Technology peripherals

Technology peripherals

AI

AI

AI-style 'technology diffusion”: 10 'lessons learned” from the past 100 years

AI-style 'technology diffusion”: 10 'lessons learned” from the past 100 years

AI-style 'technology diffusion”: 10 'lessons learned” from the past 100 years

With the rise of AI technology, a new generation of technological revolution may be just around the corner. However, humans have left some lessons in past technological revolutions. What can we learn from these histories?

On June 2, Morgan Stanley equity strategist Edward Stanley used technology diffusion theory to analyze in his report. This theory studies how technology is first commercialized and applied, through the stages of vigorous promotion and widespread adoption. The process until finally being eliminated due to falling behind.

Technological diffusion occurs after technological progress and technological innovation. From the perspective of human history, technological diffusion plays a vital role in the process of technological progress. Because if a technological innovation has not been widely applied and promoted, it will not affect the economy in a material form.

Accordingly, Morgan Stanley believes that The diffusion rate of artificial intelligence technology has exceeded any previous epoch-making technology, which means more investment opportunities and more problems.

For example, there are regulatory issues, as well as those old technology companies that are disrupted (their stock prices may never recover), and there are deflationary issues caused by new technologies that increase productivity.

1#Development speed and regulatory issues

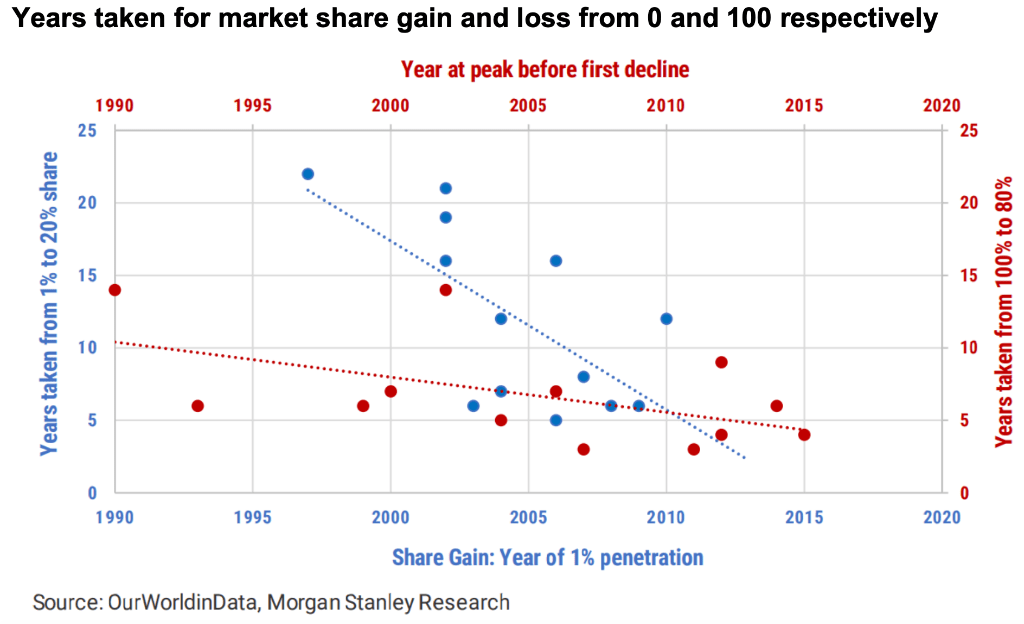

With the development of technology, each new generation of new technology accelerates its evolution based on the previous one, and the time required is continuously shortened.

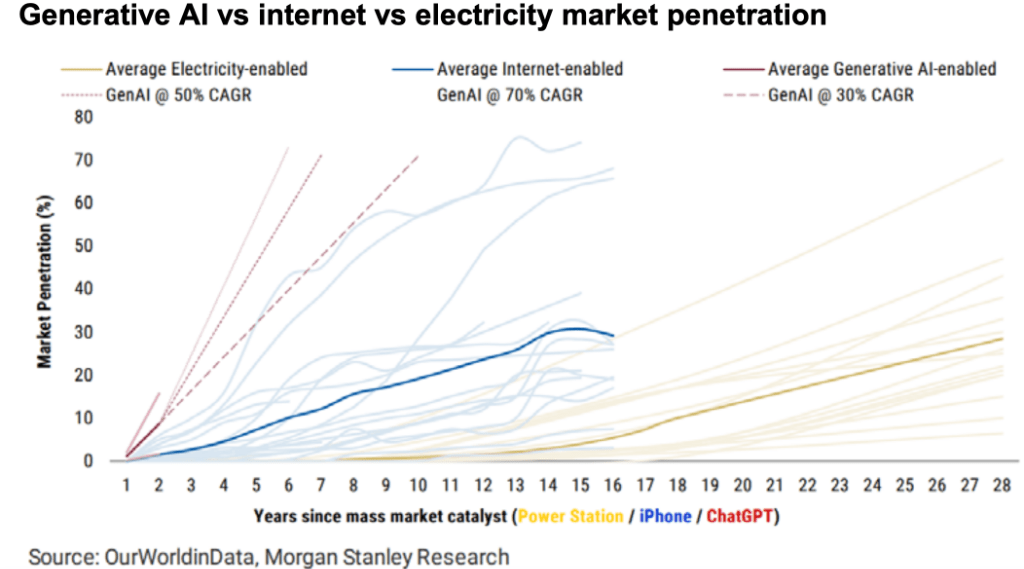

Morgan Stanley compares the adoption curves of industries that harnessed electricity after 1885, the Internet after 2007, and artificial intelligence after 2022 since their respective "iPhone moments" (i.e. when new technologies are implemented at scale). the time required for application).

Data shows that from the "iPhone moment" of each of these three technologies to the penetration rate exceeding 10%, it took 20 years for electricity, 7 years for the Internet, and only 1 for generative artificial intelligence. Year.

To reach 30% penetration and radiate to adjacent fields, electricity will take 30 years, the Internet will take 15 years, and artificial intelligence may be less than half.

Faced with such a fast speed, discussions on regulation by governments around the world are heating up. At present, the European Union, as a pioneer, is about to launch a regulatory bill.

2#Download speed>Uplink speed

Looking at the 80 structural positive and negative adoption curves over the past 50 years, Morgan Stanley pointed out that two things are clear:

- Downside share losses in disrupted industries occur faster, with peak activity declining by approximately 20% in the first 5 years relative to emerging technologies that leverage the Internet as a distribution channel.

- Share declines in disrupted industries are also more severe over longer periods of time, falling an average of 40% from their peak over 15 years, while new entrants’ market share increases by 30% over the same period.

#3 Stock downside

The release of new technologies is a fatal blow to old manufacturers.

Morgan Stanley pointed out that after the iPhone was released, the stock prices of first-generation mobile phone manufacturers fell by an average of 50% within 2 years and by an average of 75% within 5 years.

These companies can shed the "challenged" label, but hybrid transformation and capital investment will take time.

For example, Motorola's stock price fell for 2.5 years after the iPhone was released before reaching its lowest point, and it took eleven years to recover to the level before the iPhone was released.

For other companies that are considered to be affected by new technological changes, their stock prices may fall rapidly in the short term, even if their financial data remains normal.

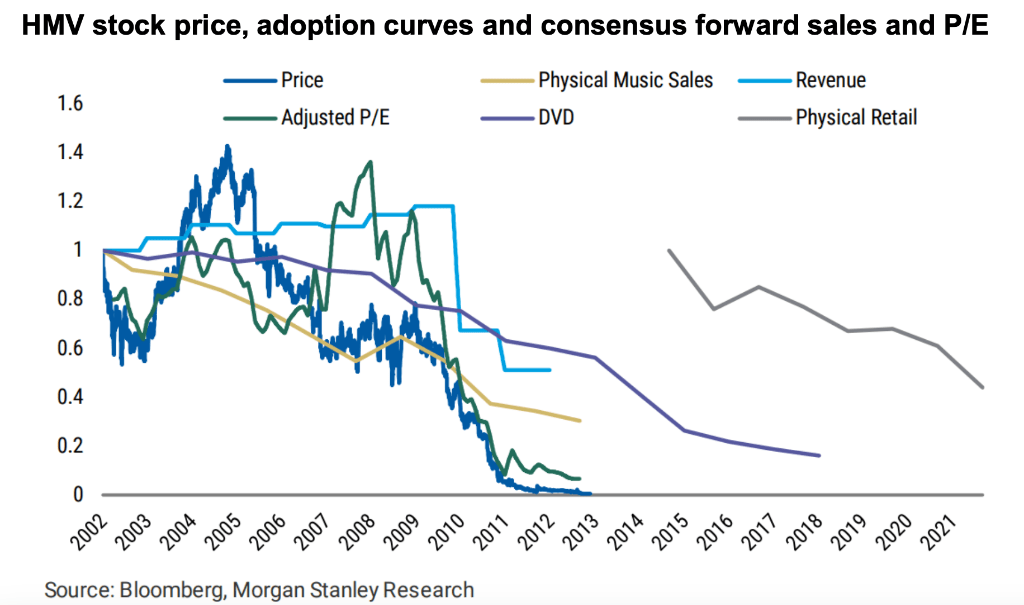

For example, HMV, a former phonograph manufacturer, saw a significant decline in profits only after its stock price fell for 7 years.

4# Stock upside

Morgan Stanley noted that it is also common for companies considered to be "winners" to see share prices rise by 100%, but consistent sales and earnings upward revisions are usually required within 6 months to maintain the multiple. expansion.

#5 Hype cycles are now the norm, not the exceptionApple’s EV/Sales doubled within 6 months after the iPhone was released. In fact, more than half of this happens before launch, not after.

Meanwhile, the consensus stock price increased only 20% during this period and only increased 15% from the launch date to the end of 2007.

The real rift between Apple and the established companies occurred over the next 5 years, with Apple's valuation falling back below where it was when the iPhone was launched, but with consensus sales forecasts 8x higher.

For established companies, although the market consensus is that their sales are stable, their average valuations are still above 90%.

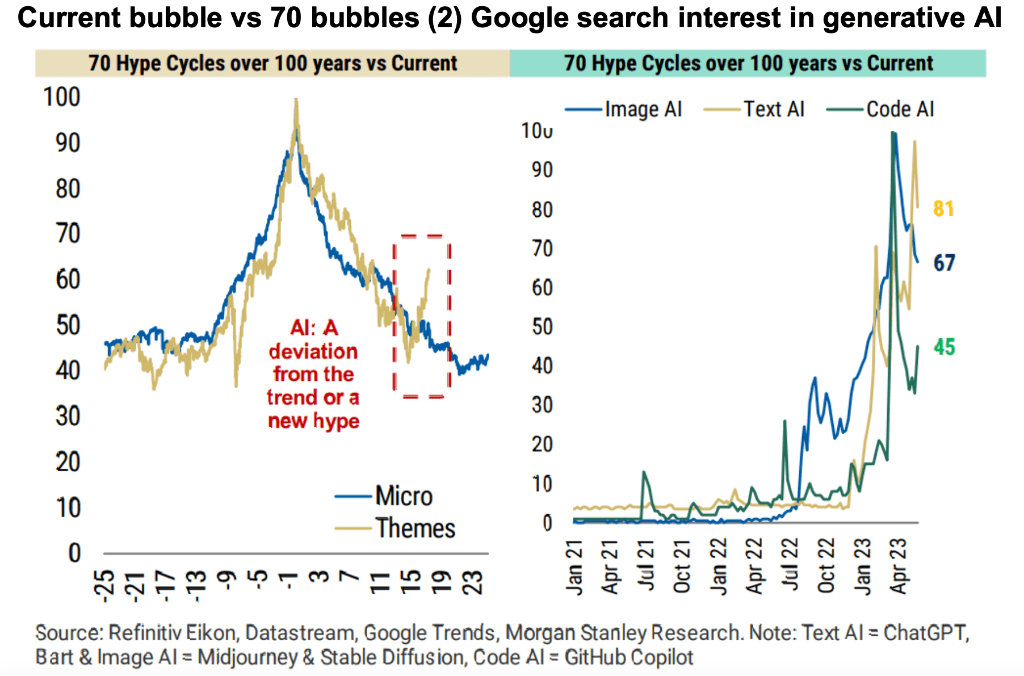

Morgan Stanley pointed out that theme bubbles tend to have a 3-year correction period after peaking, which is a faster cycle than macro themes, which tend to recover after 4 years.

#6 Find GPT’s “killer app”The current rally is an outlier compared to the 70 hype cycles we have tracked over the past 100 years. The question now is, to what extent is this hype cycle stickier than past hype cycles?

For this we will be paying close attention to Google Trends:

• There was an initial surge in activity for code generation AI tools such as GitHub Copilot, but this has fallen back to less than 45% of peak search interest.

•Image generation AI (such as Midjourney) was launched before text models, and its interest dropped from its peak to 50%.

• Text generation AI (e.g. ChatGPT/Bard) was last deployed in November 2022 and is proving to be stickier than the methods above, but we will continue to track consumer engagement.

When the iPhone was released, it was clear which manufacturers would be disrupted, but the final "winners" at that time may be new startups, most of which use hardware as a new point of contact with consumers.

From the innovation of more than 50 "platform applications", Morgan Stanley concluded that "killer applications" often take about 1.6 years to emerge from new disruptive technology platforms:

#7 The “winner” almost “takes it all”Of the $13 billion deployed by these startups to date, most of it has gone to large language model makers like OpenAI, Anthropic, and Adept, to name a few. These are the unicorns in this space.

The remaining approximately 20% of the funding is for downstream applications such as HuggingFace and other leading vendors and platforms supporting new centralized and open source LLMs.

It is within this latter category of funding that we expect to see killer apps emerge within the next two years.

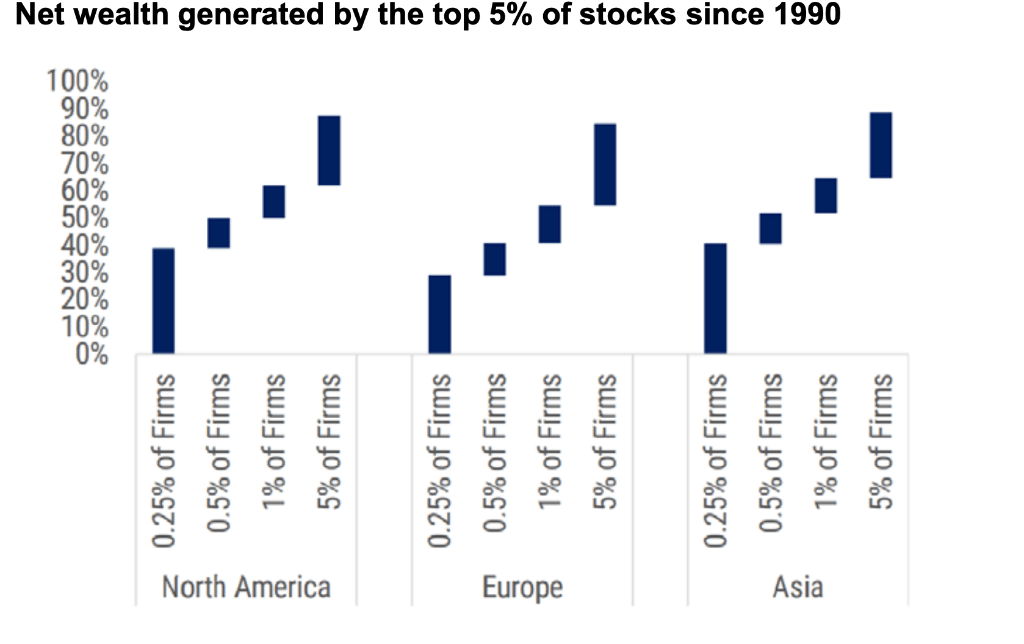

Morgan Stanley pointed out that over the past 100 years, market capitalization leadership has been more susceptible to change. Stocks that are in a leading position in technological changes often no longer are leaders 10 years after major technological innovations.

#8 High prices for pure investment stocksThe lessons from electricity and the Internet show that companies that take advantage of automation and electrification early can gain huge development and value in the market.

The diffusion of transformative technologies often leads to changes in stock market leadership, Since 1990, 2.3% of companies have generated $75 trillion in shareholder returns.

For potential buyers who feel that the upside to AI is already priced in, History shows that even missing out on the first year of a long-term trend doesn’t reward it with “winner” stocks for many years What impact does the return have.

"Pure investment stocks" refer to stocks of companies that are only engaged in a specific industry or field. The main business activities and sources of income of these companies are concentrated in a specific industry, so the performance of their stocks is highly correlated with the performance of their specific industry or sector.

Morgan Stanley pointed out that In the long term, stocks related to topics such as artificial intelligence are expected to be valued at 10-50% higher than "non-pure" stocks, with an average premium of 25%.

#9 Increase productivityAlthough (generative) AI does not appear as a stand-alone theme in our sustainable solutions database, we still recommend that investors focus on those with: (1) The highest and most sustainable barriers to entry, (2) the best data and quality, (3) the lowest internal risk, and (4) the purest business model regarding AI exposure that generates revenue upside or sustainable cost reduction enterprise.

Morgan Stanley said that after widespread industrial adoption of electricity and the spread of the Internet, technology diffusion tends to lead to a 2.5-fold increase in productivity (measured by GDP per capita).

#10 Deflation problemA growing body of corporate communications and academic literature proposes productivity gains across industries, ranging from a 55% developer productivity gain using GitHub Copilot to a 14% gain using generative AI Copilot Improved contact center agent resolution rates, to a 26% increase in legal use cases, and a 79% increase in patient-physician empathy and response engagement using ChatGPT compared to a control sample.

Morgan Stanley proposed that technology is deflationary ("Technology is deflationary"), which means that technology can promote deflation.

First, Technology reduces the demand for labor, which puts downward pressure on wages and employment levels, thereby reducing demand for goods and services as workers have less disposable income .

Second, technology allows the production of goods and services to scale up efficiently. If the production of goods can be efficiently expanded to meet the market's current and future demand for the goods, then the prices of those goods will not rise even if demand increases. As technology improves, more and more industries will reach this inflection point, and inflation in the entire market will become weaker and weaker.

One question that needs to be determined, however, is when deflation will occur and how severe it will be.

ChatGPT and other generative AI text LLMs are ideally suited to bring efficiency gains to industries that have been structurally inflated over the past 30 years, especially education, healthcare, legal, finance, construction, and licensing. How much of these efficiency and deflationary benefits will accrue to companies remains to be seen, depending on the robustness of their barriers to entry.

We are more interested in how the emerging discussion about virtual agents will exacerbate enterprise customer churn and subscription business challenges.

The above is the detailed content of AI-style 'technology diffusion”: 10 'lessons learned” from the past 100 years. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

How to implement file sorting by debian readdir

Apr 13, 2025 am 09:06 AM

How to implement file sorting by debian readdir

Apr 13, 2025 am 09:06 AM

In Debian systems, the readdir function is used to read directory contents, but the order in which it returns is not predefined. To sort files in a directory, you need to read all files first, and then sort them using the qsort function. The following code demonstrates how to sort directory files using readdir and qsort in Debian system: #include#include#include#include#include//Custom comparison function, used for qsortintcompare(constvoid*a,constvoid*b){returnstrcmp(*(

How to optimize the performance of debian readdir

Apr 13, 2025 am 08:48 AM

How to optimize the performance of debian readdir

Apr 13, 2025 am 08:48 AM

In Debian systems, readdir system calls are used to read directory contents. If its performance is not good, try the following optimization strategy: Simplify the number of directory files: Split large directories into multiple small directories as much as possible, reducing the number of items processed per readdir call. Enable directory content caching: build a cache mechanism, update the cache regularly or when directory content changes, and reduce frequent calls to readdir. Memory caches (such as Memcached or Redis) or local caches (such as files or databases) can be considered. Adopt efficient data structure: If you implement directory traversal by yourself, select more efficient data structures (such as hash tables instead of linear search) to store and access directory information

How debian readdir integrates with other tools

Apr 13, 2025 am 09:42 AM

How debian readdir integrates with other tools

Apr 13, 2025 am 09:42 AM

The readdir function in the Debian system is a system call used to read directory contents and is often used in C programming. This article will explain how to integrate readdir with other tools to enhance its functionality. Method 1: Combining C language program and pipeline First, write a C program to call the readdir function and output the result: #include#include#include#includeintmain(intargc,char*argv[]){DIR*dir;structdirent*entry;if(argc!=2){

How to learn Debian syslog

Apr 13, 2025 am 11:51 AM

How to learn Debian syslog

Apr 13, 2025 am 11:51 AM

This guide will guide you to learn how to use Syslog in Debian systems. Syslog is a key service in Linux systems for logging system and application log messages. It helps administrators monitor and analyze system activity to quickly identify and resolve problems. 1. Basic knowledge of Syslog The core functions of Syslog include: centrally collecting and managing log messages; supporting multiple log output formats and target locations (such as files or networks); providing real-time log viewing and filtering functions. 2. Install and configure Syslog (using Rsyslog) The Debian system uses Rsyslog by default. You can install it with the following command: sudoaptupdatesud

How to set the Debian Apache log level

Apr 13, 2025 am 08:33 AM

How to set the Debian Apache log level

Apr 13, 2025 am 08:33 AM

This article describes how to adjust the logging level of the ApacheWeb server in the Debian system. By modifying the configuration file, you can control the verbose level of log information recorded by Apache. Method 1: Modify the main configuration file to locate the configuration file: The configuration file of Apache2.x is usually located in the /etc/apache2/ directory. The file name may be apache2.conf or httpd.conf, depending on your installation method. Edit configuration file: Open configuration file with root permissions using a text editor (such as nano): sudonano/etc/apache2/apache2.conf

Debian mail server firewall configuration tips

Apr 13, 2025 am 11:42 AM

Debian mail server firewall configuration tips

Apr 13, 2025 am 11:42 AM

Configuring a Debian mail server's firewall is an important step in ensuring server security. The following are several commonly used firewall configuration methods, including the use of iptables and firewalld. Use iptables to configure firewall to install iptables (if not already installed): sudoapt-getupdatesudoapt-getinstalliptablesView current iptables rules: sudoiptables-L configuration

How to configure firewall rules for Debian syslog

Apr 13, 2025 am 06:51 AM

How to configure firewall rules for Debian syslog

Apr 13, 2025 am 06:51 AM

This article describes how to configure firewall rules using iptables or ufw in Debian systems and use Syslog to record firewall activities. Method 1: Use iptablesiptables is a powerful command line firewall tool in Debian system. View existing rules: Use the following command to view the current iptables rules: sudoiptables-L-n-v allows specific IP access: For example, allow IP address 192.168.1.100 to access port 80: sudoiptables-AINPUT-ptcp--dport80-s192.16

How Debian OpenSSL prevents man-in-the-middle attacks

Apr 13, 2025 am 10:30 AM

How Debian OpenSSL prevents man-in-the-middle attacks

Apr 13, 2025 am 10:30 AM

In Debian systems, OpenSSL is an important library for encryption, decryption and certificate management. To prevent a man-in-the-middle attack (MITM), the following measures can be taken: Use HTTPS: Ensure that all network requests use the HTTPS protocol instead of HTTP. HTTPS uses TLS (Transport Layer Security Protocol) to encrypt communication data to ensure that the data is not stolen or tampered during transmission. Verify server certificate: Manually verify the server certificate on the client to ensure it is trustworthy. The server can be manually verified through the delegate method of URLSession