China's car sales top the global connected car market

According to the latest data released by market research organization Counterpoint Research, in the third quarter of 2023, global sales of connected cars increased by as much as 28% year-on-year, showing impressive growth momentum. Under this trend, two out of every three cars sold are equipped with embedded interconnection systems, demonstrating the unstoppable trend of automobile interconnection.

China performs well in the global connected car market, accounting for 33% of the market share, far ahead of other countries. The U.S. and European markets follow closely behind, accounting for more than 75% of global connected car sales, forming the main sales pattern.

With the rapid development of electric vehicles and autonomous driving technology, the demand for connectivity within cars is also growing. Currently, 4G technology maintains its absolute dominance in this field, with a sales share of over 95%. However, the application of 5G technology in the automotive industry has made relatively slow progress and failed to meet the industry's early expectations. Although 5G can deliver higher speeds and lower latency, automakers and operators face several challenges. First, the coverage of 5G networks is still limited, which means that stable connections may not be available in some areas. Secondly, the cost of 5G technology is higher and requires more infrastructure investment. Finally, according to the editor's understanding, the car manufacturer

has three main reasons for the slow application and promotion of 5G technology in the automotive field. First, the lack of 5G infrastructure along highways limits the coverage and availability of 5G signals. Secondly, unique 5G application scenarios have not yet appeared in the car, and there is a lack of innovative features to attract consumers. Finally, there are problems in the supply chain, including immaturity of equipment and technology and high costs. These factors jointly restrict the popularity of 5G in the passenger car market.

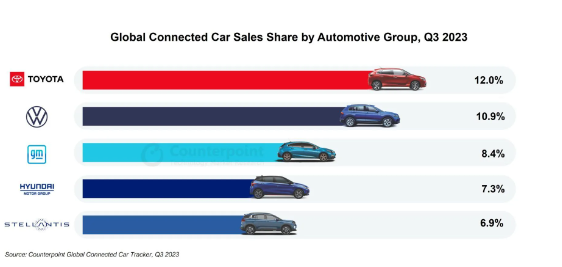

Soumen Mandal, senior analyst at Counterpoint Research, pointed out that as consumers continue to increase their awareness of technology and their demand for connectivity, the growth of non-connected cars Sales are steadily declining. According to data from the third quarter of 2023, the world's top five automobile groups account for nearly 45% of connected car sales. Among them, Toyota Group leads the market with a sales share of 12%, followed by Volkswagen Group. General Motors Group, Hyundai-Kia Motors Group and Stellantis also rounded out the top five. This trend shows that consumer demand for connected cars is growing, and automakers need to accelerate the application of connected technologies to meet market demand. The smart features and convenience of connected cars will become dominant factors in the future automotive market.

Neil Shah, vice president of research, pointed out that in developing economies, the connectivity of cars is becoming a major differentiating factor in the market and is favored by more and more consumers. It is expected that by 2030, more than 95% of new passenger cars will be equipped with embedded interconnection systems, which will further promote changes in the global automotive market.

Although 4G connections still dominate the automotive field, as the number of L3 and above cars on the market increases, the application of 5G connections will gradually increase. It is expected that by 2026, the automotive industry's adoption of 5G technology will reach a turning point. By 2030, more than 90% of connected cars sold will be equipped with embedded 5G connections, which will bring broader development space and innovation opportunities to the automotive industry.

The above is the detailed content of China's car sales top the global connected car market. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

How to make self-driving cars 'know the road'

Apr 09, 2023 pm 01:41 PM

How to make self-driving cars 'know the road'

Apr 09, 2023 pm 01:41 PM

Just like human walking, self-driving cars also need to have the ability to think independently and make judgments and decisions about the traffic environment in order to complete the travel process. With the improvement of advanced assisted driving system technology, the safety of drivers driving cars continues to improve, and the degree of driver participation in driving decision-making is gradually reduced. Autonomous driving is getting closer and closer to us. Self-driving cars, also known as driverless cars, are essentially highly intelligent robots that can complete travel behaviors with only driver assistance or without driver operation at all. Autonomous driving is mainly realized through the perception layer, decision-making layer and execution layer. As an automated vehicle, autonomous vehicles can use additional radar (millimetre-wave radar, lidar), vehicle cameras, and global navigation satellite systems (G

Read the smart car skateboard chassis in one article

May 24, 2023 pm 12:01 PM

Read the smart car skateboard chassis in one article

May 24, 2023 pm 12:01 PM

01 What is a skateboard chassis? The so-called skateboard chassis integrates the battery, electric transmission system, suspension, brakes and other components on the chassis in advance to achieve separation of the body and chassis and decoupling the design. Based on this type of platform, car companies can significantly reduce early R&D and testing costs, while quickly responding to market demand to create different models. Especially in the era of driverless driving, the layout of the car is no longer centered on driving, but will focus on space attributes. The skateboard-type chassis can provide more possibilities for the development of the upper cabin. As shown in the picture above, of course when we look at the skateboard chassis, we should not be framed by the first impression of "Oh, it is a non-load-bearing body" when we come up. There were no electric cars back then, so there were no battery packs worth hundreds of kilograms, no steering-by-wire system that could eliminate the steering column, and no brake-by-wire system.

Detailed explanation of commonly used control methods for smart car planning and control

Apr 11, 2023 pm 11:16 PM

Detailed explanation of commonly used control methods for smart car planning and control

Apr 11, 2023 pm 11:16 PM

Control is the strategy that drives the vehicle forward. The goal of control is to use feasible control quantities to minimize the deviation from the target trajectory, maximize passenger comfort, etc. As shown in the figure above, the modules associated with the input of the control module include planning module, positioning module, vehicle information, etc. The positioning module provides vehicle location information, the planning module provides target trajectory information, and vehicle information includes gear, speed, acceleration, etc. The control outputs are steering, acceleration and braking quantities. The control module is mainly divided into horizontal control and vertical control. According to the different coupling forms, it can be divided into independent and integrated methods. 1 Control method 1.1 Decoupled control The so-called decoupled control means to control the horizontal and vertical control methods independently. 1.2 Coupling control

In-depth analysis of wire-controlled chassis technology for intelligent connected cars

May 02, 2023 am 11:28 AM

In-depth analysis of wire-controlled chassis technology for intelligent connected cars

May 02, 2023 am 11:28 AM

01 Control-by-wire technology Cognitive control-by-wire technology (XbyWire) converts the driver's operating actions through sensors into electrical signals to achieve transmission control, replacing traditional mechanical systems or hydraulic systems, and the electrical signals directly control the actuators to achieve control The purpose and basic principle are shown in Figure 1. This technology originates from the FlybyWire aircraft launched by the National Aeronautics and Space Administration (NASA) in 1972. Among them, "X" is like the unknown number in a mathematical equation, representing various components and related operations in the car that are traditionally controlled mechanically or hydraulically. Figure 1 Basic principles of line control technology

The billion-dollar giant failed to survive the price war - China Grand Automobile

Jul 21, 2024 pm 05:06 PM

The billion-dollar giant failed to survive the price war - China Grand Automobile

Jul 21, 2024 pm 05:06 PM

On July 16, China Grand Automobile's closing price was lower than 1 yuan for 19 consecutive days, and the closing price on that day was 0.87 yuan. Even if it rose to the limit the next day, the stock price would be difficult to return to 1 yuan. At this point, China Grand Automobile triggered the delisting requirement of "the stock price is less than 1 yuan for 20 consecutive trading days". Therefore, delisting was locked in advance and became the stock with the largest market value at the time of delisting in the history of A-shares, with 72 A huge amount of billions. However, according to the financial report, China Grand Automobile's revenue in 2023 will still reach 137.998 billion yuan, with total vehicle sales of 713,000 vehicles. It is still the largest automobile dealership group in China in total passenger vehicle sales and second in revenue scale. In the capital market, after backdooring Metro Pharmaceuticals to go public in 2015, China Grand Automobile’s share price soared to a maximum of 32.12 yuan per share, and its market value once exceeded 100 billion.

Foton Motor releases new logo and price information of Xiangling Q series models

Sep 12, 2023 pm 09:09 PM

Foton Motor releases new logo and price information of Xiangling Q series models

Sep 12, 2023 pm 09:09 PM

On August 29, Foton Motor held a gorgeous brand refresh conference, bringing a series of exciting news to the industry. The new logo, Auman Zhilan bottom battery replacement products and the new Xiangling Q car became the focus of the press conference. Foton Motor's new logo shows the company's ambitions for the future. Foton Motor said that this new logo symbolizes the renewal and vigorous development of the brand, marking the company's entry into a new stage of development. At the press conference, Foton Motor also launched the much-anticipated Auman Smart Blue bottom battery replacement product to bring users Here comes a more convenient and efficient use experience. At the same time, the newly launched Xiangling Q car series has also attracted a lot of attention. There are 4 models in total, with prices ranging from 167,800 yuan to 168,800 yuan, providing consumers with

Hechuang Automobile releases the interior design of the new MPV model V09, which is scheduled to be launched on October 13

Sep 19, 2023 pm 01:17 PM

Hechuang Automobile releases the interior design of the new MPV model V09, which is scheduled to be launched on October 13

Sep 19, 2023 pm 01:17 PM

According to news on September 9, Hechuang Automobile, a subsidiary of GAC, recently released the interior design of the Hechuang V09 and announced that the car will begin accepting pre-orders on September 10 and plans to officially launch it on October 13. This model aims to enter the new energy MPV market. It made its debut at the Guangzhou Auto Show in December last year. It is positioned as a medium to large MPV and has attracted much attention. According to the official interior preview, the Hechuang V09 adopts a 2+2+3 style seven-seater layout and is available in three interior colors: black orange, light jade, and obsidian black, which combines a sense of luxury and sportiness. The cockpit design is mainly enveloping style, and the center console uses a combination of three screens. The central control screen is suspended, and the LCD instrument and passenger screens are cleverly embedded. The overall design style is simple and straight. Details

Smart car functional safety software architecture

Apr 27, 2023 pm 06:55 PM

Smart car functional safety software architecture

Apr 27, 2023 pm 06:55 PM

01E-GAS safety architecture concept Automotive functional safety aims to control the risk of personal harm caused by the failure of electronic and electrical systems within a reasonable range. The following figure is a common electronic and electrical system hardware composition diagram. The components of an electronic and electrical system, in addition to the visible hardware in the figure, also include software that is not visible in the figure. Figure 1 Commonly used electronic and electrical hardware systems Failures of electronic and electrical systems include both systemic failures caused by software and hardware design errors and failures caused by random hardware failures. According to the system architecture, various safety mechanisms need to be designed to prevent and detect functional failures, and to avoid or reduce the harm when a failure occurs. This requires a strong functional safety software architecture to manage and control these safety mechanisms and reduce the overall risk of functional safety.