Technology peripherals

Technology peripherals

AI

AI

Apple MR will be released soon, taking stock of the VR industry chain

Apple MR will be released soon, taking stock of the VR industry chain

Apple MR will be released soon, taking stock of the VR industry chain

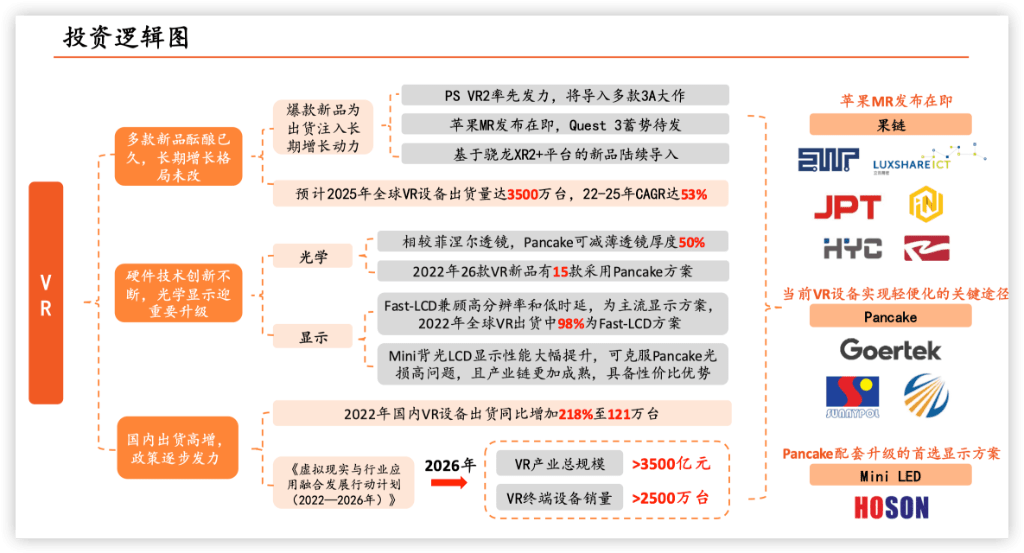

After experiencing a decline in shipments in 2022, the VR industry has finally ushered in a rare prosperity. At the WWDC conference in a week, Apple will release a blockbuster new MR headset that has been developed for seven years; just recently, the veteran giant Meta of the Metaverse has also frequently released news about its new product Quest3.

In a report released on May 26, Ping An Securities analyst Xu Yong and others pointed out that the release of a number of long-awaited new products will inject long-term growth momentum into VR equipment shipments. In the report, analysts conducted a detailed review of the entire VR industry chain.

The VR industry is in the recovery stage Meta and Pico dominate the foreign and domestic markets respectively

First of all, analysts pointed out that there are currently three categories of virtual (augmented) reality technology to which VR belongs:

1) Virtual Reality (VR) refers to computer-generated simulation of the real environment, allowing users to obtain an immersive experience;

2) Augmented Reality (AR) refers to the incorporation of computer-generated graphics on the basis of the real world to digitally enhance what we see;

3) Mixed Reality (MR), the integration of AR and VR, is to mix the real world and the virtual world together to create a new visual environment.

Due to technical limitations, most head-mounted display products currently on the market, such as Meta’s Quest and ByteDance’s Pico, are VR hardware. AR products are mainly used on the B-side and are relatively rare in the consumer market. There is almost no precedent in the market for MR headsets that combine AR and VR, and Apple is about to launch this product.

According to the degree of freedom of use, VR equipment can be divided into three types: mobile VR that needs to be connected to a mobile phone; split VR that needs to be connected to external computing power; and all-in-one VR with built-in CPU.

Since all-in-one VR is far better than the other two in terms of user experience, it currently dominates the VR hardware market. Quest 2, Pico 4, and the upcoming MR headset from Apple are all examples of all-in-one VR headsets.

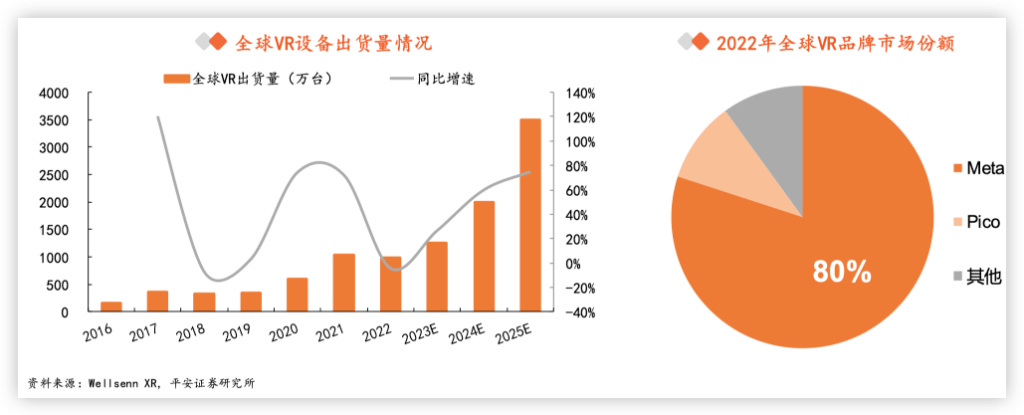

Analysts pointed out that with the improvement of VR equipment product capabilities, VR will usher in a recovery this year and is expected to experience explosive growth in 2025, with shipments reaching 35 million units by then. Meta and Pico, owned by Byte, dominate the global and domestic markets respectively:

Global VR shipments will increase to 35 million units in 2025. Global VR equipment shipments will reach 9.86 million units in 2022, -4% year-on-year, mainly due to the sluggish sales of Quest2, which increased its price by US$100, and the price of Meta's new product QuestPro, which is as high as US$1,500. Apple's two major new products, MR and Quest 3, are about to be released in 2023, but they are expected to go on sale in 23H2 and will have limited contribution to shipments in 2023. It is expected that from 2024, headsets of various brands based on Qualcomm XR2 will be launched together and once again drive the VR shipment boom.

Meta takes the lead in the global market share with a cliff-like lead. In 2022, Meta will have a global VR market share of 80% due to the excellent performance of Quest2, ranking first with an absolute lead, followed by Pico with a market share of 10%.

In 2022, domestic VR equipment shipments will reach 1.21 million units. In 2021, domestic VR equipment shipments will reach 380,000 units. In 2022, domestic VR equipment shipments will increase by 218% year-on-year, totaling 1.21 million units. Domestic VR equipment shipments are expected to increase to 8 million units by 2025. The compound annual growth rate from 2022 to 2025 is 87.7%.

Byte took over Pico, and its market share increased rapidly. Since Meta's VR products have not been sold in mainland China, the domestic market is mainly dominated by domestic brands. With ByteDance's acquisition of Pico, Pico's market share has been further increased. Pico's domestic market share will reach 66% in 2022, ranking first in the domestic market.

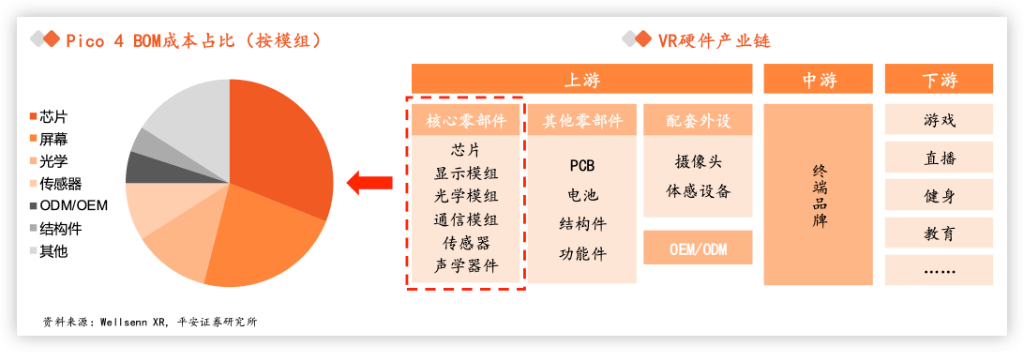

Core components account for 80% of hardware costs Pancake has gradually become a mainstream optical solution

In the VR hardware industry chain, the most critical ones are the chip, display and optical parts.

Analysts pointed out:

The core components of VR headsets are mainly divided into chips, display modules, optical modules, sensors, communication modules and acoustic devices. According to the WellsennXR disassembly Pico4 report, chips are the key cost of consumer VR equipment, accounting for About 31%, followed by display modules and optical modules, accounting for 23% and 12% respectively.

In the field of chips, there is currently a pattern in which Qualcomm dominates :

Qualcomm XR2 chip is the core XR chip at this stage. Currently, mainstream VR all-in-one machines such as Quest2 and Pico4 use Qualcomm XR2 chips. As the dominant computing chip for VR all-in-one machines in the price range of 2,000-4,000 yuan, the Qualcomm XR2 chip integrates the head 6Dof function and supports seven parallel cameras. See-through, 5G and other functions. In 2022, Qualcomm launched a new generation of XR2 chips. As an upgraded version of XR2, without sacrificing the appearance of the device, the battery life is increased by 50%, and the heat dissipation is increased by 30%. Domestic VR chips continue to be explored.

In 2017, Allwinner launched the VR9 chip, in 2020 Huawei HiSilicon laid out the XR chip, and in 2021 Rockchip released the RK3588 chip. Domestic chips have been tried, but due to multiple factors such as overseas technology restrictions and technology generation differences, , the overall effectiveness is still low, and it is still in the continuous exploration stage.

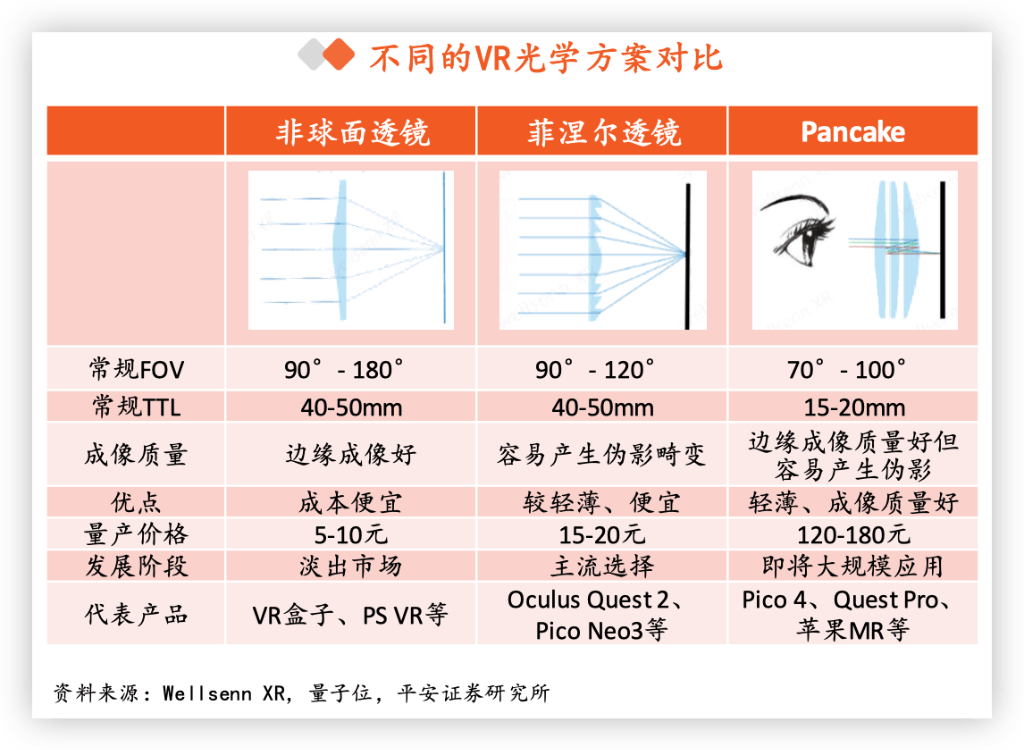

In the field of optics, in 2022, first-line products represented by Pico4 and QuestPro will all switch to the Pancake solution, and the upcoming Apple MR is also expected to adopt the Pancake solution.

Analysts pointed out that Pancake is an important solution for making VR equipment portable:

The development path of VR optics includes aspheric lenses, Fresnel lenses and Pancake lenses. The current market mainly uses Fresnel lenses as the mainstream optical solution. Although the focal length of light collection is shortened by removing the lens material, the imaging quality is low. In order to take into account both weight and image quality, Pancake, which uses a folding optical path design, was pushed to the tip. Due to its thin and light characteristics, it has gradually become the new favorite of VR manufacturers and is regarded as the first choice for the next generation of near-eye optics in VR.

Using the polarization folding mechanism, Pancake makes it possible to transmit light sources and amplify images in limited spaces. Pancake's optical solution mainly uses the principle of polarized light, using reflective polarizers and 1/4 phase delay films to adjust the shape of polarized light. After multiple reflections between the semi-transparent mirror and reflective polarized light, the light finally passes through the reflective polarizer. It is ejected and entered into the human eye to achieve focused imaging.

In the display field, Micro OLED, which has higher costs and more complex processes, is expected to dominate the market.

Looking to the future, MicroOLED has great potential. Micro OLED, also known as silicon-based OLED, is an innovative upgrade of OLED to improve the screen door effect. It combines semiconductor and OLED technology. The display uses monocrystalline silicon chips as the substrate. Not only does the display brightness achieve a significant improvement, but the pixel density also has a leapfrog upgrade, making it easy to get started. Reach 3000PPI.

In addition, MicroOLED can also make displays thinner and lighter, consume less energy, and have higher luminous efficiency. However, due to the cost of large-area silicon base and complex production processes, the cost of MicroOLED is relatively high. When MicroOLED technology becomes competitive in terms of cost and market development, it will show an explosive trend.

Apple MR is expected to accelerate the penetration of MicroOLED applications. Apple MR is expected to use two 1.4-inch, 4K-level high-resolution MicroOLEDs. The supplier is from Sony. Sony has an absolute leading position in the field of MicroOLED panels for consumer XR headsets. In addition, South Korea's Samsung, LGD and China's BOE , Shiya and other manufacturers are actively deploying MicroOLED.

The main point of this article comes from the research report "Apple MR is about to be released, pay attention to VR industry chain opportunities" published by Ping An Securities analyst Xu Yong (S1060519090004) and others, with some abridgements

The above is the detailed content of Apple MR will be released soon, taking stock of the VR industry chain. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How to publish works on Xiaohongshu How to publish articles and pictures on Xiaohongshu

Mar 22, 2024 pm 09:21 PM

How to publish works on Xiaohongshu How to publish articles and pictures on Xiaohongshu

Mar 22, 2024 pm 09:21 PM

You can view various contents on Xiaohongshu, which can provide you with various help and help you discover a better life. If you have anything you want to share, you can post it here so that everyone can take a look. , and at the same time, it can bring you profits. It is very cost-effective. If you don’t know how to publish your works here, you can check out the tutorial. You can use this software every day and publish various contents to help everyone use it better. Don’t miss it if you need it! 1. Open Xiaohongshu and click the plus icon below. 2. There are [Video] [Picture] [Live Picture] options here; select the content you want to publish and click to check. 3. Select [Next] on the content editing page. 4. Enter the text content you want to publish and click [Publish Pen]

Why can't Xiaohongshu publish videos of works? How does it publish its work?

Mar 21, 2024 pm 06:36 PM

Why can't Xiaohongshu publish videos of works? How does it publish its work?

Mar 21, 2024 pm 06:36 PM

With the rapid development of social media, short video platforms have become the main channel for many users to express themselves and share their lives. Many users may encounter various problems when publishing videos of their works on Xiaohongshu. This article will discuss the reasons that may cause the video publishing of Xiaohongshu works to fail and provide the correct publishing method. 1. Why can’t Xiaohongshu publish videos of works? The Xiaohongshu platform may occasionally experience system failures, which may be caused by system maintenance or upgrades. In this case, users may encounter the problem of being unable to publish videos of their works. Users need to wait patiently for the platform to return to normal before trying to publish. An unstable or slow network connection may prevent users from posting videos of their work on Xiaohongshu. Users should confirm their network environment to ensure that the connection is stable and

Why can't Xiaohongshu be released? What should I do if the content published by Xiaohongshu cannot be displayed?

Mar 21, 2024 pm 07:47 PM

Why can't Xiaohongshu be released? What should I do if the content published by Xiaohongshu cannot be displayed?

Mar 21, 2024 pm 07:47 PM

As a lifestyle sharing platform, Xiaohongshu has attracted a large number of users to share their daily life and grow products. Many users have reported that their published content cannot be displayed. What is going on? This article will analyze the possible reasons why Xiaohongshu cannot be released and provide solutions. 1. Why can’t Xiaohongshu be released? Xiaohongshu implements strict community guidelines and has zero tolerance for publishing advertisements, spam, vulgar content, etc. If the user's content violates the regulations, the system will block it and the content will not be displayed. Xiaohongshu requires users to publish high-quality and valuable content, and the content needs to be unique and innovative. If the content is too generic and lacks innovation, it may not pass review and therefore not be displayed on the platform. 3. Account abnormality

How to delete Xiaohongshu releases? How to recover after deletion?

Mar 21, 2024 pm 05:10 PM

How to delete Xiaohongshu releases? How to recover after deletion?

Mar 21, 2024 pm 05:10 PM

As a popular social e-commerce platform, Xiaohongshu has attracted a large number of users to share their daily life and shopping experiences. Sometimes we may inadvertently publish some inappropriate content, which needs to be deleted in time to better maintain our personal image or comply with platform regulations. 1. How to delete Xiaohongshu releases? 1. Log in to your Xiaohongshu account and enter your personal homepage. 2. At the bottom of the personal homepage, find the "My Creations" option and click to enter. 3. On the "My Creations" page, you can see all published content, including notes, videos, etc. 4. Find the content that needs to be deleted and click the "..." button on the right. 5. In the pop-up menu, select the "Delete" option. 6. After confirming the deletion, the content will disappear from your personal homepage and public page.

How to publish works on Xiaohongshu app? Tutorial on publishing works on Xiaohongshu app in five minutes

Mar 12, 2024 pm 05:10 PM

How to publish works on Xiaohongshu app? Tutorial on publishing works on Xiaohongshu app in five minutes

Mar 12, 2024 pm 05:10 PM

How does the Xiaohongshu app publish works? Many friends know that there are a large number of creative works and a strong dating circle in this software. For users who are new to this software, they probably don’t know how to publish their works, so that more people can watch the other side of you. If you still don’t know how to publish the works in it, then quickly refer to the five-minute tutorial on publishing works on the Xiaohongshu app recommended by the editor of this site. Tutorial on publishing works in Xiaohongshu app in five minutes 1. Click [Three] As shown in the picture, click [Three] pointed by the red arrow in the upper left corner. 2. Click [Creation Center] As shown in the picture, click [Creation Center] pointed by the red arrow. 3. Click [Go to Publish] as shown in the picture,

When is the best time to publish Xiaohongshu? Where does it post the most traffic recommendations from?

Mar 21, 2024 pm 08:11 PM

When is the best time to publish Xiaohongshu? Where does it post the most traffic recommendations from?

Mar 21, 2024 pm 08:11 PM

In today's social network era, Xiaohongshu has become an important platform for young people to share their lives and obtain information. Many users hope to attract more attention and traffic by publishing content on Xiaohongshu. So, when is the best time to post content? This article will explore in detail the selection of Xiaohongshu’s publishing time and the publishing location with the most traffic recommendations. 1. When is the best time to publish Xiaohongshu? The best time to publish content on Xiaohongshu is usually during periods of high user activity. According to the characteristics and behavioral habits of Xiaohongshu users, there are several time periods that are more appropriate. During the time period from 7 pm to 9 pm, most users have returned home from get off work and started browsing content on their mobile phones in search of relaxation and entertainment. Therefore, content posted during this period is more likely to attract users

PHP8.1 released: Introducing curl for concurrent processing of multiple requests

Jul 08, 2023 pm 09:13 PM

PHP8.1 released: Introducing curl for concurrent processing of multiple requests

Jul 08, 2023 pm 09:13 PM

PHP8.1 released: Introducing curl for concurrent processing of multiple requests. Recently, PHP officially released the latest version of PHP8.1, which introduced an important feature: curl for concurrent processing of multiple requests. This new feature provides developers with a more efficient and flexible way to handle multiple HTTP requests, greatly improving performance and user experience. In previous versions, handling multiple requests often required creating multiple curl resources and using loops to send and receive data respectively. Although this method can achieve the purpose

How to publish Xiaohongshu video works? What should I pay attention to when posting videos?

Mar 23, 2024 pm 08:50 PM

How to publish Xiaohongshu video works? What should I pay attention to when posting videos?

Mar 23, 2024 pm 08:50 PM

With the rise of short video platforms, Xiaohongshu has become a platform for many people to share their lives, express themselves, and gain traffic. On this platform, publishing video works is a very popular way of interaction. So, how to publish Xiaohongshu video works? 1. How to publish Xiaohongshu video works? First, make sure you have a video content ready to share. You can use your mobile phone or other camera equipment to shoot, but you need to pay attention to the image quality and sound clarity. 2. Edit the video: In order to make the work more attractive, you can edit the video. You can use professional video editing software, such as Douyin, Kuaishou, etc., to add filters, music, subtitles and other elements. 3. Choose a cover: The cover is the key to attracting users to click. Choose a clear and interesting picture as the cover to attract users to click on it.