Technology peripherals

Technology peripherals

It Industry

It Industry

Tesla leasing service is in trouble, and car residual value management faces new challenges

Tesla leasing service is in trouble, and car residual value management faces new challenges

Tesla leasing service is in trouble, and car residual value management faces new challenges

According to the latest released data, the leasing business of Tesla, a well-known American electric vehicle manufacturer, has experienced a significant decline in the latest quarter. This change has attracted widespread attention in the industry and triggered in-depth discussions on the reasons behind it.

According to data released by Tesla, the latest sales data show that in the fourth quarter of last year, only 2% of Tesla’s best-selling models Model 3 and Model Y were included in operating lease accounting. subjects, while the proportion for other models is only 3%. Both figures are the lowest since Tesla began reporting production and delivery data in 2019.

Picture source Pexels

According to the latest research report by Jefferies analyst Philip Hawes, the proportion of Tesla’s operating leasing business is declining sharply, which may mean that Tesla is facing difficulty in providing attractive lease prices to consumers. Hawes further said that while this may not have a direct negative impact on Tesla's short-term profitability, he is concerned about its ability to manage vehicle residual values in the long term. This situation has raised concerns about Tesla's future development.

Car residual value is critical to assessing the attractiveness of a car rental business. It refers to the value that a vehicle is able to retain during its ownership or lease contract. If a car doesn't hold its value well, the leasing company will often make up for the potential loss in value by raising the down payment or monthly lease fee. However, doing so will undoubtedly make the rental business less attractive. Therefore, car residual value is one of the important factors that leasing companies need to pay attention to and manage.

In the past year, the second-hand residual value of Tesla vehicles has suffered multiple shocks. Tesla has adopted a strategy of multiple price cuts, which has put tremendous pressure on car rental companies like Hertz and Germany's Six SE. These price cuts not only directly affect the price of Tesla vehicles in the second-hand market, but also further reduce consumers' willingness to choose to lease Tesla vehicles.

Meanwhile, the introduction of the U.S. Inflation Reduction Act provides commercial vehicles with the opportunity to more easily qualify for electric vehicle tax credits. The existence of this policy loophole has led other automakers to consider launching electric vehicle rental businesses in the U.S. market, thus bringing greater competitive pressure to Tesla.

It is understood that Tesla faces the challenge of how to increase the residual value of its electric vehicles while maintaining the price competitiveness of its electric vehicles. In addition, as competitors enter the electric car rental market, Tesla also needs to find new strategies to cope with the fierce competitive environment.

The above is the detailed content of Tesla leasing service is in trouble, and car residual value management faces new challenges. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1380

1380

52

52

Tesla Cybertruck violent actual test: driving in water proves super water wading ability

Feb 24, 2024 pm 06:07 PM

Tesla Cybertruck violent actual test: driving in water proves super water wading ability

Feb 24, 2024 pm 06:07 PM

According to news on February 24, Tesla’s Cybertruck electric pickup truck has been attracting much attention, and recently, this highly anticipated model has welcomed a group of enthusiastic owners for field testing. Previously, Tesla CEO Musk once said that the Cybertruck can be used as a boat, which caused widespread concern and doubts. In order to verify this statement, the first Cybertruck owners decided to conduct an unprecedented violent test: driving the vehicle directly into the water. After many attempts, the vehicle speed gradually increased, and the depth of the waterway in the test scene was also considerable. When driving at slow speeds, the water almost touches the lower edge of the window glass, giving people the illusion of driving a boat. However, what is surprising is that Cybertruck became

Tesla finally takes action! Will self-driving taxis be unveiled soon? !

Apr 08, 2024 pm 05:49 PM

Tesla finally takes action! Will self-driving taxis be unveiled soon? !

Apr 08, 2024 pm 05:49 PM

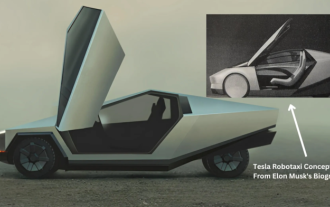

According to news on April 8, Tesla CEO Elon Musk recently revealed that Tesla is committed to developing self-driving car technology. The highly anticipated unmanned self-driving taxi Robotaxi will be launched on August 8. Official debut. The data editor learned that Musk's statement on Previously, Reuters reported that Tesla’s plan to drive cars would focus on the production of Robotaxi. However, Musk refuted this, accusing Reuters of having canceled plans to develop low-cost cars and once again publishing false reports, while making it clear that low-cost cars Model 2 and Robotax

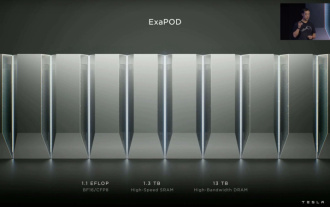

Tesla Dojo supercomputing debut, Musk: The computing power of AI training by the end of the year will be approximately equal to 8,000 NVIDIA H100 GPUs

Jul 24, 2024 am 10:38 AM

Tesla Dojo supercomputing debut, Musk: The computing power of AI training by the end of the year will be approximately equal to 8,000 NVIDIA H100 GPUs

Jul 24, 2024 am 10:38 AM

According to news from this website on July 24, Tesla CEO Elon Musk (Elon Musk) stated in today’s earnings conference call that the company is about to complete the largest artificial intelligence training cluster to date, which will be equipped with 2 Thousands of NVIDIA H100 GPUs. Musk also told investors on the company's earnings call that Tesla would work on developing its Dojo supercomputer because GPUs from Nvidia are expensive. This site translated part of Musk's speech as follows: The road to competing with NVIDIA through Dojo is difficult, but I think we have no choice. We are now over-reliant on NVIDIA. From NVIDIA's perspective, they will inevitably increase the price of GPUs to a level that the market can bear, but

Tesla Cybertruck soars off a cliff to challenge, a power show beyond the limits!

Mar 07, 2024 pm 09:28 PM

Tesla Cybertruck soars off a cliff to challenge, a power show beyond the limits!

Mar 07, 2024 pm 09:28 PM

According to news on March 7, a video of Tesla Cybertruck challenging the "Road to Hell's Revenge" in the small town of Utah, USA, was recently exposed on the Internet. Cliff is located in Salt Lake City, Utah, USA, and is a popular place for outdoor enthusiasts. There are more than 30 off-road roads here, and the rugged and steep rock walls attract many extreme off-road enthusiasts to challenge. The video shows that when Tesla Cybertruck challenged a V-shaped ravine close to 45 degrees, it relied on the strong power of its three motors to steadily climb the slope and finally successfully reached the top. During the climb, the Cybertruck performed well without any slippage, despite the slippery rock surface. According to the editor’s understanding, Tesla Cybertruck models are divided into single-motor rear

Tesla's home energy storage system Powerwall has more than 600,000 installed units worldwide, and its market share in the United States reached 30.2% last year

Feb 25, 2024 am 10:19 AM

Tesla's home energy storage system Powerwall has more than 600,000 installed units worldwide, and its market share in the United States reached 30.2% last year

Feb 25, 2024 am 10:19 AM

Tesla’s home energy storage system Powerwall has reached a new milestone, with more than 600,000 units installed worldwide. At the same time, the next generation Powerwall3 has also been officially launched in the United States. On Friday, Tesla Energy announced on social media platform X that the number of Powerwall installations worldwide has reached 600,000. This important milestone is reached at the right time, because the new generation of Powerwall3 has just been officially launched in the United States. In fact, Tesla spent most of last year quietly deploying new products to prepare for future development. This news has attracted the attention of many people and shows the growing interest and demand for clean energy and renewable energy technologies.

Tesla's new Model 3 high-performance version passed Korean certification, and the power parameters were exposed and attracted attention

Mar 06, 2024 pm 08:49 PM

Tesla's new Model 3 high-performance version passed Korean certification, and the power parameters were exposed and attracted attention

Mar 06, 2024 pm 08:49 PM

According to news on March 6, the media recently revealed that Tesla’s new Model 3 high-performance version has passed relevant Korean certifications and disclosed a series of eye-catching power parameters. It is reported that this new car will be equipped with an advanced dual-motor system, including a front-mounted 3D3 induction asynchronous motor and a rear-mounted 4D2 permanent magnet synchronous motor. The two work together to output amazing power. Specifically, the front motor provides 215 horsepower, while the rear motor provides up to 412 horsepower, bringing the total power of the vehicle to an astonishing 461kW. The rear 4D2 motor alone has a power of approximately 303kW. The motor design of this new car can reach peak power when the speed reaches 110km/h, which makes the new Model 3 perform better when driving at high speeds.

Tesla's FSD technology amazes Germany, and autonomous driving is promising in the future

Apr 29, 2024 pm 01:20 PM

Tesla's FSD technology amazes Germany, and autonomous driving is promising in the future

Apr 29, 2024 pm 01:20 PM

According to news on April 29, Tesla recently publicly demonstrated its highly anticipated fully autonomous driving FSD technology for the first time in Germany, marking the official entry of FSD technology into the European market. During the demonstration event, Rikard Fredriksson, senior adviser to the Swedish Ministry of Transport, had the opportunity to experience it. He took a Tesla Model Y and personally experienced the convenience of FSD (fully autonomous driving). Performance on German roads. Fredriksson has held product safety-related positions in Apple's automotive projects and has an in-depth understanding of autonomous driving technology. After experiencing Fredriksson's driving assistance system, the FSD+12's driving is smooth and natural. He also specifically mentioned that when traveling from Munich city center to the airport

Tesla's 2024 Q1 financial report announced: revenue declines, low-priced model production on the agenda

Apr 24, 2024 pm 06:16 PM

Tesla's 2024 Q1 financial report announced: revenue declines, low-priced model production on the agenda

Apr 24, 2024 pm 06:16 PM

According to news on April 24, Tesla disclosed its financial report for the first quarter of 2024 today. Reports show that Tesla achieved revenue of US$21.301 billion during the quarter, a 9% decrease compared to the same period last year. The figure was slightly lower than the $22.3 billion forecast by market analysts. At the same time, the company's net profit was US$1.129 billion, a sharp decline of 55% year-on-year. Tesla has had huge success in vehicle sales. In the first quarter, 386,800 vehicles were delivered globally, significantly lower than the market’s previous expectations of approximately 430,000 vehicles. Compared with the same period last year, delivery volume fell by 8.3%, and compared with the previous quarter, it fell sharply by 20.1%. This is Tesla's first year-on-year decline in deliveries since 2020. In order to slow down