Technology peripherals

Technology peripherals

It Industry

It Industry

With over 60 million users in 5 years, payment application PayPay may become Son's next IPO target

With over 60 million users in 5 years, payment application PayPay may become Son's next IPO target

With over 60 million users in 5 years, payment application PayPay may become Son's next IPO target

News on October 8th, payment application PayPay has become one of the success stories of Masayoshi Son, founder of Japan’s SoftBank Group, and its users have grown from zero to more than 60 million in five years. The app is now looking to maintain double-digit growth with help from other SoftBank investment firms, according to the company's co-chief operating officer.

The startup, seen as SoftBank's next initial public offering (IPO) target, has two-thirds of the QR code payments market in Japan, where cash still dominates. Partnering with Line, a Japanese messaging service owned by SoftBank's telecom unit, will help PayPay gain an additional 30 million users in the coming years, according to PayPay co-chief operating officer Masamichi Yasuda.

Son encourages portfolio companies to collaborate with one another, and PayPay is one of the few fruitful moves in that strategy. SoftBank holds a majority stake in PayPay through its telecom unit, holding company and second Vision Fund. The company initially adopted India's Paytm payment technology. The first Vision Fund invested in Paytm in 2017. As of March this year, PayPay's gross merchandise volume (GMV, a key indicator of performance) exceeded 10 trillion yen, a year-on-year increase of 34%. Masamichi Yasuda said this is the growth rate PayPay hopes to maintain. He said the company would use its range of services, from credit cards to insurance to stock trading, to boost transactions and user growth.PayPay's rapid growth has also benefited from the Japanese government's efforts to encourage digital payments, although Japanese people still prefer to use cash

. In 2022, cashless payments accounted for approximately 36% of total consumer transactions, according to Japan’s Ministry of Economic Affairs. While this figure lags behind neighboring countries, it is more than double what it was a decade ago. PayPay acquired a stake in PayPay Card last year, with SoftBank’s telecom unit investing heavily in the startup in an internal transaction, according to calculations by Kirk Boodry, an analyst at Astris Advisory. The valuation is approximately 1 trillion yen. Analysts said the payments company's IPO would be good for SoftBank if investors agree to the valuation. Budley said: "They have done very well with PayPay because at the beginning of this business Before, they were little known in the fintech space. Now, they have managed to capture a large share of this market."Payment by scanning QR codes is widely used in China, including WeChat Pay and Alipay , and now it is becoming more and more popular in Japan. Lower commissions compared to those charged by credit card providers continue to attract merchants.

However, PayPay is paying closer attention to its financial health. The company, which currently charges retailers a fee, reported profit before interest, taxes, depreciation and amortization for the first time in the second quarter ended June. Masamichi Yasuda said the company hopes to improve its ability to use PayPay The average amount spent on a personal account, but he declined to elaborate further. PayPay is also considering expanding into business accounts and possibly offering overseas use through partnerships with local payment apps, he added. In order to expand the coverage of PayPay, it will face fierce competition from Rakuten Group. Rakuten Group also offers a range of similar services, including Rakuten Payments, credit cards and brokerage services. The payments market is also becoming increasingly crowded, while credit cards still dominate high-value transactions such as luxury purchases "We are gradually entering a different phase of growth," Yasuda said. PayPay will continue to invest, “but at the same time, we hope that profitability will become a sticky trend for us.” Advertising statement: The external jump links contained in the article (including but not limited to hyperlinks, 2D code, password, etc.), used to transmit more information and save selection time. The results are for reference only. All articles on this site include this statement.The above is the detailed content of With over 60 million users in 5 years, payment application PayPay may become Son's next IPO target. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Behind the first Android access to DeepSeek: Seeing the power of women

Mar 12, 2025 pm 12:27 PM

Behind the first Android access to DeepSeek: Seeing the power of women

Mar 12, 2025 pm 12:27 PM

The rise of Chinese women's tech power in the field of AI: The story behind Honor's collaboration with DeepSeek women's contribution to the field of technology is becoming increasingly significant. Data from the Ministry of Science and Technology of China shows that the number of female science and technology workers is huge and shows unique social value sensitivity in the development of AI algorithms. This article will focus on Honor mobile phones and explore the strength of the female team behind it being the first to connect to the DeepSeek big model, showing how they can promote technological progress and reshape the value coordinate system of technological development. On February 8, 2024, Honor officially launched the DeepSeek-R1 full-blood version big model, becoming the first manufacturer in the Android camp to connect to DeepSeek, arousing enthusiastic response from users. Behind this success, female team members are making product decisions, technical breakthroughs and users

DeepSeek's 'amazing' profit: the theoretical profit margin is as high as 545%!

Mar 12, 2025 pm 12:21 PM

DeepSeek's 'amazing' profit: the theoretical profit margin is as high as 545%!

Mar 12, 2025 pm 12:21 PM

DeepSeek released a technical article on Zhihu, introducing its DeepSeek-V3/R1 inference system in detail, and disclosed key financial data for the first time, which attracted industry attention. The article shows that the system's daily cost profit margin is as high as 545%, setting a new high in global AI big model profit. DeepSeek's low-cost strategy gives it an advantage in market competition. The cost of its model training is only 1%-5% of similar products, and the cost of V3 model training is only US$5.576 million, far lower than that of its competitors. Meanwhile, R1's API pricing is only 1/7 to 1/2 of OpenAIo3-mini. These data prove the commercial feasibility of the DeepSeek technology route and also establish the efficient profitability of AI models.

Top 10 Best Free Backlink Checker Tools in 2025

Mar 21, 2025 am 08:28 AM

Top 10 Best Free Backlink Checker Tools in 2025

Mar 21, 2025 am 08:28 AM

Website construction is just the first step: the importance of SEO and backlinks Building a website is just the first step to converting it into a valuable marketing asset. You need to do SEO optimization to improve the visibility of your website in search engines and attract potential customers. Backlinks are the key to improving your website rankings, and it shows Google and other search engines the authority and credibility of your website. Not all backlinks are beneficial: Identify and avoid harmful links Not all backlinks are beneficial. Harmful links can harm your ranking. Excellent free backlink checking tool monitors the source of links to your website and reminds you of harmful links. In addition, you can also analyze your competitors’ link strategies and learn from them. Free backlink checking tool: Your SEO intelligence officer

Midea launches its first DeepSeek air conditioner: AI voice interaction can achieve 400,000 commands!

Mar 12, 2025 pm 12:18 PM

Midea launches its first DeepSeek air conditioner: AI voice interaction can achieve 400,000 commands!

Mar 12, 2025 pm 12:18 PM

Midea will soon release its first air conditioner equipped with a DeepSeek big model - Midea fresh and clean air machine T6. The press conference is scheduled to be held at 1:30 pm on March 1. This air conditioner is equipped with an advanced air intelligent driving system, which can intelligently adjust parameters such as temperature, humidity and wind speed according to the environment. More importantly, it integrates the DeepSeek big model and supports more than 400,000 AI voice commands. Midea's move has caused heated discussions in the industry, and is particularly concerned about the significance of combining white goods and large models. Unlike the simple temperature settings of traditional air conditioners, Midea fresh and clean air machine T6 can understand more complex and vague instructions and intelligently adjust humidity according to the home environment, significantly improving the user experience.

Another national product from Baidu is connected to DeepSeek. Is it open or follow the trend?

Mar 12, 2025 pm 01:48 PM

Another national product from Baidu is connected to DeepSeek. Is it open or follow the trend?

Mar 12, 2025 pm 01:48 PM

DeepSeek-R1 empowers Baidu Library and Netdisk: The perfect integration of deep thinking and action has quickly integrated into many platforms in just one month. With its bold strategic layout, Baidu integrates DeepSeek as a third-party model partner and integrates it into its ecosystem, which marks a major progress in its "big model search" ecological strategy. Baidu Search and Wenxin Intelligent Intelligent Platform are the first to connect to the deep search functions of DeepSeek and Wenxin big models, providing users with a free AI search experience. At the same time, the classic slogan of "You will know when you go to Baidu", and the new version of Baidu APP also integrates the capabilities of Wenxin's big model and DeepSeek, launching "AI search" and "wide network information refinement"

Prompt Engineering for Web Development

Mar 09, 2025 am 08:27 AM

Prompt Engineering for Web Development

Mar 09, 2025 am 08:27 AM

AI Prompt Engineering for Code Generation: A Developer's Guide The landscape of code development is poised for a significant shift. Mastering Large Language Models (LLMs) and prompt engineering will be crucial for developers in the coming years. Th

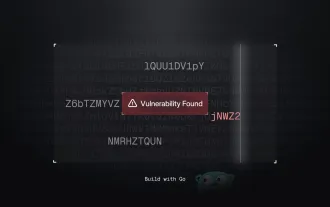

Building a Network Vulnerability Scanner with Go

Apr 01, 2025 am 08:27 AM

Building a Network Vulnerability Scanner with Go

Apr 01, 2025 am 08:27 AM

This Go-based network vulnerability scanner efficiently identifies potential security weaknesses. It leverages Go's concurrency features for speed and includes service detection and vulnerability matching. Let's explore its capabilities and ethical