Technology peripherals

Technology peripherals

AI

AI

How to invest in AI? 'Three major focus issues” faced by global first-tier VCs

How to invest in AI? 'Three major focus issues” faced by global first-tier VCs

How to invest in AI? 'Three major focus issues” faced by global first-tier VCs

At present, artificial intelligence is ushering in the "iPhone moment", and its spread is faster than any technological revolution in history.

However, Morgan Stanley pointed out in the report that it is undeniable that the uncertainty of AI development is high. VCs have keenly discovered this and pointed out the following "three major focus issues."

- AI is growing significantly and is in urgent need of modularization

The AI industry is developing rapidly, and the speed of "technology diffusion" exceeds that of the Internet revolution. Modularity is the key to achieving faster growth in AI.

"Tech Diffusion" (Tech Diffusion) is one of the most important themes in recent years. It is the process from when a technology is first commercialized, through vigorous promotion and widespread adoption, until it is finally eliminated due to backwardness.

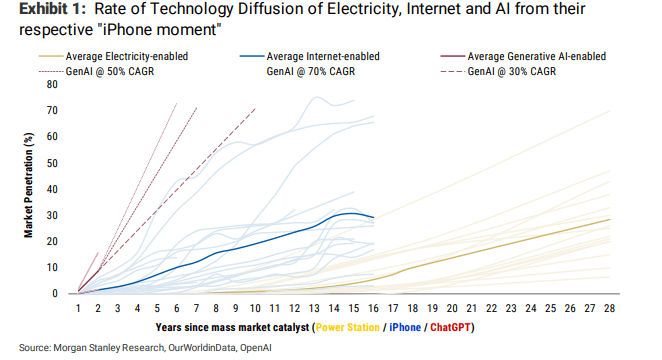

What is unprecedented is the speed and spillover effect of the diffusion of artificial intelligence technology into non-technical adjacent fields. To illustrate this point more clearly, the chart below compares the technology diffusion speed of the electricity revolution after 1885, the Internet revolution after 2007, and the artificial intelligence revolution after 2022.

Among them, modularity (Modularity sub-modules that specialize in different aspects of tasks) is the key to achieving faster growth and disruption through the innovation stack. The continued growth of AI depends on widespread internet access, which in turn requires cheap electricity to make possible. These large models of artificial intelligence will be based on modular forms and are equally applicable to areas of rapid growth and disruption in the future.

As more and more different tasks are encountered, the performance of AI is getting worse and worse, because model training cannot cover all scenarios. This is also the reason why most mainstream AI products rely on prompt words to give relatively logical answers. "Modularization", that is, dividing modules into specialized tasks to handle different aspects, is one of the solutions to the generalization problem. )

For example, open source plug-ins for companies with large models, such as OpenAI's newly released data analysis tool "Code Interpreter", will benefit from this modular expansion method and will create greater breadth, depth and stickiness of use. However, the rapid pace of adoption relative to any technology in history also means that Generative AI’s S-curve will only take months, rather than the years or decades expected in the past.

- AI company valuations decline and extreme differentiation occurs

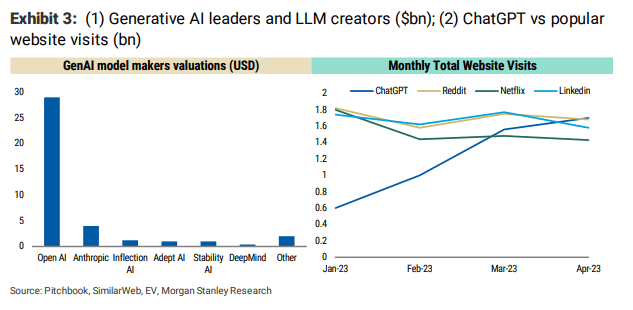

The 80/20 rule also exists in the financing and valuation of AI companies (80% of a company’s profits come from 20% of its projects). OpenAI recently raised another US$300 million, and its valuation is between US$27 billion and US$29 billion. . The company has raised a total of more than $11 billion in funding over the past seven rounds.

There is currently no competitor that can match OpenAI’s ChatGPT. Recent platform data shows that its number of monthly active users exceeds Reddit, Netflix and Linkedin, and is close to 2 billion.

However, on average, AI/ML company valuations are 60% lower than their valuation levels in January 2021, when AI/ML was in the midst of the hype cycle. Despite the clear growth in investment demand for AI (accounting for 10% of all venture capital investment), only a few private AI companies have passed the revaluation, and OpenAI is one such company.

- Open source large models may challenge financing models

The most heated question in recent weeks is how big is the moat of large model companies in the face of open source models?

As of 2023, investment funds in the AI field have exceeded US$12 billion, accounting for 10% of the total market venture capital. Despite re-achieving the Pareto point, 80% of the funding currently remains in the hands of large model owners rather than downstream APP manufacturers. The diffusion into non-tech industries has since accelerated.

Of course, there is a good reason - training larger and larger LLMs is expensive, and leveraging those models with APIs to create downstream applications is cheaper, and that seems to be the case now.

Will the emergence of open source LLM cause this capital deployment ratio to reverse at some point - whether in the public market or the private market, will financing be conducive to the emergence of low-cost open source LLM?

The above is the detailed content of How to invest in AI? 'Three major focus issues” faced by global first-tier VCs. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

Official announcement of Intel Core Ultra launch event! Towards a new AI era

Aug 09, 2023 am 11:53 AM

Official announcement of Intel Core Ultra launch event! Towards a new AI era

Aug 09, 2023 am 11:53 AM

Kuai Technology reported on August 7 that according to Intel’s official website, Intel will hold a new innovation conference “Innovation2023” (IntelOn2023) in San Jose, California on September 19, US time. The two-day conference has a very rich schedule, and one of the most noteworthy events is called "Intel Client Hardware Roadmap and the Rise of AI." At this event, Intel will introduce future consumer hardware platforms, including the highly anticipated new Core Ultra series code-named Meteor Lake, as well as its future roadmap. AI will also be a core topic, and Core Ultra will integrate an independent VPUAI hardware unit from the acquired Mov

AI covers should have boundaries

May 25, 2023 pm 10:12 PM

AI covers should have boundaries

May 25, 2023 pm 10:12 PM

In recent years, AI singers have become popular on the Internet. On major music platforms and video websites, we can enjoy "AI Stefanie" covering famous works by famous male singers such as Jay Chou and Wang Leehom, and experience a different vocal experience; Use AI technology to restore the voices of late superstars such as Teresa Teng, relive the richness of memories, and make up for the regrets of the past. The application of AI technology in the field of music is both amazing and controversial. From the perspective of the singing field itself, the behavior of AI singers covering songs has its origins and is a new attempt in music synthesis technology. Since the new century, creating and covering songs with the help of music synthesis technology has become very popular at home and abroad. There are virtual singers covering classic works, and there are also "second creations" of singers covering songs synthesized by software. The two even appeared together on the Spring Festival Gala.

Robin Li: AI cannot take away human jobs

May 30, 2023 pm 09:44 PM

Robin Li: AI cannot take away human jobs

May 30, 2023 pm 09:44 PM

In the past six months, generative artificial intelligence (AIGC) has become popular, once again arousing widespread global attention to the development of artificial intelligence. Some experts pointed out that the next 5-10 years will be a critical period for the development of artificial intelligence. It is predicted that the scale of China's core artificial intelligence industry will exceed 1 trillion yuan in 2030, and the global artificial intelligence market will reach 16 trillion U.S. dollars. There is still great potential and space for development. But at the same time, the powerful capabilities demonstrated by large artificial intelligence models such as ChatGPT have also caused many people to worry that large AI models will replace human work. What do practitioners in the artificial intelligence industry think of this? On May 18, Baidu CEO Robin Li said in a speech at the 7th World Intelligence Conference that artificial intelligence will not let people

State-owned enterprises use artificial intelligence technology to realize intelligent improvements in sand and gravel aggregate production

Nov 27, 2023 pm 09:07 PM

State-owned enterprises use artificial intelligence technology to realize intelligent improvements in sand and gravel aggregate production

Nov 27, 2023 pm 09:07 PM

On November 16, news came from the China Building Materials Circulation Association that the "Research and Development and Engineering Application of Integrated Intelligent Monitoring Platform for High-Speed Railway Mechanism Aggregate Production and Application" scientific and technological achievements participated by China Railway Fourth Bureau Materials Company won the science and technology selected by the association. First prize in the science and technology progress category. This award is approved by the Ministry of Science and Technology and is a nationwide industry science and technology award initiated and specifically organized by the China Building Materials Circulation Association in the award series of the National Science and Technology Award Office. It is reviewed and awarded once a year. The above-mentioned scientific and technological achievements are inseparable from the efforts of a young scientific and technological innovation team. The company team aims at the pain points and difficulties of sand and gravel aggregate mining and processing in construction construction, which are affected by uneven resource distribution, unstable quality of finished products, large mining environmental pollution, and multiple factors affecting transportation distance, and introduces artificial intelligence

Golang's advantages and applications in AI development

Sep 10, 2023 am 11:51 AM

Golang's advantages and applications in AI development

Sep 10, 2023 am 11:51 AM

Golang is an open source programming language developed by Google and officially released in 2009. It is simple, efficient and safe, and is suitable for handling large-scale, high-concurrency tasks. In recent years, with the development of artificial intelligence (AI), Golang has also shown unique advantages and applications in the field of AI development. First of all, Golang has strong capabilities in concurrent programming. Concurrent programming is an integral part of AI development because many AI applications require processing large amounts of data and performing complex tasks.

Meta plans to make large-scale investments in AI next year, Zuckerberg reveals

Oct 26, 2023 pm 05:21 PM

Meta plans to make large-scale investments in AI next year, Zuckerberg reveals

Oct 26, 2023 pm 05:21 PM

Driving China News on October 26, 2023 According to The Paper, Meta CEO Zuckerberg stated at the fiscal year 2023 third quarter earnings call that he believes that generative AI-related technologies will change the way people use various applications. Even more meaningfully, in the future, Meta may even use AI to directly generate content for users based on their interests. He said that by 2024, AI will become Meta's largest investment area, mainly in engineering and computing resources. In addition, Zuckerberg also added that in order to avoid hiring a large number of new employees, the company will lower the priority of some non-AI projects and transfer relevant personnel to AI jobs. According to reports, during the artificial intelligence boom in the past two years , Meta has been released

Robots move towards 'human'

Oct 15, 2023 am 08:21 AM

Robots move towards 'human'

Oct 15, 2023 am 08:21 AM

In just a few decades of development, robots have adapted to and can execute complex and diverse instructions. Now, empowered by AI, they are developing towards more advanced forms of humanoid robots. Perhaps in the near future, they will also Undertake the continuation of carbon-based life. Text | Source of Ji Sheng | "Manager" Magazine On August 16, 2023, Beijing successfully held the World Robot Conference. There are more than 140 companies participating in this exhibition, and nearly 600 robot products are on display. Among them, there are more than 10 humanoid robot companies participating in the exhibition. Compared with only one company in previous years, the growth rate can be said to be geometric. In addition, just before the exhibition, Beijing issued the "Several Measures to Promote the Innovation and Development of the Robot Industry" policy, including Establish a 10 billion yuan robot industry fund, and at the same time

Robin Li mentioned the 'busy traffic' again, saying that AI will create more opportunities for human beings

May 25, 2023 pm 10:05 PM

Robin Li mentioned the 'busy traffic' again, saying that AI will create more opportunities for human beings

May 25, 2023 pm 10:05 PM

Two months ago, the painting "Car, Water, Horse, Dragon" created by Baidu Wenxinyiyan when it was tested by the first batch of users became popular on the Internet overnight. "Car", "Water", "Horse", The picture of "Dragon", four unrelated things stacked together, is indeed a bit innocent. Then almost overnight, Wen Xinyiyan completed the iteration and successfully interpreted the profound Chinese idiom "traffic and traffic" with pictures. Two months later, on May 18, when Robin Li, founder, chairman and CEO of Baidu, explained to the audience what "generative AI" was, he once again mentioned the "busy traffic", and what emerged from the joke was something more. Much confidence and calmness. Yes, in the past two months, Wen Xinyiyan's academic "scores" have increased almost linearly. "Baiduwen