Technology peripherals

Technology peripherals

AI

AI

The application of AI technology in Ant Group's insurance business: innovating insurance services and bringing new experiences

The application of AI technology in Ant Group's insurance business: innovating insurance services and bringing new experiences

The application of AI technology in Ant Group's insurance business: innovating insurance services and bringing new experiences

The importance of the insurance industry to social people’s livelihood and the national economy is self-evident. As a risk management tool, insurance provides protection and welfare for the people and promotes economic stability and sustainable development. In the context of the new era, the insurance industry is facing new opportunities and challenges, and needs continuous innovation and transformation to adapt to changes in social needs and adjustments to the economic structure

In recent years, China's insurance technology has developed vigorously. Through innovative business models and advanced technological means, we actively promote the digital and intelligent transformation of the insurance industry. The goal of insurtech is to improve the convenience, personalization and intelligence of insurance services and change the face of the traditional insurance industry at an unprecedented speed. This development trend has injected new vitality into the insurance industry and made insurance products closer to the actual needs of the people. Through the application of new technologies such as the Internet, cloud computing, and artificial intelligence, insurance technology has achieved remarkable results in sales, services, risk control, underwriting, claims, etc., bringing new development opportunities and experience innovation to the insurance industry

At the 2023 China International Fair for Trade in Services, Sun Zhenxing, chief technology officer of Ant Group’s insurance business group, attended and delivered a speech titled “AI New Technology Reshapes Insurance Services and Brings New Experience to the Industry.” He introduced in detail how the Ant Insurance platform uses artificial intelligence technology to reshape insurance services and bring a new experience to the industry in four aspects: product selection, customer service, risk control and claims

Sun Zhenxing introduced that around Product selection, service, risk control, and claims settlement, AI technology is playing a key role in the entire insurance service chain. Especially since 2022, generative AI technology has made many breakthroughs, and Ant Insurance has also fully explored the field of insurance technology. Practice and explore the application paradigm of generative large models in vertical fields. Sun Zhenxing believes that "Generative large models are good at cognition, understanding, reasoning, and control of language, and have extensive general knowledge, but in How to achieve safety, controllability and accuracy in the vertical professional field is extremely challenging, and this is exactly what the insurance industry must solve."

"In the user purchase stage, how can Provide a new experience of clearly understanding insurance products." - Insurance products usually have multiple clauses, with a total of dozens of pages, and they also contain a lot of medical professional terms. For ordinary people, it is difficult to fully understand these clauses. Quite difficult. At the same time, there are a large number of highly homogeneous insurance products on the market, making users face huge challenges in the selection process.

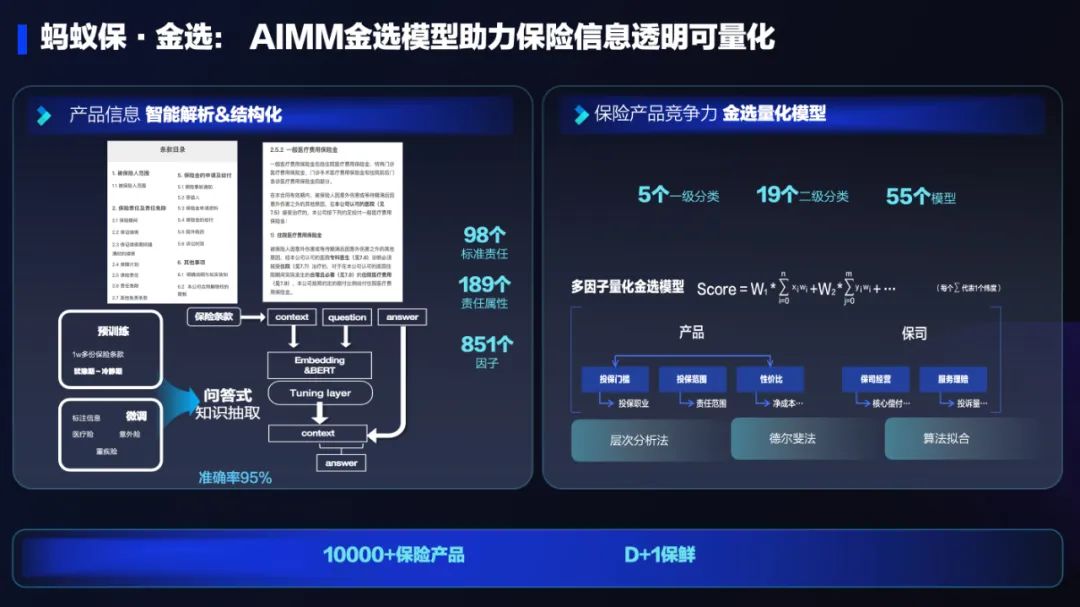

To this end, Ant Group has launched the Jinxuan AIMM model, which aims to be user-centered and help screen high-quality insurance products across the industry so that users can choose to purchase with confidence. This involves two most critical links: First, how to automatically and intelligently conduct structured analysis of the terms of tens of thousands of insurance products across the market. In the past, traditional natural language processing methods faced huge challenges, but today, the era of large models makes this possible. Sun Zhenxing said, "After more than half a year of exploration, our analysis and extraction capabilities have covered 98 standard responsibilities, 189 responsibility attributes, and 851 factors, with an accuracy of more than 95%. Based on this, we have built the industry's most advanced A complete product information database.”

Second, how to conduct automatic quantitative evaluation. Based on the product information database, Ant Insurance combined the input of actuaries and industry experts to define a multi-factor quantitative model covering five dimensions such as insurance threshold, coverage coverage, cost performance, insurance company operation, and claims experience, to achieve comprehensive analysis of the entire product database. Automatic evaluation and quantification. At present, the AIMM Golden Selection model has covered the five major tracks and 55 subdivided tracks in the insurance industry, providing users with a full range of help in purchasing insurance products and reducing purchase costs.

# "In terms of consulting services, how to bring a new experience that is available to everyone, online in real time, and for thousands of people." —— Traditional manual services This method has the problem of limited coverage and inability to be online in real time. At the same time, the traditional technical solutions used in the past have also reached their bottlenecks. However, new AIGC generative technologies offer opportunities for breakthroughs. Despite this, it is not realistic to directly use this technology in the insurance industry, and it will face many challenges such as authenticity and rigor. In the process of practical exploration, the key to current application is to deconstruct the tasks in the vertical field.

"The three most critical things: The first is to achieve accurate user insights, which can be achieved through multi-modal methods, combining static portraits and dynamic behaviors to improve the understanding of user personality;The second is intelligent dialogue, which is deconstructed into multiple tasks such as intention understanding, entity extraction, answer production, reasoning and expression, etc., giving full play to the advantages of AIGC in language processing tasks; The third is knowledge expertise With power, the answers to insurance professional questions must be accurate, compliant, and controllable," Sun Zhenxing pointed out, "Our approach is to use the two-wheel drive of domain knowledge graph and AIGC to build a full product channel for the industry. The knowledge map currently covers 1,000 products on the platform, covering 40,000 diseases, and the total knowledge reaches 500 million levels. Based on this, the professional capabilities of insurance intelligent consultants have basically reached expert-level service levels, and each user is equipped with An expert intelligent insurance consultant becomes possible." "How to make risk control both universal and beneficial, helping financial institutions continue to expand service boundaries and allow more users to enjoy a higher-quality service experience." — — Risk control is the core competency in the financial industry, but today some users with sub-healthy or sick conditions cannot enjoy the services of professional institutions. They may be rudely rejected when applying for insurance, and some users have insufficient insurance coverage. question. On the premise of ensuring that data does not leave the domain and is compliant and secure, Ant Insurance is based on Ant Group's privacy computing technology and big data layered risk control capabilities to maximize the value of data, helping insurance companies better provide services to users and achieve inclusive benefits. experience.

Sun Zhenxing introduced, “Ant Insurance has built a hierarchical risk control model and an adverse selection model to provide differentiated intelligent health warning solutions for people who were originally violently intercepted, helping as many users as possible to buy the best products. Matching insurance products. With the support of this set of solutions,

helps cooperative insurance companies reduce the risk control interception rate by 50% on the premise of reducing risks by 10%, which means that people who were originally unable to enjoy insurance services are experiencing differentiated health risks. With the help of advertisements, half of them can buy suitable insurance products.”Pet insurance is an emerging industry, and risk control capabilities are also a necessary prerequisite for scale. To achieve scale, the problem of pet identification must first be solved. After continuous exploration, Ant Bao successfully developed pet identification technology. This is not an easy task, and there are two main challenges: first, how to obtain high-quality photos of pet nose prints; second, how to achieve high-accuracy identification. In order to meet these challenges, a pet camera with an integrated end-side intelligent engine has been launched, which can detect and capture photos in real time on the end-side, greatly reducing the cost of photography for pet owners. In terms of recognition, a biometric model based on metric learning and DAM feature weighting is used, and the current accuracy of cats and dogs has reached 99.9%. This technology makes it possible to scale pet insurance.

“How to be user-centered and provide a full-cycle, companion service experience.”——

“How to be user-centered and provide a full-cycle, companion service experience.”——

Claims settlement service is an important post-warranty service. In the past, claims settlement was difficult, faced with long cycles and various uncertainties. When users really need to make a claim, they often don’t know how to make a claim, who to contact, and what materials to submit. It is also difficult to understand in a timely manner what problems may occur during the long waiting process after submission. In order to solve these problems, Ant Insurance and industry partners have jointly created a safe compensation service. Help users quickly upload claim materials online and give clear instructions. At the same time, Ant Insurance has built an intelligent claim verification auxiliary system on the insurance company's side to help insurance companies quickly review, reduce costs and increase efficiency. Sun Zhenxing said, "

2-day fast compensation is not the end. As technology continues to evolve, we believe we should strive for greater excellence and continue to make breakthroughs in experience and efficiency.We have developed a multi-modal generation method in the field of claims Extraction model has made new breakthroughs in the extraction of claim settlement materials. For the extraction of difficult materials such as complex materials, long texts, occlusions/blurs, etc., the case-level accuracy rate has exceeded 95%. This provides a comprehensive automation for future claims settlement. Based on the foundation, we believe that the timeliness experience of claims settlement will also be further improved." At the same time, at the 2023 China International Trade in Services Fair, the

intelligent claims assistance system applied by Ant Insurance Agency Co., Ltd. won the " Typical cases of artificial intelligence integrated development and safety application in 2023."It is reported that. Ant Insurance was established in September 2016 and is managed and operated by Ant Insurance Agency Co., Ltd. Since its launch, it has reached cooperation with 90 insurance companies and has served more than 600 million users. The platform's products cover health insurance, accident insurance, pension and education funds, property insurance, pet insurance and other categories, and provide "Ant Insurance Premium Selection", "Insurance Payment Xiaobao", "Ant Insurance Savings Care Package", and "Ant Security Care Insurance Compensation" and other high-quality insurance services. Users can search for “Ant Insurance” on the Alipay APP to view related insurance products and services. Ant Insurance Platform is committed to becoming the most trusted and favorite insurance service platform for users and institutions through the power of technology and openness. It hopes to continue to use AI technology to bring high-quality services and experiences to users and institutions.

The above is the detailed content of The application of AI technology in Ant Group's insurance business: innovating insurance services and bringing new experiences. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

DeepMind robot plays table tennis, and its forehand and backhand slip into the air, completely defeating human beginners

Aug 09, 2024 pm 04:01 PM

DeepMind robot plays table tennis, and its forehand and backhand slip into the air, completely defeating human beginners

Aug 09, 2024 pm 04:01 PM

But maybe he can’t defeat the old man in the park? The Paris Olympic Games are in full swing, and table tennis has attracted much attention. At the same time, robots have also made new breakthroughs in playing table tennis. Just now, DeepMind proposed the first learning robot agent that can reach the level of human amateur players in competitive table tennis. Paper address: https://arxiv.org/pdf/2408.03906 How good is the DeepMind robot at playing table tennis? Probably on par with human amateur players: both forehand and backhand: the opponent uses a variety of playing styles, and the robot can also withstand: receiving serves with different spins: However, the intensity of the game does not seem to be as intense as the old man in the park. For robots, table tennis

The first mechanical claw! Yuanluobao appeared at the 2024 World Robot Conference and released the first chess robot that can enter the home

Aug 21, 2024 pm 07:33 PM

The first mechanical claw! Yuanluobao appeared at the 2024 World Robot Conference and released the first chess robot that can enter the home

Aug 21, 2024 pm 07:33 PM

On August 21, the 2024 World Robot Conference was grandly held in Beijing. SenseTime's home robot brand "Yuanluobot SenseRobot" has unveiled its entire family of products, and recently released the Yuanluobot AI chess-playing robot - Chess Professional Edition (hereinafter referred to as "Yuanluobot SenseRobot"), becoming the world's first A chess robot for the home. As the third chess-playing robot product of Yuanluobo, the new Guoxiang robot has undergone a large number of special technical upgrades and innovations in AI and engineering machinery. For the first time, it has realized the ability to pick up three-dimensional chess pieces through mechanical claws on a home robot, and perform human-machine Functions such as chess playing, everyone playing chess, notation review, etc.

Claude has become lazy too! Netizen: Learn to give yourself a holiday

Sep 02, 2024 pm 01:56 PM

Claude has become lazy too! Netizen: Learn to give yourself a holiday

Sep 02, 2024 pm 01:56 PM

The start of school is about to begin, and it’s not just the students who are about to start the new semester who should take care of themselves, but also the large AI models. Some time ago, Reddit was filled with netizens complaining that Claude was getting lazy. "Its level has dropped a lot, it often pauses, and even the output becomes very short. In the first week of release, it could translate a full 4-page document at once, but now it can't even output half a page!" https:// www.reddit.com/r/ClaudeAI/comments/1by8rw8/something_just_feels_wrong_with_claude_in_the/ in a post titled "Totally disappointed with Claude", full of

At the World Robot Conference, this domestic robot carrying 'the hope of future elderly care' was surrounded

Aug 22, 2024 pm 10:35 PM

At the World Robot Conference, this domestic robot carrying 'the hope of future elderly care' was surrounded

Aug 22, 2024 pm 10:35 PM

At the World Robot Conference being held in Beijing, the display of humanoid robots has become the absolute focus of the scene. At the Stardust Intelligent booth, the AI robot assistant S1 performed three major performances of dulcimer, martial arts, and calligraphy in one exhibition area, capable of both literary and martial arts. , attracted a large number of professional audiences and media. The elegant playing on the elastic strings allows the S1 to demonstrate fine operation and absolute control with speed, strength and precision. CCTV News conducted a special report on the imitation learning and intelligent control behind "Calligraphy". Company founder Lai Jie explained that behind the silky movements, the hardware side pursues the best force control and the most human-like body indicators (speed, load) etc.), but on the AI side, the real movement data of people is collected, allowing the robot to become stronger when it encounters a strong situation and learn to evolve quickly. And agile

ACL 2024 Awards Announced: One of the Best Papers on Oracle Deciphering by HuaTech, GloVe Time Test Award

Aug 15, 2024 pm 04:37 PM

ACL 2024 Awards Announced: One of the Best Papers on Oracle Deciphering by HuaTech, GloVe Time Test Award

Aug 15, 2024 pm 04:37 PM

At this ACL conference, contributors have gained a lot. The six-day ACL2024 is being held in Bangkok, Thailand. ACL is the top international conference in the field of computational linguistics and natural language processing. It is organized by the International Association for Computational Linguistics and is held annually. ACL has always ranked first in academic influence in the field of NLP, and it is also a CCF-A recommended conference. This year's ACL conference is the 62nd and has received more than 400 cutting-edge works in the field of NLP. Yesterday afternoon, the conference announced the best paper and other awards. This time, there are 7 Best Paper Awards (two unpublished), 1 Best Theme Paper Award, and 35 Outstanding Paper Awards. The conference also awarded 3 Resource Paper Awards (ResourceAward) and Social Impact Award (

Hongmeng Smart Travel S9 and full-scenario new product launch conference, a number of blockbuster new products were released together

Aug 08, 2024 am 07:02 AM

Hongmeng Smart Travel S9 and full-scenario new product launch conference, a number of blockbuster new products were released together

Aug 08, 2024 am 07:02 AM

This afternoon, Hongmeng Zhixing officially welcomed new brands and new cars. On August 6, Huawei held the Hongmeng Smart Xingxing S9 and Huawei full-scenario new product launch conference, bringing the panoramic smart flagship sedan Xiangjie S9, the new M7Pro and Huawei novaFlip, MatePad Pro 12.2 inches, the new MatePad Air, Huawei Bisheng With many new all-scenario smart products including the laser printer X1 series, FreeBuds6i, WATCHFIT3 and smart screen S5Pro, from smart travel, smart office to smart wear, Huawei continues to build a full-scenario smart ecosystem to bring consumers a smart experience of the Internet of Everything. Hongmeng Zhixing: In-depth empowerment to promote the upgrading of the smart car industry Huawei joins hands with Chinese automotive industry partners to provide

Li Feifei's team proposed ReKep to give robots spatial intelligence and integrate GPT-4o

Sep 03, 2024 pm 05:18 PM

Li Feifei's team proposed ReKep to give robots spatial intelligence and integrate GPT-4o

Sep 03, 2024 pm 05:18 PM

Deep integration of vision and robot learning. When two robot hands work together smoothly to fold clothes, pour tea, and pack shoes, coupled with the 1X humanoid robot NEO that has been making headlines recently, you may have a feeling: we seem to be entering the age of robots. In fact, these silky movements are the product of advanced robotic technology + exquisite frame design + multi-modal large models. We know that useful robots often require complex and exquisite interactions with the environment, and the environment can be represented as constraints in the spatial and temporal domains. For example, if you want a robot to pour tea, the robot first needs to grasp the handle of the teapot and keep it upright without spilling the tea, then move it smoothly until the mouth of the pot is aligned with the mouth of the cup, and then tilt the teapot at a certain angle. . this

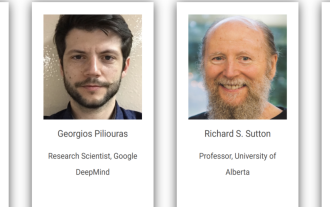

Distributed Artificial Intelligence Conference DAI 2024 Call for Papers: Agent Day, Richard Sutton, the father of reinforcement learning, will attend! Yan Shuicheng, Sergey Levine and DeepMind scientists will give keynote speeches

Aug 22, 2024 pm 08:02 PM

Distributed Artificial Intelligence Conference DAI 2024 Call for Papers: Agent Day, Richard Sutton, the father of reinforcement learning, will attend! Yan Shuicheng, Sergey Levine and DeepMind scientists will give keynote speeches

Aug 22, 2024 pm 08:02 PM

Conference Introduction With the rapid development of science and technology, artificial intelligence has become an important force in promoting social progress. In this era, we are fortunate to witness and participate in the innovation and application of Distributed Artificial Intelligence (DAI). Distributed artificial intelligence is an important branch of the field of artificial intelligence, which has attracted more and more attention in recent years. Agents based on large language models (LLM) have suddenly emerged. By combining the powerful language understanding and generation capabilities of large models, they have shown great potential in natural language interaction, knowledge reasoning, task planning, etc. AIAgent is taking over the big language model and has become a hot topic in the current AI circle. Au