Technology peripherals

Technology peripherals

AI

AI

Hong Kong stock AIGC is the first stock to go IPO, and hardware companies are riding the AI bandwagon

Hong Kong stock AIGC is the first stock to go IPO, and hardware companies are riding the AI bandwagon

Hong Kong stock AIGC is the first stock to go IPO, and hardware companies are riding the AI bandwagon

Under the global AI trend, the Hong Kong Stock Exchange will also usher in the first AIGC shares.

On May 30, artificial intelligence company Mobvoi officially submitted an application to the Hong Kong Stock Exchange. CICC and CMB International serve as joint sponsors.

Mobvoi was founded in 2012 and is one of the few AI companies in Asia with the ability to build general large models. In 2014, it became one of the very few AI companies with software and hardware integration capabilities. In 2020, we developed a universal large-scale model called "UCLAI" while providing a full set of AIGC applications for content creators. This year, Mobvoi announced that it will further upgrade its iterative model to "Sequence Monkey".

Mobvoi’s business is divided into two main areas, namely AI software solutions and AIoT solutions. Initially, Mobvoi’s main business focused on AloT solutions and positioned itself as an intelligent hardware company. AloT smart hardware device series includes TicWatch AI smart watches, AI smart treadmills, etc.

At that time, competition in the domestic smart hardware field was fierce, but Mobvoi’s smart hardware products did not form a clear advantage, sales were low, and the company even reported news of layoffs. In 2019, in order to increase revenue, the company chose to expand its SaaS service business. In 2020, Mobvoi began to lay out generative artificial intelligence, and at the end of 2022, we ushered in the AIGC boom launched by ChatGPT.

From 2020 to 2022, Mobvoi’s AIoT solution revenue accounted for 83.0%, 85.0%, and 39.4% of total revenue respectively; AI software solution revenue accounted for 17.0% of total revenue respectively. , 15.0%, 60.6%. Due to delays in the launch of new flagship products and old products entering the later stages of the product life cycle, Mobvoi's revenue share from AloT solutions will decline sharply in 2022.

Currently, in terms of AI software solutions, Mobvoi has launched a product matrix for content creators including AI dubbing assistant "Magic Sound Workshop", AI writing assistant "Magic Writing" and AI digital human "Wonderful Yuan" ".

According to data from the Zhuoshi Consulting Industry Report, China’s AI market has increased from US$8.4 billion in 2018 to US$31.9 billion in 2022, with a compound annual growth rate of 39.7%, and is expected to reach US$115 billion in 2027. The compound annual growth rate from 2022 to 2027 is 29.2%.

The prospectus shows that from 2020 to 2022, Mobvoi’s revenue was 265 million yuan, 398 million yuan, and 500 million yuan respectively; its net profits attributable to the parent company were 251 million yuan, -205 million yuan, and -986 million yuan respectively; gross The interest rates can reach 30.12%, 37.49% and 67.20% respectively. Because software services generally have higher gross profit margins than hardware sales, the company's gross profit margin will increase significantly in 2022, which is also related to the increase in the proportion of AI software solution business.

Regarding whether Mobvoi is a smart hardware company or an AI software service company, the company’s founder and CEO Li Zhifei once firmly stated in an interview with the media: “ What we mainly do is AI, and we will not do anything next. Hardware. " This graduated from the computer science department of Johns Hopkins University in the United States and was an expert in machine learning and machine translation at Google's U.S. headquarters. He believes that the company's previous hardware was to allow AI technology to be implemented in better scenarios.

The professional background of the team has also allowed Mobvoi to receive investments from many well-known venture capital institutions. ZhenFund, Sequoia China, Haina Asia, Google Ventures and Volkswagen Group are all investors in Mobvoi. It is worth mentioning that Mobvoi has not raised new financing since 2017.

Pure smart hardware is already a red ocean and can no longer attract capital investment. chatgpt came to the ground with a thunder, giving Moutouwen new growth opportunities. Due to his Google background and keen industry sense, Li Zhifei began to actively invest in the field of large-scale AI models in 2020, which allowed him to accumulate a certain first-mover advantage.

Mobvoi has become increasingly clear about its positioning. Since the terminal cannot do what others do, it is better to make full use of its technological advantages to become an enabler. Including Spring Airlines, China Mobile, China Telecom and Industrial and Commercial Bank of China, the company's B-side customers have exceeded 500.

Currently, many companies have joined the AIGC competition. In the past, major Internet companies such as Baidu were rushing to produce the Chinese version of chatgpt. Later, Wang Huiwen, a retired Internet veteran, posted a "hero post" to start an AI business. Mobvoi also needs more ammunition support. It is understood that the funds raised from this initial public offering will be mainly used to develop general large-scale models, expand market share and promote solutions, as well as seek possible investment and acquisition opportunities.

Author/Yideng

The above is the detailed content of Hong Kong stock AIGC is the first stock to go IPO, and hardware companies are riding the AI bandwagon. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

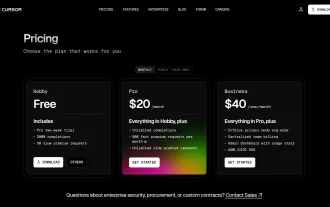

I Tried Vibe Coding with Cursor AI and It's Amazing!

Mar 20, 2025 pm 03:34 PM

I Tried Vibe Coding with Cursor AI and It's Amazing!

Mar 20, 2025 pm 03:34 PM

Vibe coding is reshaping the world of software development by letting us create applications using natural language instead of endless lines of code. Inspired by visionaries like Andrej Karpathy, this innovative approach lets dev

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!

Mar 22, 2025 am 10:58 AM

Top 5 GenAI Launches of February 2025: GPT-4.5, Grok-3 & More!

Mar 22, 2025 am 10:58 AM

February 2025 has been yet another game-changing month for generative AI, bringing us some of the most anticipated model upgrades and groundbreaking new features. From xAI’s Grok 3 and Anthropic’s Claude 3.7 Sonnet, to OpenAI’s G

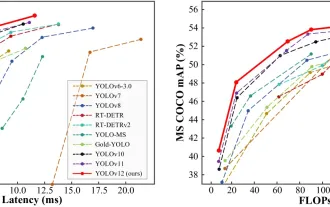

How to Use YOLO v12 for Object Detection?

Mar 22, 2025 am 11:07 AM

How to Use YOLO v12 for Object Detection?

Mar 22, 2025 am 11:07 AM

YOLO (You Only Look Once) has been a leading real-time object detection framework, with each iteration improving upon the previous versions. The latest version YOLO v12 introduces advancements that significantly enhance accuracy

Is ChatGPT 4 O available?

Mar 28, 2025 pm 05:29 PM

Is ChatGPT 4 O available?

Mar 28, 2025 pm 05:29 PM

ChatGPT 4 is currently available and widely used, demonstrating significant improvements in understanding context and generating coherent responses compared to its predecessors like ChatGPT 3.5. Future developments may include more personalized interactions and real-time data processing capabilities, further enhancing its potential for various applications.

Best AI Art Generators (Free & Paid) for Creative Projects

Apr 02, 2025 pm 06:10 PM

Best AI Art Generators (Free & Paid) for Creative Projects

Apr 02, 2025 pm 06:10 PM

The article reviews top AI art generators, discussing their features, suitability for creative projects, and value. It highlights Midjourney as the best value for professionals and recommends DALL-E 2 for high-quality, customizable art.

o1 vs GPT-4o: Is OpenAI's New Model Better Than GPT-4o?

Mar 16, 2025 am 11:47 AM

o1 vs GPT-4o: Is OpenAI's New Model Better Than GPT-4o?

Mar 16, 2025 am 11:47 AM

OpenAI's o1: A 12-Day Gift Spree Begins with Their Most Powerful Model Yet December's arrival brings a global slowdown, snowflakes in some parts of the world, but OpenAI is just getting started. Sam Altman and his team are launching a 12-day gift ex

Google's GenCast: Weather Forecasting With GenCast Mini Demo

Mar 16, 2025 pm 01:46 PM

Google's GenCast: Weather Forecasting With GenCast Mini Demo

Mar 16, 2025 pm 01:46 PM

Google DeepMind's GenCast: A Revolutionary AI for Weather Forecasting Weather forecasting has undergone a dramatic transformation, moving from rudimentary observations to sophisticated AI-powered predictions. Google DeepMind's GenCast, a groundbreak

Which AI is better than ChatGPT?

Mar 18, 2025 pm 06:05 PM

Which AI is better than ChatGPT?

Mar 18, 2025 pm 06:05 PM

The article discusses AI models surpassing ChatGPT, like LaMDA, LLaMA, and Grok, highlighting their advantages in accuracy, understanding, and industry impact.(159 characters)