This article is based on public information and is for information exchange only and does not constitute any investment advice.

Produced|Company Research Office IPO Team

文|大you

Recently, Jieka Robot Co., Ltd. (hereinafter referred to as "Jieka Robot") disclosed its prospectus, and the company plans to be listed on the Science and Technology Innovation Board.

In this IPO, Jieka Robot plans to raise 750 million, which will be used for annual production of 50,000 sets of intelligent robot projects, R&D center construction projects and supplementary working capital.

Is it necessary for a company with annual sales of less than 5,000 robots to expand its production capacity 10 times?

01. Obtained investment from SoftBank with a pre-IPO valuation of 3.5 billion yuan

Jieka Robot was founded in 2014 and was co-founded by Li Mingyang, Wang Jiapeng, Sheng Xinjun and others.

Before founding Jieka, Li Mingyang had no experience in the research and development, production and sales of robots. Before that, he had worked as an engineer in a beverage industry company and as a sales manager at Tetra Pak Packaging Company for many years.

Li Mingyang once talked about entrepreneurial opportunities in an interview. He said that although the milk processing link has achieved highly automated production, the packaging process of high-end dairy gift boxes is still dominated by human labor. Implementing intelligent production for packaging can solve the problem of labor shortage and reduce labor costs.

To this end, he approached Tetra Pak colleague Wang Jiapeng to start a business together.

However, the key to the success of the card-saving robot is that Li Mingyang found a group of professors from Shanghai Jiao Tong University and settled in the Shanghai Jiao Tong University Entrepreneurship Incubator in the year of its establishment.

In 1985, Shanghai Jiao Tong University established the Shanghai Jiao Tong University Robotics Research Institute, which is one of the earliest professional institutions engaged in the research and development of robot technology in my country. In addition to card-saving robots, Shanghai Jiao Tong University's companies in the field of robots also include Cloud Whale sweeping robot, "the first company in vascular interventional surgery robots" Runmed, minimally invasive robots and other companies.

The Jiaotong University scholar Li Mingyang found is Sheng Xinjun, who is currently the deputy dean of the School of Mechanical and Power Engineering of Shanghai Jiaotong University, the deputy dean of the Yuanzhi Robotics Research Institute of Shanghai Jiaotong University, and the founding partner of Jieka Robot.

Since its establishment, Card Saving Robot has completed six rounds of financing, with a cumulative financing amount exceeding 1.4 billion. In July 2022, the card-saving robot Pre-IPO round of financing was 1 billion yuan, jointly led by Temasek, SoftBank Vision Fund Phase II and other institutions, with a post-investment valuation of approximately 3.5 billion yuan.

Before the IPO, founder Li Mingyang directly held 5.98% of the shares, indirectly held 35.65% of the voting rights, and held a total of 41.63% of the voting rights. He served as the chairman of the company and was the actual controller; Sheng Xinjun indirectly held 1.62% of the card-saving robot; Four foreign shareholders, including SoftBank Vision Fund, SPRINGLEAF, TRUE LIGHT, and AVIL, hold 7.97%, 6.38%, 1.59%, and 1.06% of the shares respectively.

02. Turn losses into profits and make a profit of 44,000 yuan in 2022

The main business of Jieka Robotics involves both collaborative robot assembly and robot system integration, including integrated equipment and automated production lines.. Among them, collaborative robots are mainly used in automobiles, electronics, precision parts and other fields. Multinational automobile suppliers Jinhe Group, CRRC, Luxshare Precision, Dongshan Precision, etc. have been the company's top five customers in recent years.

From 2020 to 2022, the revenue of card-saving robots was 48 million, 175 million and 281 million respectively, with a compound annual growth rate of 142% for three consecutive years.

Among them, the revenue of robots is 39 million, 141 million, and 216 million respectively, accounting for 81%, 80%, and 77% of the revenue respectively, which is the company's core business; the revenue of robot system integration is 70 million and 0.31 million respectively. billion and 59 million, accounting for 15%, 18% and 21% of revenue respectively.

Compared with peers, the gross profit margin of card-saving robots is higher than the industry average. From 2020 to 2022, the company's main business gross profit margins were 50.27%, 49.28% and 50.20% respectively, while the industry averages were 30.49%, 23.48% and 25.58% respectively.

However, due to the small scale of revenue, the proportion of card-saving robot R&D is much higher than that of its peers. From 2020 to 2022, the company's R&D expenses were 18 million, 27 million, and 48 million respectively, and the R&D expense rates were 37.31%, 15.27%, and 16.92% respectively, while the industry averages were only 6.57%, 6.67%, and 2.61% respectively.

In the past three years, the card-saving robot’s losses have narrowed year by year, and it will become profitable in 2022. From 2020 to 2022, the company's non-net profits were -26.1291 million, -18.4638 million and 44,000 respectively, with a cumulative loss of 44.5489 million in three years. Until the end of 2022, the undistributed profit of the card-saving robot is still negative 35.7147 million, and the accumulated losses have not been made up.

However, it should be noted that the company’s net operating cash outflow will increase significantly in 2022. From 2020 to 2022, the company's net cash flows from operating activities were -42.3878 million, -35.5942 million, and -104 million respectively, showing a continuous net outflow.

03. Is it reasonable and necessary to expand production capacity tenfold?

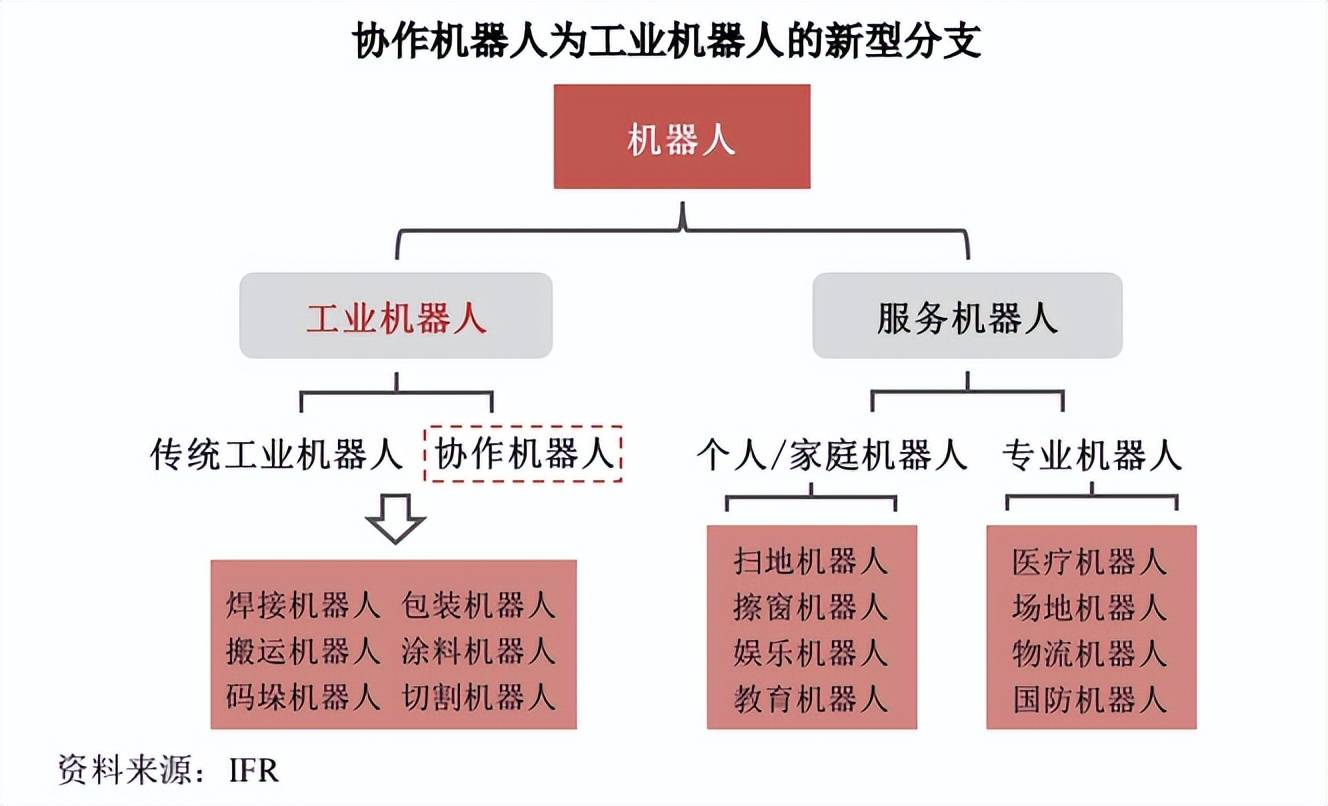

Jieka’s core business, collaborative robots, is a new branch of industrial robots. The market has grown rapidly in recent years, but overall, the collaborative robot market is relatively limited.

According to statistics from the International Federation of Robotics (IFR), the total global sales of collaborative robots was only 10,000 units in 2017, rising to 39,000 units in 2021. The "2022 China Collaborative Robot Technology Development Report" states that domestic collaborative robot sales will reach 15,300 units in 2021, a year-on-year increase of 45.7%, with sales exceeding 1.5 billion yuan.

From 2020 to 2022, the output of card-saving collaborative robots was 1,084 units, 2,871 units, and 4,563 units respectively, and the sales volume was 599 units, 2,267 units, and 3,579 units respectively. It is mentioned in the prospectus that Jieka Robot’s global collaborative robot market share is approximately 6%.

From 2020 to 2022, the production and sales rates of card-saving collaborative robots were 55%, 79%, and 78% respectively, and the production capacity utilization rates were 72%, 87%, and 91% respectively. There is still a surplus of production capacity, and it has not reached full capacity. Full production and sales status.

But what is strange is that in this IPO, Jieka Robot plans to invest 420 million yuan in funds raised into a project to produce 50,000 sets of intelligent robots per year, which is equivalent to the company's future production capacity expanding to 10 times the current sales volume.

According to the prediction of the Advanced Industrial Research Institute, global sales of collaborative robots will reach 80,000 units by 2023, with the market size approaching 12 billion yuan. Assuming that the market share increases to 10% in 2023, the annual sales volume of Jieka will still be less than 10,000 units.

If the downstream market growth or market development does not meet expectations, there will be a risk that the new production capacity cannot be digested in time. Whether it is reasonable and necessary to use 420 million yuan to expand the production capacity of card-saving robots remains to be discussed.

The above is the detailed content of The annual sales volume is less than 5,000 units. Is it reasonable and necessary to expand the production capacity of the card-saving robot ten times?. For more information, please follow other related articles on the PHP Chinese website!