Technology peripherals

Technology peripherals

It Industry

It Industry

For the sixth consecutive month, SWIFT data shows that RMB accounted for 3.06% of global payments in July.

For the sixth consecutive month, SWIFT data shows that RMB accounted for 3.06% of global payments in July.

For the sixth consecutive month, SWIFT data shows that RMB accounted for 3.06% of global payments in July.

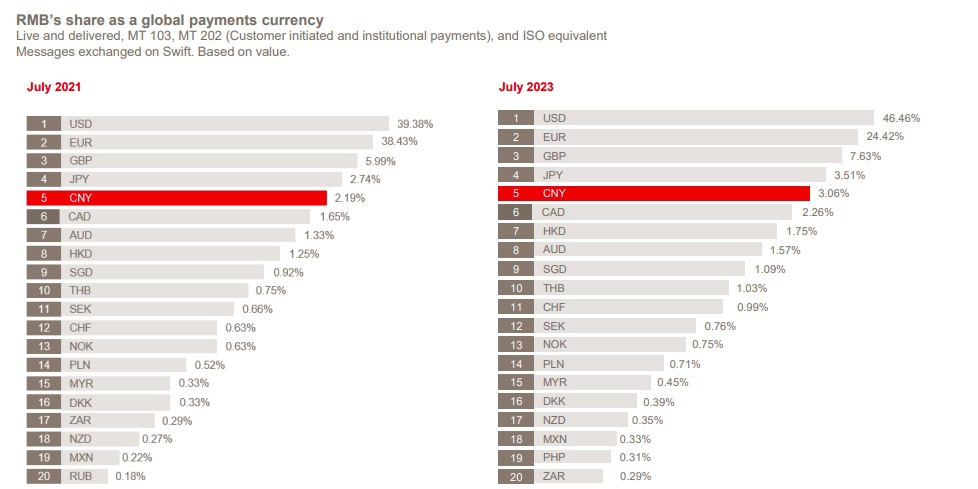

News from this site on August 24, the monthly report released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) yesterday showed that in July 2023, in the ranking of global payment currencies based on amount statistics, the RMB remained fifth in the world As the most active currency, its share rose to 3.06%, marking the sixth consecutive month of increase. This is also the second time on record that the RMB’s share of global payments has exceeded 3%.

According to the query results, the proportion of RMB in international payments The last time it exceeded 3% was back in January 2022. At that time, the proportion of RMB in international payments reached 3.2%, breaking the previous record set in 2015

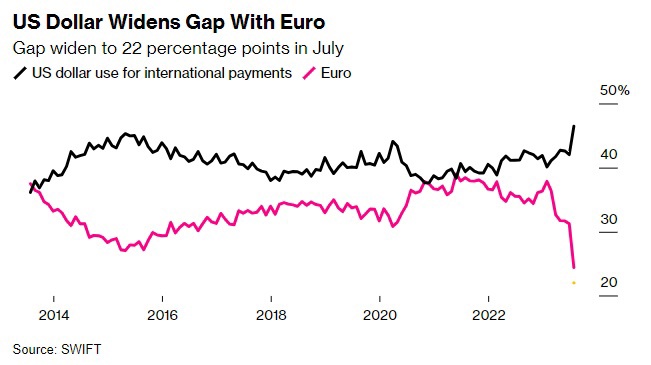

. The U.S. dollar's share of payments in SWIFT reports continues to increase, largely at the expense of the euro.

The share of euro payments fell to 24.42% in July, the highest level since the advent of the euro. lowest. Advertising Statement: This article contains external jump links (including but not limited to hyperlinks, QR codes, passwords, etc.), which are intended to provide more information and save screening time. The results are for reference only. Please note that all articles on this site contain this statement

The above is the detailed content of For the sixth consecutive month, SWIFT data shows that RMB accounted for 3.06% of global payments in July.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1392

1392

52

52

36

36

110

110

The price of Bitcoin since its birth 2009-2025 The most complete summary of BTC historical prices

Jan 15, 2025 pm 08:11 PM

The price of Bitcoin since its birth 2009-2025 The most complete summary of BTC historical prices

Jan 15, 2025 pm 08:11 PM

Since its inception in 2009, Bitcoin has become a leader in the cryptocurrency world and its price has experienced huge fluctuations. To provide a comprehensive historical overview, this article compiles Bitcoin price data from 2009 to 2025, covering major market events, changes in market sentiment, and important factors influencing price movements.

Is USDT equivalent to the US dollar? A popular science guide on the relationship between USDT and the US dollar

Jun 05, 2024 pm 06:38 PM

Is USDT equivalent to the US dollar? A popular science guide on the relationship between USDT and the US dollar

Jun 05, 2024 pm 06:38 PM

There has been controversy over the legality of the USDT stablecoin, which is backed by banks holding full U.S. dollars in a one-to-one ratio to every token issued, since it was first launched. In fact, many of the current attempts to have Tether verify its holdings are just excuses, and they keep explaining why a full audit would be too complicated. "The latest news in the world of Tether is very disturbing at the moment, as the organization has almost admitted that its stablecoin is no longer pegged to the US dollar. The official description of Tether has changed, and many investors want to know the equivalent value of USDT and US dollars? Here is Let the editor explain the relationship between USDT and the US dollar. Is USDT equal to the US dollar? 1 USDT = 1 US dollar.

For the sixth consecutive month, SWIFT data shows that RMB accounted for 3.06% of global payments in July.

Aug 25, 2023 am 10:20 AM

For the sixth consecutive month, SWIFT data shows that RMB accounted for 3.06% of global payments in July.

Aug 25, 2023 am 10:20 AM

According to news from this site on August 24, the monthly report released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) yesterday showed that in July 2023, in the ranking of global payment currencies based on amount statistics, the RMB maintained its position as the fifth most active currency in the world. , the share rose to 3.06%, rising for the sixth consecutive month. This is also the second time on record that the RMB accounted for more than 3% of global payments. ▲Image source According to the monthly report of the Society for Worldwide Interbank Financial Telecommunication, the query results show that the last time the RMB’s proportion in international payments exceeded 3%, it dates back to January 2022. At that time, the proportion of RMB in international payments reached 3.2%, breaking the previous record set in 2015 ▲ Source: Association for Worldwide Banking and Financial Telecommunications Monthly Report In addition to the People’s

What is USD Coin? How does USD Coin work?

Mar 15, 2024 pm 04:43 PM

What is USD Coin? How does USD Coin work?

Mar 15, 2024 pm 04:43 PM

USDCoin: USD-pegged stablecoin USDCoin (USDC) is a USD-pegged stablecoin issued by the CENTRE Alliance. The CENTRE Alliance is a consortium co-founded by Coinbase and Circle. How it works USDC works based on the following key mechanisms: USD Reserves: USDC is backed 1:1 by reserves denominated in US dollars. This means that for every USDC in circulation, there is one dollar held in a regulated financial institution. Transparency: The CENTRE Alliance regularly publishes audit reports proving that USDC’s reserves match the number of tokens in circulation. Redeemability: USDC holders can redeem their tokens for equivalent U.S. dollars at any time. Benefits and its

PayPal supports converting PYUSD to USD for international money transfers

Apr 05, 2024 pm 06:37 PM

PayPal supports converting PYUSD to USD for international money transfers

Apr 05, 2024 pm 06:37 PM

Global payments giant PayPal has announced that it will expand international transfer options by enabling the exchange of PYUSD and US dollars. At the same time, American users can now use the U.S. dollars converted from the EPayPalUSD (PYUSD) determined currency to transfer funds to relatives and friends overseas. However, PYUSD is not available to residents of Hawaii. PYUSD to USD exchange for cross-border transfers PayPal said that U.S. customers using its cross-border payments platform Xoom will be able to convert PYUSD to U.S. dollars and then send funds to recipients in approximately 160 countries. This means that US users can now make international transfers through PayPal's established currency PYUSD, first converting PYUSD to US dollars, and then through Xoom

Is USDT equal to the US dollar? A simple explanation of the relationship between USDT and the US dollar

Dec 23, 2024 pm 07:32 PM

Is USDT equal to the US dollar? A simple explanation of the relationship between USDT and the US dollar

Dec 23, 2024 pm 07:32 PM

USDT (Tether) is a stablecoin pegged to the U.S. dollar, with 1 USDT theoretically always equaling 1 U.S. dollar. Tether claims that it holds U.S. dollars and U.S. Treasuries as reserves to support the value of USDT. While USDT generally maintains parity with the U.S. dollar, there may be deviations in certain circumstances, such as extremely high demand or concerns about reserves.

Bitcoin's latest price and US dollar trend_BTC today's US dollar price in December 24

Dec 23, 2024 pm 06:22 PM

Bitcoin's latest price and US dollar trend_BTC today's US dollar price in December 24

Dec 23, 2024 pm 06:22 PM

Bitcoin Price Prediction for December 2024 Wall Street Journal: The Wall Street Journal predicts Bitcoin prices will hit $50,000 by December 2024. JPMorgan Chase: JPMorgan predicts Bitcoin price will reach $40,000 by December 2024. Goldman Sachs: Goldman Sachs predicts Bitcoin price will reach $30,000 by December 2024.