As the world’s leader in AI computing power, Nvidia has benefited from the artificial intelligence boom and achieved unexpected growth in its latest fiscal quarter. Its market value is approaching the trillion-dollar mark. On May 29, Nvidia released a generative AI supercomputing platform and super chip. GH200 and other series of new artificial intelligence products are intended to redefine the new computing era.

Released supercomputing platform

On May 29, NVIDIA founder and CEO Jen-Hsun Huang launched a series of products at COMPUTEX 2023 in Taipei, including the large-memory generative AI supercomputing platform DGX GH200, which can accelerate generative AI design. The Grace Hopper super chip GH200 has been put into full production and a new accelerated Ethernet platform Spectrum-X has been launched.

“We are re-inventing computers, and accelerated computing and artificial intelligence signify that computing is being redefined.” Huang Renxun said.

Official website information shows that DGX GH200 is a new AI supercomputing platform that fully connects 256 NVIDIA Grace Hopper super chips to a single GPU. It supports trillion-parameter AI large model training and has 144TB of shared memory. Compared with The previous generation DGX A100 launched in 2020 has expanded its capacity nearly 500 times.

Huang Renxun introduced that DGX GH200 is easier to train large language models and deep learning recommendation systems without the need to store data in many modules.

In addition, Google Cloud, Meta and Microsoft will be the first companies to use DGX GH200, which is expected to be launched at the end of 2023 and used as the base for future ultra-large-scale generative AI infrastructure.

"We are now at the turning point of a new computing era. Accelerated computing and artificial intelligence have been accepted by almost all computing platforms and cloud service vendors in the world. NVIDIA's technology is being used by 40,000 large companies and 1.5 Used by tens of thousands of startups, Huang said.

As demand for the chips needed to train and deploy artificial intelligence software soars, Nvidia’s high-end H100 chip sells for more than $40,000. Both the most advanced A100 and the newer H100 are prohibited from being sold in China due to the U.S. ban. , and only provides downgraded versions of the A800 and H800 chips. In addition, Nvidia’s main competitor AMD launched a new AI training product MI300 in the first quarter of this year, and Intel also announced its Falcon Shores chipset plan.

Accelerate the implementation of the application

To support the application of ultra-large-scale generative AI, NVIDIA launched the acceleration network platform Spectrum-X, which can reduce the running time of large-scale generative AI models based on transformers. In addition, NVIDIA also launched Omniverse, an enterprise-level metaverse platform that combines AI with digital twins and is expected to promote the next stage of the artificial intelligence wave.During the keynote, Huang also demonstrated the use of Omniverse and generative AI APIs by electronics manufacturers including Foxconn, Innodisk, Pegatron, Quanta and Wistron to connect design and manufacturing tools, as well as NVIDIA Isaac Sim to simulate and test robots, and use the visual AI framework NVIDIA Metropolis for automated optical inspection. Jensen Huang announced the launch of the Isaac AMR platform to assist in the simulation, deployment and management of intelligent robot groups.

In addition, NVIDIA will provide customized AI model foundry service - Avatar Cloud Engine (ACE) for Games, which can develop AI models running on the cloud and PC. Developers can use the service to build and deploy personalized speech, conversation and animation artificial intelligence models in software and games.

When Huang Jen-Hsun delivered a speech at the graduation ceremony of National Taiwan University a few days ago, he said that we are currently at the beginning of a major technological era, just like personal computers, networks, mobile devices and the cloud. But AI is more fundamental because every level of computing has been reshaped.

A-share Nvidia concept stock changes

Nvidia’s performance is also being “reshaped” through artificial intelligence. On May 25, the company released its first quarter financial report for fiscal year 2024, which showed that the company achieved quarterly revenue of US$7.192 billion, a month-on-month increase of 19%, GAAP net profit of US$2.043 billion, a month-on-month increase of 44%, and a gross profit margin of 64.6%, of which, Data center quarterly revenue reached a record high of US$4.28 billion, and the development of generative AI accelerated, driving exponential growth in global computing demand. NVIDIA expects to achieve revenue of US$11 billion (plus or minus 2%) in the second fiscal quarter, continuing rapid growth.Stimulated by better-than-expected performance, NVIDIA’s stock price rose by more than 25% on May 25, with the latest closing market value approaching US$1 trillion; the A-share artificial intelligence sector was once boosted, and AI chips and computing power were boosted on May 29 Concepts and other stocks closed up, with Chiplet Concept leading the way with a 1.88% increase. Zhongfu Circuit and Tongfu Microelectronics hit their daily limit. In addition, many companies clarified their relationship with Nvidia.

Jin Baize recently issued a change announcement stating that the company has not supplied goods to NVIDIA and there is no related income; only some of the product solutions developed will require the purchase of NVIDIA-related products; NVIDIA's performance is not consistent with the company's performance. There is no direct relevant impact. On May 29, the company’s stock price reached its daily limit again.

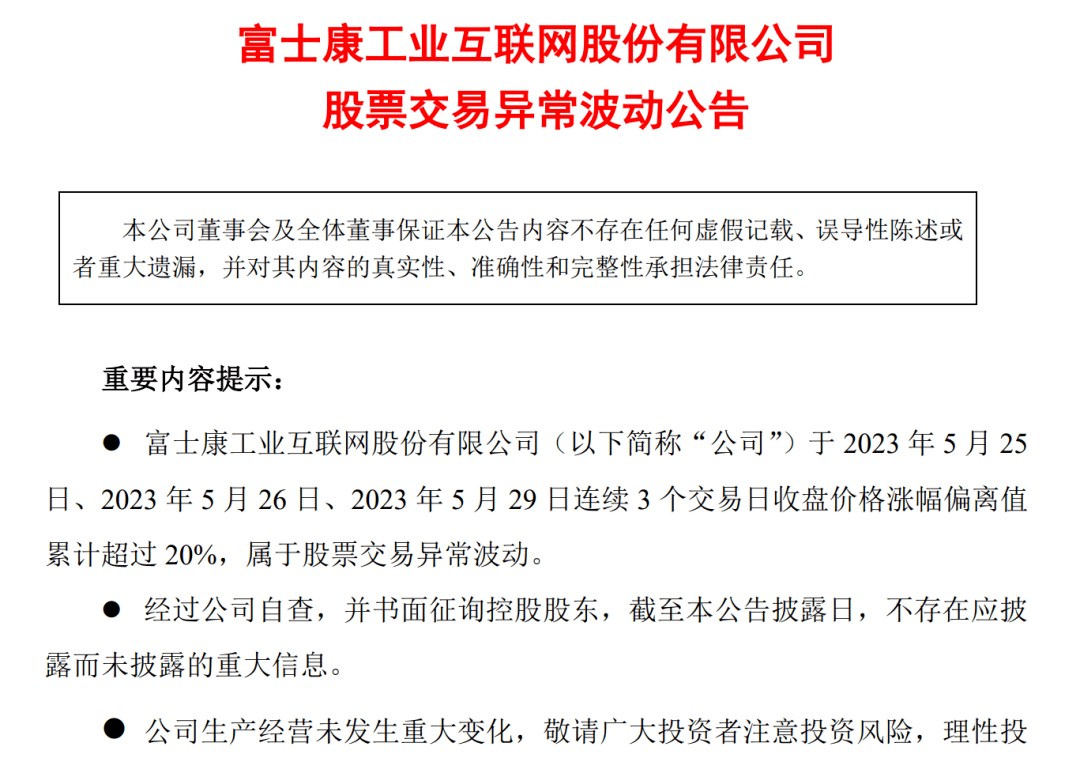

As Fii’s AI server foundry business has attracted much attention from the capital market, the company’s stock price has continued to rise. On May 29, Fii Industrial released a change announcement, stating that the company had no media reports or market rumors that would affect the company's stock trading price. Currently, production and operation activities are normal, and there have been no major changes in daily operations.

Companies such as Intel Technology and Shenzhen Huaqiang stated on the interactive platform that the company has not yet cooperated with Nvidia.

There are also listed companies introducing their cooperation with NVIDIA.

Yakang Shares stated on the investor interaction platform on May 29 that the company is a customer related to Nvidia products. According to reports, the company has indirect business relationships with NVIDIA both domestically and overseas, and the complete GPU machines purchased and sold by the company are all based on NVIDIA products.

Haitian Ruisheng recently stated on the interactive platform that the company currently purchases chips produced by multiple hardware manufacturers, including NVIDIA, for data storage and data production. In addition, China Electronics Port claims to be one of Nvidia's legally authorized distributors in China, while Bojie said it has cooperation orders with Nvidia, but the amount is small.

Editor: Zhang Qianyao

Proofreading: Yao Yuan

The above is the detailed content of Zoom in! The US$960 billion chip leader launches blockbuster new AI products, and A-share 'moments' clarify the 'ambiguous' relationship. For more information, please follow other related articles on the PHP Chinese website!