Major listed companies in the industry: (300024), (688580), (836163), etc.

Core data of this article: Industrial chain panorama, regional heat map, merger and reorganization trends

Panoramic review of the industrial chain of the exoskeleton robot industry: extensive upstream and downstream layout

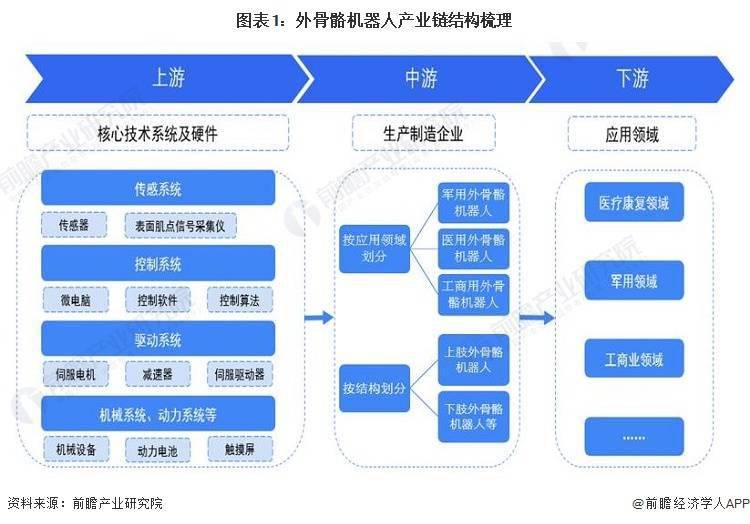

The exoskeleton robot industry is centered on midstream exoskeleton robot manufacturers. The upstream mainly includes core technology systems and hardware, and the downstream is its application field. From an upstream perspective, the sensing system, control system, and drive system are the three key systems, while the mechanical system and power system serve as supporting equipment. The upstream core products include control sensors, surface muscle point signal collectors, control software, servo motors, servo drives, reducers, etc. In the midstream, exoskeleton robots can be divided into military exoskeleton robots, rehabilitation exoskeleton robots, and industrial and commercial exoskeleton robots according to application fields; according to structure, they can be divided into upper limb exoskeleton robots, lower limb exoskeleton robots, etc. The main downstream fields include medical rehabilitation, military field, industrial and commercial field, personal application, etc.

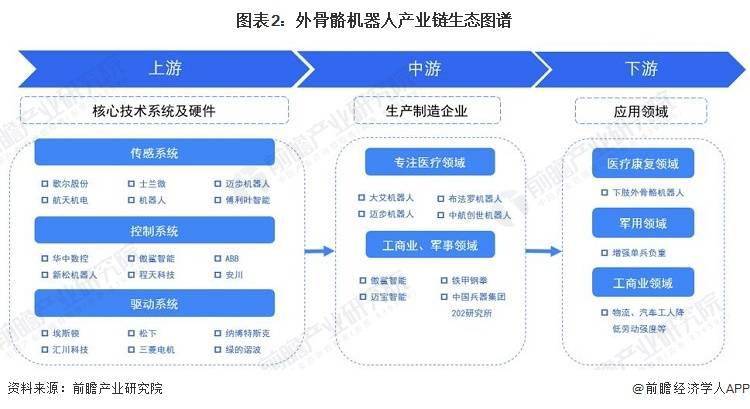

The middle reaches of the exoskeleton robot industry chain are mainly divided into two camps: focusing on the medical field and focusing on the industrial, commercial and military fields. Representative companies in the medical field include Daai Robot, Step Robot, Buffalo Robot, and representative companies in the industrial, commercial and military fields. Including Aosha Intelligence, Maibao, Iron Armor Steel Fist, etc. The upstream sensing systems include Maobu Robot, Fourier Intelligence, etc., the control systems include Xinsong Robot, Aosha Intelligence, Chengtian Technology, etc., and the driving systems include Panasonic, Inovance Technology, etc. The downstream medical field is mainly used for patient rehabilitation training, the industrial and commercial field applications include enhancing load-bearing capacity, reducing labor pressure, and reducing worker strain, etc. The military field is mainly used to enhance the load-bearing level of individual soldiers.

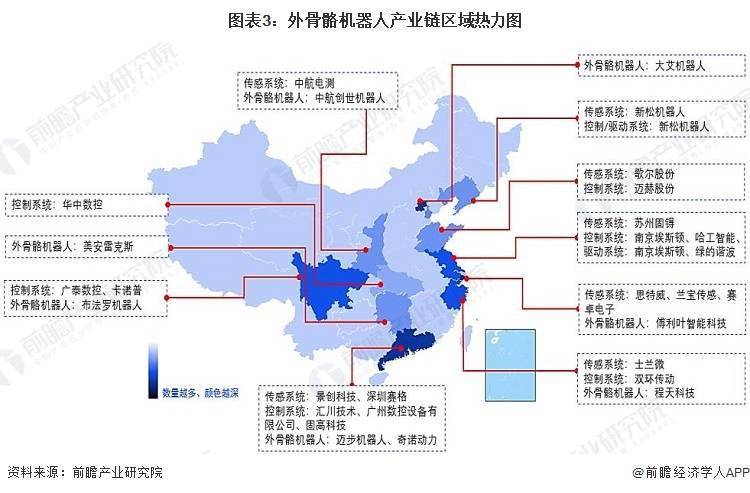

The regional heat map of the exoskeleton robot industry chain shows that most companies are mainly concentrated in the coastal areas of East China

Judging from the regional distribution of enterprises related to China's foreign skeleton robot industry chain, Guangdong Province, Jiangsu Province, Zhejiang Province, Shanghai City, Sichuan Province and other places have gathered a large number of supporting enterprises, and the industrial agglomeration effect is good. Representative exoskeleton robot companies in Guangdong include Step Robot, Chino Power, etc., and corresponding upstream companies include Jingchuang Technology, Shenzhen SEG, Guangzhou CNC Equipment Co., Ltd., etc.; related companies in Jiangsu, Zhejiang, and Shanghai in the Yangtze River Delta region It is also relatively rich, gathering representative companies such as Fourier and Chengtian Technology.

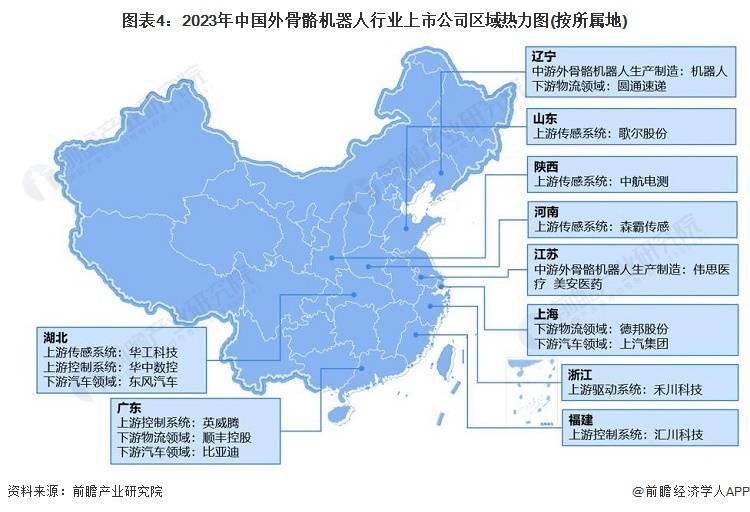

Judging from the regional distribution of listed companies, currently listed companies in China's exoskeleton robot industry are mainly distributed in East China, and most of the selected representative companies are located in Jiangsu and Shanghai.

Product layout of representative exoskeleton robot companies: Products are mainly concentrated in the medical field

The main representative companies of China’s exoskeleton robots are mainly unlisted companies. From the perspective of product types, Chinese companies Daai Robot and Fuli Exoskeleton Robot have a wide range of products. DaAi Robot's business covers products for patients in the early, middle and late stages of recovery, such as Aikang in the early recovery stage, Xiao Aikang in the middle stage of recovery, and AiDong in the late recovery stage. Analyzing from the perspective of qualification certificates obtained, Weiss Medical has obtained more qualification certificates, a total of 87. From the perspective of the number of tenders and tenders, Weisi Medical has a larger number of tenders, reaching 500 pieces

Please note: The data query date is July 25, 2023

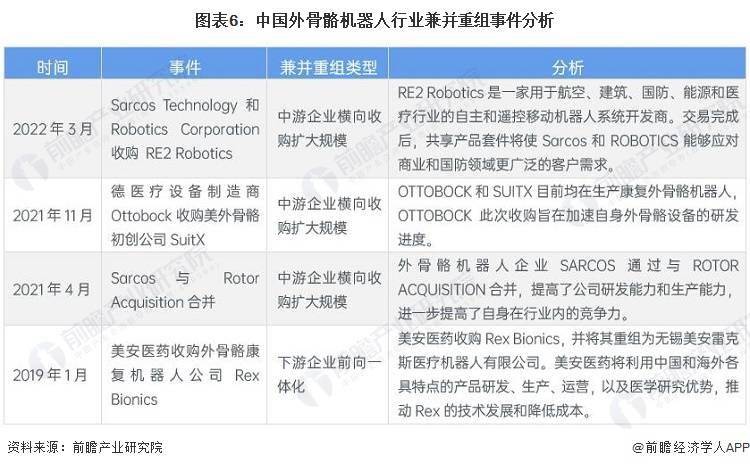

Analysis of mergers and reorganizations in the exoskeleton robot industry: mainly horizontal integration

The domestic exoskeleton robot industry is still in its infancy, the commercialization level of each company's products is low, and there has not yet been a large-scale merger or reorganization in the industry. From the perspective of industry development, the key cases of mergers and reorganizations in China's exoskeleton robot industry are analyzed as follows:

Please refer to Qianzhan Industry Research Institute's "" for more research and analysis on this industry

Qianzhan Industry Research Institute also provides other solutions, such as consulting services. If you need to quote the content of this article in public information disclosures such as prospectuses and company annual reports, you must obtain formal authorization from the Qianzhan Industry Research Institute in advance

More in-depth industry analysis is available in [Forward-looking Economist APP], and you can also communicate and interact with 500 economists/senior industry researchers.

The above is the detailed content of New title: China's exoskeleton robot industry: Analysis of the status quo of the industrial chain and market competition pattern in 2023 (with the distribution of enterprises in the coastal areas of East China). For more information, please follow other related articles on the PHP Chinese website!