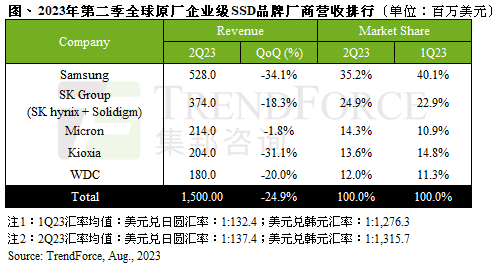

According to news from this site on August 31, TrendForce released its latest research report. Data show that in the second quarter of 2023, global original enterprise-level SSD revenue hit a new low, only US$1.5 billion (currently about 10.935 billion yuan), a 24.9% decrease from the previous quarter.

Among them, Samsung has the highest revenue but dropped by 34.1% month-on-month, with a market share of 35.2%. Hynix (including Solidigm) decreased by 18.3% month-on-month to 24.9%. The market share of the two companies has exceeded 60%.

The third place is Micron (14.3%), a decrease of 1.8% month-on-month; the fourth place is Kioxia (13.6%), a decrease of 31.1% month-on-month; Western Digital's market conditions are poor, with second quarter revenue of only 180 million US dollars (note on this site: currently about 1.312 billion yuan), a month-on-month decrease of 20.0%.

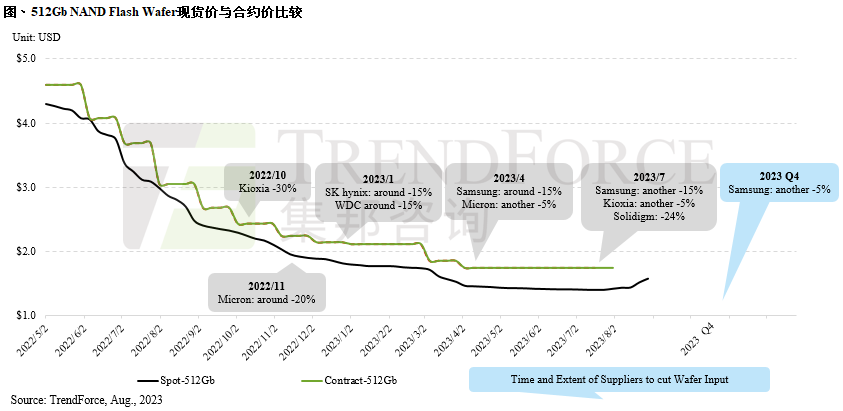

Analysts also said that the recent NAND Flash spot market particle quotations have been driven by the news that the wafer contract price has successfully increased, and some items have seen more active inquiries. price demand.

According to TrendForce’s investigation, the main reason for this price increase is further price increases by NAND Flash original manufacturers and some Chinese indicator module manufacturers in late August. This shows that the original manufacturers are no longer willing to sell products at low prices, thus promoting the recent short-term upward trend in the wafer spot market. However, since the relevant purchase orders appear based on the supply-side quotation increase, whether there is actual terminal order support still needs to be observed. Therefore, it will take some time for this price increase to be reflected in the terminal SSD market

TrendForce analysts believe that because sellers still hold Wafer and other related NAND Flash products have the upper hand in price increases. Short-term market price fluctuations are inevitable. However, compared with actual terminal demand, buyers are still conservative or even pessimistic about the subsequent demand outlook. Even if the purchase price is forced to increase, it is still difficult to stimulate an increase in order volume. , so it remains to be seen whether the price increase in the wafer spot market can continue.

Advertising Statement: This article contains external jump links (including but not limited to hyperlinks, QR codes, passwords, etc.), which are intended to provide more information and save screening time, but the results are for reference only. . Please note that all articles on this site contain this statement

The above is the detailed content of Trendforce: The original manufacturer successfully increased the contract price of wafer, and Samsung ranked first in Q2 enterprise SSD revenue share. For more information, please follow other related articles on the PHP Chinese website!