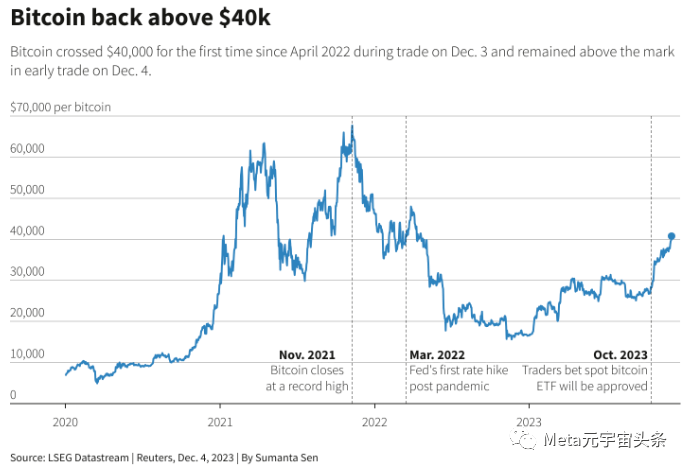

Crypto market re-emerges after FTX collapse and other events, BTC crosses $40,000 mark

On December 4, Bitcoin exceeded $40,000 for the first time this year. Bitcoin ushered in an upward momentum, benefiting from widespread expectations for a U.S. interest rate cut and traders’ expectations of the imminent approval of a U.S. stock market trading Bitcoin fund.

The world’s largest cryptocurrency hit $41,522 on Monday, its highest level since April 2022. This seems to be a positive sign, suggesting that the crypto market is gradually emerging from the predicament since the collapse of FTX and the collapse of other crypto businesses. This may bring more confidence to investors, sparking more interest and investment in cryptocurrencies.

Source Reuters

Bitcoin has returned to above US$40,000 after 578 days. What is the reason that causes the price of Bitcoin to continue to rise?

01

Bitcoin Spot ETF Expectations

With the fermentation of fake news about the adoption of the Bitcoin spot ETF in October, the news of the implementation of the Bitcoin spot ETF application continues to stimulate the encryption market.

According to a research report from Glassnode, Bitcoin spot ETF products are facing a large amount of pent-up demand. Currently, the total assets under management of the 14 Bitcoin spot ETF applicants has reached US$14 trillion. Analysts believe that stock, bond and gold investors could potentially introduce inflows of up to $70.5 billion by allocating only a small portion of their assets to the crypto market. Even the more conservative forecasts see tens of billions of dollars flowing into the market in the first few years.

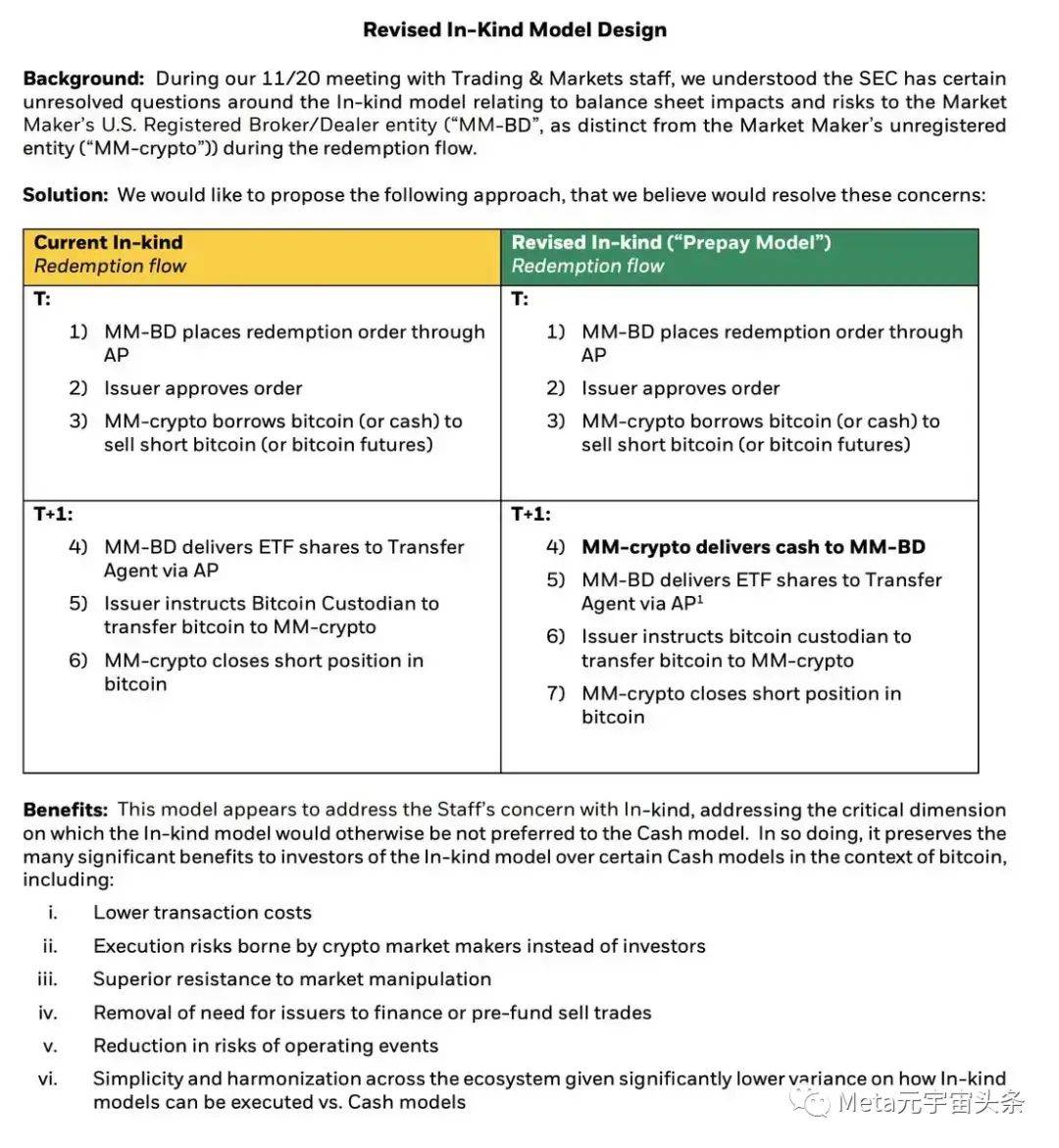

At the end of November, the US SEC met with eight institutions including Grayscale, BlackRock, Hashdex, Bitwise, VanEck, Fidelity and Invesco regarding their respective Bitcoin spot ETF applications. On November 30, when BlackRock met with the SEC’s Trading and Markets Department, it also showed them a “revised” Bitcoin ETF spot physical model design. In the new model, offshore entity market makers operate from Coinbase Get Bitcoin and cash advances with a US-registered broker-dealer.

BlackRock Bitcoin ETF spot physical model design; Source: Eric Balchunas

On December 1, Bloomberg analyst James Seyffart also said that the approval window for a Bitcoin spot ETF is expected to be between January 5 and 10, 2024. According to the SEC filing, the comment period ends on January 5 for Franklin/Hashdex and on January 10 for Ark/21.

On the same day, Coinbase CEO Brian Armstrong said in an interview that he was “quite optimistic” about the approval of the spot Bitcoin ETF. Armstrong said, “Judging from everything that has been read publicly, it feels like the spot Bitcoin ETF is getting closer and closer to approval. 』

02

Institutional funds continue to flow in

While the market believes in the positive expectations that the Bitcoin spot ETF will finally be launched, institutional funds are also continuing to enter the market.

On November 27, CoinShares released a weekly report stating that the net inflow of funds in digital asset investment products in the past week was US$346 million, which has been a net inflow for 9 consecutive weeks and set the largest weekly inflow amount in the past 9 weeks.

A combination of higher prices and inflows has now pushed total assets under management (AuM) to $45.3 billion, the highest level in 1-and-a-half years. Bitcoin inflows totaled $312 million last week, bringing year-to-date inflows to just over $1.5 billion.

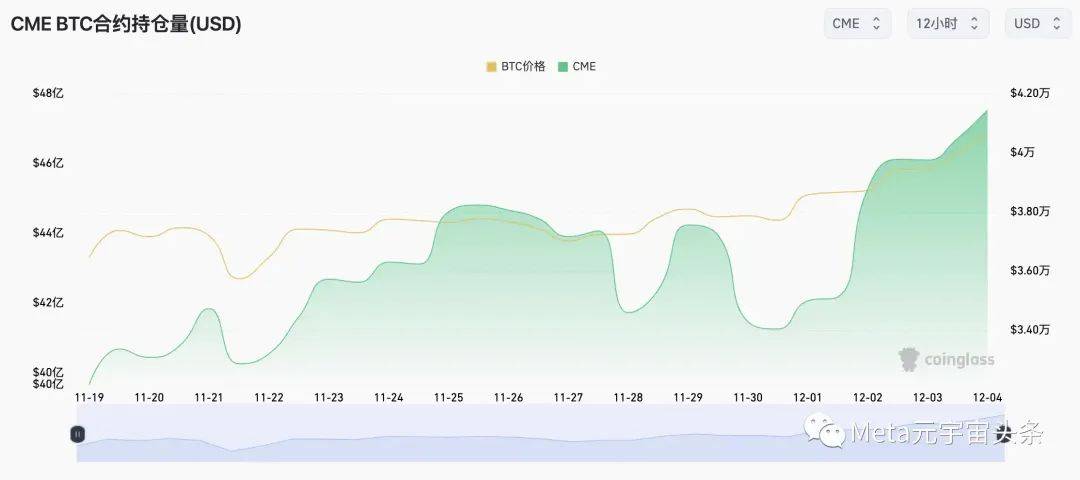

On December 4, according to Coinglass data, CME BTC futures contract positions increased by 3.02% in the past 24 hours to 116,700 BTC, with a position value of US$4.753 billion, accounting for 25.47% of the entire network, becoming the current BTC futures contract position. The largest exchange.

CME BTC contract open interest; Source: Coingalss

Giovanni Vicioso, CME’s global head of crypto products, pointed out that the increase in trading volume and open interest in the crypto derivatives market is “a clear sign that institutions are entering this space.”

03

Binance reaches settlement with regulators

In November, in addition to strong prices, the crypto market also took a big step forward in terms of regulation. Compared with the blow to the crypto market caused by the FTX thunderstorm in November 2022, the settlement between Binance and US regulators has sent a positive signal to the market.

Since the FTX thunderstorm, the market's confidence has collapsed. Everyone believes that centralized trading platforms must have problems of one kind or another. However, this time Binance was investigated by multiple regulatory agencies and found no problems that were serious enough to cause thunderstorms. The United States has not accused it of misappropriating user funds or market manipulation. In a sense, this is already building industry confidence.

On November 22, Conor Grogan, director of Coinbase, posted on social media that according to Binance (Binance Corporate)’s Proof of Reserves (PoR) data, its crypto asset holdings were US$6.35 billion, including US$3.19 billion in stablecoins. Includes off-chain cash balances or funds not in wallets in PoR. There is a good chance that Binance will pay the $4.3 billion DOJ fine in full without selling any crypto assets at all.

The new CEO of Binance, Richard Teng, also said that "Binance has no debt in its capital structure and the fees are moderate. Although the fees we charge users are lower, we have strong revenue and profits," which gave the market a boost. .

In addition to some macro factors, the active Bitcoin ecosystem has also increased the number of transactions in the secondary market, thereby driving up the price of Bitcoin. The income of Bitcoin miners continues to increase. In November 2023, Bitcoin transaction fees were once as high as $18. On December 3, data from The Block Pro showed that Bitcoin miner revenue increased by 30.1% in November to $1.15 billion.

The above is the detailed content of Crypto market re-emerges after FTX collapse and other events, BTC crosses $40,000 mark. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

gateio official website entrance

Mar 05, 2025 pm 08:09 PM

gateio official website entrance

Mar 05, 2025 pm 08:09 PM

The official Gate.io website is accessible through the official application. Fake websites may contain misspelled, design differences, or suspicious security certificates. Protections include avoiding clicking on suspicious links, using two-factor authentication, and reporting fraudulent activity to the official team. Frequently asked questions cover registration, transactions, withdrawals, customer service and fees, while security measures include cold storage, multi-signatures, and KYC compliance. Users should be aware of common fraudulent means of impersonating employees, giving tokens, or asking for personal information.

What are the Grayscale Encryption Trust Funds? Common Grayscale Encryption Trust Funds Inventory

Mar 05, 2025 pm 12:33 PM

What are the Grayscale Encryption Trust Funds? Common Grayscale Encryption Trust Funds Inventory

Mar 05, 2025 pm 12:33 PM

Grayscale Investment: The channel for institutional investors to enter the cryptocurrency market. Grayscale Investment Company provides digital currency investment services to institutions and investors. It allows investors to indirectly participate in cryptocurrency investment through the form of trust funds. The company has launched several crypto trusts, which has attracted widespread market attention, but the impact of these funds on token prices varies significantly. This article will introduce in detail some of Grayscale's major crypto trust funds. Grayscale Major Crypto Trust Funds Available at a glance Grayscale Investment (founded by DigitalCurrencyGroup in 2013) manages a variety of crypto asset trust funds, providing institutional investors and high-net-worth individuals with compliant investment channels. Its main funds include: Zcash (ZEC), SOL,

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

The possible price increase of Dogecoin ETF after approval is 2 to 5 times, and the current price of $0.18 may rise to $0.6 to $1.2. 1) In the optimistic scenario, the increase can reach 3 times to 10 times, due to the bull market and the boost of Musk; 2) In the neutral scenario, the increase is 1.5 times to 3 times, due to moderate capital inflows; 3) In the pessimistic scenario, the increase is 0.5 times to 1.5 times, due to bear market and low liquidity.

Is there any difference between South Korean Bitcoin and domestic Bitcoin?

Mar 05, 2025 pm 06:51 PM

Is there any difference between South Korean Bitcoin and domestic Bitcoin?

Mar 05, 2025 pm 06:51 PM

The Bitcoin investment boom continues to heat up. As the world's first decentralized digital asset, Bitcoin has attracted much attention on its decentralization and global liquidity. Although China was once the largest market for Bitcoin, policy impacts have led to transaction restrictions. Today, South Korea has become one of the major Bitcoin markets in the world, causing investors to question the differences between it and its domestic Bitcoin. This article will conduct in-depth analysis of the differences between the Bitcoin markets of the two countries. Analysis of the differences between South Korea and China Bitcoin markets. The main differences between South Korea and China’s Bitcoin markets are reflected in prices, market supply and demand, exchange rates, regulatory supervision, market liquidity and trading platforms. Price difference: South Korea’s Bitcoin price is usually higher than China, and this phenomenon is called “Kimchi Premium.” For example, in late October 2024, the price of Bitcoin in South Korea was once

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Detailed tutorial on downloading and installing the latest version of gate.io official website APP

Mar 12, 2025 pm 07:24 PM

Detailed tutorial on downloading and installing the latest version of gate.io official website APP

Mar 12, 2025 pm 07:24 PM

Introduction to the download and function of the Gate.io Exchange Android App: This article introduces in detail the download method of the Gate.io Android App. Just visit the official website of Gate.io and find "Download App" in the "User Center" to download and install. Gate.io App has rich trading functions and supports more than 3,500 cryptocurrencies, including BTC, ETH, DOGE, etc., and provides a variety of trading methods such as spot, leverage, and contracts. In addition, Gate.io App also integrates wallets, cross-chain, airdrop, currency earning, Dapp and many other products.

gateio Sesame Open Door Exchange official website login the latest entrance

Mar 05, 2025 pm 08:12 PM

gateio Sesame Open Door Exchange official website login the latest entrance

Mar 05, 2025 pm 08:12 PM

Gate.io is a crypto asset exchange that provides a wide range of services including registration, account verification, deposits, transactions and withdrawals. Users can start using Gate.io by creating an account, completing verification, selecting a deposit method, and then sending funds to the generated address. The platform provides a variety of transaction pairs, order types and trading tools to facilitate users to conduct transactions. Users can also withdraw money from Gate.io by selecting a withdrawal method, generating a withdrawal address, entering the withdrawal amount, and completing security verification.

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.