Technology peripherals

Technology peripherals

It Industry

It Industry

TrendForce predicts that smartphone panel shipments will decrease by 9% in 2024

TrendForce predicts that smartphone panel shipments will decrease by 9% in 2024

TrendForce predicts that smartphone panel shipments will decrease by 9% in 2024

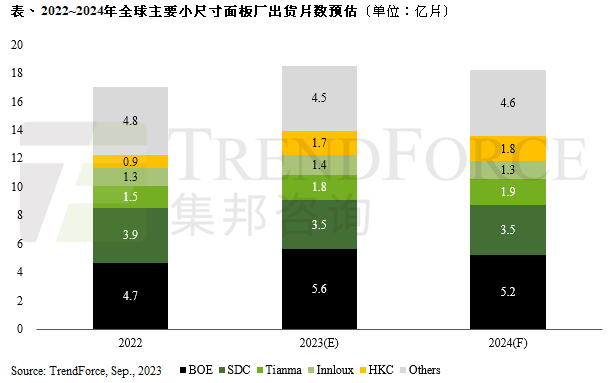

According to news from this website on September 28, this website learned from the TrendForce official account that the shipment volume of smartphone panels in 2023 is estimated to be about 1.85 billion pieces, with an annual increase of 8.7%, mainly affected by Driven by the repair market and the boom in second-hand mobile phones, the smartphone market is expected to return to the normal supply and demand cycle in 2024, and the demand for repair and second-hand mobile phones may decrease. It is estimated that smartphone panel shipments will be approximately 1.82 billion pieces, a year-on-year decrease of 9 %.

TrendForce TrendForce said that judging from the shipments of various panel manufacturers, LCD demand decline is a common problem faced by some manufacturers. BOE currently ranks as the global leader in smartphone panel shipments, with shipments expected to be approximately 560 million units in 2023. Affected by the decline of LCD, shipments are estimated to be approximately 520 million units in 2024, an annual decrease of 7.2%. Samsung Display (SDC) ranks second in shipments. Due to the shrinkage of the rigid AMOLED panel market, shipments this year are about 350 million pieces. Supported by demand from Apple and its own mobile phones, shipments in 2024 are expected to be the same as this year. Ranked third is Tianma, with shipments of approximately 175 million pieces in 2023. With expanded cooperation with various brands, shipments may grow slightly to 190 million pieces in 2024, an annual increase of 5.2%.

Innolux ranks fourth and is expected to ship approximately 140 million pieces in 2023. However, the reduction in LCD market demand will have an impact on shipments in 2024, which is expected to be approximately 125 million units, an annual decrease of 11.2%. Ranked fifth is HKC. With the cost advantage of the G8.6 generation line, shipments are expected to be 170 million pieces in 2023, and are expected to grow to 180 million pieces in 2024, with an annual increase of 4.2%. According to TrendForce, among the top five manufacturers, only SDC’s shipments will decline due to the weakening demand for rigid AMOLED panels in 2023. This represents the entry of Korean rigid AMOLED panels into mainland flexible AMOLED panels. After the production, due to insufficient cost competitiveness, it is gradually declining

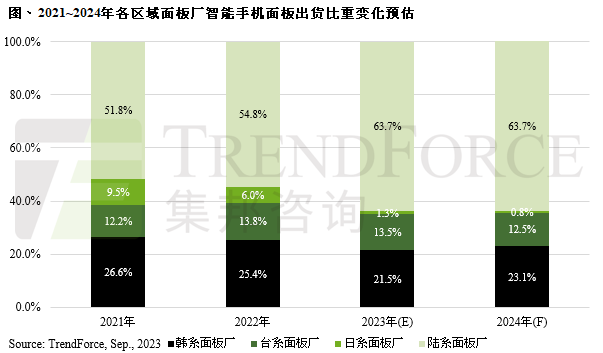

If we look at the shipment proportion of panel factories in each region, Taiwanese panel factories have The support of a-Si LCD can maintain the proportion; Japanese panel manufacturers have sharply and quickly withdrawn from the mobile phone market, resulting in a decline in the proportion; Korean panel manufacturers can still maintain a share of 23~25% with the use of flexible AMOLED panel technology and high-end mobile phones; mainland China The proportion of Chinese panel manufacturers in overall smartphone panel shipments will increase rapidly from 54.8% in 2022 to 63.7% in 2023, showing that Chinese panel manufacturers continue to play a key role in the overall smartphone supply chain

Advertising statement: The external jump links contained in the article (including but not limited to hyperlinks, QR codes, passwords, etc.) are used to convey more information and save selection. Time and results are for reference only. All articles on this site contain this statement.

The above is the detailed content of TrendForce predicts that smartphone panel shipments will decrease by 9% in 2024. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Long awaited! Xiaomi MIX Flip upgrade adds Mijia App external screen display function

Aug 20, 2024 pm 09:39 PM

Long awaited! Xiaomi MIX Flip upgrade adds Mijia App external screen display function

Aug 20, 2024 pm 09:39 PM

According to news on August 20, today, Xiaomi ThePaper OS officially announced an important update. Mijia App now supports external screen display on Xiaomi MIX Flip. To enable this feature, users only need to upgrade Mijia App to version V9.7.701 and above, and then add Mijia App in phone settings-external screen-external screen application. After opening the app, users can view supported devices in "My Home" directly on the external screen and quickly adjust the device status. In addition to the Mijia App, fenye's English learning software app also supports the external screen display of Xiaomi MIX Flip and can be directly switched to the internal screen for use. Xiaomi MIXFlip release date: July 19 Processor: Snapdragon 8Gen3 internal screen

The first 1.5K under-screen camera! Nubia Z70 Ultra is here: the world's first Snapdragon 8 Gen4 true full-screen phone

Aug 19, 2024 pm 03:47 PM

The first 1.5K under-screen camera! Nubia Z70 Ultra is here: the world's first Snapdragon 8 Gen4 true full-screen phone

Aug 19, 2024 pm 03:47 PM

According to news on August 19, Nubia has been adhering to the true full-screen design since the release of Z50 Ultra, and has been continuously exploring the field of proactive photography under high-pixel screens. Today, digital blogger Wisdom Pikachu broke the news that the Nubia Z70 Ultra, which will be released in the second half of this year, will debut with 1.5K under-screen camera technology, which is the highest-resolution UDC solution in the industry so far. It is reported that ZTE’s under-screen proactive solution has advanced to the sixth generation. The latest under-screen proactive solution is available in the Nubia Z60 Ultra and Red Magic 9S Pro series. The screen resolution is 2480x1116, which is between 1080P and 1.5K resolution. This time Nubia will break through the limitations of existing resolutions and set a new benchmark in the industry.

Yu Chengdong once said that he copied Huawei! Xiaomi's response is to smear: the keel shaft patent is officially confirmed and there are big differences between the two parties

Aug 07, 2024 pm 07:28 PM

Yu Chengdong once said that he copied Huawei! Xiaomi's response is to smear: the keel shaft patent is officially confirmed and there are big differences between the two parties

Aug 07, 2024 pm 07:28 PM

According to news on August 7, Xiaomi’s keel pivot hinge patent was recently approved. The application was filed on September 18, 2020, and the application was published on March 18, 2022. The final authorization announcement date is June 25, 2024. The technology involved in this patent is the "keel hinge" that has been installed on Xiaomi MIX Fold3 as early as 2018. Judging from the patent abstract, the rotating shaft adopts a unique three-stage connecting rod rotating shaft design, which not only improves the freedom of the rotating shaft, but also greatly improves the reliability and anti-drop performance of the entire machine. Its folding life has reached 500,000 times. . 1. Yu Chengdong laughed at the 2023 Pollen Annual Meeting and talked about plagiarism by friends, saying that he had infringed on Huawei's intellectual property rights, used Huawei's designs without authorization and changed names at will. Yu Chengdong pointed out that Xiaomi

Realme GT7 Pro is full of products: ultrasonic fingerprint, super large battery, and 100W fast charging are all listed

Aug 23, 2024 pm 03:31 PM

Realme GT7 Pro is full of products: ultrasonic fingerprint, super large battery, and 100W fast charging are all listed

Aug 23, 2024 pm 03:31 PM

According to news on August 23, according to digital bloggers Digital Chat Station, the product capabilities of the Realme GT7 Pro will be comprehensively strengthened, and its configuration will cover ultrasonic fingerprints, periscope telephoto, ultra-large batteries, and 100-watt fast charging. 1. Realme GT7Pro has a built-in large 6000mAh battery and supports 100W fast charging. The engineering machine does not support wireless charging, and the mass production model is unknown. Equipped with single-point ultrasonic fingerprint recognition and supports IP68/69 dustproof and waterproof. Equipped with LYT6003X periscope, it does not support telephoto macro. Equipped with a 1.5K resolution equal depth four-curved screen, using BOE X2 substrate. It uses the Snapdragon 8Gen4 processor and supports up to 16GB of memory and 1TB of storage. The Realme GT7Pro is expected to be launched as soon as Q4 this year.

The price of Mate 60 is reduced by 800 yuan, and the price of Pura 70 is reduced by 1,000 yuan: Just wait until Huawei releases Mate 70!

Aug 16, 2024 pm 03:45 PM

The price of Mate 60 is reduced by 800 yuan, and the price of Pura 70 is reduced by 1,000 yuan: Just wait until Huawei releases Mate 70!

Aug 16, 2024 pm 03:45 PM

According to news on August 16, for current Huawei mobile phones, they are already working hard to clear the way for the launch of new models, so everyone has seen the prices of the Mate60 series and Pura70 series being reduced one after another. With Huawei officially announcing price cuts for the Mate60 series on August 15, the latest models of Huawei’s two flagship series have completed price adjustments. In July this year, Huawei officially announced that the Huawei Pura70 series would be on sale, with prices reduced by up to 1,000 yuan. Among them, Huawei Pura70 has a direct discount of 500 yuan, with a starting price of 4999 yuan; Huawei Pura70 Beidou Satellite News Edition has a direct discount of 500 yuan, with a starting price of 5099 yuan; Huawei Pura70Pro has a direct discount of 800 yuan, with a starting price of 5699 yuan; Huawei Pura70Pr

Samsung improves the quality of Galaxy smartphone repair services: experts go overseas and share technology

Aug 07, 2024 pm 07:23 PM

Samsung improves the quality of Galaxy smartphone repair services: experts go overseas and share technology

Aug 07, 2024 pm 07:23 PM

According to news on August 7, Samsung Electronics announced today that it is actively promoting a knowledge transfer plan in order to improve the quality of global smartphone repairs. The company is sending Korean smartphone repair experts overseas to improve repair technology at local service centers. Source: Samsung Electronics press release Samsung has always been known for its excellent after-sales service and repair capabilities, and the company hopes to extend this advantage to the global market. Overseas dispatch of domestic service experts Earlier this year, Samsung launched the "Overseas dispatch of domestic service experts" project in South Korea. As part of the project, Samsung sent a Galaxy Service Expert Instructor to India to impart relevant experience and techniques to engineers at local service centers. The lecturer worked with Samsung Services in eight cities including Delhi, Mumbai and Noida

iPhone innovation is dead! Apple has fallen off the altar: there won't be any game-changing products in the next 2-3 years

Aug 08, 2024 am 01:34 AM

iPhone innovation is dead! Apple has fallen off the altar: there won't be any game-changing products in the next 2-3 years

Aug 08, 2024 am 01:34 AM

According to news on August 5, according to foreign media reports, Apple’s innovation has stagnated, and you will not see any game-changing products in the next 2-3 years. Foreign media reporter Mark Gurman said that everything is fine with Apple. But the company's pace of innovation has slowed to a crawl and may have missed out on the latest major new products while eliminating future sources of growth like in-house screen technology and cars. "I don't see any game-changing products on Apple's product roadmap for the next two or three years. In my opinion, anything new and meaningful may not appear until around 2027." Gu Mann said. This reporter has accurately exposed Apple’s new products many times before, and judging from his latest speech, he also expressed his enthusiasm for the company’s innovation.

Snapdragon 8 Gen4 is truly full screen! Nubia Z70 Ultra parameters first revealed: registered 1.5K under-screen front camera

Aug 08, 2024 pm 06:48 PM

Snapdragon 8 Gen4 is truly full screen! Nubia Z70 Ultra parameters first revealed: registered 1.5K under-screen front camera

Aug 08, 2024 pm 06:48 PM

According to news on August 8, today digital blogger @ Smart Pikachu revealed that Nubia’s new true full-screen flagship will continue to be equipped with quasi-1.5K under-screen front-facing technology, and is expected to be the Nubia Z70 Ultra equipped with the Snapdragon 8Gen4 mobile platform. . The true full-screen design of the Nubia Z series has been committed to the true full-screen design since the Nubia Z50 Ultra. Its follow-up product, the Z60 Ultra leading version, also inherits this concept. Quasi-1.5K resolution The screen resolution of these models has reached 2480x1116, which is between 1.5K and 1080P resolution, and can be called quasi-1.5K. Under-screen proactive technology Although there was news last year about ZTE’s development of 1.5K under-screen proactive technology, considering the length of the research and development cycle, currently