Technology peripherals

Technology peripherals

AI

AI

AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?

AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?

AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?

Morgan Stanley points out that the rise of artificial intelligence has the potential to change some investors’ core investment principles: 60/40 investment portfolio

This investing strategy — allocating 60% of a portfolio to stocks and 40% to bonds — has been touted as the foundation of investing since the 1950s, but over the past few years it has come under scrutiny. There are more and more doubts. Now, another driver of the debate is growing: artificial intelligence.

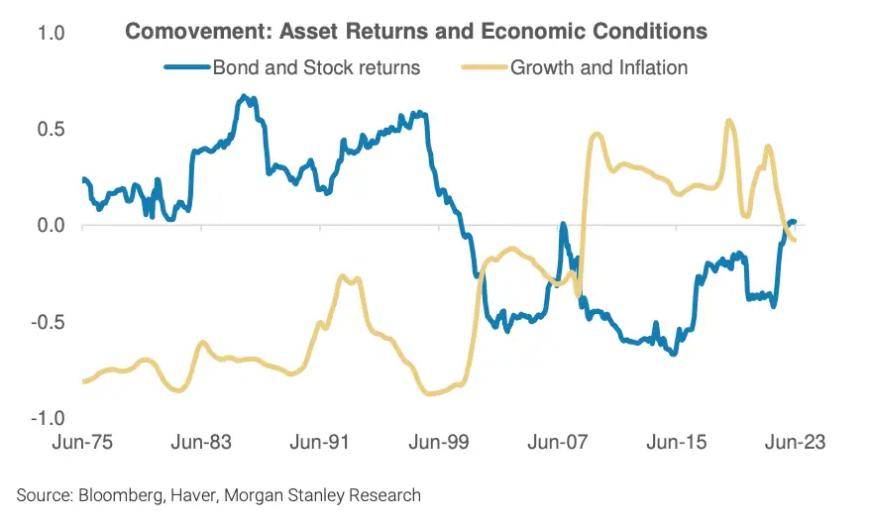

That’s because the technology could boost productivity so much that the correlations between economic growth and inflation, and between stocks and bonds, could reverse.

Morgan Stanley analysts wrote: "Technological diffusion acts like a supply shock, boosting growth in the short term and often lowering inflation at the same time."

As a result, previous assumptions about how to diversify risk may no longer apply, as the AI boom will deliver healthy returns for both stocks and bonds - breaking the traditional negative correlation between the two.

This undermines a key part of the 60/40 strategy. "In other words, bonds - as has been the case this year - will no longer be the good diversifiers they have been for the past 30 years," the analysts wrote.

Analysts at Morgan Stanley further explained that the traditional negative correlation between stocks and bonds has been reversed, a situation that also occurred during the Internet bubble in the 1990s. The explosive growth of information and communication technology has accelerated capital investment, reduced operating costs for enterprises, and increased wealth, leading to higher consumption levels

“Similar to information and communication technologies, artificial intelligence, especially generative artificial intelligence, has the potential to broadly improve productivity across industries.”

After the recent "U.S. debt crisis", the debate about the 60/40 portfolio has become increasingly fierce. This comes after the Federal Reserve sharply raised interest rates to curb rising inflation. Therefore, the 60/40 portfolio did not achieve amazing returns

BlackRock said that in the new era of high interest rates, the 60/40 investment portfolio is no longer applicable and investors now need to be more "flexible" and "meticulous." At the same time, Vanguard Group expects the strategy to bring high returns next year

Morgan Stanley said that the impact of generative artificial intelligence is only one of many factors that may affect asset correlation and has a certain impact on economic growth and inflation

The strategists said, "But if we do see this happen, we think it could mean that long-term portfolios will tilt more towards stocks than bonds, as fixed income becomes a less reliable diversifier. Investment tools. We think investors may be looking for new portfolio diversification tools,"

We may also see a further acceleration in asset allocators investing money into private credit. In theory, private credit is less correlated with listed equities and fixed income. They added

Source: Financial Associated Press

The above is the detailed content of AI will change the core logic of investment, will the 60/40 stock and bond strategy become obsolete?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

How to implement file sorting by debian readdir

Apr 13, 2025 am 09:06 AM

How to implement file sorting by debian readdir

Apr 13, 2025 am 09:06 AM

In Debian systems, the readdir function is used to read directory contents, but the order in which it returns is not predefined. To sort files in a directory, you need to read all files first, and then sort them using the qsort function. The following code demonstrates how to sort directory files using readdir and qsort in Debian system: #include#include#include#include#include//Custom comparison function, used for qsortintcompare(constvoid*a,constvoid*b){returnstrcmp(*(

How to optimize the performance of debian readdir

Apr 13, 2025 am 08:48 AM

How to optimize the performance of debian readdir

Apr 13, 2025 am 08:48 AM

In Debian systems, readdir system calls are used to read directory contents. If its performance is not good, try the following optimization strategy: Simplify the number of directory files: Split large directories into multiple small directories as much as possible, reducing the number of items processed per readdir call. Enable directory content caching: build a cache mechanism, update the cache regularly or when directory content changes, and reduce frequent calls to readdir. Memory caches (such as Memcached or Redis) or local caches (such as files or databases) can be considered. Adopt efficient data structure: If you implement directory traversal by yourself, select more efficient data structures (such as hash tables instead of linear search) to store and access directory information

How to set the Debian Apache log level

Apr 13, 2025 am 08:33 AM

How to set the Debian Apache log level

Apr 13, 2025 am 08:33 AM

This article describes how to adjust the logging level of the ApacheWeb server in the Debian system. By modifying the configuration file, you can control the verbose level of log information recorded by Apache. Method 1: Modify the main configuration file to locate the configuration file: The configuration file of Apache2.x is usually located in the /etc/apache2/ directory. The file name may be apache2.conf or httpd.conf, depending on your installation method. Edit configuration file: Open configuration file with root permissions using a text editor (such as nano): sudonano/etc/apache2/apache2.conf

How debian readdir integrates with other tools

Apr 13, 2025 am 09:42 AM

How debian readdir integrates with other tools

Apr 13, 2025 am 09:42 AM

The readdir function in the Debian system is a system call used to read directory contents and is often used in C programming. This article will explain how to integrate readdir with other tools to enhance its functionality. Method 1: Combining C language program and pipeline First, write a C program to call the readdir function and output the result: #include#include#include#includeintmain(intargc,char*argv[]){DIR*dir;structdirent*entry;if(argc!=2){

How Debian OpenSSL prevents man-in-the-middle attacks

Apr 13, 2025 am 10:30 AM

How Debian OpenSSL prevents man-in-the-middle attacks

Apr 13, 2025 am 10:30 AM

In Debian systems, OpenSSL is an important library for encryption, decryption and certificate management. To prevent a man-in-the-middle attack (MITM), the following measures can be taken: Use HTTPS: Ensure that all network requests use the HTTPS protocol instead of HTTP. HTTPS uses TLS (Transport Layer Security Protocol) to encrypt communication data to ensure that the data is not stolen or tampered during transmission. Verify server certificate: Manually verify the server certificate on the client to ensure it is trustworthy. The server can be manually verified through the delegate method of URLSession

Debian mail server firewall configuration tips

Apr 13, 2025 am 11:42 AM

Debian mail server firewall configuration tips

Apr 13, 2025 am 11:42 AM

Configuring a Debian mail server's firewall is an important step in ensuring server security. The following are several commonly used firewall configuration methods, including the use of iptables and firewalld. Use iptables to configure firewall to install iptables (if not already installed): sudoapt-getupdatesudoapt-getinstalliptablesView current iptables rules: sudoiptables-L configuration

How to learn Debian syslog

Apr 13, 2025 am 11:51 AM

How to learn Debian syslog

Apr 13, 2025 am 11:51 AM

This guide will guide you to learn how to use Syslog in Debian systems. Syslog is a key service in Linux systems for logging system and application log messages. It helps administrators monitor and analyze system activity to quickly identify and resolve problems. 1. Basic knowledge of Syslog The core functions of Syslog include: centrally collecting and managing log messages; supporting multiple log output formats and target locations (such as files or networks); providing real-time log viewing and filtering functions. 2. Install and configure Syslog (using Rsyslog) The Debian system uses Rsyslog by default. You can install it with the following command: sudoaptupdatesud

Debian mail server SSL certificate installation method

Apr 13, 2025 am 11:39 AM

Debian mail server SSL certificate installation method

Apr 13, 2025 am 11:39 AM

The steps to install an SSL certificate on the Debian mail server are as follows: 1. Install the OpenSSL toolkit First, make sure that the OpenSSL toolkit is already installed on your system. If not installed, you can use the following command to install: sudoapt-getupdatesudoapt-getinstallopenssl2. Generate private key and certificate request Next, use OpenSSL to generate a 2048-bit RSA private key and a certificate request (CSR): openss