Technology peripherals

Technology peripherals

AI

AI

Intel releases third-quarter financial report, artificial intelligence and new foundry business attract much attention

Intel releases third-quarter financial report, artificial intelligence and new foundry business attract much attention

Intel releases third-quarter financial report, artificial intelligence and new foundry business attract much attention

Chipmaker Intel released its third-quarter earnings report today, and its stock price rose nearly 8% in extended trading hours. At the same time, Intel gave an optimistic forecast, with profits and sales exceeding expectations, and mentioned the new customers attracted by its foundry business, as well as revealing that it is receiving increasing attention in the field of AI.

In the third quarter, Intel’s earnings, excluding specific costs such as stock compensation, were 41 cents per share, exceeding Wall Street expectations of 22 cents per share. Revenue fell 8% from the same period last year to $14.16 billion. , but this was still higher than analysts’ consensus forecast of $13.53 billion.

Intel’s net profit for the quarter was US$297 million, down from US$1.02 billion in the same period last year, and its gross profit margin was 45.8%, which was the same as the same period last year.

In terms of guidance, Intel expects fourth-quarter revenue to be between US$14.6 billion and US$15.6 billion, far exceeding the US$14.4 billion target set by analysts. Additionally, Intel forecast earnings of 44 cents per share, compared with expectations of 33 cents per share.

Intel CEO Pat Gelsinger (pictured) said on a conference call that despite continued inventory depletion in the data center server market over the past few quarters, CPU and accelerator card The share of spending has changed, but the market now appears to be normalizing. He mentioned his confidence in the position of Intel and its Xeon CPUs in the fast-growing AI market.

He said: "It's fun to train these large models, but we think the deployment and inference use of these models is what will be really amazing in the future. And... some of them will run on accelerator cards, but A lot of it runs on Xeon."

In recent years, Intel has been promoting its emerging foundry business, which mainly produces computer chips for other companies, Gelsinger also told analysts The progress made in this business is presented. He said that three major customers have already committed to using Intel's 18A manufacturing process technology. Previously, Intel only announced one customer, but this time he did not disclose the names of these customers.

He said: "The other thing we saw in the quarter that was a little unexpected was a huge surge in interest in AI and Intel's advanced packaging technology."

He said that Intel It is still expected to catch up with main rival TSMC in 2025. Intel has developed a plan called "Five Nodes in Four Years" to improve its chip manufacturing process to compete with competitors, and during the quarter Intel revealed that it had made progress at Fab 34 in Leixlip, Ireland. The factory began mass-producing chips using EUV extreme ultraviolet lithography, the most advanced semiconductor manufacturing technology on the market.

He said: "About two and a half years ago, when we started the 'five nodes in four years' plan, many people thought we were a bit ambitious, but we set our sights on achieving our goals. The further away."

Judging from the latest quarterly data, Intel's client computing division, which produces laptops and personal computer chips, had sales of US$7.9 billion, a year-on-year decrease of 3%. Sales of the data center and artificial intelligence division, which makes server chips, fell 10% to $3.8 billion. In this area, Intel acknowledged that it faces some "competitive pressures."

The foundry services business still accounts for a small proportion of Intel's overall business, with revenue of US$311 million, a year-on-year increase of 300%, partly due to an advance payment from a major customer.

Earlier today, Mobileye, Intel’s self-driving car chip listing subsidiary, announced that sales increased by 18% to US$530 million. Finally, sales at Intel's Network and Edge segment, which sells networking chips and low-power processors, fell 32% to $1.5 billion.

Intel revealed earlier this month that it intends to simplify its business by turning its programmable chip unit, currently part of its data center and artificial intelligence group, into a separate business. Intel could ultimately spin off the unit into an independent company through an initial public offering in the next two to three years.

Intel’s Programmable Solutions segment produces field-programmable gate arrays (FPGAs) that customers can program for specific use cases after they ship. FPGA is commonly used in data centers, telecommunications, video encoding, aviation and other industries, and can also be used to run some AI algorithms.

The above is the detailed content of Intel releases third-quarter financial report, artificial intelligence and new foundry business attract much attention. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1381

1381

52

52

Intel Core Ultra 9 285K processor exposed: CineBench R23 multi-core running score is 18% higher than i9-14900K

Jul 25, 2024 pm 12:25 PM

Intel Core Ultra 9 285K processor exposed: CineBench R23 multi-core running score is 18% higher than i9-14900K

Jul 25, 2024 pm 12:25 PM

According to news from this website on July 25, the source Jaykihn posted a tweet on the X platform yesterday (July 24), sharing the running score data of the Intel Core Ultra9285K "ArrowLake-S" desktop processor. The results show that it is better than the Core 14900K 18% faster. This site quoted the content of the tweet. The source shared the running scores of the ES2 and QS versions of the Intel Core Ultra9285K processor and compared them with the Core i9-14900K processor. According to reports, the TD of ArrowLake-SQS when running workloads such as CinebenchR23, Geekbench5, SpeedoMeter, WebXPRT4 and CrossMark

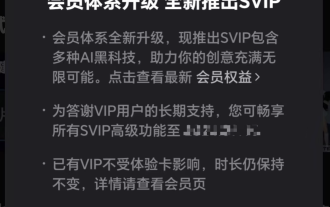

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

This site reported on June 27 that Jianying is a video editing software developed by FaceMeng Technology, a subsidiary of ByteDance. It relies on the Douyin platform and basically produces short video content for users of the platform. It is compatible with iOS, Android, and Windows. , MacOS and other operating systems. Jianying officially announced the upgrade of its membership system and launched a new SVIP, which includes a variety of AI black technologies, such as intelligent translation, intelligent highlighting, intelligent packaging, digital human synthesis, etc. In terms of price, the monthly fee for clipping SVIP is 79 yuan, the annual fee is 599 yuan (note on this site: equivalent to 49.9 yuan per month), the continuous monthly subscription is 59 yuan per month, and the continuous annual subscription is 499 yuan per year (equivalent to 41.6 yuan per month) . In addition, the cut official also stated that in order to improve the user experience, those who have subscribed to the original VIP

MSI launches new MS-C918 mini console with Intel Alder Lake-N N100 processor

Jul 03, 2024 am 11:33 AM

MSI launches new MS-C918 mini console with Intel Alder Lake-N N100 processor

Jul 03, 2024 am 11:33 AM

This website reported on July 3 that in order to meet the diversified needs of modern enterprises, MSIIPC, a subsidiary of MSI, has recently launched the MS-C918, an industrial mini host. No public price has been found yet. MS-C918 is positioned for enterprises that focus on cost-effectiveness, ease of use and portability. It is specially designed for non-critical environments and provides a 3-year service life guarantee. MS-C918 is a handheld industrial computer, using Intel AlderLake-NN100 processor, specially tailored for ultra-low power solutions. The main functions and features of MS-C918 attached to this site are as follows: Compact size: 80 mm x 80 mm x 36 mm, palm size, easy to operate and hidden behind the monitor. Display function: via 2 HDMI2.

ASUS releases BIOS update for Z790 motherboards to alleviate instability issues with Intel's 13th/14th generation Core processors

Aug 09, 2024 am 12:47 AM

ASUS releases BIOS update for Z790 motherboards to alleviate instability issues with Intel's 13th/14th generation Core processors

Aug 09, 2024 am 12:47 AM

According to news from this website on August 8, MSI and ASUS today launched a beta version of BIOS containing the 0x129 microcode update for some Z790 motherboards in response to the instability issues in Intel Core 13th and 14th generation desktop processors. ASUS's first batch of motherboards to provide BIOS updates include: ROGMAXIMUSZ790HEROBetaBios2503ROGMAXIMUSZ790DARKHEROBetaBios1503ROGMAXIMUSZ790HEROBTFBetaBios1503ROGMAXIMUSZ790HEROEVA-02 joint version BetaBios2503ROGMAXIMUSZ790A

Intel Panther Lake mobile processor specifications exposed: up to '4+8+4' 16-core CPU, 12 Xe3 core display

Jul 18, 2024 pm 04:43 PM

Intel Panther Lake mobile processor specifications exposed: up to '4+8+4' 16-core CPU, 12 Xe3 core display

Jul 18, 2024 pm 04:43 PM

According to news from this site on July 16, following the revelation of the specifications of the ArrowLake desktop processor and the BartlettLake desktop processor, blogger @jaykihn0 released the specifications of the mobile U and H versions of the Intel PantherLake processor in the early morning. The Panther Lake mobile processor is expected to be named the Core Ultra300 series and will be available in the following versions: PTL-U: 4P+0E+4LPE+4Xe, 15WPL1PTL-H: 4P+8E+4LPE+12Xe, 25WPL1PTL-H: 4P+8E+4LPE+ 4Xe, 25WPL1. The blogger also released the 12Xe nuclear display version of the PantherLake processor.

Intel once again adjusts its foundry business leadership: Naga Chandrasekaran takes over as chief global operating officer

Jul 26, 2024 pm 08:41 PM

Intel once again adjusts its foundry business leadership: Naga Chandrasekaran takes over as chief global operating officer

Jul 26, 2024 pm 08:41 PM

According to news from this site on July 26, Intel announced yesterday (local time) that former Micron executive Naga Chandrasekaran will replace Keyvan Esfarjani, who has decided to retire, as Intel's chief executive. Global Operations Officer. ▲Naga Chandrasekaran on the left and Kiwan Esfajani on the right. Picture source Intel official website. Chandrasekaran will officially join Intel on August 12, leading foundry manufacturing and supply chain management and serving as executive vice president, reporting to Intel CEO Pat Gelsinger. Chandrasekaran will be responsible for Intel Foundry’s global manufacturing operations, including fab sort manufacturing, assembly test manufacturing, UK

Intel Core Ultra 9 285K processor exposed: clocked at 5 GHz, TDP 125W

Jul 24, 2024 pm 04:10 PM

Intel Core Ultra 9 285K processor exposed: clocked at 5 GHz, TDP 125W

Jul 24, 2024 pm 04:10 PM

According to news from this website on July 24, the source @wxnod tweeted yesterday (July 23) and shared a CPU-Z screenshot, showing relevant information about the Intel Core Ultra9285K "ArrowLake-S" processor. According to the screenshot information, the processor is an engineering sample (ES) with the name "Intel Core Ultraxx5K", a TDP of 125W, and an LGA1851 socket. This site previously reported that the ArrowLake processor uses Intel's Intel20A process node, and the GPU module will use TSMC's N3 process, so the 7nm shown in the screenshot may be wrong. The screenshot information shows that the processor supports a 5.0GHz clock frequency and will be equipped with

It is reported that Intel CEO Pat Gelsinger will deliver a plenary speech at ISSCC for the first time next year to introduce foundry progress.

Aug 10, 2024 am 07:42 AM

It is reported that Intel CEO Pat Gelsinger will deliver a plenary speech at ISSCC for the first time next year to introduce foundry progress.

Aug 10, 2024 am 07:42 AM

According to news from this website on August 9, Korean media "Chosun Ilbo" reported that Intel CEO Pat Kissinger will attend the next IEEEISSCC International Solid-State Circuits Conference to be held in San Francisco from February 16th to 20th, 2025 local time. , and will deliver a keynote speech at the ISSCC plenary session for the first time. Note from this site: Speakers at the ISSCC2024 plenary session include Zhang Xiaoqiang, deputy co-chief operating officer of TSMC, etc.; at ISSCC2023, AMD CEO Su Zifeng, imec Chief Strategy Officer JoDeBoeck, etc. delivered plenary speeches. According to reports, Intel’s plenary speakers mainly introduce CPU-related technologies at the ISSCC conference, but Pat Kissinger’s speech to be released next year will focus on Intel’s I