According to experts, artificial intelligence has the potential to reshape the wealth management industry, and those who do not adopt the technology risk being left behind.

According to an October 20 report by William Blair analyst Jeff Schmitt, the younger generation of digital natives is now entering old age and their wealth is also growing. To meet these young people’s expectations for digitalization and personalization, wealth management companies are turning to artificial intelligence technology

While initially skeptical, consultants now realize that AI can be an effective tool to improve business rather than replace human interaction

He wrote in the article: "Those wealth management companies that can respond to the changing environment by using and expanding artificial intelligence technology will have a greater ability to capitalize on these demographic trends and achieve greater success in the coming years. Large market share and profitability.”

PwC’s head of U.S. asset and wealth management consulting Roland Castun said that artificial intelligence has been present in the wealth management field for several years. Consultants utilize technologies such as machine learning and natural language processing to assist with data analysis

He pointed out that currently, combining this technology with generative artificial intelligence can effectively improve productivity and income levels

Large enterprises such as Morgan Stanley, BlackRock Investments, and JPMorgan Chase are already adopting generative AI solutions

According to Wells Fargo analyst Mike Mayo, there will be investment opportunities in the future that don’t exist yet. Just like the first half of the first game, one person is already out and it is difficult to predict who will win in the end

However, overall, he believes that JPMorgan Chase is currently the clear industry leader

According to Mayo, “JPMorgan Chase appears to have the digital, data and mature processes to apply artificial intelligence in ways that many other companies cannot. In addition, JPMorgan Chase also has the ability to attract more talent, which will be That’s the key.”

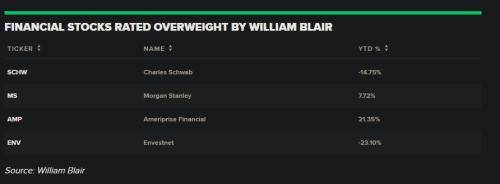

Meanwhile, Charles Schwab (SCHW) is Schmitt’s top pick in 2024. He believes the stock is poised to outperform due to the potential for a sharp rebound in earnings, and he is also bullish on Schwab's artificial intelligence capabilities

Schmitt noted in his presentation that the wealth management firm, the largest institution with $8 trillion worth of client assets, has been committed to leveraging its scale and technology to advance artificial intelligence technology, focusing on Improve customer service

He said: "While continuing to develop Schwab's core artificial intelligence technology, we believe that this process will accelerate over time as Schwab looks to maintain its industry leadership in customer service and price."

Schmitt gives Morgan Stanley, Merida Financial (AMP) and Envestnet (ENV) an overweight rating

Morgan Stanley said in a memo in September that it had launched a generative artificial intelligence assistant for financial advisors designed to "revolutionize" client interactions and bring new efficiencies

Schmitt said that Envestnet, the largest provider of technology solutions for wealth advisors in the United States, is in the early stages of adopting artificial intelligence, but has sufficient resources to continue to enhance and expand its artificial intelligence capabilities

Meanwhile, Schmitt added that Ameriprise Wealth Management has been developing artificial intelligence software in recent years to streamline operations, improve advisor productivity and improve customer service levels

Veteran technology investor Paul Meeks is particularly bullish on BlackRock, which he believes will benefit as artificial intelligence pushes more investors toward passive investing rather than active investing. He said State Street, Invesco and Schwab will also benefit from this ongoing shift

According to Baker Professor Meeks of The Citadel Business School, large institutions such as Morgan Stanley and Goldman Sachs will also adopt this technology

He said: “Not only can artificial intelligence be used to create asset allocations for customers, but it can also drive securities selection and marketing.” He further added that artificial intelligence can effectively reach a wider audience at a very low cost

However, he may not need to invest in bank stocks right now

He said: "Once interest rates start to fall, we will enjoy the dual benefits of the artificial intelligence trend and falling interest rates at the same time."

Finance Source

The above is the detailed content of Wall Street will be a beneficiary in the artificial intelligence boom, and these companies will be well-positioned. For more information, please follow other related articles on the PHP Chinese website!