total revenue. This site learned from the report that Anker’s R&D investment reached 599 million yuan, a year-on-year increase of 33.

Luxshare Precision's net profit in the first half of 2024 was 5.396 billion yuan, a year-on-year increase of 23.89%

Aug 24, 2024 am 12:00 AM

Luxshare Precision's net profit in the first half of 2024 was 5.396 billion yuan, a year-on-year increase of 23.89%

Aug 24, 2024 am 12:00 AM

According to news from this site on August 23, Luxshare Precision has just released its latest 2024 semi-annual report. The highlights of this site are as follows: revenue of 103.598 billion yuan, a year-on-year increase of 5.74%, increased corporate mergers and increased product shipments. Net profit attributable to the parent company was 5.396 billion yuan, a year-on-year increase of 23.89%; basic earnings per share was 0.75 yuan, a year-on-year increase of 22.95%; R&D investment was 4.220 billion yuan, a year-on-year increase of 13.24%; in addition to fenye, Luxshare Precision also released its third According to the quarterly performance forecast, the third quarter net profit is expected to be 3.453 billion-3.822 billion yuan, a year-on-year increase of 14.39%-26.61%.

Nvidia expects its Q2 financial report to be released on August 23-24, with year-on-year growth expected to exceed 50%.

Aug 23, 2023 pm 02:21 PM

Nvidia expects its Q2 financial report to be released on August 23-24, with year-on-year growth expected to exceed 50%.

Aug 23, 2023 pm 02:21 PM

According to news from this website on August 20, according to Taiwan media Economic Daily reported early this morning, Nvidia will announce its Q2 financial report for the 2024 fiscal year on August 23, US time (between August 23 and August 24, Beijing time). According to the report, the outside world expects the company's financial report to "further verify the substantial benefits brought by AI" and learn a clear long-term outlook. As a reference, Nvidia's total revenue in Q1 of the 2024 fiscal year is US$7.19 billion (notes from this site: Currently about 52.487 billion yuan), a year-on-year decrease of 13%, but an increase of 19% compared with the previous quarter. Its data center-related performance showed double-digit growth year-on-year and month-on-month. Nvidia predicts that Q2 performance in fiscal year 2024 will exceed

BOSS direct employment: Revenue in the first half of the year reached 2.765 billion yuan, a year-on-year increase of 22.9%

Sep 12, 2023 pm 10:05 PM

BOSS direct employment: Revenue in the first half of the year reached 2.765 billion yuan, a year-on-year increase of 22.9%

Sep 12, 2023 pm 10:05 PM

According to news from this website on August 29, BOSS Zhipin released the interim results announcement for the six months ended June 30, 2023. In the first half of the year, operating income was 2.765 billion yuan, a year-on-year increase of 22.9%; operating profit was 97.73 million yuan, a year-on-year increase. 33.8%; pre-tax profit was 384 million yuan, a year-on-year increase of 306.3%; net profit was 342 million yuan, a year-on-year increase of 326.1%; adjusted net profit was 813 million yuan, a year-on-year increase of 123.9%. This site noticed that the average monthly active users in the first half of the year reached 41.7 million, a year-on-year increase of 61%. At the same time, the average daily active users in the first half of the year accounted for 26.8% of the monthly active users, which is basically consistent with the first half of 2022. BOSS Direct Recruitment’s marketing expenses in the first half of the year were 1