Technology peripherals

Technology peripherals

AI

AI

The impact of artificial intelligence on the future development of accounting

The impact of artificial intelligence on the future development of accounting

The impact of artificial intelligence on the future development of accounting

Innovations in artificial intelligence will make accounting a lucrative profession, and accountants can capitalize on its value.

Artificial intelligence can make accounting careers more attractive through technology and innovation. Some accountants worry that AI will replace their jobs, but the real chance is that accountants who know how to leverage AI software may one day replace those who don’t.

If we were not completely isolated from the world, we would not be exposed to the headlines about artificial intelligence (AI) every day. Whether through ChatGPT, Bard, or one of the many apps that take advantage of its capabilities, artificial intelligence is helping people with writing, shopping, personal assistant tasks, and more. As with any new technological development, there are opportunities and challenges. As artificial intelligence continues to advance at a rapid pace, leaders in organizations across industries will need to navigate the complexity of these tools and learn how to leverage them for enterprise success.

Artificial Intelligence in Accounting

Artificial intelligence has a wide range of uses in almost every industry. While there are many ways this new technology could improve lives, redundant considerations and concerns about human ethics are almost as common. As artificial intelligence becomes more common in the accounting industry, the question many accountants have been asking is: “Will artificial intelligence replace us?” The answer is no. Artificial intelligence will change the way accountants work, but it cannot and will not replace them. What is really worrying is that accountants who know how to use AI software to improve efficiency and efficiency may in the near future replace those who do not use AI well.

Accountants may worry that machines will take over their jobs, but the real pressing issue is the lack of talent in the accounting profession. In fact, a 2022 Deloitte poll found that 82% of hiring managers for accounting and finance positions at public companies and 69% at private companies said accounting talent retention is a challenge. Because AI can reduce tedious accounting tasks, freeing accountants to focus on higher-level tasks, implementing AI may make job openings more attractive to younger job seekers interested in technology and innovation.

Artificial intelligence can do the drudgery of accounting

When people think of better career paths, accounting may not be the first career they think of. That's because, historically, the job has often involved the drudgery of months-long billing cycles, endless Excel formulas, and never-ending audits. While automation can take on some of these tasks, AI goes beyond understanding rules and can actually extract and feed information into other areas and provide users with concise summaries of information who would otherwise have to read hundreds of pages of documents .

Artificial intelligence increases the efficiency of accountants and even allows non-accountants to handle some of the busy work while focusing on more complex tasks such as managing relationships, developing strategies, evaluating opportunities and making strategic decisions.

Artificial Intelligence Adds Value

As user-friendly cloud-based software solutions become more common, service providers across industries are faced with the challenge of understanding their customers business complexities and help them achieve their goals in a more strategic way. Microsoft's recent Guardians of the Future Economy report shows that 80% of finance leaders believe it's more challenging than ever for them and their teams to add value outside of standard roles and responsibilities. As accounting professionals look for more ways to work smarter (not harder), automation and artificial intelligence have the potential to free people up, allowing for more collaboration and therefore more strategic work.

Applications of Artificial Intelligence in Lease Accounting

One area of the accounting industry that has recently added new complexities is the lease accounting department. The new lease accounting standard ASC842 issued by the Financial Accounting Standards Board (FASB) sets out how entities record the financial impact of their lease agreements.

Considered one of the most sweeping changes to lease accounting in decades, ASC 842 requires all public and private entities that report under U.S. Generally Accepted Accounting Principles (GAAP) to now record the vast majority of their leases in assets in the balance sheet. The new standards are designed to enhance transparency of liabilities arising from leasing arrangements and reduce off-balance sheet activities.

So, what does this mean for CPAs? For many, fully understanding ASC842 has become an immediate source of frustration as they determine the implications of the updated standard and begin implementing the required changes. In the past two years alone, nearly 300,000 accountants have left their jobs; last year alone, more than 40% of auditing and accounting work was not completed. The leasing accounting profession is certainly not becoming any more attractive to new applicants as the heavy burden of understanding and successfully complying with the new standards looms over their heads.

This is where artificial intelligence comes in and will make life easier for accountants. Leasing accounting software uses artificial intelligence technology to effectively reduce the time required for tedious and repetitive tasks, while also reducing the probability of human error. It gives people more time to think deeply about the business and the impact of accounting practices on it, making people's jobs more valuable.

Artificial Intelligence in Action

The above discussed a lot of issues about artificial intelligence from a theoretical perspective. Taking a deeper look from a product perspective, how AI actually plays a role in the management workflow of the lease accounting process.

If you have rented items before, you will know that this usually involves a large number of printed documents that need to be signed in about 500 places. Then, after using up the ink in the pen, the lease may be scanned with a copier or printer, uploaded and stored as an image in a non-searchable PDF file. Using AI-powered lease accounting software, users can upload lease documents, which are then processed through computer vision and OCR technology to produce clean and searchable digital copies. This process alone can save hundreds of man-hours and make information more accessible.

Next, using the searchable lease copy, AI technology is able to accurately extract key data for verification and enter this data into the system. However, AI accuracy is not the only important factor. When used to its full potential, AI should be combined with tailored experiences to help users understand the lease more quickly, rather than having to read the entire document to find important terms such as renewal, termination, HVAC or maintenance cost. Understanding these terms means lessors and lessees can understand their responsibilities and report them where appropriate. Embedding AI helps all users easily and accurately enter their leases into the product, automating accounting and completing compliance.

The compliance journey does not end with the adoption of new lease accounting standards. There are always new leases and modifications to existing leases. Artificial intelligence has unlimited potential to continue to reduce the burden of tedious tasks and take on the daily tedium of accounting.

The above is the detailed content of The impact of artificial intelligence on the future development of accounting. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1359

1359

52

52

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

This site reported on June 27 that Jianying is a video editing software developed by FaceMeng Technology, a subsidiary of ByteDance. It relies on the Douyin platform and basically produces short video content for users of the platform. It is compatible with iOS, Android, and Windows. , MacOS and other operating systems. Jianying officially announced the upgrade of its membership system and launched a new SVIP, which includes a variety of AI black technologies, such as intelligent translation, intelligent highlighting, intelligent packaging, digital human synthesis, etc. In terms of price, the monthly fee for clipping SVIP is 79 yuan, the annual fee is 599 yuan (note on this site: equivalent to 49.9 yuan per month), the continuous monthly subscription is 59 yuan per month, and the continuous annual subscription is 499 yuan per year (equivalent to 41.6 yuan per month) . In addition, the cut official also stated that in order to improve the user experience, those who have subscribed to the original VIP

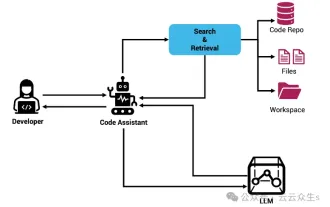

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Context-augmented AI coding assistant using Rag and Sem-Rag

Jun 10, 2024 am 11:08 AM

Improve developer productivity, efficiency, and accuracy by incorporating retrieval-enhanced generation and semantic memory into AI coding assistants. Translated from EnhancingAICodingAssistantswithContextUsingRAGandSEM-RAG, author JanakiramMSV. While basic AI programming assistants are naturally helpful, they often fail to provide the most relevant and correct code suggestions because they rely on a general understanding of the software language and the most common patterns of writing software. The code generated by these coding assistants is suitable for solving the problems they are responsible for solving, but often does not conform to the coding standards, conventions and styles of the individual teams. This often results in suggestions that need to be modified or refined in order for the code to be accepted into the application

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Can fine-tuning really allow LLM to learn new things: introducing new knowledge may make the model produce more hallucinations

Jun 11, 2024 pm 03:57 PM

Large Language Models (LLMs) are trained on huge text databases, where they acquire large amounts of real-world knowledge. This knowledge is embedded into their parameters and can then be used when needed. The knowledge of these models is "reified" at the end of training. At the end of pre-training, the model actually stops learning. Align or fine-tune the model to learn how to leverage this knowledge and respond more naturally to user questions. But sometimes model knowledge is not enough, and although the model can access external content through RAG, it is considered beneficial to adapt the model to new domains through fine-tuning. This fine-tuning is performed using input from human annotators or other LLM creations, where the model encounters additional real-world knowledge and integrates it

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

Seven Cool GenAI & LLM Technical Interview Questions

Jun 07, 2024 am 10:06 AM

To learn more about AIGC, please visit: 51CTOAI.x Community https://www.51cto.com/aigc/Translator|Jingyan Reviewer|Chonglou is different from the traditional question bank that can be seen everywhere on the Internet. These questions It requires thinking outside the box. Large Language Models (LLMs) are increasingly important in the fields of data science, generative artificial intelligence (GenAI), and artificial intelligence. These complex algorithms enhance human skills and drive efficiency and innovation in many industries, becoming the key for companies to remain competitive. LLM has a wide range of applications. It can be used in fields such as natural language processing, text generation, speech recognition and recommendation systems. By learning from large amounts of data, LLM is able to generate text

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

To provide a new scientific and complex question answering benchmark and evaluation system for large models, UNSW, Argonne, University of Chicago and other institutions jointly launched the SciQAG framework

Jul 25, 2024 am 06:42 AM

Editor |ScienceAI Question Answering (QA) data set plays a vital role in promoting natural language processing (NLP) research. High-quality QA data sets can not only be used to fine-tune models, but also effectively evaluate the capabilities of large language models (LLM), especially the ability to understand and reason about scientific knowledge. Although there are currently many scientific QA data sets covering medicine, chemistry, biology and other fields, these data sets still have some shortcomings. First, the data form is relatively simple, most of which are multiple-choice questions. They are easy to evaluate, but limit the model's answer selection range and cannot fully test the model's ability to answer scientific questions. In contrast, open-ended Q&A

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Five schools of machine learning you don't know about

Jun 05, 2024 pm 08:51 PM

Machine learning is an important branch of artificial intelligence that gives computers the ability to learn from data and improve their capabilities without being explicitly programmed. Machine learning has a wide range of applications in various fields, from image recognition and natural language processing to recommendation systems and fraud detection, and it is changing the way we live. There are many different methods and theories in the field of machine learning, among which the five most influential methods are called the "Five Schools of Machine Learning". The five major schools are the symbolic school, the connectionist school, the evolutionary school, the Bayesian school and the analogy school. 1. Symbolism, also known as symbolism, emphasizes the use of symbols for logical reasoning and expression of knowledge. This school of thought believes that learning is a process of reverse deduction, through existing

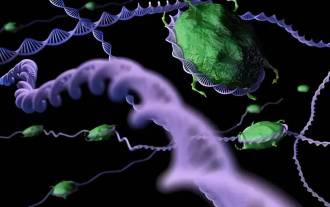

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

SOTA performance, Xiamen multi-modal protein-ligand affinity prediction AI method, combines molecular surface information for the first time

Jul 17, 2024 pm 06:37 PM

Editor | KX In the field of drug research and development, accurately and effectively predicting the binding affinity of proteins and ligands is crucial for drug screening and optimization. However, current studies do not take into account the important role of molecular surface information in protein-ligand interactions. Based on this, researchers from Xiamen University proposed a novel multi-modal feature extraction (MFE) framework, which for the first time combines information on protein surface, 3D structure and sequence, and uses a cross-attention mechanism to compare different modalities. feature alignment. Experimental results demonstrate that this method achieves state-of-the-art performance in predicting protein-ligand binding affinities. Furthermore, ablation studies demonstrate the effectiveness and necessity of protein surface information and multimodal feature alignment within this framework. Related research begins with "S

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

Laying out markets such as AI, GlobalFoundries acquires Tagore Technology's gallium nitride technology and related teams

Jul 15, 2024 pm 12:21 PM

According to news from this website on July 5, GlobalFoundries issued a press release on July 1 this year, announcing the acquisition of Tagore Technology’s power gallium nitride (GaN) technology and intellectual property portfolio, hoping to expand its market share in automobiles and the Internet of Things. and artificial intelligence data center application areas to explore higher efficiency and better performance. As technologies such as generative AI continue to develop in the digital world, gallium nitride (GaN) has become a key solution for sustainable and efficient power management, especially in data centers. This website quoted the official announcement that during this acquisition, Tagore Technology’s engineering team will join GLOBALFOUNDRIES to further develop gallium nitride technology. G