Technology peripherals

Technology peripherals

It Industry

It Industry

IDC: China's Bluetooth headset market has achieved positive growth for the first time since 2022, with shipments increasing by 9.9% year-on-year in the second quarter

IDC: China's Bluetooth headset market has achieved positive growth for the first time since 2022, with shipments increasing by 9.9% year-on-year in the second quarter

IDC: China's Bluetooth headset market has achieved positive growth for the first time since 2022, with shipments increasing by 9.9% year-on-year in the second quarter

News from this site on September 26, IDC’s official public account today released the “China Wireless Headset Market Quarterly Tracking Report, Second Quarter of 2023”, which shows that China’s wireless Bluetooth headset market shipped 45.88 million units in the first half of 2023. , a year-on-year decrease of 0.1%.

This site learned from official reports that bluetooth headset shipments in the second quarter of this year were 25.27 million units, a year-on-year increase of 9.9%, ushering in the first positive growth since 2022.

IDC said that this means that with mid-year promotions and consumption picking up, market demand has begun to show recovery. Among them, the overall market price has further dropped, and products in the low-price segment have become the main force driving market growth.

The Bluetooth headset market segment situation in the first half of 2023 is as follows:

True Wireless Headset

Shipments were 33.22 million units, a year-on-year increase of 0.5 %; of which 18.04 million units were shipped in the second quarter, a year-on-year increase of 8.7%.

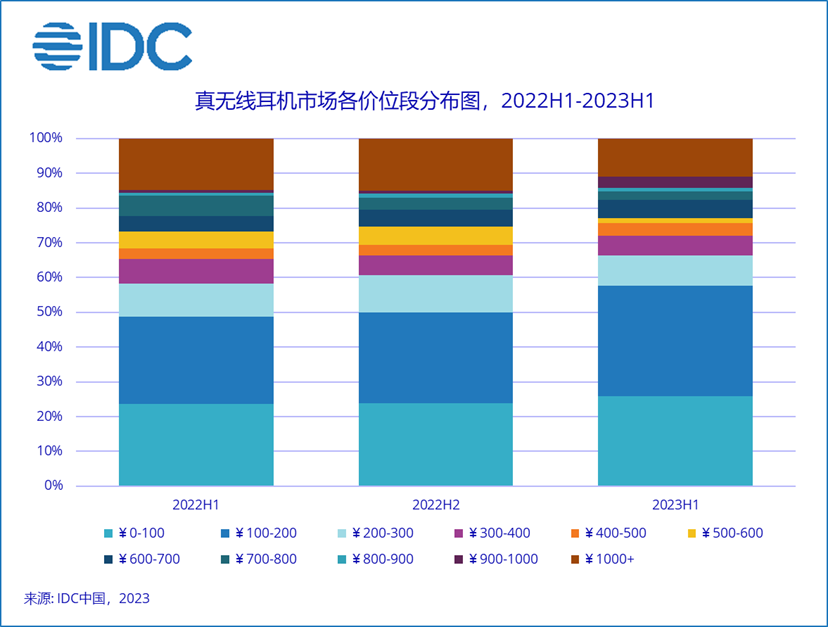

The true wireless headphone market has become the first product type to return to positive growth besides open-back headphones, and it has also led to the recovery of the market. Although the overall true wireless headset market has obviously shifted to the low-price segment, the shipment proportion of active noise-cancelling headsets has remained stable. High cost performance has become an important competitive method for manufacturers in the relatively mature true wireless headset market.

Neck-worn Bluetooth headsets

Shipments were 7.01 million units, a decrease of 16.3% from the same period last year; shipments in the second quarter were 3.81 million units, a decrease of 3.8% compared with the same period last year

The neck collar market also rebounded from continued negative growth to a positive growth of 8.1% in the second quarter.

Bluetooth headphones

Shipments were 2.72 million units, a year-on-year decrease of 15.7%; shipments in the second quarter were 1.46 million units, a year-on-year decrease 13.1%.

The market share of leading manufacturers increased relatively in the second quarter, which is partly related to the mid-year promotional activities. In addition, in the online market, the high-end market of more than 1,000 yuan is relatively stable, while the offline market is more obviously shifting to less than 1,000 yuan

Open Bluetooth Headset

Shipments reached 2.93 million units, a year-on-year increase of 125.2%; shipments in the second quarter were 1.96 million units, a year-on-year increase of 158.2%

The overall economic environment is not yet stable Under stable conditions, the open Bluetooth headset market has maintained stable positive growth and shown further differentiation. In addition to bone conduction technology, ear clips and ear hook products are also developing rapidly. In particular, ear clip products are rapidly penetrating the market at extremely low prices.

IDC predicts that China’s Bluetooth headset market will grow in 2023 Shipment volume will reach 94.86 million units, a year-on-year increase of 2.7%, of which the true wireless headset market will ship 70.47 million units, a year-on-year increase of 3.3%.

The current Bluetooth headset market mainly presents the following two characteristics:

Entry-level price segment drives overall market growth

In the second quarter, the price segment of true wireless products within RMB 200 (excluding tax) accounted for 59.6%, and shipments increased by 32.2% year-on-year, thereby driving significant growth in the true wireless market. As brand competition becomes increasingly fierce, manufacturers are exploring the market to gain or stabilize their share and seek a balance between sales volume and operating profits. At the same time, white-label manufacturers are developing rapidly in the entry-level market. Their advantages mainly lie in extremely high cost performance and flexible online channels.

From a consumer perspective, the market has become more price sensitive under the current economic environment. In addition, various new Bluetooth headsets, including different shapes and co-branded styles of brands, can bring some small happiness to consumers, thus triggering consumer demand for these products, which also promotes the sales of entry-level Bluetooth headsets. Sales growth

Open market product forms are further enriched

The open market still maintains a trend of rapid and stable growth in the first half of 2023, whether it is bone conduction and air conduction from a technical perspective, or ear hooks, ear clips and neck wear from a morphological perspective formulas, all showing rapid growth.

In the second quarter, the brand concentration in the overall open market was further dispersed, and various manufacturers joined the layout to accelerate market differentiation.

Among them, bone conduction headphones, as the most important product form of open headphones, still maintain great growth momentum as the demand for outdoor sports increases in spring and summer. And as more players enter, the threshold drops, driving the proportion of mid- to low-price segments to rise.

Ear-hook and ear-clip products are mainly based on air conduction technology. The prices of ear-hook products are obviously polarized. Ear-clip products are concentrated in the entry-level market represented by white brands, with low prices. and flexible channel advantages to quickly penetrate the market.

Reference

- The first positive growth since 2022, China’s Bluetooth headset market shipments increased by 9.9% year-on-year in the second quarter. Rewritten content: Since 2022, China’s Bluetooth headset market has achieved positive growth for the first time in the second quarter, with shipments increasing by 9.9% year-on-year

The above is the detailed content of IDC: China's Bluetooth headset market has achieved positive growth for the first time since 2022, with shipments increasing by 9.9% year-on-year in the second quarter. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

How to connect Xiaomi Bluetooth headset to Apple phone_Introduction to tutorial on pairing Xiaomi Bluetooth headset to iPhone

Mar 23, 2024 pm 03:01 PM

How to connect Xiaomi Bluetooth headset to Apple phone_Introduction to tutorial on pairing Xiaomi Bluetooth headset to iPhone

Mar 23, 2024 pm 03:01 PM

1. Place the earphones in the charging box and press and hold the button under the charging box for ten seconds. 2. Select Bluetooth in the phone settings menu. 3. Turn on the button on the right side of Bluetooth and connect the Xiaomi headphones.

How to recover lost earphones from oppo_Steps to recover lost earphones from oppo

Apr 19, 2024 pm 04:25 PM

How to recover lost earphones from oppo_Steps to recover lost earphones from oppo

Apr 19, 2024 pm 04:25 PM

1. Enter the Bluetooth device of your mobile phone and click the [i] icon after the name of the Bluetooth headset to enter the pairing setting interface. 2. Click [Headphone Function]. 3. Click [Find OPPO Wireless Headphones]. When the headphones are nearby, you can play the sound to determine the location. When the headphones are not nearby, you can view the last location. Editor's tip: To use the "Search OPPO Wireless Headphones" function, you must meet the following conditions: 1. If you want to search for: EncoX, EncoW51, EncoFree, Encofree2, you need to use an OPPO mobile phone with ColorOS7 or above system version to search. 2. If you want to find: EncoPlay, EncoAir, you need to use an OPPO mobile phone with ColorOS11 or above system version to search. 3

Why is there no sound in the Amap navigation?

Apr 02, 2024 am 05:09 AM

Why is there no sound in the Amap navigation?

Apr 02, 2024 am 05:09 AM

The reasons why there is no sound in Amap navigation include improper speaker connection, lowering the device volume, incorrect Amap settings, background application interference, mobile phone silent or vibration mode, and system permission issues. The solutions are as follows: check the speaker connection; adjust the volume; check the Amap map settings; close background applications; check the phone mode; grant permissions; restart the device; update the Amap map; and contact customer service.

How to connect Bluetooth headset to computer win10_How to connect bluetooth headset to computer win10

Mar 27, 2024 pm 03:00 PM

How to connect Bluetooth headset to computer win10_How to connect bluetooth headset to computer win10

Mar 27, 2024 pm 03:00 PM

1. Click the Windows logo in the lower left corner of the computer, and then click the Settings logo on the left. 2. Select device options to enter. 3. Select Bluetooth and its devices in the device bar on the left, and click to add Bluetooth or other devices. 4. In the pop-up Add Device option, click Bluetooth. 5. Enter the search process. After the search is completed, select the Bluetooth device you want to connect to. 6. After selecting the Bluetooth device to be connected, click Connect. 7. After the connection is successful, the connected device will be displayed on the Bluetooth and other devices page. At this time, you can use the Bluetooth device to perform transmission tasks.

How to pair Huawei Bluetooth headsets with new devices

Mar 29, 2024 am 10:06 AM

How to pair Huawei Bluetooth headsets with new devices

Mar 29, 2024 am 10:06 AM

How to pair Huawei Bluetooth headsets with new devices 1. With the headset in the box, with the cover open, press and hold the button for more than 10 seconds until the indicator light in the box flashes white, entering re-pairing mode. 2. Turn on Bluetooth on your phone, search for the pairable device, and click on the Bluetooth name of the headset, FreeBuds3, to pair it. When connecting to a Huawei phone, after turning on the phone's Bluetooth, a proximity auto-discovery pop-up box with the name and picture of the headset will appear on the phone. Click Connect and the headset will be connected. 4. Or open the Smart Life APP, click the "+" button in the upper right corner, scan the device and add it. How to pair Huawei wireless headphones? This article uses Huawei P40 (connected to Huawei FreeBuds3); EMUI11 as a case to explain. 1. Place the Huawei wireless headset body into the charging box and open it.

Why do Bluetooth headsets always sound intermittent and how to deal with them. Detailed introduction: Introduction to the reasons why Bluetooth headsets sound intermittent.

Mar 10, 2024 am 10:31 AM

Why do Bluetooth headsets always sound intermittent and how to deal with them. Detailed introduction: Introduction to the reasons why Bluetooth headsets sound intermittent.

Mar 10, 2024 am 10:31 AM

It's very annoying when Bluetooth headsets or speakers are intermittent. Let me troubleshoot them one by one. 1. Troubleshoot hardware problems: First, try to connect the mobile phone to the headset or stereo via Bluetooth to ensure that the sound transmission is normal. Then, switch the phone from Wi-Fi to mobile network to check the sound performance. If the Bluetooth device does not have intermittent sound on the mobile network but does on Wi-Fi, it may be due to interference between Wi-Fi and Bluetooth. If the sound from your Bluetooth headset or speaker is still interrupted after connecting to your phone and using the mobile network, it may be due to a problem with the Bluetooth device itself. It is recommended to try another device for testing. If the problem persists, it is likely that the device itself is faulty. 3. There is another strange situation that few people notice.

What should I do if win11 Bluetooth cannot connect? Analysis of the problem that win11 Bluetooth cannot connect and can only pair

Mar 16, 2024 pm 06:30 PM

What should I do if win11 Bluetooth cannot connect? Analysis of the problem that win11 Bluetooth cannot connect and can only pair

Mar 16, 2024 pm 06:30 PM

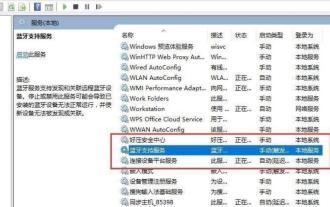

When we use the computer, we will find that win11 cannot connect to Bluetooth. So what should we do if win11 cannot connect to Bluetooth? Users can turn on the Bluetooth support service option or enter the network adapter under the device manager to operate. Let this site carefully introduce to users the analysis of the problem that Win11 Bluetooth cannot connect and can only pair. Win11 Bluetooth cannot connect and can only pair. Step 1: 1. Run (Win R), enter the [services.msc] command, and press [OK or Enter] to quickly open the service. 2. In the service window, find the name [Bluetooth Support Service]. 3. Double-click to open [Bluetooth Support Service], if the service status is stopped

Apple 14 wired headphone link usage tutorial

Mar 22, 2024 pm 08:30 PM

Apple 14 wired headphone link usage tutorial

Mar 22, 2024 pm 08:30 PM

The Apple 14 is not equipped with a 3.5mm headphone jack in the traditional sense, so it cannot be directly plugged into ordinary headphones. If you need to listen to audio, you can only connect it with the help of an adapter or accessories using a dedicated interface. Apple 14 wired headset link usage tutorial A: Use a dedicated interface headset or adapter 1. Please note that the entire iPhone 14 series no longer provides direct support for wired headsets. 2. Since the release of iPhone7, Apple has not provided a 3.5mm headphone jack on new models. 3. If you want to use wired headphones on iPhone 14, it is recommended to choose a headset equipped with a dedicated adapter cable and thunderbolt interface. 4. Purchase at Apple’s official online accessories store, which is also launched by many third-party manufacturers.