Is this exclusive good news for corporate bond investors coming?

Last week, LTX, a subsidiary of the American financial technology company Broadridge, announced the launch of a chatbot APP based on the GPT-4 large model-BondGPT.

BondGPT is mainly aimed at corporate bond investors, including hedge funds, traders, etc., and can answer various bond-related questions and help users solve related problems.

The product is claimed to enhance liquidity and price discovery in the $10.3 trillion U.S. corporate bond market.

Broadridge said that subsidiary LTX inputs real-time bond data from its bond analysis platform Liquidity Cloud into the GPT-4 language model, which not only simplifies the user workflow, can also avoid AIBS, improving users’ efficiency in bond selection and portfolio construction.

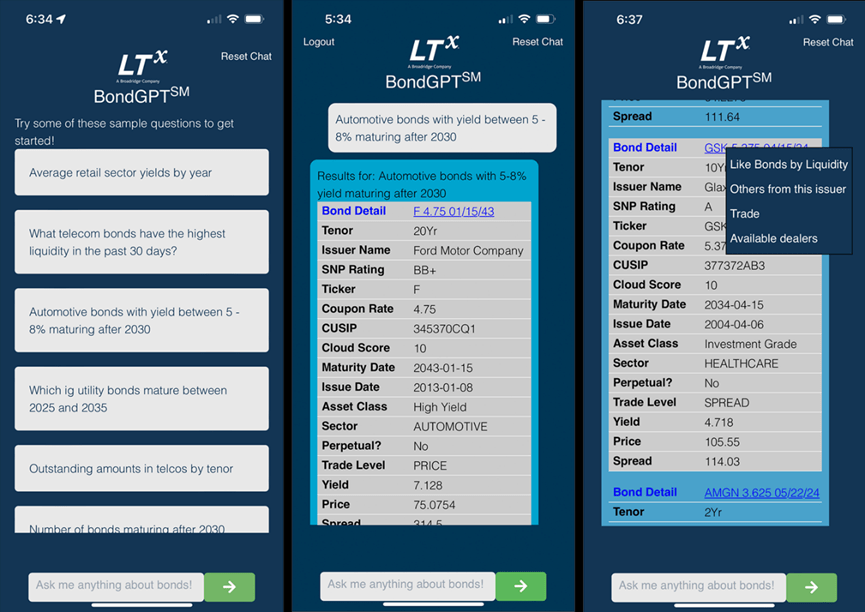

According to the sample shown by Broadridge, users can ask BondGPT questions similar to the following:

Provides annual average bond yields in the retail sector;

Which telecom company bonds have yielded the highest returns in the past 30 days?

Which car bonds have a yield between 5-8% and mature after 2030?

How many bonds will mature after 2030?

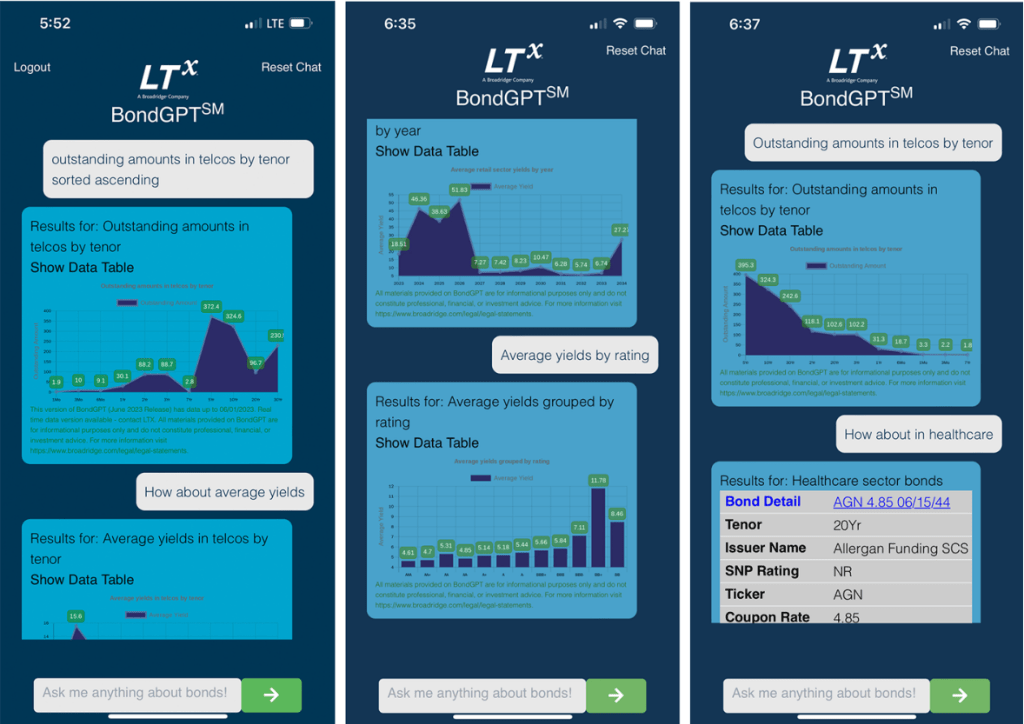

Arrange the returns on bonds of telecommunications companies in ascending order of time.

The results show that BondGPT will list the detailed information of the bond, including bond number, issuing company name, interest rate, price, release date, maturity date, bond rating, etc.

At the same time, users can ask consecutive questions on the same topic, Of course, the content must involve the bond market.

In addition to providing question and answer services, BondGPT can also filter and output visual charts based on specific data. Similarly, this function also supports continuous questions.

In the announcement, Broadridge stated that BondGPT is available to all LTX customers. According to reports, more than 30 traders and more than 80 asset management companies are currently using the LTX platform.

LTX’s Liquidity Cloud received more than US$7 billion in confirmed orders in the first quarter of this year, with average daily transactions exceeding US$25 billion.

In addition, Broadridge has helped financial firms process more than $9 trillion in daily transactions in equities, fixed income and securities.

The above is the detailed content of AI enters bond trading, BondGPT is here!. For more information, please follow other related articles on the PHP Chinese website!